The Fund Industry Loves These Categories. Should You?

When it makes sense—and doesn’t—to buy into the industry’s fastest-growing areas.

If you’re a fund-company product manager, you probably spend a lot of time thinking about what types of new products to roll out. While the total number of mutual funds and exchange-traded funds has been relatively flat over the past 10 years, there are always new funds hitting the market as older funds are merged or liquidated out of existence. As a result, the mix of funds available to individual investors is ever-evolving as fund companies introduce new products to meet anticipated demand.

But not every trendy area for newly minted funds is worth investing in. In this article, I’ll look at some of the most popular areas for fund launches lately and give my thoughts on their investment merit.

What’s Hot

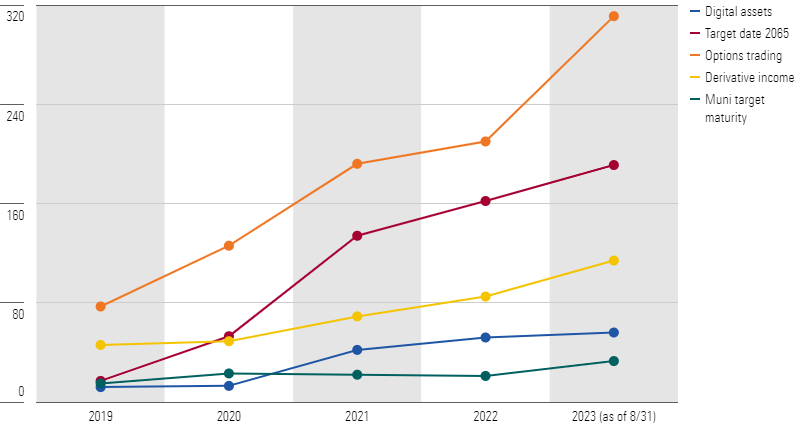

The graph below shows five of the most popular Morningstar Categories based on growth in the number of funds over the past couple of years (including multiple share classes). The growth rate represents the net change in the number of funds, as the total each year includes funds that previously existed plus funds that were newly launched, minus any funds that were merged or liquidated.

Number of Funds Per Category

I’ve written before about the fund industry’s propensity to roll out more and more specialized funds. This trend shows no signs of changing: Three of the five fastest-growing categories are more specialized categories that most investors probably don’t need. With that generalization out of the way, here’s more detail on each of the top five areas, along with my opinion on whether each one is worth investing in.

Digital Assets

The digital-assets category is relatively new; Morningstar just added it as a separate category in April 2022. To qualify for inclusion, funds in this category must have a material portion of their risk exposure coming from digital assets. Digital-asset portfolios invest the majority of their assets into one or more areas broadly classified as decentralized finance, stablecoins, currency assets, smart contracts platforms, exchange assets, privacy assets, yield farming, and nonfungible tokens, among others.

The category has exploded in recent years and ranks as by far the most popular area for new fund launches. As of the end of 2020, there were 13 crypto-related funds, but that number more than tripled by the end of 2022. The group now includes a motley assortment of crypto-related funds ranging from single-coin offerings to broader plays on companies that leverage digital assets. Crypto in general is highly speculative, but in many cases, the newly launched digital-assets funds are even more volatile and have had lower returns than investors would get by simply buying major cryptocurrencies directly.

The verdict: Most investors should take a pass or handle with extreme caution.

Target-Date 2065+

There’s nothing controversial or gimmicky about this category. Like other target-date funds, funds in this category provide diversified exposure to stocks, bonds, and cash for investors who have a specific date in mind (in this case, around the year 2065 and beyond) for retirement. These portfolios aim to provide investors with an appropriate level of risk and return based on the target date. Management adjusts the asset mix to become more conservative as the target date approaches, following a preset glide path.

The large number of funds launched in this category reflects both demographic trends (as millennials are now old enough to start saving for retirement) and the growing popularity of target-date funds. Following the Pension Protection Act of 2006, retirement plan sponsors can now use target-date funds (as well as managed retirement accounts) as qualified default investment alternatives, or QDIAs. Target-date funds have become increasingly popular: 98% of the plans working with Vanguard as a recordkeeper that identified a QDIA offered target-date funds as a default investment option.

Target-date funds are sound investment options because they offer built-in portfolio diversification that automatically adjusts to become more conservative as shareholders approach retirement age. As all-in-one packages, target-date funds eliminate most of the guesswork and potential pitfalls that investors would court if they tried to build their own retirement portfolios.

The verdict: These funds are a great choice for millennials saving up for retirement in a tax-deferred account.

Options Trading

Options-trading strategies use a variety of options trades, including put-writing, options spreads, options-based hedged equity, and collar strategies, among others. Some funds in this category also engage in options writing to generate part of their returns. They often use options strategies to reduce volatility and/or downside risk.

The number of funds in this category has nearly doubled since the end of 2020. Chalk up most of the growth to defined-outcome ETFs, also known as buffer funds. These funds promise to provide downside protection below a certain level over a predetermined outcome period. To do so, they employ options strategies on an underlying equity index (often the S&P 500) to limit losses while providing some upside returns.

Most of these funds have delivered on their promises thus far. For example, the average buffer fund limited losses to about 9% in 2022′s bear market. However, options-trading funds are relatively pricey given that they’re basically index funds with an options overlay. Investors should also be aware that in exchange for limiting losses, they’ll trade off significant upside potential. Most of these funds only provide investors with price gains on the underlying index, sacrificing returns from dividends.

The verdict: Not a terrible option for investors willing to give up some gains in exchange for limiting losses.

Derivative Income

Derivative-income strategies primarily use an options overlay to generate income while maintaining significant exposure to equity market risk. They typically generate income by writing covered calls. Although they still have some equity exposure, they typically have lower-than-average betas versus broad stock market benchmarks.

If you’ve been investing in funds for a long time, these funds probably sound familiar. They’re option-income funds with a slightly different twist. Back in the late 1980s, option-income funds that invested in government bonds were all the rage. Like their predecessors, though, today’s derivative-income funds have two major drawbacks. Their “income” really consists of short-term capital gains, which are typically taxed at higher rates compared with equity dividends. They also give up significant return potential in exchange for lower volatility. Moreover, derivative-income funds are relatively pricey, with an average expense ratio of about 1.00%.

The verdict: Probably not worth the hype.

Muni Target Maturity

Muni target-maturity funds typically invest in bonds issued by various state and local governments to fund public projects. The income from these bonds is generally free from federal taxes and may be exempt from state and local taxes for investors residing in the same location as the issuer. In contrast to other municipal-bond funds, which typically invest in bonds with a variety of maturity dates, muni target-maturity funds invest in bonds with a set maturity date. When the fund reaches the target maturity date, it then distributes cash back to investors.

These funds can be useful for investors who want to match the cash flows from their investments with a specific date, for example, to pay for a wedding, a child’s college education, or a down payment on a house. Retirees could use these funds to build a ladder of assets with increasing maturity dates to help them meet their cash flow needs for retirement spending. Investors can also accomplish this asset/liability matching by purchasing an individual bond, but that would involve more issuer-specific risk as well as higher transaction costs.

The verdict: These funds are a solid choice that can fill a practical need for many investors.

Conclusion

The areas highlighted above are just a small sample of new funds launched over the past few years. But the patterns are instructive: At least three out of the five categories represent highly specialized areas that I’d personally avoid. If you see a bunch of new funds being launched in an area with strong recent performance, it pays to be skeptical.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)