ETFs See Near-Record Inflows in July as US Fund Flows Heat Up

Momentum is building for bond funds as well.

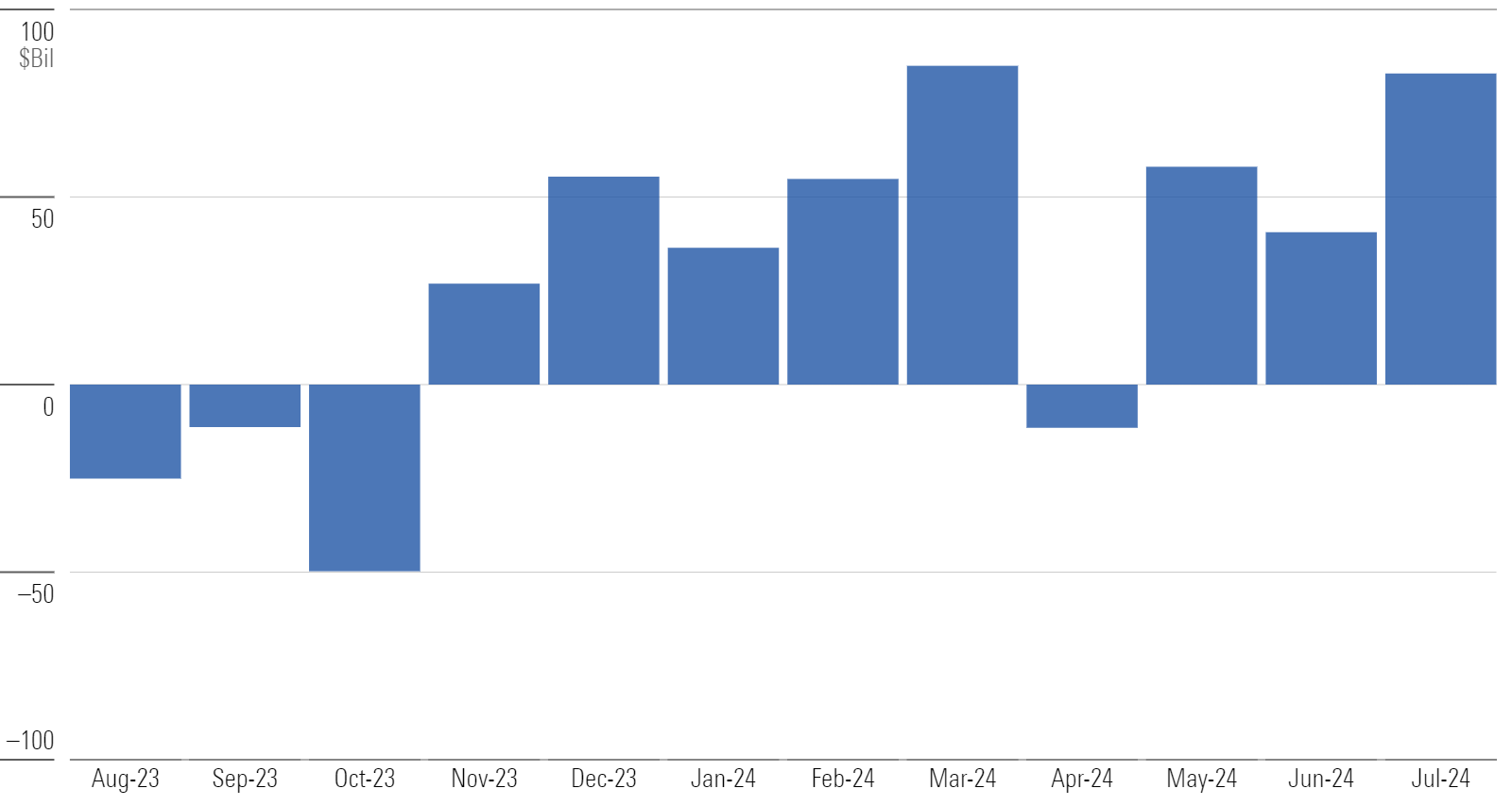

US funds collected $83 billion in July, their second-strongest month of the year so far. Despite market volatility, equity category groups generally enjoyed moderate inflows, while fixed-income groups took in larger sums. More broadly, eight of the 10 category groups saw positive flows in July.

US Fund Flows

ETFs Threaten Monthly Record, Settle for Silver

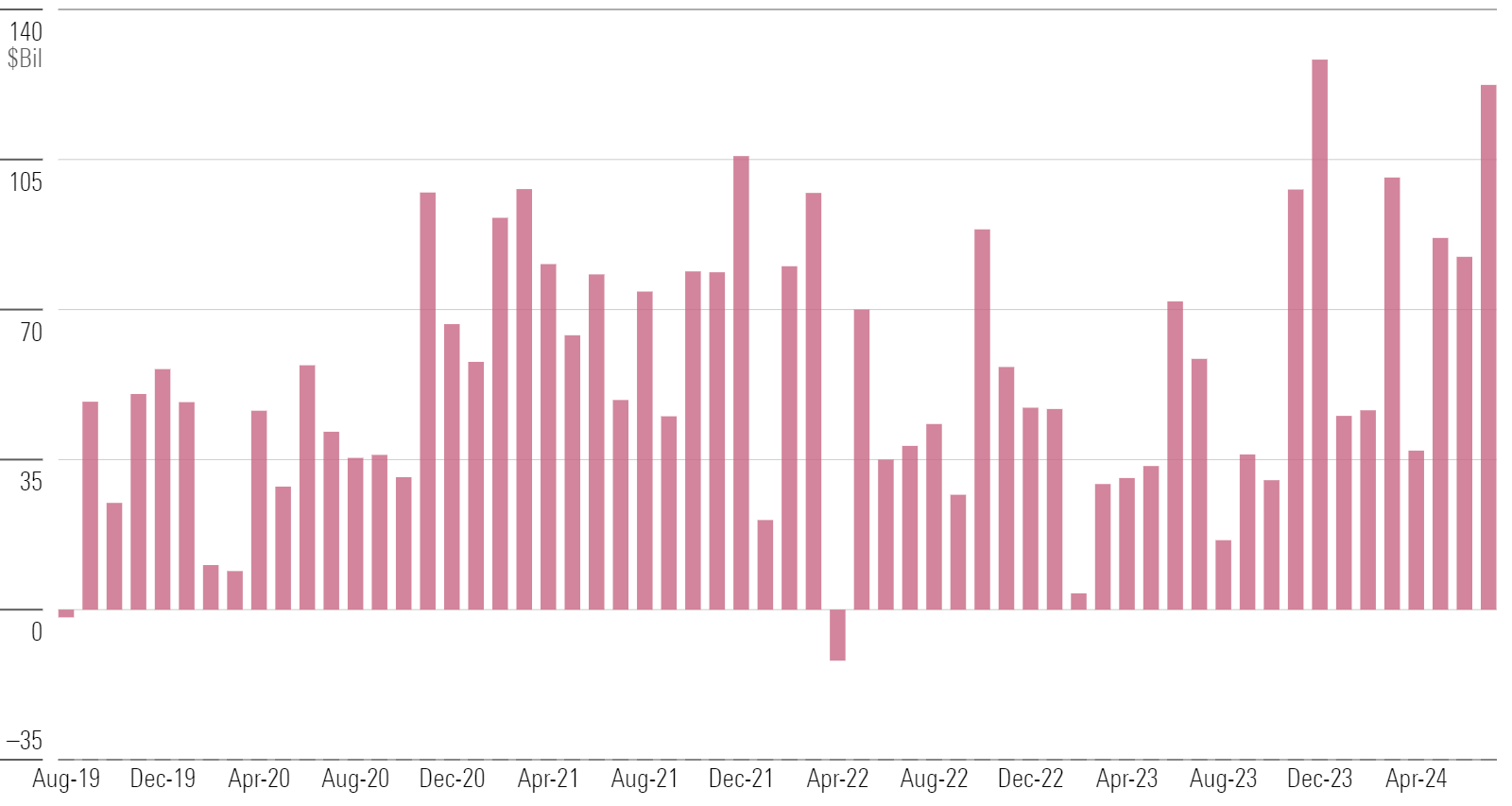

Investors poured $122 billion into US exchange-traded funds in July. That was the second-highest monthly total on record, behind $128 billion in December 2023, and the fourth month ever with inflows north of $100 billion. Meanwhile, mutual funds shed $39 billion in July.

ETF Flows

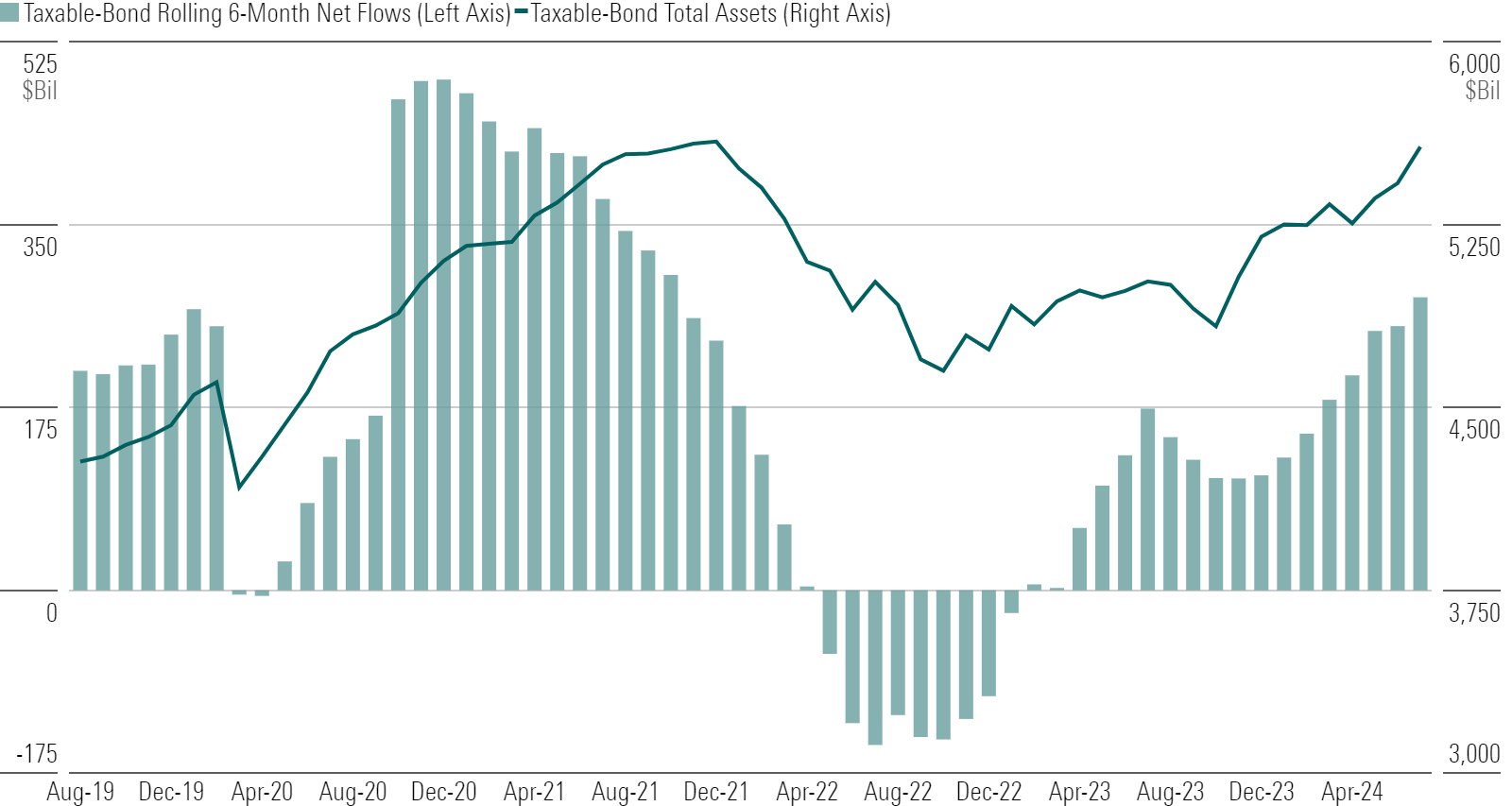

Taxable-Bond Funds Nearly All the Way Back

Taxable-bond funds are pulling in money like it’s 2021. That December marked the cohort’s high-water mark before outflows and bad performance shrank its treasure chest. But after a run of inflows and steadier returns, taxable-bond funds have come nearly all the way back. They totaled $5.57 trillion at the end of July—only $2 billion short of the December 2021 total.

Taxable-Bond Flows

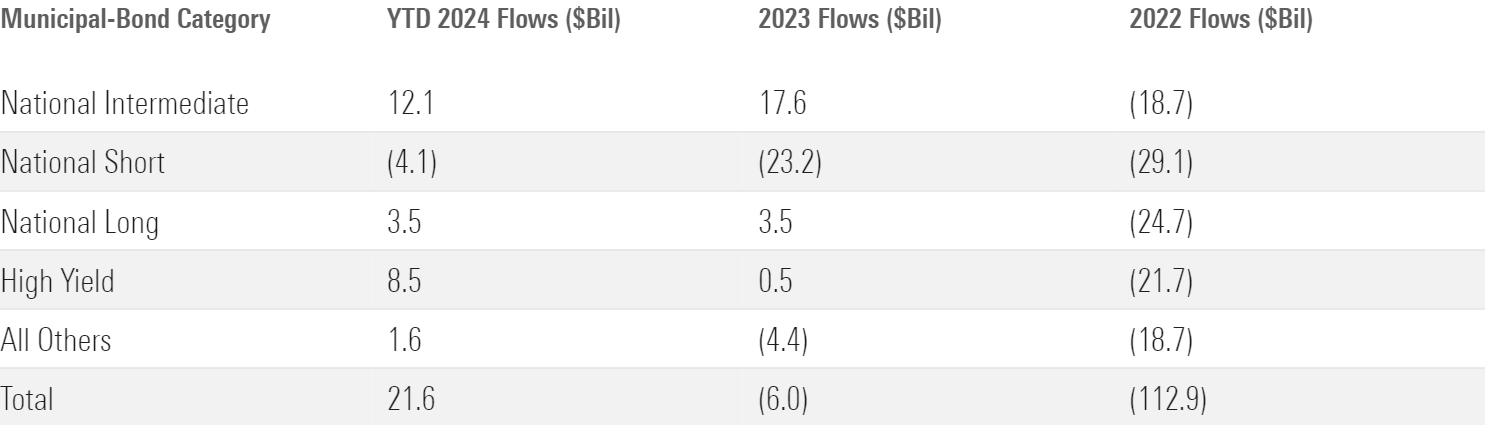

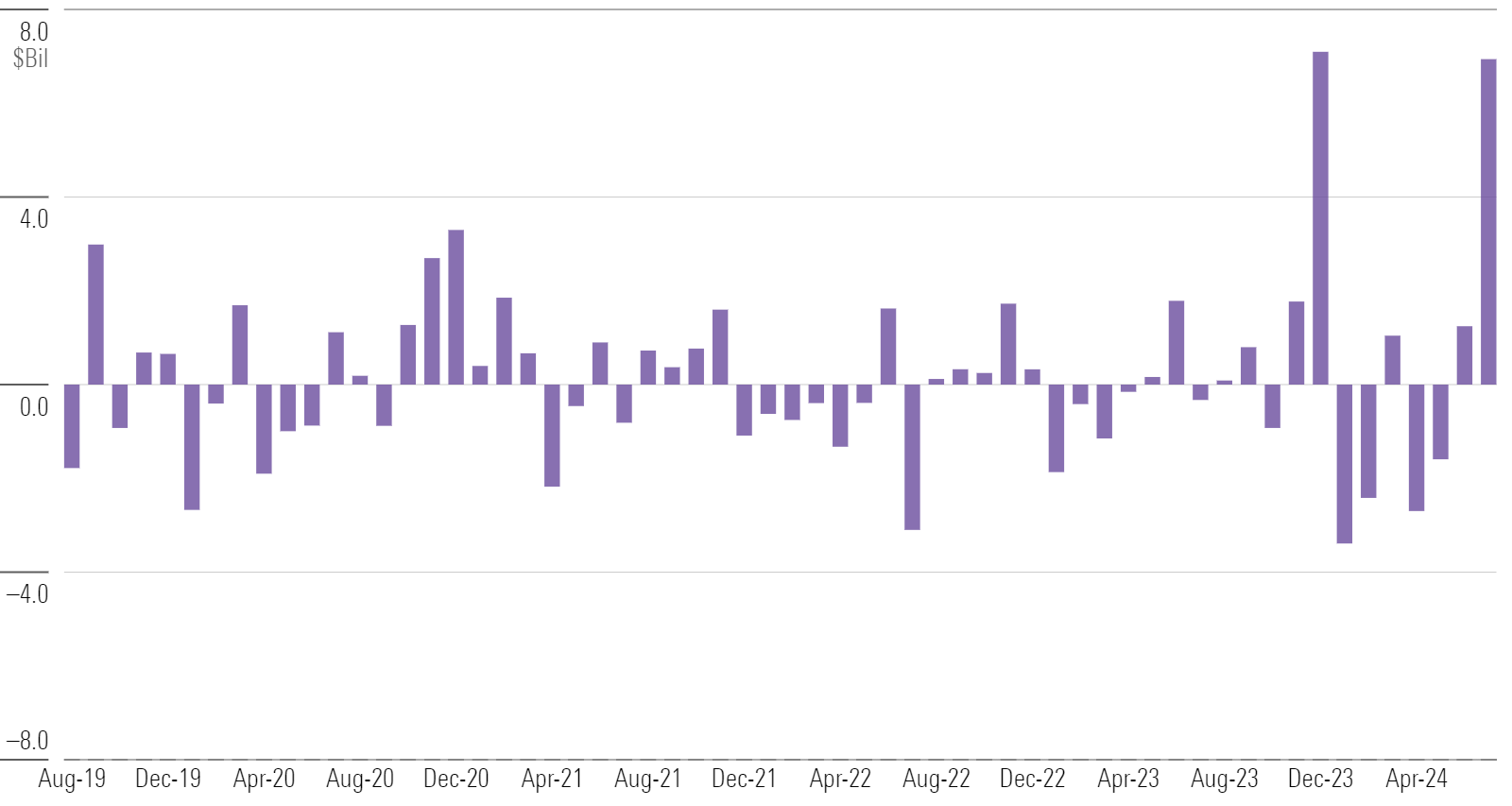

Momentum Is Building for Municipal Bonds

Municipal-bond funds hauled in nearly $7 billion, the most since August 2021. They are on track for a positive year after outflows in 2022 and 2023. Officially joining in on the turnaround: the national short-term category, whose modest July inflows marked its first positive month since October 2021.

Municipal-Bond Flows

Small Caps Stand Out

US equity funds gathered $20 billion in July, marking their fourth month of inflows so far in 2024. While S&P 500-tracking funds typically dominate the category group, an ETF tracking a popular small-cap index was the standout. The iShares Russell 2000 ETF IWM took in $6.9 billion, its second-highest monthly total ever behind December 2023. The Russell 2000 Index rallied furiously during both of these months.

iShares Russell 2000 ETF IWM Flows

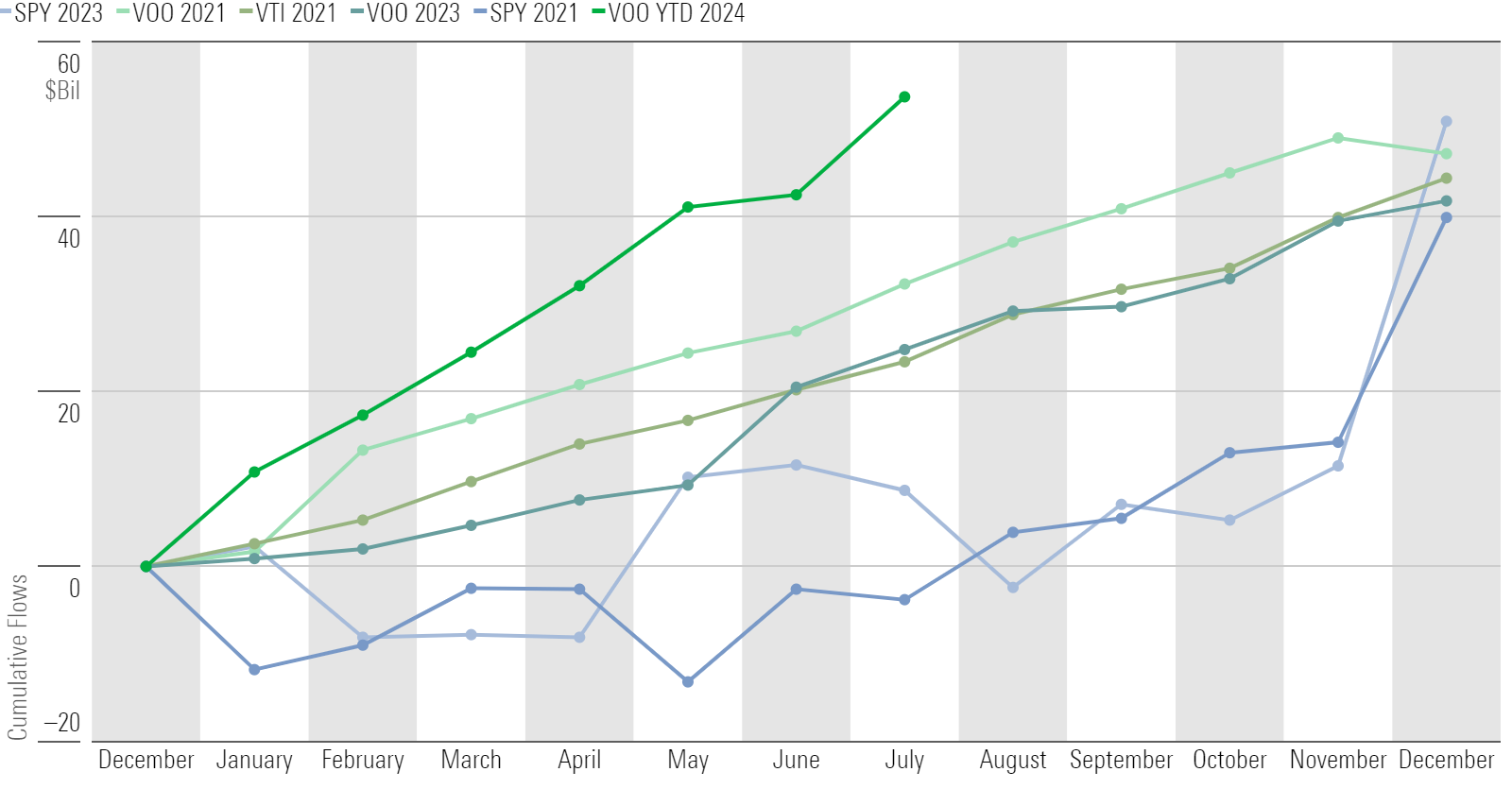

Woo-Hoo for VOO

Vanguard has raked in $118 billion in 2024 (second to iShares). Vanguard S&P 500 ETF VOO alone has claimed an incredible $54 billion, which already exceeds the annual inflow record for any fund. The exhibit below charts VOO’s campaign against the five best calendar years of inflows ever. It’s almost certain to set the new inflow record. The question now becomes: by how much?

Vanguard S&P 500 ETF VOO Flows

This article is adapted from the Morningstar Direct US Asset Flows Commentary for July 2024. Download the full report here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NPR5K52H6ZFOBAXCTPCEOIQTM4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-24-2024/t_c34615412a994d3494385dd68d74e4aa_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)