States Emerge With Options for Expanding Retirement Savings

None of the proposals to expand retirement plan coverage is a perfect fit.

director of policy research Aron Szapiro

Last week we looked at how California is looking to expand retirement savings access through its Secure Choice plan and how that plan falls short of being a full substitution for employer plans. California is not alone in trying to improve retirement security. The GAO identified proposals in 29 states to expand retirement plan coverage in 2015. These proposals run the gamut, but they all use the structure of existing federal retirement-savings programs, and none is a perfect fit for the states' goals.

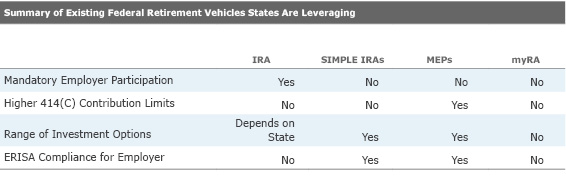

The three key existing federal programs the states are considering leveraging as they try to expand access to retirement savings vehicles: IRAs, SIMPLE IRAs, and Multiple-Employer Plans. Some states have also considered promoting a federal program--the myRA. And many states are considering multiple approaches leveraging more than one of these programs; particularly states are looking into a "marketplace approach" to promote different options that employers could use to offer a retirement plan.

Making Payroll IRA Contributions Easier or Even Automatic: The First to the Finish Line The strategies closest to implementation are ones that make use of existing IRAs. In these plans, states will set up and manage IRAs that make it easy for workers to contribute from their paychecks. In some cases, they will mandate that employers support payroll deductions directly into these IRAs and automatically enroll workers in them. The plans will likely start will with low-cost, low-risk investments, and states could eventually offer a robust range of investment options. This approach could greatly expand the number of people with retirement accounts, but a lack of employer matches and low contribution limits are key drawbacks.

State-run auto IRAs are set to go into effect in Illinois and Connecticut by next year, and in California, Gov. Jerry Brown is expected to sign legislation that would create a similar program. On the federal level, the Obama administration introduced myRA, which allows workers to contribute to a no-fee Roth IRA from their paycheck that pays a return similar to U.S. Series E Savings bonds and cannot lose money. While these plans similarly try to leverage the existing IRA vehicle, they do not feature automatic enrollment or mandatory employer participation.

SIMPLE IRAs: An Option States Are Trying to Make More Appealing SIMPLE IRAs were designed to let small employers provide a retirement plan to their workers without taking on the regulatory obligations of the Employee Income Retirement Security Act like they would if they offered a 401(k). The catch is that the employers have to match employee contributions up to 3 percent of their salary or make automatic contributions of 2 percent of salary. And, employers cannot contribute more than these amounts. For their part, employees can contribute more than they could to a regular IRA, but less than they could contribute to a defined contribution plan.

The accounts (and the similar but less popular Simplified Employee Pensions) have had some success, but 50% of workers still lack access to a retirement plan at work, and only about 14% of small employers sponsor some type of plan, according to a 2012 U.S. Government Accountability Office report. Some states, like Washington, are looking at making SIMPLE IRAs easier to offer by setting up marketplaces to help employers select a plan and ensuring that they meet certain requirements like being required to offer target-date funds and a balanced fund. Washington will also promote other options including traditional IRAs and myRA, which would relieve employers of the burden of making contributions and taking on ERISA responsibilities.

It remains to be seen how much this approach will expand coverage. SIMPLE IRAs already exist, and the states are essentially just attempting to market them better and make sure they meet certain basic guidelines.

State-Run MEPs: Will the Federal Government Lap the States? States (and a few cities) have also explored running Multiple-Employer Plans, which have historically been a collection of small businesses with a common nexus forming a retirement plan. MEPs are real retirement plans that offer participants the same benefits as more common single-employer plans. Small employers can combine their assets and use their increased market power to negotiate lower average fees for participants. Although MEPs are often marketed as reducing an employer's fiduciary liability and administrative responsibilities, single-employer sponsors could also hire a third-party to take some fiduciary responsibility. In either case, employers have a responsibility to monitor their plan fiduciary.

The Department of Labor has blessed these arrangements, and several states have considered them, but no state has implemented this approach. Massachusetts has the most concrete proposal, and is working on rolling it out on a voluntary basis for nonprofits with a maximum of 20 workers.

Making MEPs easier to form seems like the most elegant solution to encouraging small employers to offer plans voluntarily, although it would be politically difficult to require participation, given the burden to small employers to comply with ERISA. In this case, Congress has been considering legislation to make it easier for small companies to band together to form retirement plans, and the Senate Finance Committee released a bill on Sept. 21 that would do just that--create retirement plans called pooled employer plans. These plans are essentially MEPs, but employers could form them with a pooled plan provider, even if the employers had no common nexus. Although experts do not expect Congress to act this session, if they did so, it would probably discourage states from offering their own MEPs, but might encourage them to market the pooled employer plans on their state retirement marketplaces.

State efforts to increase retirement security may spur more federal action and new laws. But none of the existing vehicles that states are trying to leverage is perfect. The easiest approach--automatic IRAs--provides the least adequate coverage. The more complex approaches--promoting SIMPLE IRAs, setting up MEPs--may well still be too complex for small businesses to find appealing.

/s3.amazonaws.com/arc-authors/morningstar/c6d5b386-6df4-434b-bf56-ac0c9546e5aa.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T6LOA5ZYUZEWPLNEAQHTZASGTY.png)

/d10o6nnig0wrdw.cloudfront.net/09-16-2024/t_dfa7464cdf714550aa17147bbf0892e9_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-16-2024/t_f4bff959970341438335b5c352bbd465_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c6d5b386-6df4-434b-bf56-ac0c9546e5aa.jpg)