Animal Healthcare Is Barking Up the Right Tree

Idexx and Zoetis have profited from pandemic pets, but their valuations remain high.

The COVID-19 pandemic caused a mismatch between supply and demand in the pet market, much as it did for toilet paper, exercise bikes, and more recently, semiconductors. The intake of dogs and cats at animal shelters fell dramatically, by 40% and 33%, respectively, as shelter-in-place orders dominated spring 2020. This put a major squeeze on supply just as demand for pets went through the roof. As a result, the adoption rate of this smaller pool of animals spiked to 60%-70% during spring 2020, compared with typical levels in the mid- to high 50s. We estimate there was a 13% net increase in dog adoptions in 2020 year over year, based on consolidated shelter data and American Kennel Club records. It is less clear what the rise in cat adoptions was as there is simply less reliable data.

We think this increase in adoptions, along with the extended period of intense pet bonding for new and existing pet owners during the pandemic, should support the robust increase in pet healthcare spending that occurred in 2020 over the next 8-10 years, reflecting the general lifespan of newly adopted pets. On pet health demand, we see growth in spending driven by increased pet ownership, as well as owners wanting to spend more on their pets. On the supply side, we think ongoing medicalization and more sophisticated healthcare is also driving up spending.

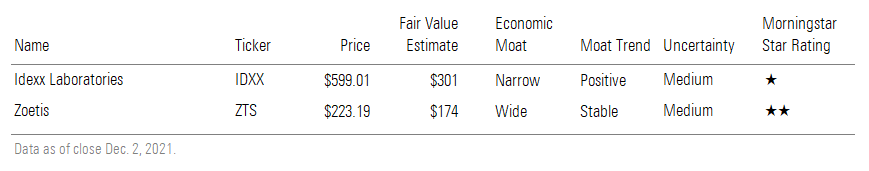

Idexx Laboratories IDXX and Zoetis ZTS have been able to capitalize on this rising demand, and we have dialed up our cash flow projections for them. We believe their economic moats--rooted in intangible assets and cost structures--are intact. However, both companies’ share prices remain rich and imply wildly optimistic expectations.

Pandemic Pet Boom

Overall, we estimate there was a net 6% increase in pet adoption from shelters in 2020, an incremental increase of 7% in fostering (from mid-March through mid-September 2020) of shelter pets, and a 16% boost in purebred dogs last year. This increase was smaller than we’d expected and is likely understated to some degree because we think demand for pets has generally continued since October 2020 as the pandemic has worn on. Based on the collection of disparate shelter and AKC data, we forecast net dog adoption growth at 13% in 2020 year over year. Though there is far less detailed information available about cats and cat adoption, there is little in the historical cat shelter data to suggest the pandemic had a different impact on cats compared with dogs.

We think there was significant pressure driving down the supply of shelter just as demand skyrocketed in spring 2020. This dramatic drop in “inventory” also pushed down absolute numbers of shelter pet adoptions, especially as everyone pivoted to a virtual format that slowed the usual vetting process for prospective owners. The supply situation was exacerbated, in the dog market at least, by biological constraints that govern canine reproduction, which made it challenging for breeders of purebred dogs to increase supply quickly to meet the jump in demand.

The remainder of 2020 was characterized by easing supply constraints, as pet shelter intake gradually recovered from the steep decline in April and May last year, and production of purebred dogs accelerated by fall 2020. Nonetheless, shelter intake of dogs and cats remains roughly 22% and 23% below prepandemic levels in 2019, respectively.

This mismatch in supply and demand for pets revealed a market disrupted by the pandemic. We’ve seen far more media attention paid to the growth in demand, which makes intuitive sense as workers were sent home, but far less on the supply of pets, which we believe played a significant role in adoption last year.

No Longer Raining Cats and Dogs

Based on PetPoint’s aggregated shelter and pet rescue data, dog and cat intake numbers were down 40% and 33%, respectively, from April to June 2020, compared with the prior-year period. We speculate there were a number of dynamics at play for pets entering shelters that led to dramatically fewer animals available.

- Shelter-at-home orders in spring 2020 limited most people having out-of-home excursions primarily to supermarkets, medical facilities, and pharmacies. The usual flow of dogs and cats coming into shelters, including from owners surrendering their pets, was disrupted and we saw intake weaken quickly starting in March.

- We suspect some owners who would have otherwise surrendered their pets might have had second thoughts, especially if they were suddenly working from home, and found it would be easier to keep them. There is a markedly lower level of owners surrendering dogs since March 2020, compared with prepandemic 2018-19.

- We think fewer dogs and cats were captured as strays and placed with animal intake in 2020 thanks to shelter-in-place orders and the spread of COVID-19. Again, this put pressure on the seasonal increase in supply we usually see as the weather warms up.

On the other side of the equation, we saw some evidence of increased demand for pets in the consolidated shelter data, though the adoption data was counterintuitive. Adoption of pets from shelters largely reflected the same pattern we saw in the supply data: As the pandemic constrained normal inventory growth, it also put a damper on adoptions.

However, pet intake declined even more than adoptions decreased. Put another way, adoptions held up better than intake did during 2020. As a result, the adoption rate –the percentage of dogs taken in and that were then adopted out--rose significantly higher in 2020, compared with the prepandemic years. Interestingly, the adoption rate for dogs in 2021 has fallen back to prepandemic levels, and the adoption rate for cats has also moderated, albeit more slowly than for dogs. This suggests the increased demand during the height of the pandemic has receded and leads us to believe the one-time pop is generally over.

We estimate, based on adoption rates in the prepandemic years, an incremental 3% increase in shelter dog adoption and 9% incremental growth in shelter cats adopted in 2020 thanks to pandemic-fueled increases in pet demand. This amounts to a 6% net increase in pet adoption from shelters last year, compared with historical demand.

The 6% net growth in adoption seems underwhelming, especially when placed against the backdrop of media attention on many stories of pandemic pets adopted, shelters that had been emptied of available pets, and disappointed prospective pet owners who faced significant competition from other potential adopters during 2020. After examining the available shelter data, we think there was another indicator of heightened demand in 2020.

We estimate there was an approximate 7% increase in pets going into foster care from the shelters, which likely contributed to the increases we’ve seen in pet healthcare utilization. Foster parents often take on the responsibility of getting their foster pets into the vet for initial health evaluations and addressing any specific issues that might come up. We surmise this rising capacity in foster care played a considerable role in emptying the shelters and helped support the rise in demand for all things pet-related through 2020.

Also, as more pets went to foster homes, shelters were able to increase their capacity to take in more pets, which helped lower the euthanasia rate. Overall, the lower rates of euthanasia likely kept more dogs and cats alive in the shelter system compared with prepandemic periods. We suspect this dynamic might have helped to marginally offset the larger fall seen in animals coming into shelter care and helped enhance supply in a very peripheral manner.

Biological Constraints Are Hard to Overcome

Though we think the shelter data provided a unique view into shifting supply and demand for pets during the pandemic, purebred dogs account for nearly half the dogs adopted each year in the U.S. American Kennel Club registrations provide another peek into production of purebreds because registrations are dominated by breeders, versus plain-vanilla pet owners.

There was a marked acceleration in growth of registrations in 2020, which suggest an expansion of the supply of purebred dogs. Registration of dog litters rose 12% for 2020 compared with 2019. Historically, registration typically grows at 4% annually.

Moreover, the double-digit year-over-year growth in litter registration began in August 2020. This is significant because the canine estrus cycle only takes place twice a year for most breeds. Further, canine ovulation is considerably more complex and unpredictable than seen in most other domesticated species, which is why humans have never been able to reliably manipulate canine cycles to accelerate or synchronize breeding as we typically do for cattle and swine. Thus, even if the breeder had taken note of the surge in demand for dogs in spring 2020 and decided to increase the number of litters produced, it would have taken another five to six months to realize that “expansion” in supply.

We estimate pandemic conditions led to an incremental 16 percentage points of growth in the supply of purebred dogs, which partially offset the dramatic 25% fall in supply in the shelter system last year. Purebred production has been slower to adjust to the drastic changes in supply and demand, given it is ultimately constrained by mother nature. However, this lagged effect also means the strong growth in 2020 continued to accelerate in the first quarter of 2021 (based on the most recent available data). We expect this outsize growth should slow as we approach 2022.

The registration data does not provide us an indication of adoption, but based on the relative strength of demand seen in shelter adoption data, we think it is reasonable to assume demand for purebred dogs was similarly resilient. We speculate that rising prices on purebred dogs over the last 18 months could be another indicator of surging demand.

Finally, we have yet to find any consolidated and reliable data on so-called “designer dogs,” which are not recognized as purebreds by the AKC but have becoming remarkably popular in the last 10-15 years. These “breeds” include first-generation crossed Labradoodle (Labrador retriever and poodle), goldendoodle (golden retriever and poodle), puggle (pug and beagle), and schnoodle (schnauzer and poodle). We think these designer dogs could be a sizable factor, considering they seem to be growing faster than most purebreds, but we haven’t included potential supply expansion that they may have contributed during the pandemic.

New Pets and Strong Pet Bonds Put Animal Healthcare in Catbird Seat

Despite pandemic pet adoption that was more muted than we’d originally expected, animal healthcare companies managed to capitalize on rising demand, even though supply looked constrained through much of last year. As a result, Idexx saw its 2020 companion animal segment increase 13% year over year, while Zoetis delivered 31% revenue growth from cats and dogs in the trailing 12-month period.

This is consistent with other data points suggesting a rise in companion animal healthcare spending. Idexx’s survey data indicated growth in clinical vet visits has been tracking at 4%-5% in recent quarters, compared with 1%-1.50% seen before the pandemic. This has translated into vet practice revenue growth near 15% for the trailing nine months.

We speculate this growth could be driven by three factors.

- We estimate the net increase in pet adoptions and fostering was 13% in 2020.

- More time at home has given owners more opportunities to notice any behavior out of the ordinary and take pets to the vet to have them checked.

- Pet adopters during the pandemic likely skewed toward white-collar workers who were able to work from home and less likely to lose employment, which may have made it possible for them to keep spending on their pets.

One Element That Could Put Spending on a Short Leash

Considering the trend for ever-increasing spending on animal health, we are wary of how much the absolute price tag of pet healthcare can grow before it becomes less affordable for a larger swath of pet owners. We think the outer limits of what pet owners are able to afford could gradually constrain that growth over the longer term. The growth in pet healthcare services reflects greater intensity and more sophisticated medical care for pets, and we do not believe this trend will reverse itself. We have long hypothesized that consumers will eventually reach a breaking point on pet spending, but it’s been less clear where that might be, especially after more than three decades of 8% annual growth.

Though it is easy to point a finger at big-ticket procedures, rising prices for even regular, routine care could become unaffordable for more pet owners over time. Increased spending on vet bills is exacerbated by the tendency for pet owners to have more than one cat or dog. With the dog-owning household averaging 1.62 dogs in 2018, this amounts to $410 in routine annual vet care, which is likely to grow into a steeper expense for more households. Additional spending on surgery or emergency care can easily double that vet bill.

One Factor That Could Give Pet Health Spending Nine Lives

We think increased pet health spending is resulting in more owners taking another look at pet health insurance, which we think could support continued growth over the long term if penetration of insurance reaches critical mass. Historically, penetration of pet health insurance in the U.S. has been immaterial, hovering around 1%-3%. As of 2019, almost 3% of pets in North America were covered, according to the North American Pet Health Insurance Association.

However, we think the tide is changing; consumer interest in pet health insurance is increasing and we anticipate accelerating growth in penetration over the next several years, fueled by several factors.

- In a recent survey of employers by Willis Towers Watson, there was greater employer interest in providing pet insurance on the menu of employee benefits. If more employers follow this pattern, we expect it could significantly raise the profile of pet insurance.

- The policies themselves have been evolving to include more coverage for accidents, preventative care, and wellness care. We think this could make the product more appealing.

- The competitive field has expanded substantially as more companies have come to view pet insurance as an attractive business opportunity, since the niche product has seen double-digit growth recently.

We think greater penetration of pet health insurance would allow pet owners, especially dog owners who face significantly higher vet spending, to absorb the growing medical bills for longer. This could help sustain the longstanding 8% compound annual growth rate in pet health spending through the medium to long term. The distant and potential risk we see in more extensive pet coverage is if the segment undergoes major consolidation, which could give more power to the remaining payers to set prices for care. If that happens, it could slow the rate of pet health spending in the long term.

Biting Off More Than They Can Chew

The greater near-term risk for a pullback in pet health spending is related to some owners surrendering their pets acquired during the pandemic either because they must return to the office or because they are evicted from their homes now that the U.S. government’s moratorium on evictions has expired. This is frequently changing, especially considering how many employers have had to revise return-to-office plans multiple times.

Between evictions and the work-from-home dynamic, we suspect the latter may have a greater effect. In an average year, approximately 3.60 million renters are evicted in the United States. Morningstar projects 6 million-7 million could be at risk of eviction in the near term, though that number is likely tempered by various stimulus relief measures granted since March 2020 (depending on how quickly local authorities pay these funds). Moreover, only 37% of renters have pets, compared with 57% of homeowners. This suggests approximately 2.20 million-2.60 million U.S. renters who also own pets may face eviction.

On the other hand, Morningstar estimates 20% of full-time employees were still working remotely in mid-2021. This translates into almost 31 million workers--significantly more than the projected number of renters who face the risk of eviction. Over the longer term, we anticipate approximately 20 million of these workers will continue to work remotely as employers adjust their policies. Of the roughly 10 million workers who return to the office, we suspect many will use dog-walking and dog daycare services. Of course, returning to the office will place less of a burden on cat owners.

Finally, we think this period of intense bonding with pets, in addition to the estimated 13% net increase in the pet population during the pandemic, adds to the rosy conditions that have supported robust growth in pet health spending for more than 30 years. As a result, we have baked in more optimistic postpandemic assumptions for cash flows at Idexx and Zoetis, but we think the market has latched on to these animal health companies like a dog with a bone and driven the shares beyond what we can justify in our models.

Idexx Laboratories, and Zoetis

/s3.amazonaws.com/arc-authors/morningstar/adf521c2-d9af-477d-a6bc-03ec7ca34c40.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/adf521c2-d9af-477d-a6bc-03ec7ca34c40.jpg)