Introducing a New Tool to Evaluate Funds and Firms

Insights from Morningstar’s first active equity benchmarking report.

The landscape of actively managed equity funds is vast and varied. Morningstar Categories go a long way to help investors compare funds with similar investment styles, but there can still be considerable differences within these groups. Furthermore, the firms managing these funds are equally as diverse, ranging from small boutiques to global behemoths, yet data describing their research resources is scant.

Morningstar’s new active equity benchmarking report addresses these challenges by pooling together portfolio data from almost 3,000 unique funds and aggregating survey responses from nearly 50 firms covered by Morningstar Equity Manager Research. The report is designed to serve as a due-diligence tool for asset allocators and a benchmark against which active managers can assess themselves. The following are just a few of the findings from the inaugural report.

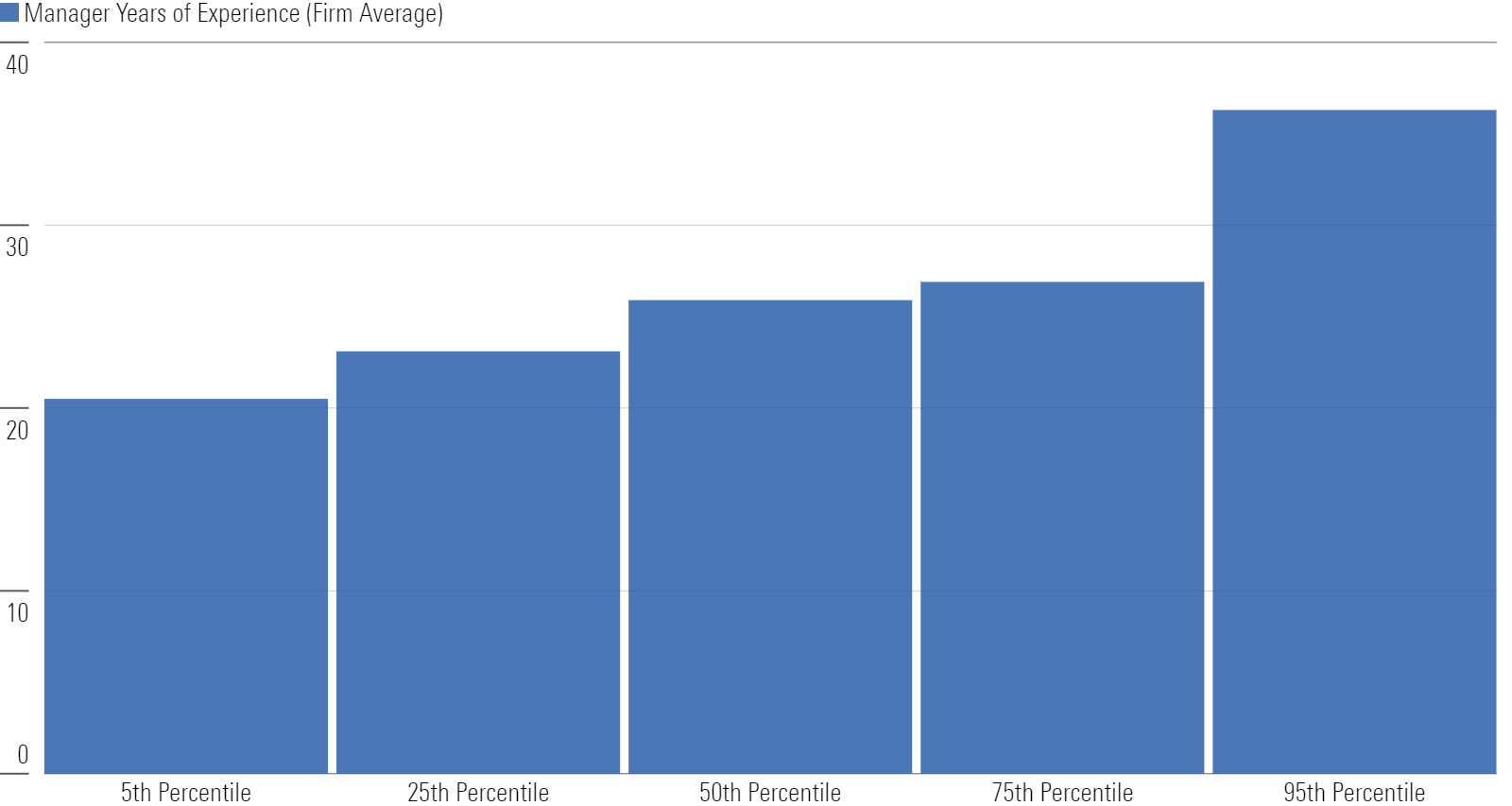

Manager Industry Experience Isn’t a Differentiator

Many firms advertise how experienced their portfolio managers are, yet data aggregated from company surveys indicates that nearly all named equity portfolio managers have many years of industry service. Indeed, even the fifth percentile figure for a firm’s average level of manager industry experience was more than 20 years. The median firm’s average level of manager experience was 25.9 years, while the 75th percentile was 26.9 years. The length of time managers have spent in their current role or at their current firm showed greater dispersion, however, making those traits a better differentiator.

Manager Years of Experience (Firm Average)

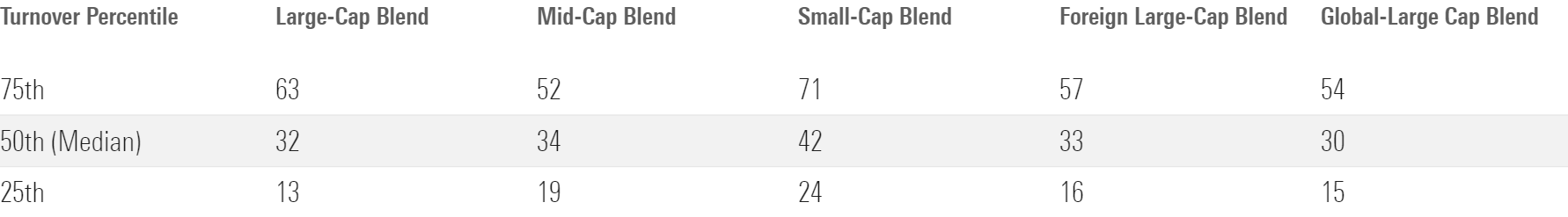

‘Low Turnover’ May Be the New Normal

Some active managers claim they are more patient than the competition, arguing their low turnover evinces discipline amid market volatility. But what is “low”? Lower than many might think. The majority of the nearly 3,000 funds across Morningstar’s broad US and international style box categories had turnover below 40%. The median annual turnover for global large-cap growth funds was just 28%. Even the 75th percentile for turnover was in the 50%-range for some categories. These data points suggest a buy-and-hold approach is closer to the standard than the exception.

Turnover Percentile

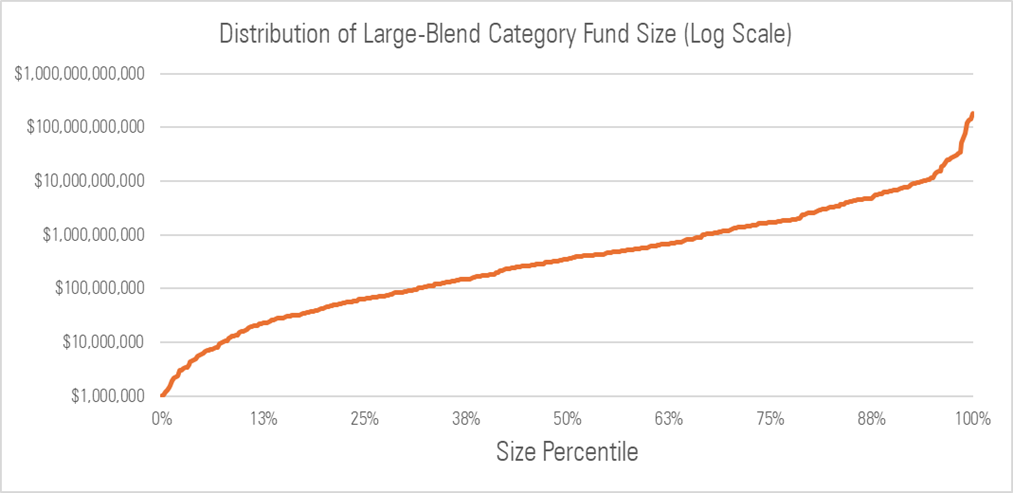

Most Active Funds Are Small

The largest and most popular equity funds typically grab headlines, but many investors may not realize just how much bigger they are than their competitors. The distribution of active funds’ asset bases skews sharply to the right, with most remaining quite small and a few running huge sums. Even for the large-blend and large-growth categories, which contain some of the biggest funds around, the 75th fund size percentiles were just $1.7 billion and $3.0 billion, respectively, as of June 2024. The median large-blend fund had about $400 million—roughly the same as the median small-blend fund. Foreign and global funds’ asset distributions look similar.

Distribution of Large-Blend Category Fund Size

Most Portfolio Managers Run More Than One Strategy

The survey data highlights how few managers focus on one strategy. The median firm’s portfolio managers oversee an average of 2.2 strategies. The 75th percentile firm’s managers oversee an average of 3.5. Firms whose managers run just one fund on average are rare, ranking at the fifth percentile of the distribution. While managers may have comanagers or spend more time on one fund than another, they’ve usually got more than one portfolio to stay on top of.

Morningstar’s active equity benchmarking report can help investors set objective baselines for these and other common fund and firm selection criterion.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NPR5K52H6ZFOBAXCTPCEOIQTM4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-24-2024/t_c34615412a994d3494385dd68d74e4aa_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)