How to Improve Retirement Plans for Teachers and Other Public Servants

One simple fix to bring down investment costs.

Congressmembers Jimmy Panetta, Ron Estes, Brendan Boyle, Darin LaHood, Madeleine Dean, and Andy Barr have introduced a new bill--The Public Service Retirement Fairness Act--that would allow 403(b) plans to invest in collective investment trusts. These 403(b) plans are like private-sector 401(k) plans, but they are for teachers and other public servants as well as some churches and nonprofits. Such a change could help introduce low-cost options to plans that have been riddled with high-cost options and conflicts of interest.

Introducing CITs into these plans will not fix everything in the 403(b) market. However, we support the proposal (see a full analysis here) because it is a common-sense, straightforward way to help some plans get a lot better. Simply put, workers in 403(b) plans deserve access to the same best-in-class investments as workers in other plans, and CITs can often provide the best value compared with the mutual funds and annuities available in most 403(b) plans. We also have some ideas for further improving the legislation to ensure that it confers some important participant protections.

What Are CITs and What's Their Benefit? CITs are generally pooled investment vehicles organized as trusts and maintained by a bank or trust company, and they are managed in accordance with a common investment strategy. Individual investors cannot buy CITs. However, many kinds of retirement plans--such as 401(k) plans, other defined-contribution or defined-benefit retirement plans that are qualified under Internal Revenue Code Section 401(a), and government 457(b) plans--may invest in CITs.

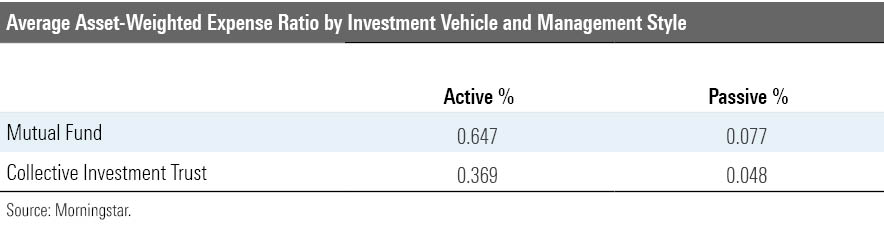

CITs can offer a significant benefit to workers saving for retirement through reduced expenses. Morningstar's analysis demonstrates that CITs are often more-affordable investment options for retirement investors. Because CITs are not marketed and regulated in the way that mutual funds are, the administrative and regulatory costs are generally lower than those of mutual funds, allowing for lower expense ratios to be charged to end investors.

In fact, in many cases, firms offer CITs and mutual funds for the same investment strategy, which reveals the gap between CITs and funds. By comparing the net expense ratio of CIT tiers and mutual fund share classes of the same strategy, we see that CITs are cheaper 91% of the time, and even when considering only the least expensive CIT tier and mutual fund share class, CITs are cheaper 82% of the time.

The asset-weighted average expense ratios of both active and passive CITs are roughly half those of their mutual fund counterparts. Across all investment strategies, as of year-end 2019, the average passive CIT cost fewer basis points than the average passive mutual fund. Similarly, the average active CIT cost less in basis points than the average active mutual fund. (See the full paper for details on this analysis.)

How the CIT Legislation Could Be Further Improved While we support new legislation that would allow 403(b) plans to offer CITs to their participants and we believe it would make lower-cost options available to potentially millions of public-service workers saving for retirement, we believe it could be improved.

The bill could be enhanced by adding additional participant safeguards. Specifically, we believe that the CITs permitted in 403(b) plans should be limited to those already included in plans covered by the Employee Retirement Income Security Act of 1974, such as 401(k) plans. (For those who are really in the weeds on arcane ERISA issues, about 9,000 403(b) plans are covered by ERISA. These plans also are generally prohibited from offering CITs, although a smattering of plans have used novel mechanisms to offer modified CITs. Some church plans have a clearer path to offering CITs.)

The reason for such a change is that CITs in 401(k) plans have a nexus with ERISA, allowing ERISA plan participants to bring an action against the trustee if the trustee has violated its fiduciary duty. While CITs are generally considered low-cost products and we are unaware of any actions in recent history alleging wrongdoing in the CIT marketplace, we think it is possible that new CITs could be created separately for the 403(b) marketplace, and we want to protect against such possible gaming of the law. Nonetheless, such a concern is unlikely to be relevant on day one of the Public Service Retirement Fairness Act going into law. Consequently, the proposed legislation would be beneficial at this time with or without our enhancement, and efforts should be made to include such a change in the near term.

This enhancement would ensure that the CIT offered basic participant protections and would also ensure there was data collected by the federal government on these CITs. Such a change to the proposed legislation would afford 403(b) plan participants greater protections in relation to CITs introduced into their plans.

Concluding Observation There are a lot of other problems with the 403(b) marketplace, and the addition of CITs will not solve most of them. But showing that the federal government is serious about modernizing these plans would be an enormously useful first step to addressing the often-subpar defined-contribution retirement options available to our public servants.

/s3.amazonaws.com/arc-authors/morningstar/c6d5b386-6df4-434b-bf56-ac0c9546e5aa.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T6LOA5ZYUZEWPLNEAQHTZASGTY.png)

/d10o6nnig0wrdw.cloudfront.net/09-16-2024/t_dfa7464cdf714550aa17147bbf0892e9_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-16-2024/t_f4bff959970341438335b5c352bbd465_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c6d5b386-6df4-434b-bf56-ac0c9546e5aa.jpg)