Managed Futures: What to Know About This Strategy for ETFs

Their diversification benefit justifies their place in a portfolio during market downturns.

As investor demand for exchange-traded funds has crescendoed in recent years, fund companies have rushed to offer everything under the sun. But more is not always better in the world of ETFs. Most areas of the market are now oversaturated with glitzy offerings that investors may want but do not need.

Managed futures are one exception to the crowded marketplace. The hedge-fund-like strategies have long struggled to take root in the ETF vehicle. But this nascent corner of the market may be coming to life.

Managed-futures strategies trounced stocks and bonds during recent market downswings, sparking flows into those ETFs. That resilience was more than lightning in a bottle: Managed futures have a long track record of diversifying risk in traditional portfolios. Investors must understand how these strategies work and the differences between them before they can successfully harness their potential. The “managed futures” label covers a diverse range of strategies—even in an upstart ETF market that spans just a handful of products.

What Are Managed Futures?

Managed-futures strategies generate returns by trading futures contracts, often including several different contracts of up to hundreds of futures globally. Current ETF offerings employ trend-following, a popular strategy akin to momentum ETFs for stocks.

Trend-following taps a straightforward formula: Buy what’s up, sell what’s down. These systematic strategies eschew fundamental analysis, manager due diligence, and intuition, relying instead on investments’ recent direction to foretell their trajectory.

This simple strategy is head-scratching. For one, the logic seems backward: Many investors make their bacon by loading up on underpriced securities or fading those whose valuations become too lofty. Buying the winners and selling the losers seems like chasing a boat that already left the harbor. By nature, the strategy will never buy the bottom or sell the top. Plus, building a fund around a handful of cut-and-dried rules seems too unsophisticated to translate into a performance edge.

The best explanation for why trend-following works is that investors react to new information too slowly. Preconceived notions make us slow to incorporate positive news that should increase prices or bad news that should decrease them. Clients may be dubious of new information. Investment committees take time to review new theses. Systematic trend-following exploits the sloth, carving an advantage by capitalizing on human inefficiencies.

Trend-following rhymes with momentum investing, a better-known philosophy. A couple of key features delineate the two. Momentum strategies tend to focus on stocks and show positive correlation to the stock market. Managed-futures funds can trade futures on stock, bond, commodity, and currency markets around the world. They are also willing to go long or short, resulting in low or negative correlation with the broad equity market, a key differentiator compared with long-only momentum ETFs.

Touch and Go

Managed futures generated respectable returns over the past two-plus decades. The Societe Generale CTA Index, a benchmark of equal-weighted popular managed-futures strategies, gained 4.8% annualized from January 2000 through May 2024. That trailed the Morningstar Global Markets Index (5.9%) but outpaced the Morningstar Global Core Bond Index (3.9%).

Managed-futures performance comes in fits and starts. Its protracted falls and sharp rises mean that managed futures have seen long stretches of subpar returns punctuated by bursts of outperformance. Indeed, the SG CTA beat the global stock market in just 35% of rolling three-year windows from 2000 through June 2024.

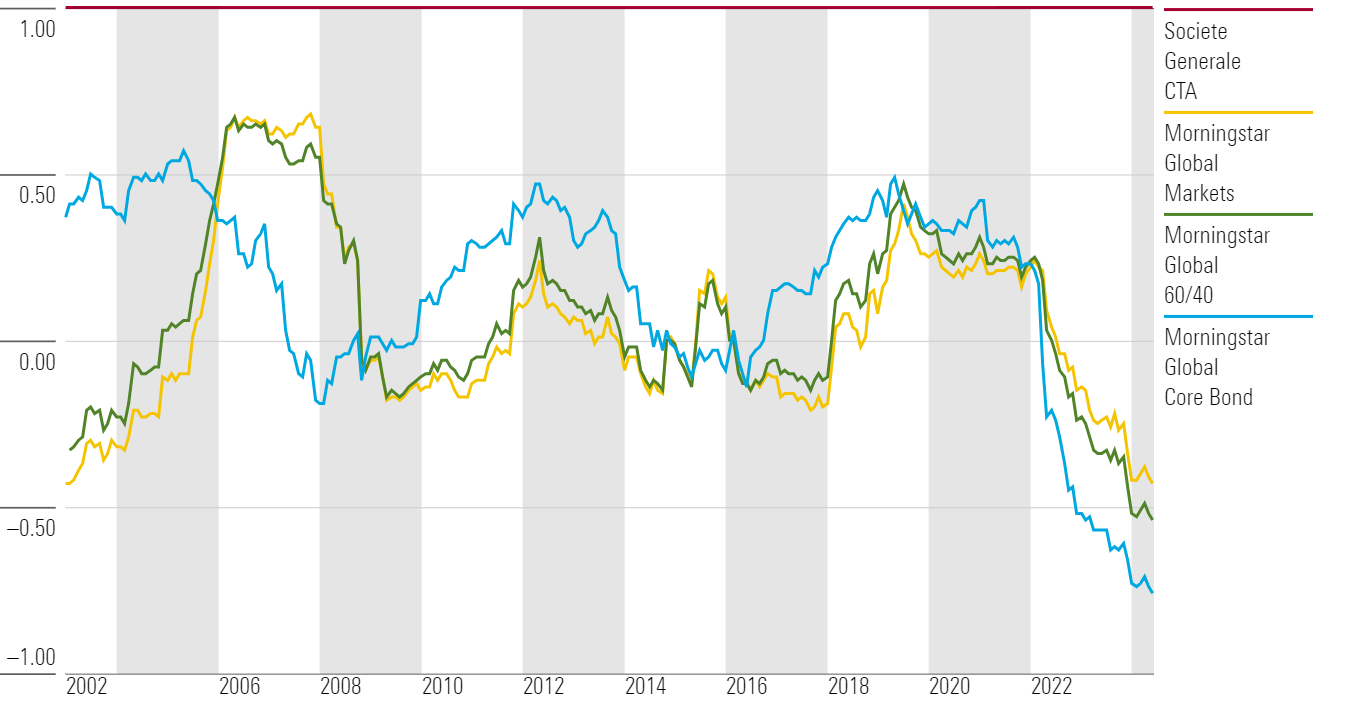

Relative Wealth of SG CTA Index Versus Morningstar Global Markets Index

Stretches of underperformance can make it difficult to stick with managed futures. It’s hard to hold an investment when other choices consistently outperform it. That’s doubly true when the investment is unconventional and everyone else owns the same alternative—stocks and bonds. Placing $100 in the SG CTA Index in January 2010 would have earned $17 over the next decade. The same investment in iShares Core S&P 500 ETF IVV would have netted $255. Investing in managed futures requires patience and conviction.

Portfolio Fit

When the going gets tough, it’s important to remember why one would bother with managed futures in the first place: diversification. Managed-futures funds seek to deliver positive absolute returns in all market environments, and they have historically delivered protection in stress markets—evidenced by excess return spikes around major crises against the Morningstar Global Markets Index. In the long run, they have maintained low correlation to traditional, long-only asset classes.

Rolling 3-Year Correlation vs. Societe Generale CTA Index

Managed-futures strategies’ correlation to major traditional asset classes have largely remained low in absolute terms, whether negative or positive. Their uncorrelated performance to a classic 60/40 portfolio can be crucial in periods when stocks and bonds start to move in lockstep. This will not always be the case for all managed-futures strategies, depending on their positioning. But it has proved valuable in many instances when stock-bond correlation rises, such as during the 2008 financial crisis and in 2022.

Like most other categories of alternative investments, managed-futures funds won’t always outperform stocks in absolute terms. But their diversification benefit justifies their place in a portfolio from a risk-adjusted returns perspective. Between January 2000 and April 2024, the Sharpe ratio of the Morningstar Global Markets Index was 0.32 annually. Allocating 80% to that benchmark and the remainder to the SG CTA improved the Sharpe ratio to 0.37 because of lower volatility and higher excess returns. This feat still holds up in the trailing 10-year period, which features an extended period of sluggish managed-futures returns.

It’s understandably tempting to time market trends or chase manager’s performance. Picking a strategy comparable to your portfolio’s risk budget and understanding its performance expectations will make staying the course much easier. Investors need to keep a holistic and long-term view of the portfolio to successfully reap the benefits of managed futures.

Managed-Futures’ ETF Presence

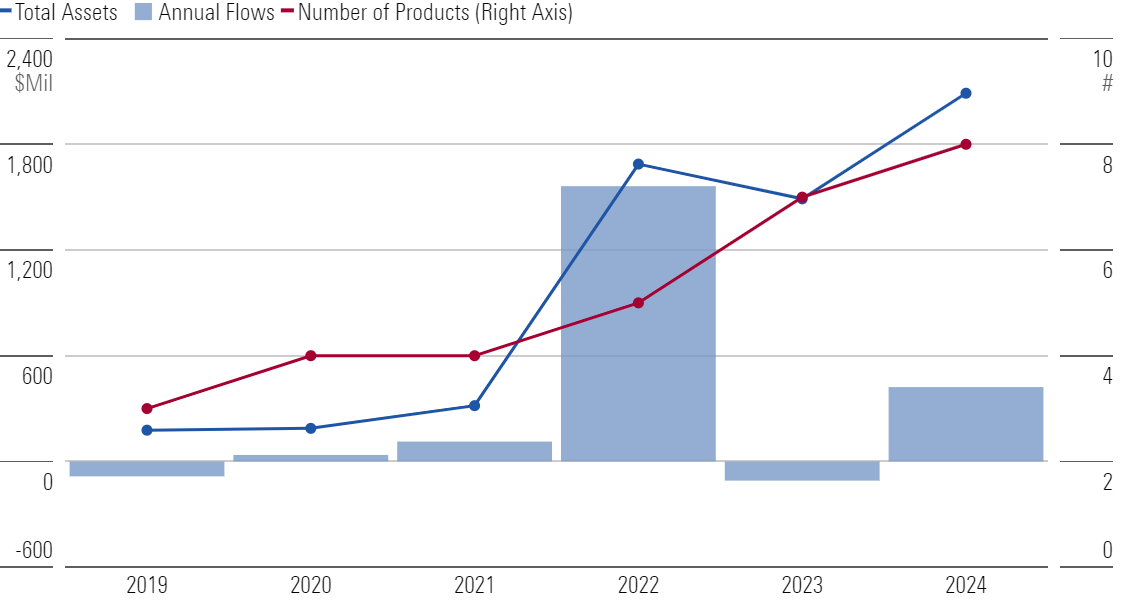

The diversification benefits of managed futures haven’t caught on with ETF investors. The eight managed-futures ETFs totaled just $2.1 billion in assets at the end of June 2024. That’s well short of the $18 billion parked in trend-following mutual funds and $300-plus billion in managed-futures hedge funds. It represented a mere 0.02% of the US ETF market.

Still, managed-futures ETFs have made strides more than a decade after the first one debuted. They grew assets nearly tenfold and doubled their count over the past three years. Some of that owes to legislation, as the SEC’s Derivatives and ETF Rules cleared regulatory hurdles for these products. But the real breakthrough came in 2022, when managed futures flourished as both stocks and bonds tumbled. That momentum stalled in 2023 but resumed in 2024; investors plowed roughly $420 million into the ETFs in the first half of 2024.

Managed-Futures ETFs Have Gained Traction

The ETFs making up this growing space can look quite different from one another, from investment approach to asset classes included in their strategy. Some ETFs run their own trend-following strategies, while others attempt to replicate an index composed of the largest managed-futures strategies, like the SG CTA index. Replication strategies have recently gained the most traction. Providers argue that replicating a diverse basket of funds’ returns lowers single-manager risk. This generates a more stable return profile and is easier to stick with.

Funds sharing the same investment approach might still carry different portfolios. Each ETF trades a different list of futures contracts and sometimes even different asset classes, like those that exclude equity and/or currency futures.

Most managed-futures ETFs seem to agree on the number of futures contracts to include. A typical managed-futures mutual fund trades up to hundreds of different contracts to diversify exposure and broaden their opportunity set. In contrast, most ETFs pare their list down to around 20. They typically stay in the largest, most liquid contracts, citing trading costs and pricing availability for market makers as a concern (if market makers struggled to price and trade the underlying markets, bid-ask spreads would be wider and the ETF would deviate from net asset value more easily). While this might make sense for replication-based strategies that rely on major risk indicators, the benefit is less clear for discretionary strategies given the lack of markets diversification.

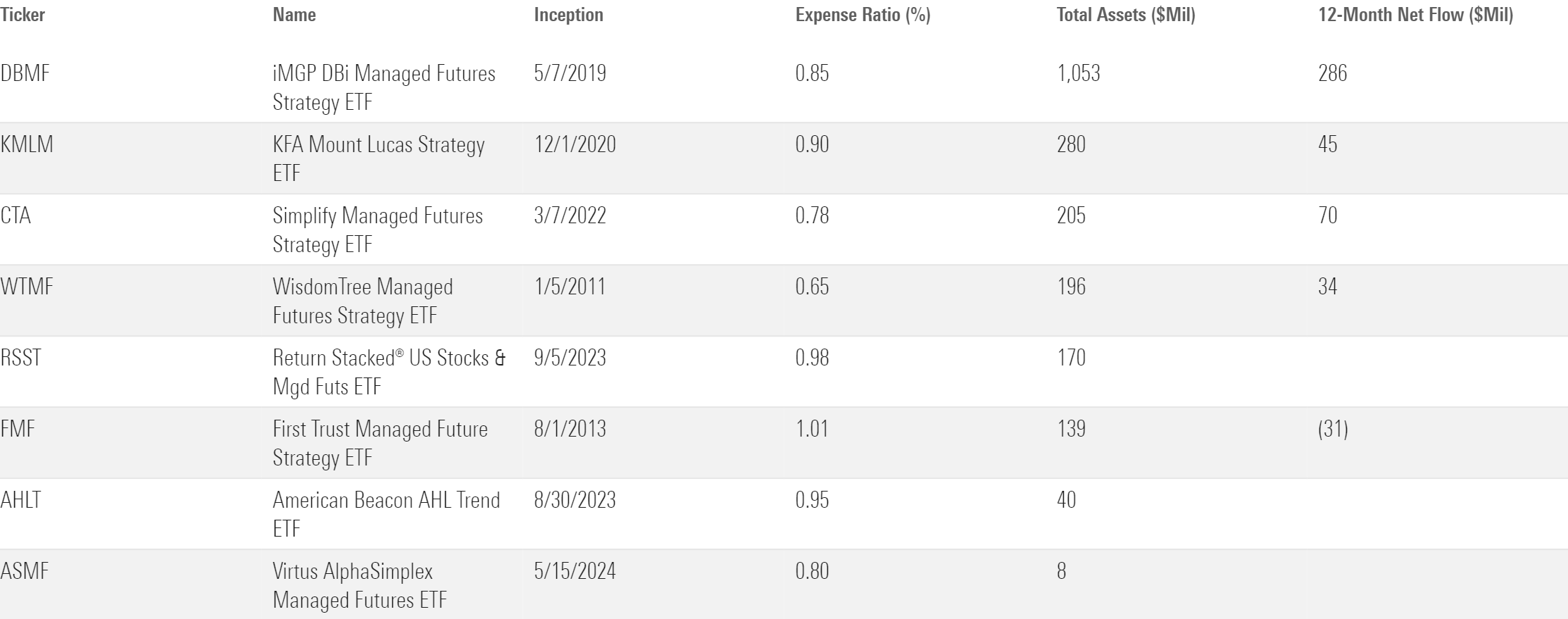

The Lineup of Managed-Futures ETFs

Fund Spotlights

IMGP DBi Managed Futures Strategy ETF DBMF is a replication strategy whose spirit resembles traditional index funds. It subscribes to the same logic: Rather than generate original investment ideas, sweep in the whole market segment and build an edge by charging a low fee.

This fund replicates the SG CTA Index, an equal-weighted composite of the 20 largest managed-futures strategies that report daily returns. The index is designed to represent the managed-futures space. That’s a tall task. Many managed-futures strategies don’t report daily returns because their structures don’t require it, and those that do can behave quite differently from one another. Still, the index should provide a reasonable snapshot of the market.

A model constructs this portfolio using only SG CTA Index returns. Traditional index funds know their benchmark’s daily holdings and weights; this one backs into its composition based on performance alone. Instead of following a recipe, the fund tastes the cake and determines the ingredients itself.

Cost efficiency is the main benefit to this replication strategy. It’s cheaper to leverage the market’s consensus opinion than formulate one’s own. That shows up in the 0.85% fee—cheaper than more than 90% of systematic-trend funds. A drawback is that following the market requires a lag. This strategy rebalances weekly to minimize that lag.

A somewhat narrow scope is another trade-off for the fund’s cost advantage. It trades just 14 contracts in total. Implementation costs and returns-based replication prevent it from reaching esoteric markets that may aid performance for broader managed-futures strategies. The fund still covers solid ground, though, trading in equity, bond, currency, and commodity contracts.

This fund climbed 10.2% annualized from its May 2019 inception through June 2024, trouncing the average systematic trend fund (5% gain) and Morningstar Global 60/40 Index (5.5%). It carved out the bulk of its gains in 2022, when it advanced 23.1%, about 10 percentage points better than its average category peer and 40 percentage points better than the global 60/40. Short positions in the yen and US Treasuries and a long oil stake drove it ahead.

KFA Mount Lucas Strategy ETF KMLM is the only managed-futures ETF that directly tracks an index. It plies a transparent, straightforward trend-following strategy that has existed for decades.

This fund tracks the KFA MLM Index, a cut-and-dried benchmark that subadvisor Mount Lucas launched in the late 1970s to capture the trend-following premium. The index budgets risk along three main markets—bonds, currencies, and commodities—based on their historical volatility. Position sizes within those three buckets are determined by a trend signal that compares each contract’s current price with its moving average. Simply put, the index buys contracts trading above their moving average and sells those trading below it.

That simplicity and a set-it-and-forget-it ethos make this strategy unique. It has dealt in the same futures contracts since 2005: five global bond markets, six currencies, and 11 commodities. Equity is the notable absence. Mount Lucas maintains that stocks are built to rise more than they fall. That lopsided profile would leave managed-futures long stocks more often than short, hurting their ability to diversify a portfolio anchored by equities. Indeed, this ETF showed lower three-year correlation with the Morningstar Global Markets Index than all 22 of its category peers with the requisite track record.

This strategy shares similar pros and cons with the iMGP DBi Managed Futures Strategy ETF. Both funds can be slow to digest changes in market trends on account of monthly rebalancing. Trading 22 contracts provides a bit more range, but that still falls well short of more sophisticated peers (and of course excludes stocks). A competitive expense ratio helps conceal those drawbacks. The fund charges a 0.90% fee, ranking in the cheapest 10% of systematic trend funds.

Lower fees have factored into the fund’s excellent performance. Its 10.1% annualized gain from its December 2020 inception through June 2024 ranked in the systematic trend category’s best third and led the Morningstar Global 60/40 Index by 7.4 percentage points (albeit with more volatility). Its best calendar year came in 2022. Going long the US dollar and commodities and short global bonds helped it soar 30.5% on the year, about 16 percentage points ahead of its average peer.

Simplify Managed Futures Strategy ETF CTA only uses commodity and interest-rate futures, differentiating itself from most peers that include currency and equity contracts.

This fund relies on a suite of underlying models from Altis Partners to power the portfolio construction process. A trend-following model is the main driver for the commodity futures, though Altis also applies an additional fundamental reversion model. The reversion signal should put a brake on pure trend-chasing at inflection points in the market with the hopes of curbing losses from sudden reversals. This is a common feature among trend-following managed-futures strategies.

The interest-rates contracts use both models but also incorporate models exploiting the carry trade and the stock-bond correlation. The carry model seeks to profit from roll yield on the US and Canada Treasury curve, while the intermarket model determines directional bets for bonds based on the stock-bond correlation and stock market performance.

Notably absent from this portfolio are equity and currency futures. The managers argue that incorporating equity futures will increase the ETF’s correlation to the stock market, opposite of what they set out to do. The fund has generally delivered on this remit and maintained negative correlation to the Morningstar Global Markets Index since its April 2022 inception. However, its results aren’t markedly better than those of the SG CTA Index or many of its category peers that do utilize equity futures. Currency futures also did not make the cut as the managers deem their mean-reverting nature to be more dominant than the strength of their momentum.

The managers expect the ETF’s standard deviation of returns to run around 15%-18% annually. It has run closer to 19% so far, but the fund hasn’t been around for a full market cycle yet. Thanks to its negative equity correlation, the ETF delivered superb downside protection during the 2022 market meltdown. It outpaced Morningstar Global Markets Index by nearly 45 percentage points between April and September 2022, better than the 30-percentage-point range for the average category peer.

Its bond exposure might still suffer during stress markets, however. The ETF lost over 14% in March 2023 when regional bank failures spurred a drastic plunge in short-term bond yield. Carry trades work best when the yield curve is static, but the regional banking crisis in March 2023 shifted the curve and put a dent in that assumption.

Return Stacked US Stocks & Managed Futures ETF RSST uses leverage to add a replication-based managed-futures sleeve on top of a traditional stock portfolio, all within a single ETF.

For every dollar invested, this fund offers $1 worth of notional exposure to its equity portfolio and $1 worth of notional exposure to its managed-futures portfolio. It achieves this by utilizing futures in two ways: Capital efficiency in its equity sleeve, and diversification in its managed-futures sleeve.

The equity sleeve holds a large allocation to the iShares Core S&P 500 ETF IVV, roughly 70% since inception, and rounds out its stock exposure with S&P 500 index futures. The minimal amount of cash required to collateralize the index futures frees up capital for the managed -futures sleeve. The ETF’s focus isn’t on adding alpha in the equity sleeve, so using an index-tracking ETF makes sense for cost and ease of implementation.

The managed-futures portfolio aims to replicate the performance of the SG Trend Index. Unlike the SG CTA Index, this index tracks the performance of the 10 largest trend-following strategies, who naturally keep their recipes a secret. ReSolve Asset Management, who handles the managed-futures sleeve, runs risk models on the index returns against 27 different futures markets to parse out its component parts. The fund blends both a top-down approach that fits index returns against the different markets’ returns, as well as a bottom-up approach that tests different trend-following strategies and signals. The latter should help the fund better capture changes in the underlying portfolios during market reversals and as new trends establish.

The ETF is part of a broader suite of return-stacked ETFs that use leverage to stretch their investors’ notional exposure to various asset classes. While leverage doesn’t have a stellar reputation, it can amplify both the gain and loss on the underlying strategy when done right. In this case, managed futures and equity have shown highly uncorrelated performance historically, meaning neither element of the fund is likely to exacerbate the market reaction in the other sleeve.

This has so far held true. The ETF maintained a correlation of 0.7 to the Morningstar Global Markets Index from its inception in September 2023 through June 2024, much lower than its notional equity exposure. Though its track record is still short, its managed-futures sleeve has cushioned some equity drops. This April, the fund beat the Morningstar Global Markets Index by 1.6 percentage points when a pessimistic rate outlook blunted the stock and bond markets, but managed futures remained steady.

This article first appeared in the June 2024 issue of Morningstar ETFInvestor. Download a complimentary copy of ETFInvestor by visiting this website.

Correction: This article was updated to correct the rebalancing schedule of IMGP DBi Managed Futures Strategy ETF, which is weekly.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NPR5K52H6ZFOBAXCTPCEOIQTM4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-24-2024/t_c34615412a994d3494385dd68d74e4aa_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)