How Did the Largest Equity Funds Do in the Second Quarter?

Investors in the most widely-held stock funds endured another down quarter.

Investors in the most widely-held U.S. equity funds suffered the same fate as owners of every other U.S. stock fund in the second quarter: they lost money.

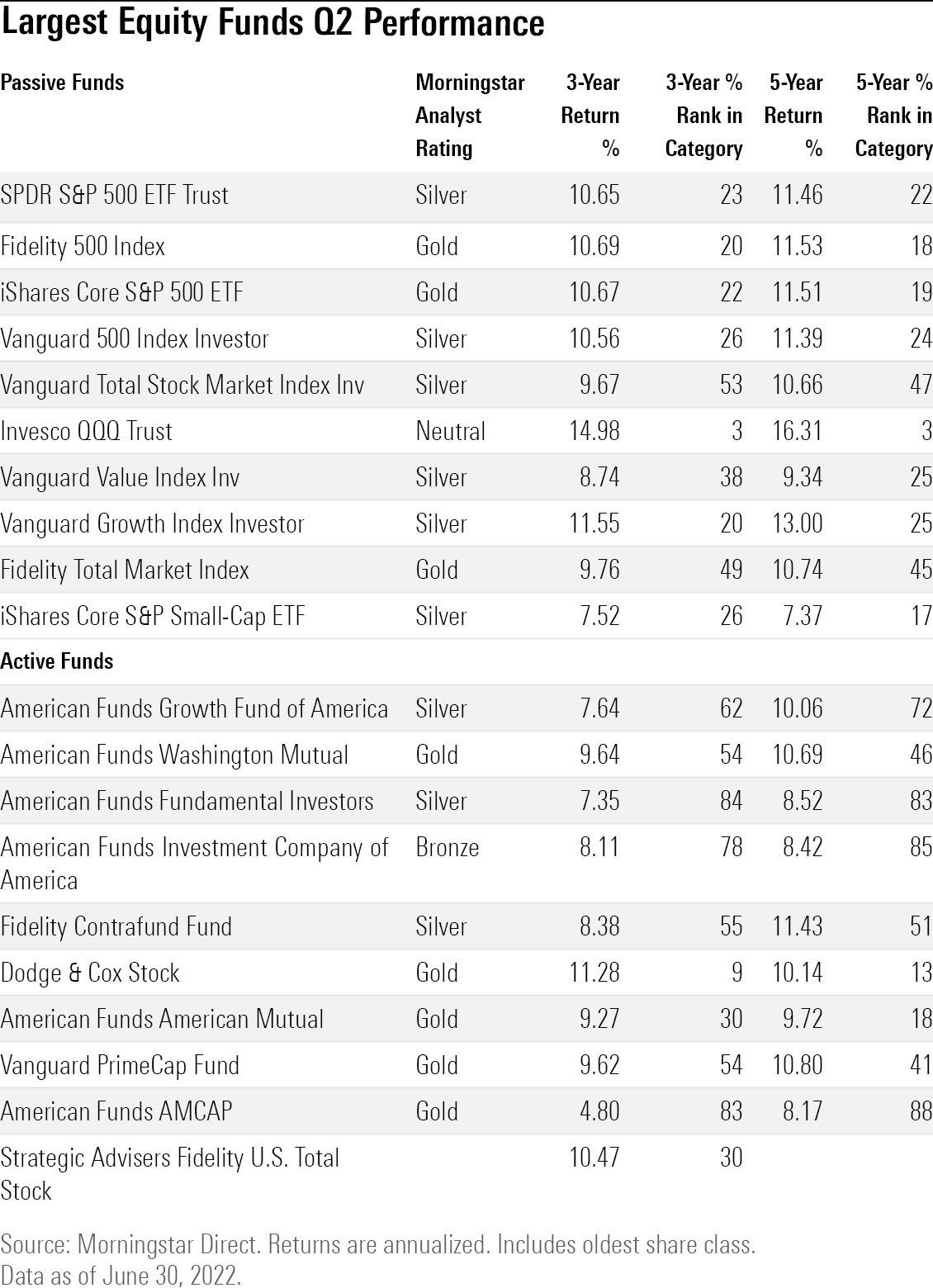

Here’s a look at results for the 10 largest index-tracking U.S. stock funds, and the 10 largest actively-managed U.S. stock funds, according to Morningstar Direct. A table with long-term results for all 20 funds can be found at the bottom of this article.

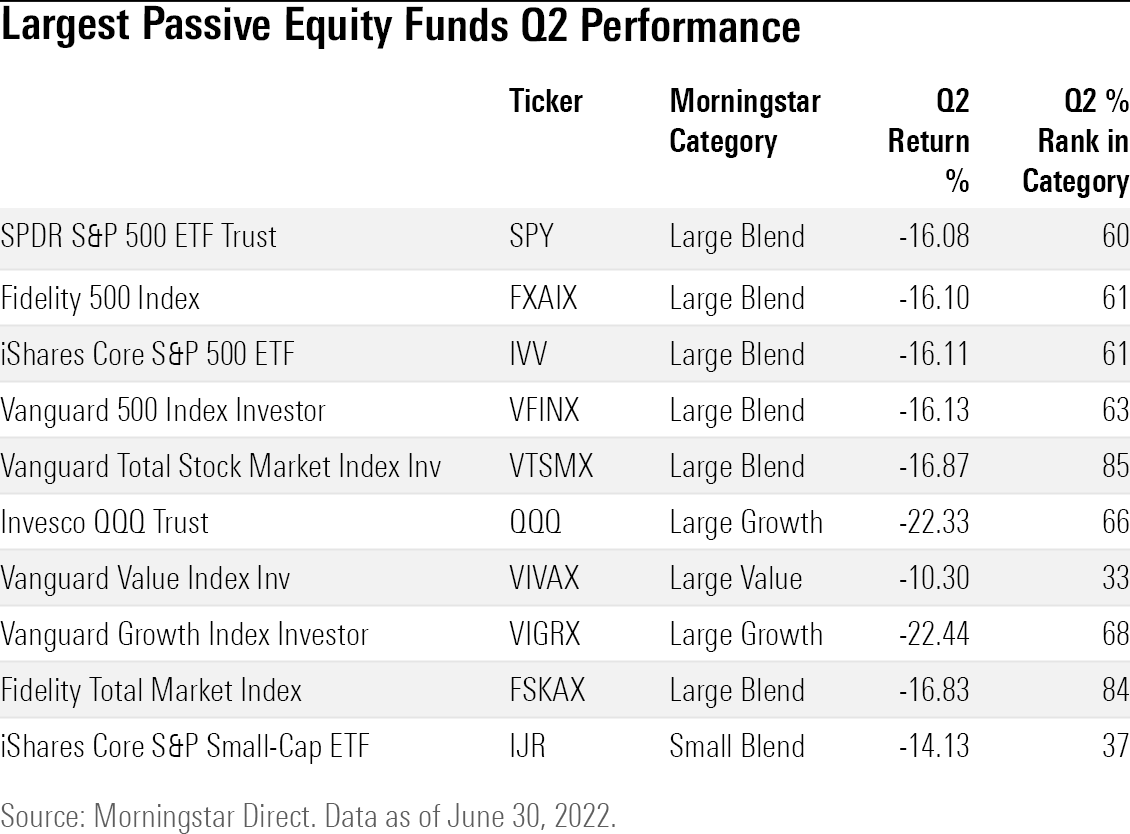

Largest Passively-Managed Funds Second-Quarter Performance

As the overall stock market fell into a bear territory, funds that track the broad U.S. stock market indexes fell around 16% in the second quarter.

The largest U.S. stock fund, the $350 billion SPDR S&P 500 ETF Trust SPY, lost just over 16% in the quarter, its worst performance since the pandemic-sparked bear market in the first quarter of 2020. The $247.3 billion Vanguard Total Stock Market Index VTSMX lost 16.9%.

Hardest hit were funds oriented toward growth stocks, which had led returns in recent years, but were ground-zero for the bear market thanks to the effects of rising interest rates.

The $154.2 billion Invesco QQQ Trust QQQ lost 22.3% for its worst quarter since 2008. The technology-stock focused fund tracks the largest non-financial firms listed on the Nasdaq. The biggest holdings in the fund declined including Apple, AAPL which fell 21.6%, Microsoft MSFT down 16.5%, and Amazon AMZN, which declined 34.8%.

“The fund's Nasdaq-only remit precipitates sector concentration,” writes Morningstar analyst Ryan Jackson. “Companies within the tech sector—and sometimes different segments within the companies—can derive revenue from differentiated resources. Still, the tech sector's heterogeneity is not a panacea in difficult markets.”

Value-focused funds fared better than growth funds, but still posted declines, with the Vanguard Value VIVAX Index down 10.3%.

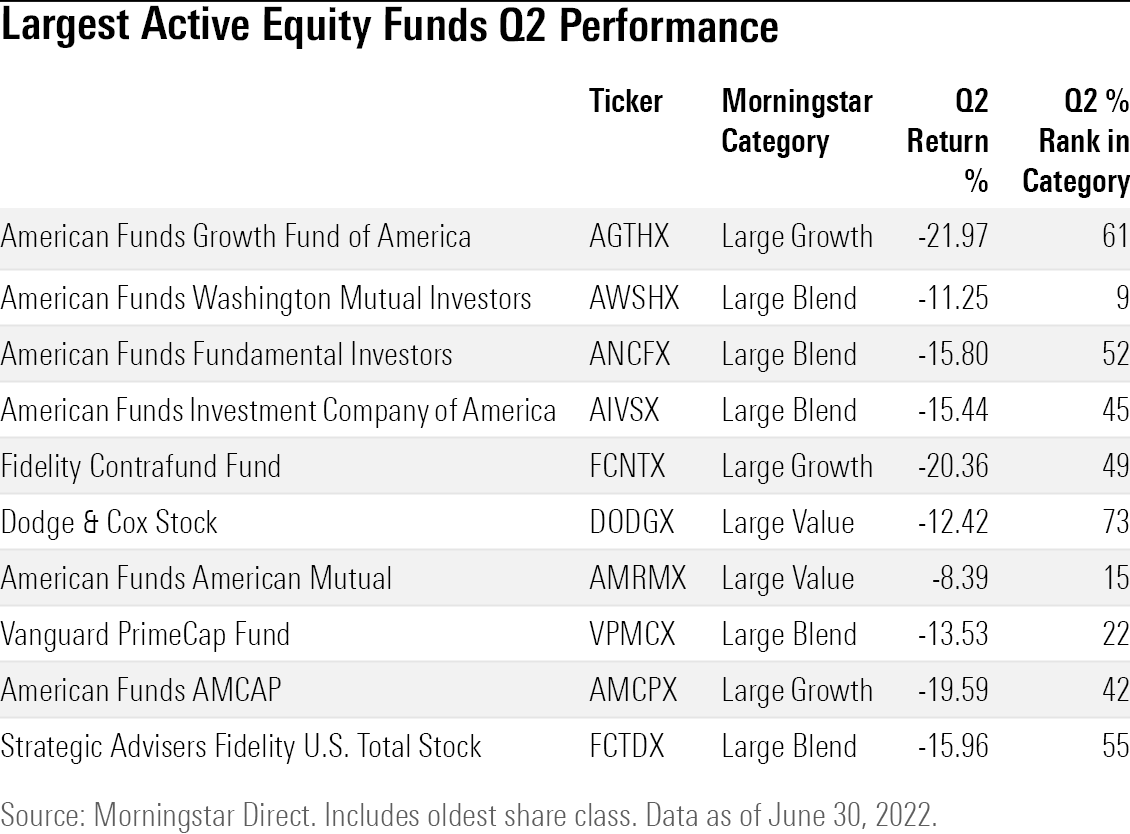

Largest Actively-Managed Funds Second Quarter Performance

Among the largest actively-managed stock funds, American Funds American Mutual AMRMX fared the best. The Gold-rated fund declined 8.4%, which put it in the 15th percentile of the large value category for the quarter.

American Mutual "is cautious by design," writes Morningstar director Alec Lucas. The fund's dividend-focused strategy and ability to hold sizable cash and bond stakes has helped it hold up well in downturns. American Mutual "remains an excellent long-term option for risk-averse investors."

Another large value fund, Dodge and Cox DODGX, posted a 12.4% loss, landing it in the 73rd percentile of its category. Its outsized financial services stake hurt performance, with Charles Schwab SCHW, a 3.7% weight in the fund, down 24.8%, and Wells Fargo WFC, a 3.9% weight, off by 18.7%, according to Morningstar Direct.

Among the biggest active, large-growth funds, American Funds AMCPX held up the best. The fund’s 19.6% decline put in the 42nd percentile for second-quarter performance.

“Stocks like Rivian have hurt the fund in 2022's bear market thus far,’’ Lucas writes. “But the fund's biggest recent detractor has been in the portfolio for about a decade, Netflix NFLX.’’ The streaming service was a top-five holding for the fund entering the year.

Still, its relatively lighter stake in technology companies, 25.9% versus the category average of 35% as of March 31, helped mitigate losses, according to Morningstar Direct.

In a quarter where dividend strategies proved to be a somewhat safe harbor for investors, American Funds Washington Mutual Investors AWSHX shined relative to its peers in the large blend category. With an 11.3% decline, the fund ranked in the ninth percentile of its category, while the average fund in the group lost 14.9%.

The fund's Great Depression-era influenced guidelines for the stocks it holds prioritizes investment-grade companies that have paid dividends in eight of the past 10 years, Lucas writes. Healthcare companies Eli Lilly and Co LLY and Humana HUM contributed positively to the fund in the quarter, according to Morningstar Direct.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)