100% Downside Protection ETFs: What’s the Catch?

How these ETFs work, when they work best, and where they fall short.

Everybody wants 100% downside protection, but not everyone likes the price of getting 100% downside protection. A new suite of defined-outcome ETFs attempts to find middle ground.

These new funds provide 100% downside protection in the accessible exchange-traded fund wrapper at a decent price tag. The catch: They give up most of the upside on the underlying market. These ETFs use options to provide a narrow range of returns within a specific period, from roughly 0% to an upside cap that is higher than Treasury bills rate but much lower than what the stock market has often achieved. These ETFs are not for everyone, but are they for you? In this article, I’ll dive into how these ETFs work, when they work best, and where they fall short.

How They Work

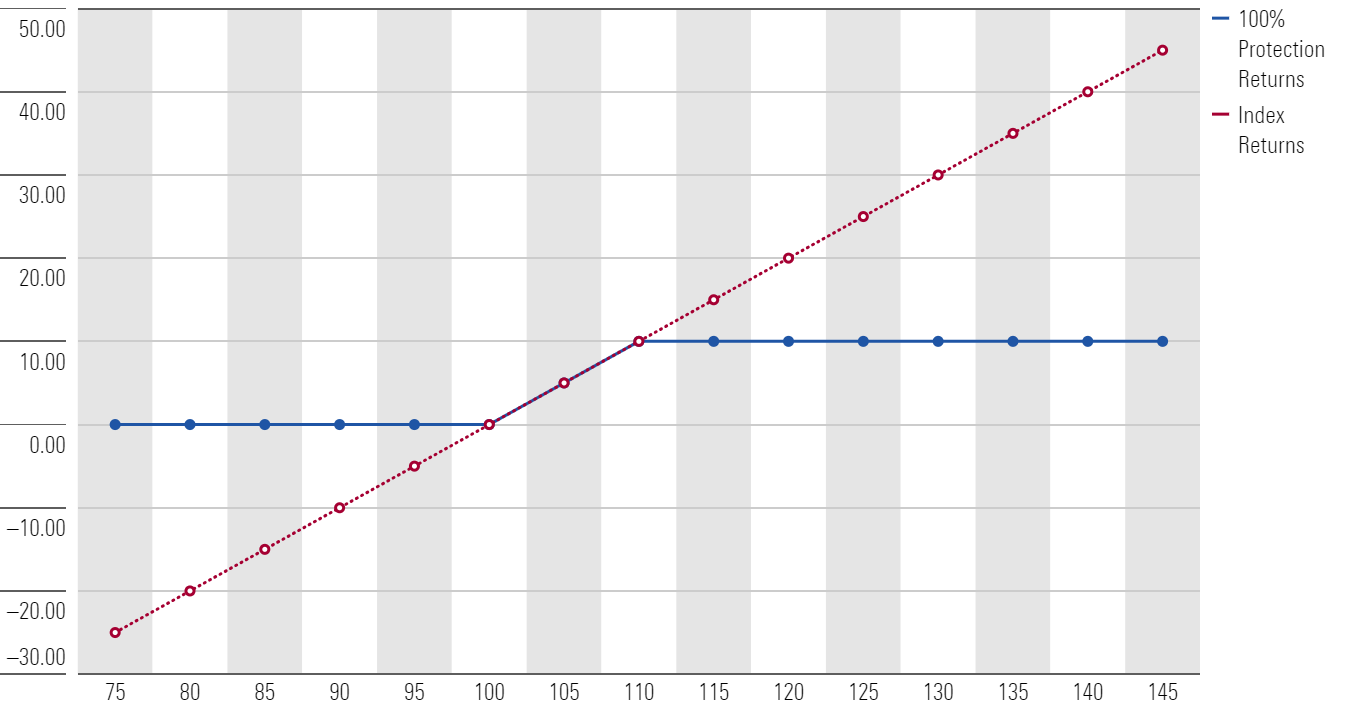

In a nutshell, these ETFs trade in upside for downside protection. They buy a put option to protect against all losses on the underlying security and sell a call option to finance the purchase. The put provides a performance floor, while the call sets a ceiling. The third part of the portfolio is a long stock position that tracks the underlying market, which provides the returns between that floor and ceiling. Investors essentially get a much narrower band of potential outcomes with the end product. Both options have the same expiration date and typically use a popular index such as the S&P 500 as the underlying benchmark. Exhibit 1 maps out the return profile for a hypothetical 100% protection ETF with a 10% upside cap for a one-year outcome period. The ETF would have no downside exposure (gross of fee) but will not receive any more gains when the index goes past the call strike price, which is its upside cap.

Payoff Profile of a Hypothetical 100% Downside Protection ETF

This is not a terrible proposition by default. The upside cap typically equals the T-bill rate for the duration of the options, plus a spread. The current cap for 100% protection ETFs with an outcome period between July 2024 and July 2025 is around 10%, or nearly double the one-year risk-free rate. As interest rates come down, however, the cap will also decrease and might lose its appeal. While the potential returns might be higher than a certificate of deposit or plain Treasury bills, investors can miss out on substantial stock market gains. In addition, principal protection is not guaranteed the same way a CD would be, nor is the stated cap always achieved.

These ETFs are a variant of the popular defined-outcome ETFs, most of which offer protection against some but not all downside. Higher interest rates in the past few years amped up the return ceiling on a 100% protection structure and made it more lucrative as a product.

Like other defined-outcome ETFs, the intended outcomes only apply when investors buy and hold the fund for the stated outcome period. This means buying the ETF the day they put on the options position and holding it until the options expire, which can be six months, one year, or two years down the road depending on the strategy. Selling and buying outside of this period isn’t advised, as investors might receive a different payout structure. Consider an ETF that starts its outcome period on Jan. 1, 2024. If investors buy in on July 15 and the S&P 500 has already climbed close to the ETF’s upside cap, they risk severely limiting their upside while exposing themselves to downside if the index declines.

In addition, the ETF will not precisely track the underlying index’s performance during the period. The options’ values will converge with their defined outcome as they approach expiration, but their prices can deviate during the period because of volatility and the time-value left on the option.

Should You Invest?

Use Case

These strategies work best for capital preservation. The cost of downside protection is prohibitive but best justified for investors with short-term liquidity needs or a short investing horizon. Think people anticipating large purchases or retirees starting their withdrawal phase. Alternatively, yields on cash and cashlike investments are not bad right now, but these ETFs offer a bit more upside at the cost of added risk and uncertainty. The stated cap is the best possible outcome, but not a guaranteed return. This should factor into an investor’s calculation when comparing these ETFs against holding a CD or clipping bond coupons.

Some providers of these ETFs compare them to fixed index annuities, which offer principal protection and are sold by an insurance company. The ETFs’ transparency and lower fees are clear advantages, but they miss on one major objective of annuities: a guaranteed income stream absent from the ETFs.

Consider Alternatives

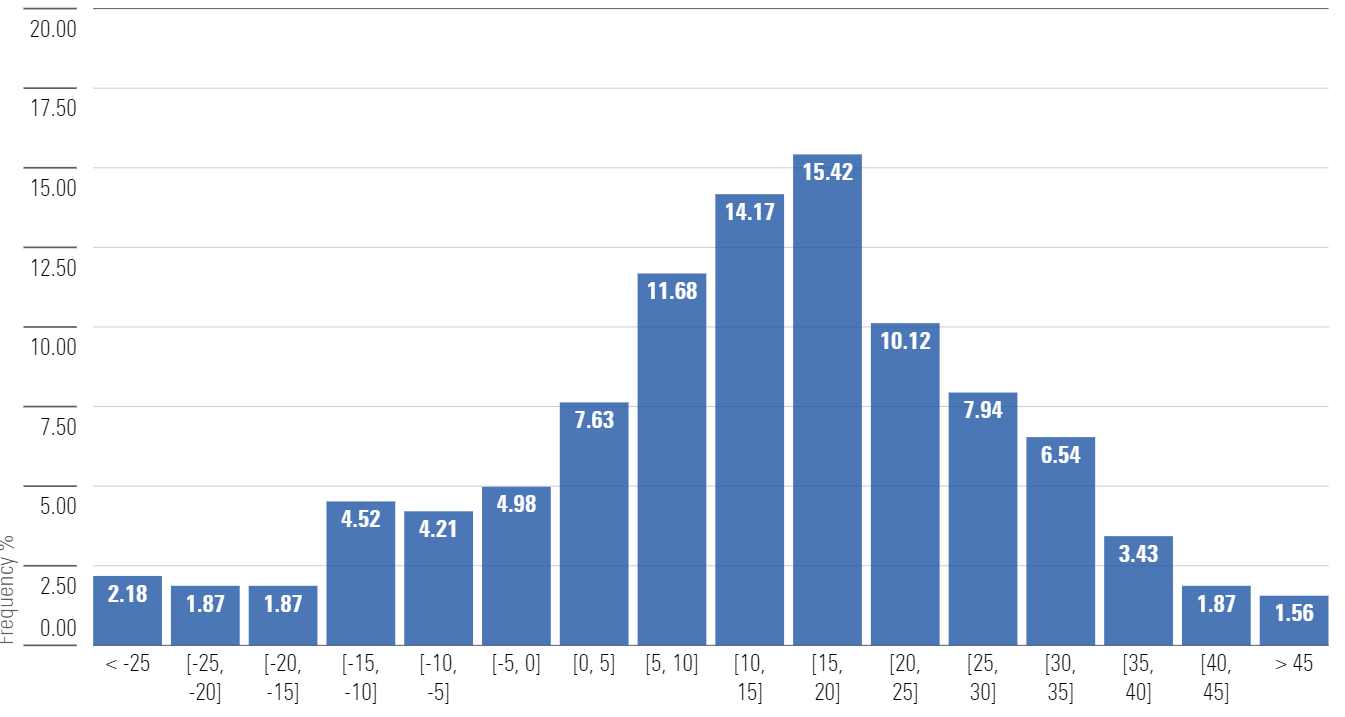

For nonretirees or those without short-term capital protection needs, the alternative is much more straightforward: the stock market. Exhibit 2 displays the return distribution of the S&P 500 over rolling 12-month periods. I’m using the total return version of the index here because these ETFs use options on funds tracking the index whose prices should reflect dividends, compared with options on the index itself. On a rolling one-year basis, the S&P 500 most frequently returned between 10% and 20%, which is beyond the current annualized upside caps of these ETFs. The opportunity cost of capping returns is substantial, especially after compounding that disadvantage over longer periods of time. Missing 5%-10% a year compounds into missing between 27% and 61% cumulatively over just a five-year holding period.

Return Distribution for Rolling 12-Month Periods of S&P 500 Total Return Index

Investors with a longer investing horizon and little need for immediate liquidity will be much better off parking their money in the stock market and simply waiting it out. Diversifying the stock portion with some other asset classes, like bonds, can help ease volatility (and that sinking feeling in your stomach when the market dives).

User Guide

Below is a brief overview of the products currently available. Only four firms offer these funds so far. Some differentiate themselves by tenor, such as Innovator’s range of outcome periods, or by underlying index, such as Calamos. All four firms use exchange-traded FLEX options that clear through the Options Clearing Council, limiting their counterparty risk. BlackRock uses options on its own iShares Core S&P 500 ETF IVV, while the other firms use SPDR S&P 500 Trust SPY for S&P 500 options. SPDR S&P 500 Trust options are much more liquid than iShares Core S&P 500 ETF options, which can better facilitate primary market trading activities.

| Innovator | First Trust | Calamos | BlackRock | |

|---|---|---|---|---|

| Annual fee | 0.79% | 0.85% | 0.69% | 0.50% |

| Outcome period | 2 years, 1 year & 6 months | 1 year | 1 year | 1 year |

| Options underlying | SPDR S&P 500 ETF Trust | SPDR S&P 500 ETF Trust | SPDR S&P 500 ETF Trust, Invesco QQQ Trust & iShares Russell 2000 ETF | iShares Core S&P 500 ETF |

| Minimum upside cap | - | 7% | - | 2% |

| Current cap on comparable 1-year ETF | 9.08% (6/24/2024 - 6/20/2025) | 9.50% (7/1/2024 - 6/30/2025) | 9.45% (7/1/2024 - 6/27/2025) | 11.14% (7/1/2024 - 6/30/2025) |

| Long stock position | Synthetic (call option) | Synthetic (call option) | Synthetic (call option) | Physical (iShares Core S&P 500 ETF) |

| Tax treatment | No required distribution In-kind options on ETF | No required distribution In-kind options on ETF | No required distribution In-kind options on ETF | Required distribution of ETF dividends Unrealized gain/loss on futures taxed at year-end, 60% at long-term capital gains rate |

Source: Provider’s website & filings. Current stated cap is gross of fee. Data as of July 15, 2024.

BlackRock is also the only firm that physically holds an ETF to get underlying market exposure. (It also holds a small allocation to S&P 500 futures, which tracks the S&P 500 returns with little cash outlay and frees up more money for the rest of the ETF.) Others use a deep in-the-money call that moves in step with SPDR S&P 500 Trust to synthetically track its performance. Both come with different costs, but the current high interest-rate environment makes buying a call more expensive than paying the 0.03% annual fee on iShares Core S&P 500 ETF. See above how iShares Large Cap Max Buffer ETF MAXJ offers a higher upside cap than competitors that launched with a comparable outcome period.

BlackRock and First Trust also implement a minimum upside cap in their ETFs. As the return ceiling comes down alongside interest rates, these ETFs will reduce their downside buffer to maintain this minimum cap. While this might appeal to some investors’ preference for upside, those looking for strictly 100% protection shouldn’t gloss over the stated buffer and cap level before purchasing or rolling their funds.

Last but not least, taxes. Unfortunately, you still have to pay taxes. However, you might be able to pay fewer taxes with these ETFs. Options on ETFs such as SPDR S&P 500 Trust and iShares Core S&P 500 ETF are eligible for in-kind redemptions, which allow the ETF to avoid realizing taxable gains. Most of these ETFs will also not be required to distribute any dividend or capital gains at year-end. One exception is BlackRock, whose physical ETF holding will pay dividends that the fund is required to distribute. They also use S&P 500 futures to round out their market exposure, which are marked-to-market at year-end and taxed at a 60% long-term and 40% short-term capital gains rates. The fund’s ability to recognize offsetting losses on its options is also limited compared with synthetically constructed peers.

All in all, investors who can stomach the market’s ups and downs should continue to stay invested in uncapped stocks. But these ETFs offer cheaper options for those requiring a plushier downside cushion. They would serve these investors best if held throughout the stated outcome period and if their fees don’t detract too much from their limited potential returns.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NPR5K52H6ZFOBAXCTPCEOIQTM4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-24-2024/t_c34615412a994d3494385dd68d74e4aa_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)