Markets Brief: Stocks Fall for the First Time in a Month, More Retail Earnings Ahead

Cheniere Energy Partners, Coterra Energy rally on higher gas prices. Bed Bath & Beyond shares plunge following volatile trading sessions.

Stocks closed the week lower for the first time in a month, with the Morningstar US Market Index down for the week after big-box retailers reported results and Federal Reserve minutes showed policymakers were planning to continue raising rates but were starting to show concerns that they may be moving too fast.

The best-performing sectors last week were utilities and energy. Communication services and basic materials stocks lagged the most.

The biggest gains among individual stocks were energy companies, as natural gas prices rose about 5%. Companies in the electric vehicle charging infrastructure space saw their stocks decline.

U.S. retail sales, excluding autos, rose by less than 0.4% in July from June, despite predictions of no change.

Investors will be keeping an eye on earnings results from retailers to monitor how the latest moves in consumer spending have affected specific firms. Among retailers slotted to report next week are Macy’s M, Nordstrom JWN, and Gap GPS.

Tech and software firms Nvidia NVDA, Zoom Video Communications ZM, and Salesforce CRM are expected to report as well.

Events scheduled for the coming week include:

- Monday: Zoom reports earnings.

- Tuesday: Macy's and Nordstrom report earnings.

- Wednesday: Nvidia and Salesforce report earnings.

- Thursday: Gap, Dollar Tree DLTR, and Dollar General DG report earnings.

For the trading week ended Aug. 19:

- The Morningstar US Market Index fell 1.49%.

- The best-performing sectors were utilities, up 1.11%, and energy, up 1.03%.

- The worst-performing sectors were communication services, down 3.77%, and basic materials, down 2.67%.

- Yields on the U.S. 10-year Treasury rose to 2.98% from 2.79%.

- WTI crude-oil prices fell 1.43% to $90.77 per barrel.

- Of the 854 U.S.-listed companies covered by Morningstar, 228 (27%) were up, and 626 (73%) declined.

What Stocks Are Up?

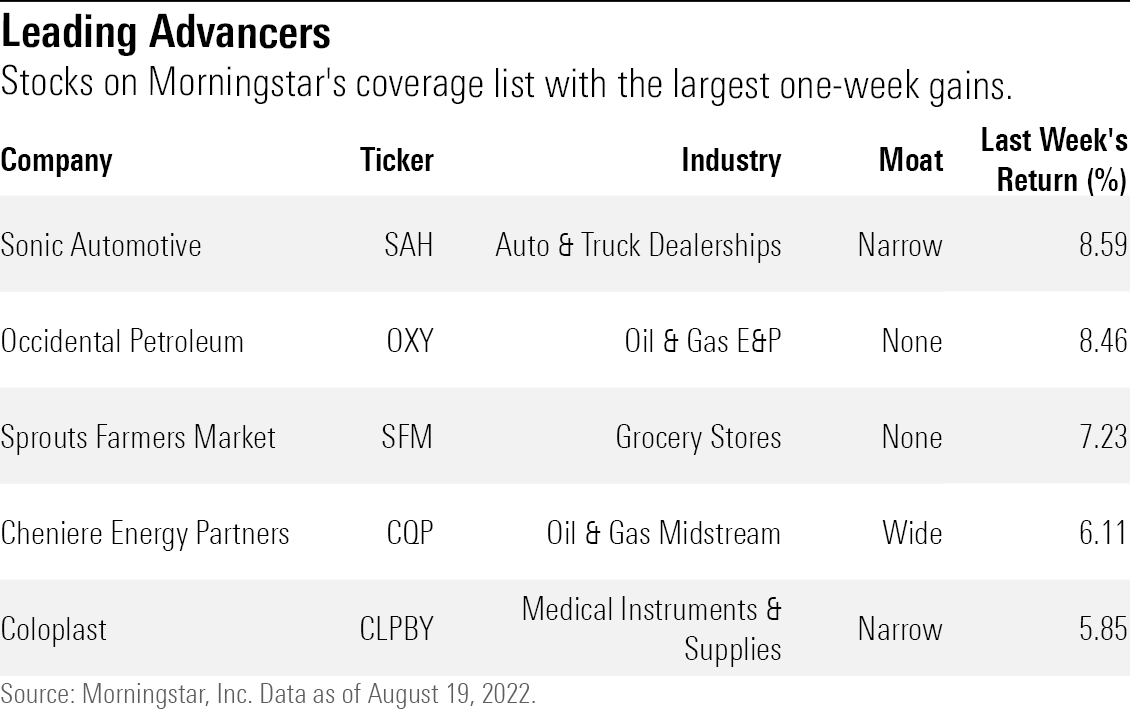

The best-performing stocks in the past week were Sonic Automotive SAH, Occidental Petroleum OXY, Sprouts Farmers Market SFM, Cheniere Energy Partners CQP, and Coloplast CLPBY.

Morningstar

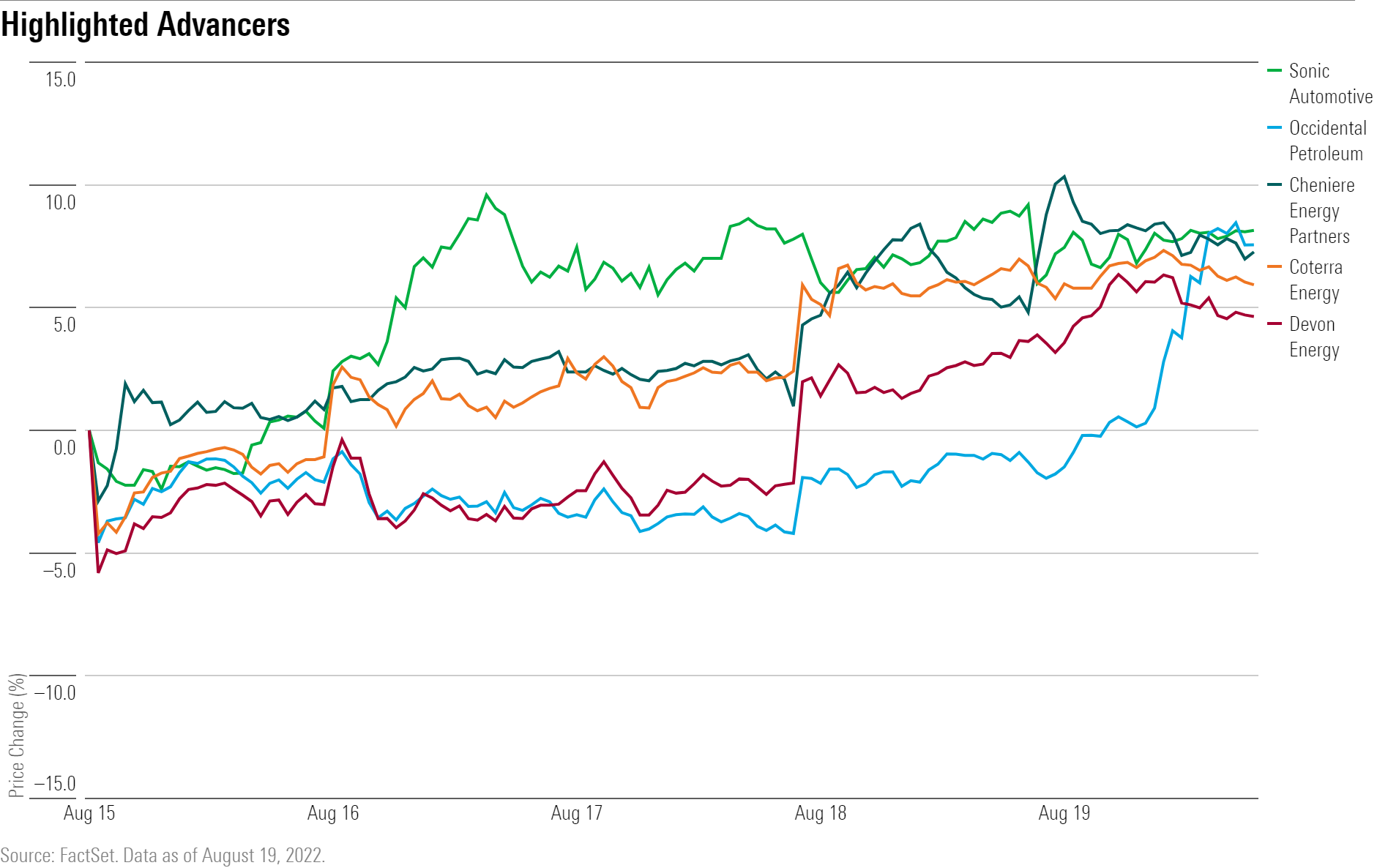

Energy companies also advanced on the rise in natural gas prices this week. The leading gainers were Cheniere Energy Partners, Coterra CTRA, and Devon Energy DVN.

Shares of Occidental Petroleum rallied Friday following the news that Berkshire Hathaway BRK.A, BRK.B received federal government approval to buy up to 50% of the company, CNBC reported.

Morningstar

What Stocks Are Down?

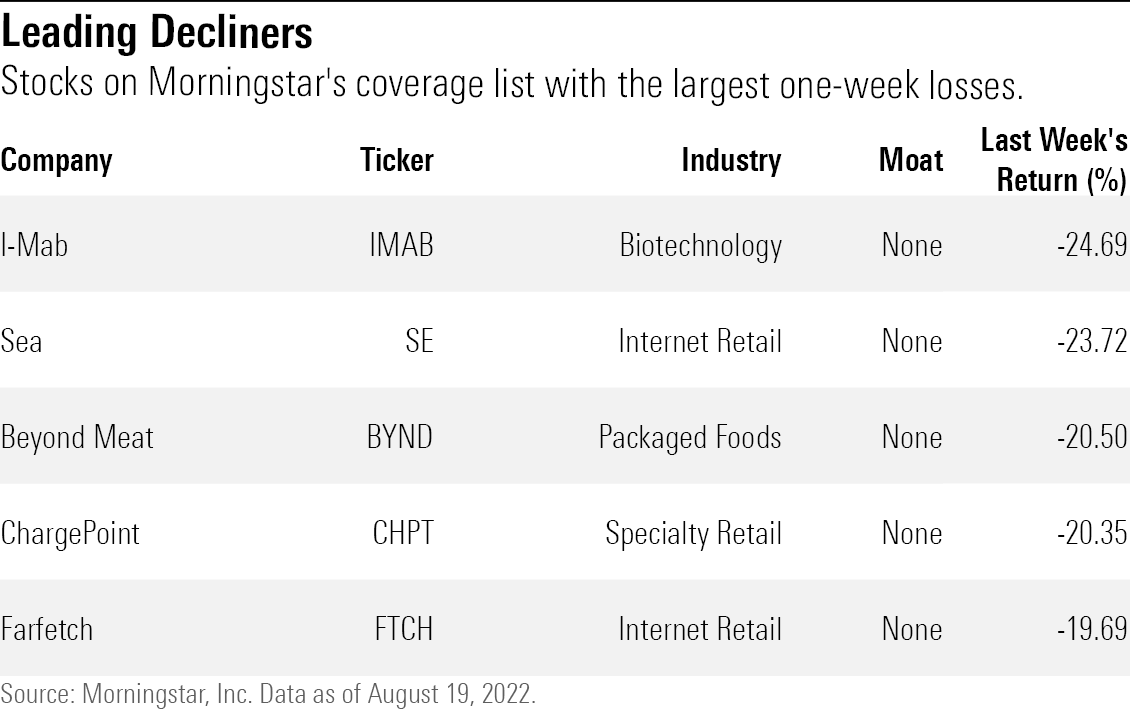

The worst-performing stocks in the past week were I-Mab IMAB, Sea SE, Beyond Meat BYND, ChargePoint CHPT, and Farfetch FTCH.

Morningstar

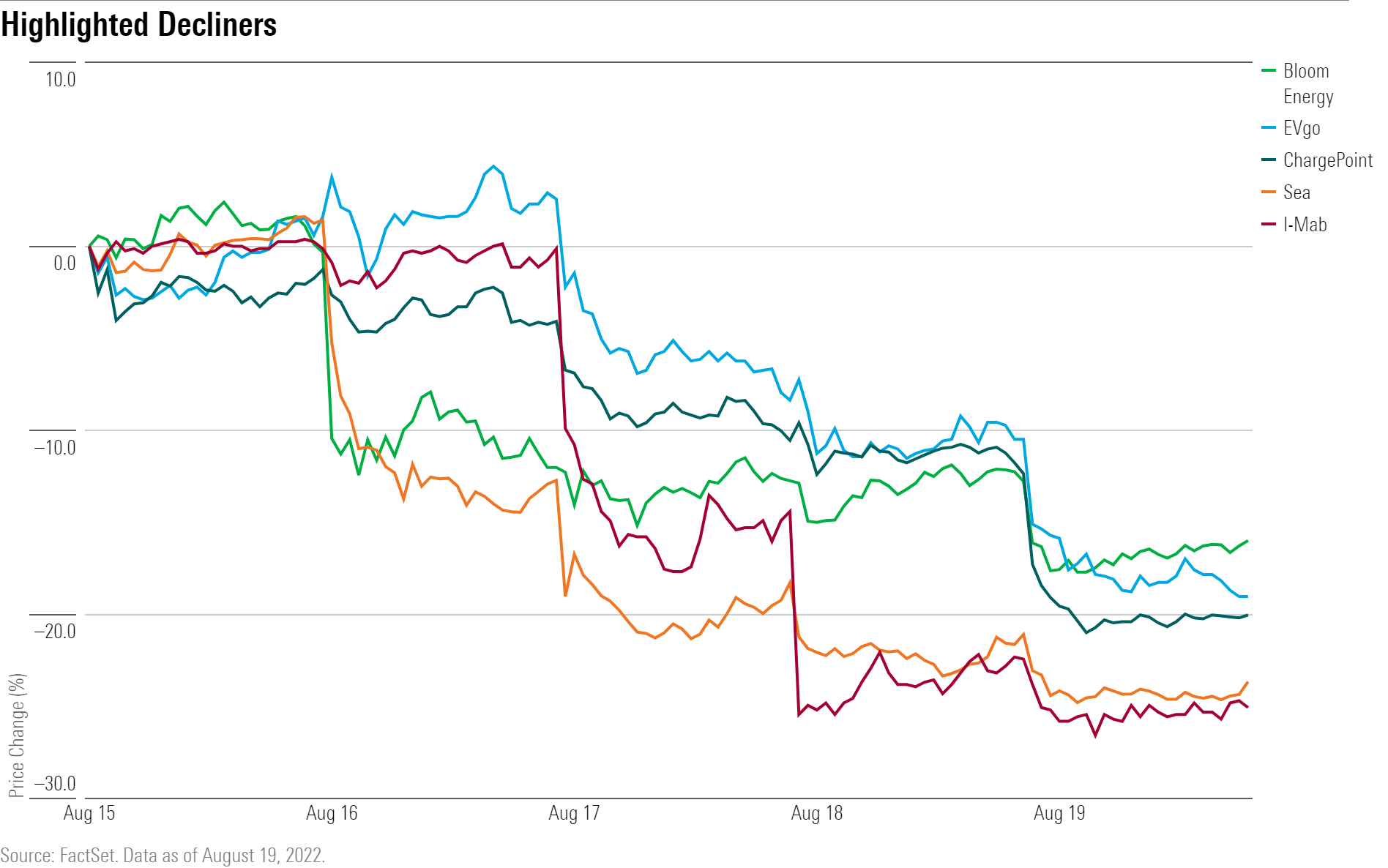

Electric vehicle charging infrastructure companies EVgo EVGO and ChargePoint pared back gains from earlier this month as investors parsed the details of the Inflation Reduction Act to see how its proposals would affect the industry. Hydrogen fuel cell manufacturer Bloom Energy BE also fell. The company said this week that it had priced an offering of 13 million shares of its Class A stock.

Shares of meme stock Bed Bath & Beyond BBBY had a volatile week rising and then coming down on news that activist investor Ryan Cohen sold the entirety of his stake in the company, CNBC reported.

Morningstar

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UUSODIGU4REULCOR35PTDS7HW4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HBAEAVIJHFEBTPMEK2UMVQ3NFQ.png)