Strong February Jobs Report Leaves Fed on Track for More Rate Hikes

Slower wage gains offer good news on inflation, but the upcoming CPI report could determine how aggressive the next Fed move is.

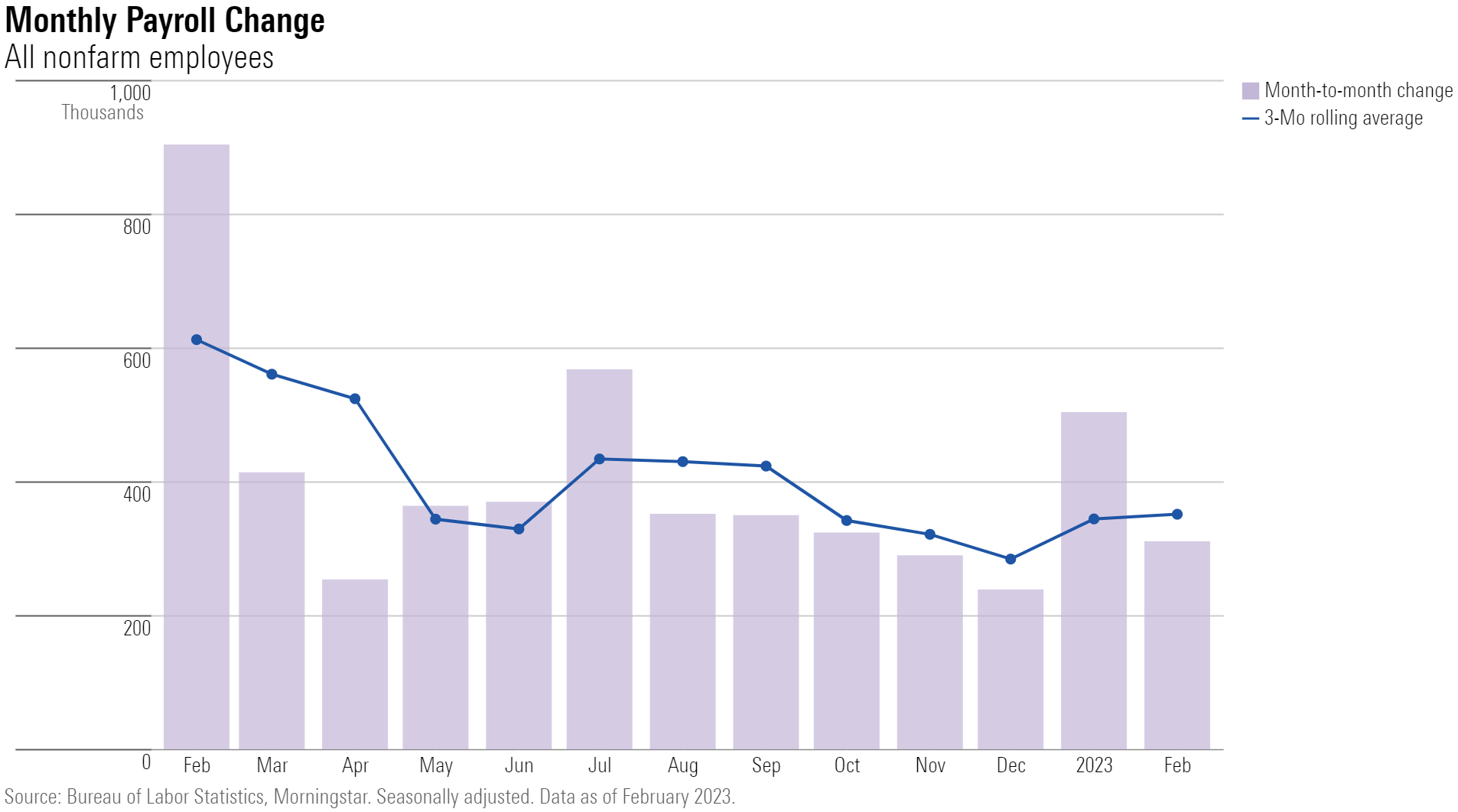

February was another month of solid job growth for the U.S. economy, leaving the Federal Reserve on track to yet again raise interest rates.

But better news on the wage inflation front has the outlook for the scope of any rate increase this month up for debate.

“Job growth continues to remain robust in defiance of the Fed’s rate hike campaign,” says Preston Caldwell, chief U.S. economist at Morningstar. “Today’s report leaves the door open for a 50-basis-point rate hike in the Fed’s March meeting, although such a decision will hinge more on the upcoming CPI report and other factors.”

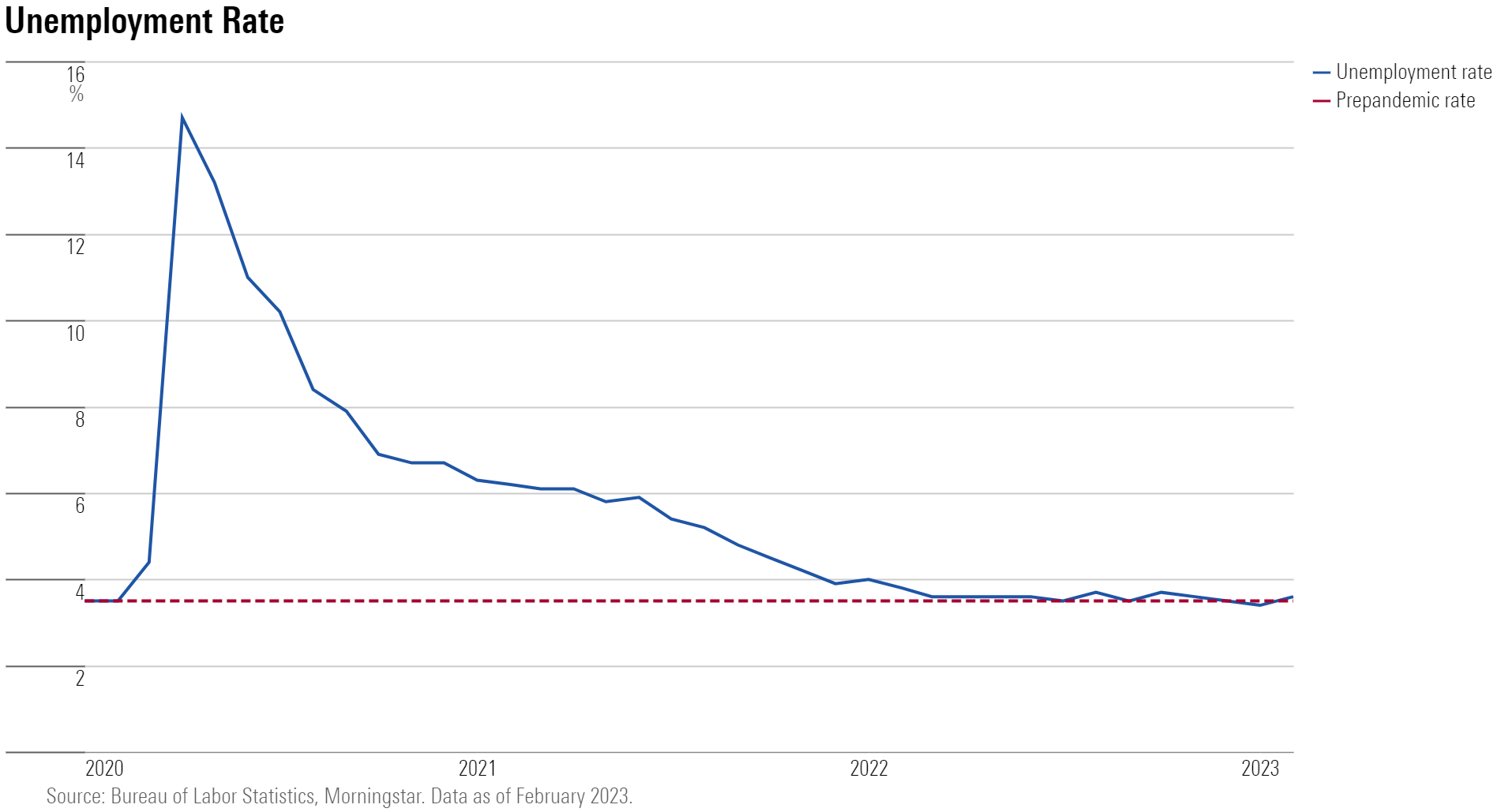

Payroll numbers for February 2023 showed the economy adding 311,000 new jobs, an increase well above economists’ forecasts. At the same time, the unemployment rate rose slightly to 3.6%.

With the continued fast jobs growth, Caldwell says, the level of nonfarm payroll employment now exceeds its prepandemic mark by 2%. He adds the caveat, however, that job openings remain high at 6.6%.

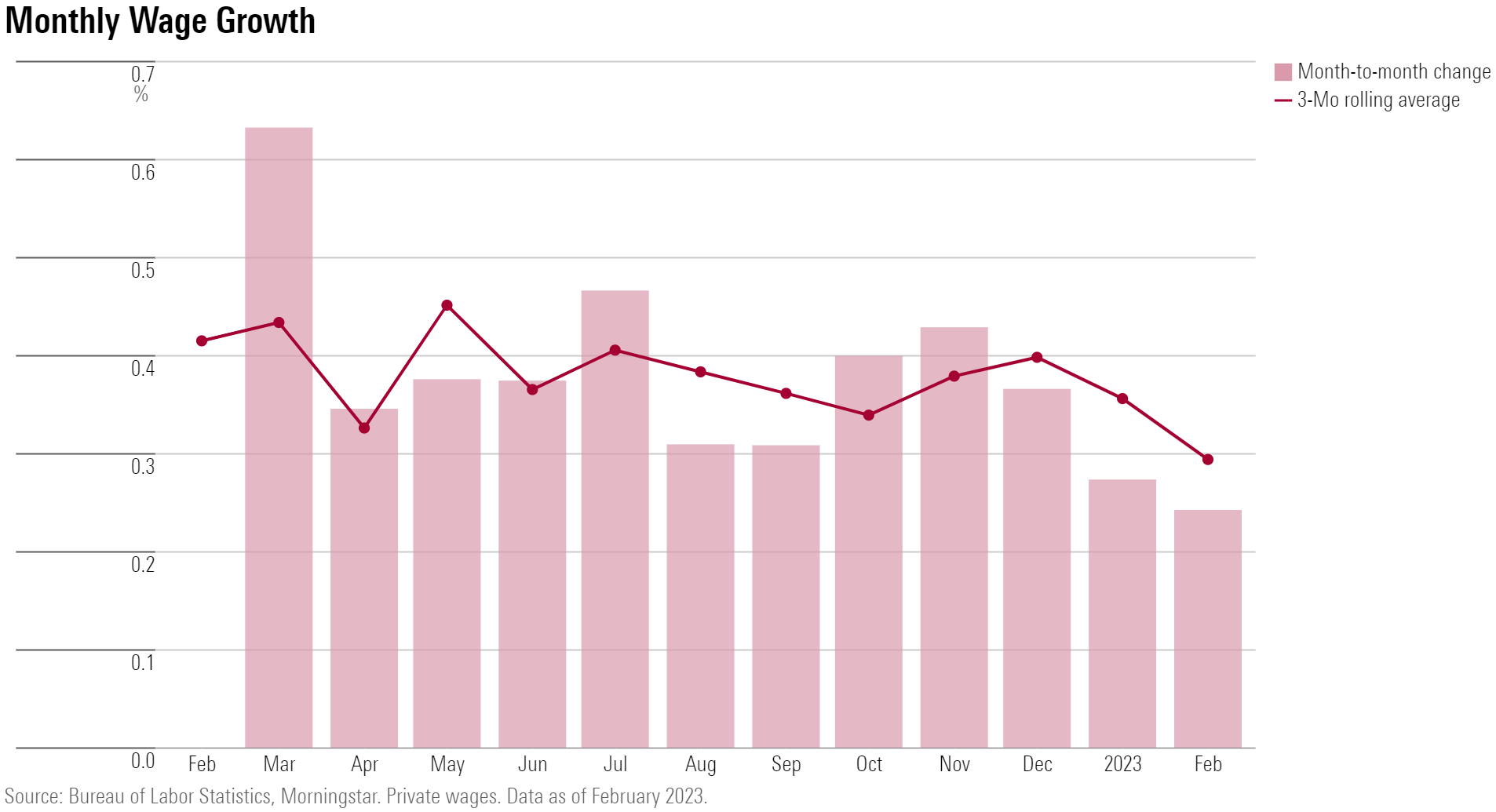

Meanwhile, wages edged upward only slightly as a growing labor supply appeared to cool upward pressures. That’s a positive sign when it comes to concerns about wage hikes fueling continued high levels of inflation. “Broader signals of overheating in the job market have diminished compared to a year ago,” Caldwell says.

February Jobs Report Key Stats

- Total nonfarm payrolls rose by 311,000 versus 517,000 in January.

- The unemployment rate ticked up to 3.6% from 3.4% in January.

- Average hourly wages grew by 0.2% to $33.09 after rising 0.3% in January.

- Jobs in leisure and hospitality grew by 105,000, roughly in line with the average monthly rise of 343,000 over the past six months.

Strong Job Growth Continues

The February jobs report from the Bureau of Labor Statistics showed that total nonfarm payrolls rose by 311,000, below the average monthly gain of 401,000 in 2022 but higher than consensus expectations from FactSet for jobs growth of roughly 200,000. And at an annualized pace, nonfarm payroll employment has grown by 2.8% in the past three months, according to Caldwell.

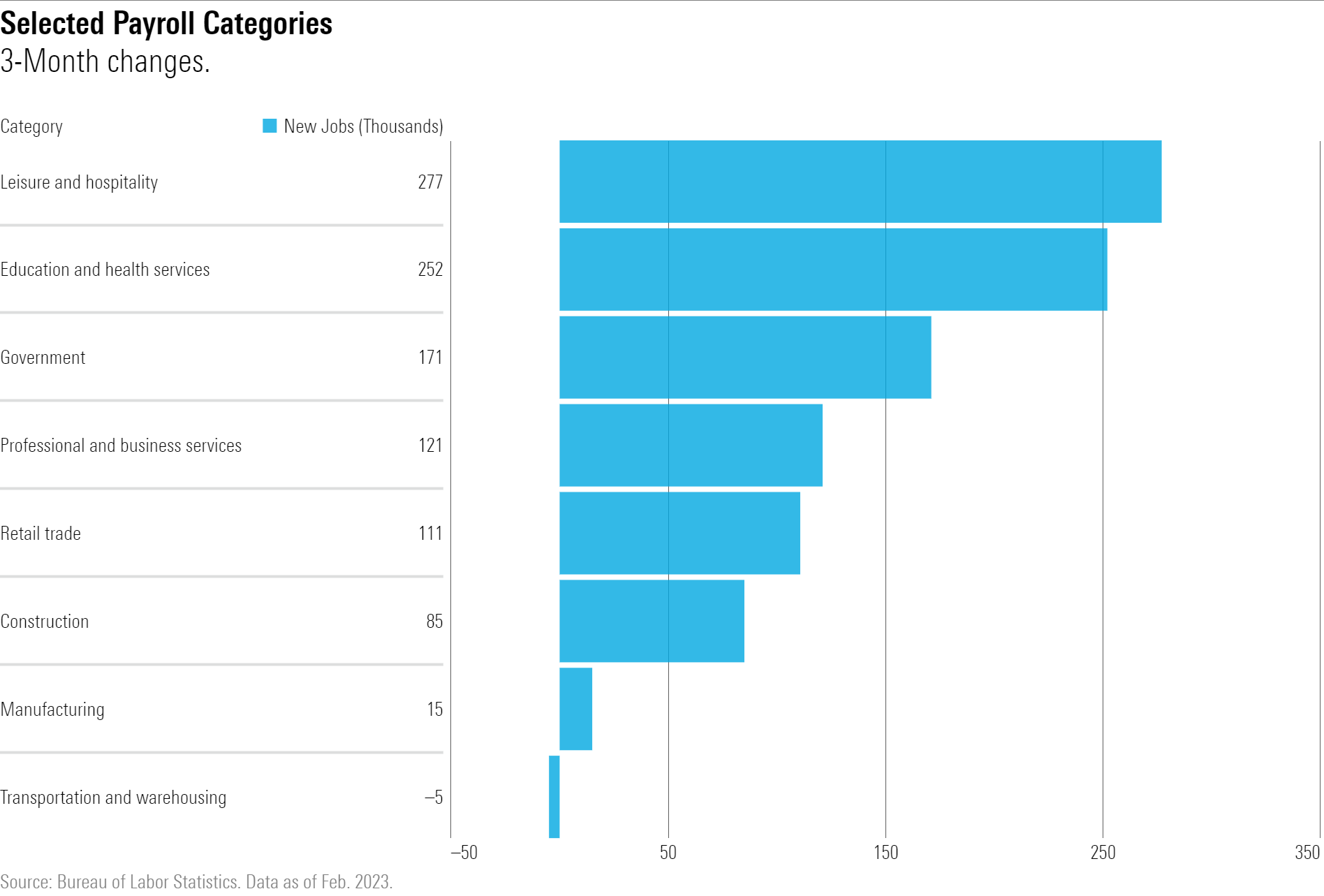

Gains in hiring were led by leisure and hospitality, retail trade, government, and healthcare. Jobs declined within information as well as transportation and warehousing.

Unemployment Rate Edges Upward

“The downtrend in growth which had prevailed throughout 2022 now appears arrested,” Caldwell says.

In year-over-year terms, employment is up about 3%, while expectations for real GDP growth in the first quarter range from 1% to 2%, according to Caldwell. “It’s unusual for job growth to outpace GDP growth,” he says.

If this discrepancy persists, Caldwell says, it will start to cut into businesses’ profits. “Employers seem to still be stuck in the mentality dominant a year ago of struggling against rampant labor shortages,” he says. “But we do expect businesses to curtail their hiring sharply over the course of 2023, especially if profit margins begin to erode.”

The unemployment rate rose to 3.6% from 3.4% in January. It is now up slightly from its lowest level since 1969. Over the past year, the unemployment rate has hovered steadily. From March 2022 onward, the rate ranged between 3.5% and 3.7%.

Strength in Construction Jobs, but a Slowdown Looms

“There’s still much reason to think that a slowdown in hiring is coming, at the industry level,” Caldwell says. “Surprisingly, employment in construction and real estate industries hasn’t been hit at all from the housing slowdown stemming from higher mortgage rates.”

In fact, Caldwell says, construction and real estate jobs grew at a 4% annualized pace in the past three months, but “that’s bound to change within the next year.”

Meanwhile, the fastest rate of hiring has been within the restaurant and leisure categories. “These industries have benefited from a normalization of consumer demand after the pandemic thus far, but that process is wrapping up.”

Within the jobs report, leisure and hospitality jobs rose 105,000 in February, and new jobs in food services and drinking places rose by 70,000. Employment in the leisure and hospitality category is still below its February 2020 prepandemic level by 2.4%, or 410,000 jobs.

Wage Growth Moderates

“Current year-over-year wage growth is consistent with an inflation rate of 3.0% to 3.5%, which is above the Fed’s 2.0% target, but less alarming than what we’ve seen over the past year,” Caldwell says.

Private wage growth has fallen to 4.6% year over year versus 5.9% in March 2022, by Caldwell’s measure.

“Based on this,” he says, “it shouldn’t be too difficult for the Fed to cool off labor markets sufficiently to reach its inflation goals.”

Caldwell says if wage growth has moderated even as employment levels move higher, “that suggests that labor supply is expanding at a healthy pace.” He notes that it’s hard to account for labor supply because metrics are derived from the household survey, which he says has posted slower job growth over the past year compared with the headline nonfarm payroll figures.

“But the household survey does show the labor force participation rate hitting 62.5% in February compared to 62.2% a year ago, a solid rate of increase,” Caldwell says.

Average hourly wages rose by 0.2% in February, up to $33.09.

Jobs Report Strengthens Outlook for Fed Rate Hikes

“With the job market showing no signs of slowdown yet not appearing overheated either, the Fed will look to other data to help decide whether to hike by 25 basis points or 50 basis points in its late March meeting,” Caldwell says.

“The upcoming CPI inflation report will be important,” he says. The Bureau of Labor Statistics is set to release the February CPI report on Tuesday.

In addition to the CPI, Caldwell says that retail sales data will help clarify the trend in consumer spending: “An outside possibility is that the brisk rate of hiring feeds back into consumer demand, which would help perpetuate a cycle of ongoing growth in jobs and economic activity.”

In that scenario, according to Caldwell, “the Fed would be apt to take the federal-funds terminal rate much higher than the approximately 5% we expect in 2023.”

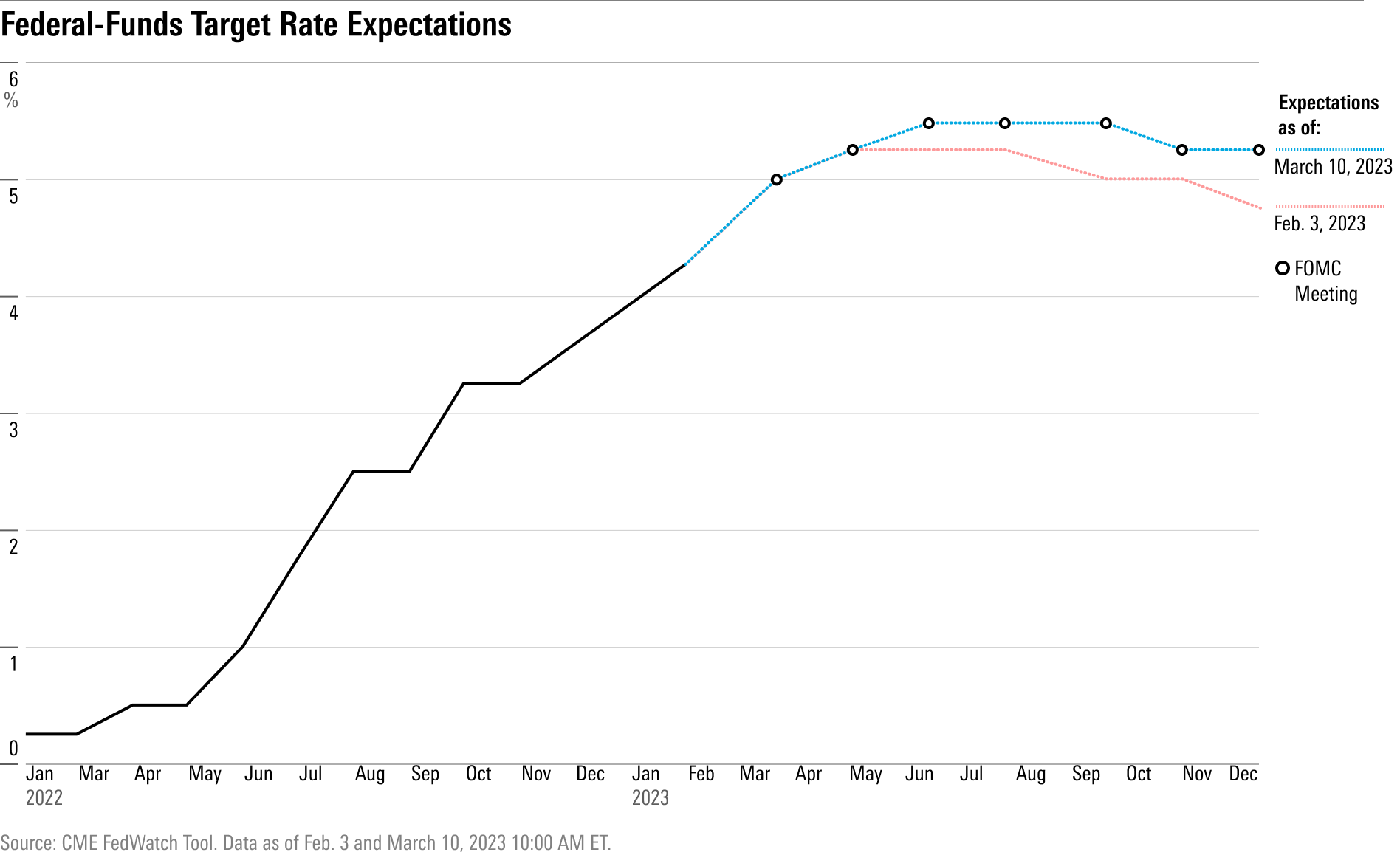

The market’s expectations for the federal-funds effective rate at the Fed’s upcoming March 22 meeting are roughly split between a quarter-point and half-point rise: 55% of the market sees the rate rising by 0.25 percentage points in March, while 45% expects the Fed to issue a stronger 0.50-percentage-point hike, according to the CME FedWatch Tool. Just a week ago, only 28% of market participants expected the Fed to issue a 0.50-percentage-point hike.

And for longer-term expectations, the majority of market participants see the federal-funds rate reaching an upper limit of 5.50% at the Federal Open Market Committee meeting in June and holding steady until falling back to an upper limit of 5.25% in November. About a month ago, most expected the rate to reach an upper limit of just 5.25% and drop to 5.00% in the fall.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UUSODIGU4REULCOR35PTDS7HW4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HBAEAVIJHFEBTPMEK2UMVQ3NFQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)