Backlog Grows for Orthopedic Procedures

But the disruption caused by COVID-19 has little effect on the device industry’s moats.

Editor's note: At the time of publication (July 2, 2020), a family member of the analyst owned shares in Stryker (SYK) in an account managed by a third party. Morningstar has confirmed that her ownership of Stryker did not influence any ratings or analysis.

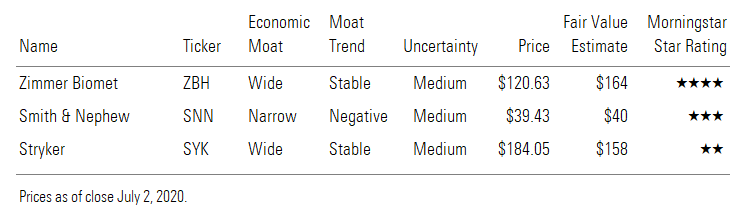

Though some medical device companies indicated that April would probably be the nadir of COVID-19-related cancellations of non-pandemic medical procedures in the United States, we continue to think that procedure volume for the orthopedic companies will remain under pressure into the second half of the year, especially now that populous states like Florida and Texas have seen alarming rises in new SARS-CoV-2 infections. We’re holding steady on our fair value estimates for Stryker SYK, Zimmer Biomet ZBH, and Smith & Nephew SNN, which have baked in our projection of a 75% decline in large joint replacement procedures for the second quarter, followed by a 50% decline in the same for the third quarter before further stabilization in the fourth quarter. Nonetheless, we see little in this near-term (albeit significant) disruption to procedure volume that holds implications for the wide and narrow economic moats that characterize the orthopedic device industry.

The widespread postponement of relatively elective orthopedic procedures has resulted in a substantial backlog. In a recent professional webinar with orthopedic surgeons, roughly one fourth indicated their hospitals had reached orthopedic backlogs in excess of 1,000 patients per hospital in the first six weeks of states shutting down. A more comprehensive analysis by the CovidSurg Collaborative examined the 12 weeks of peak pandemic disruption and has projected a backlog of 1.2 million orthopedic procedures in North America. Though it may take months, or perhaps even years, to work through this backlog, its existence underscores our confidence that demand for elective joint reconstruction has not been impaired permanently.

We see several factors that could affect how quickly this backlog is addressed. First, it may take some time for patients to feel comfortable that providers have taken appropriate measures to minimize the risk of exposure to SARS-CoV-2. Second, the degree to which hospital capacity can be increased will depend on new pandemic-related protocols to manage cleaning and staffing of hospital operating rooms that are now emerging. If it takes longer to turn over operating rooms, this could hamper the volume of procedures. However, we anticipate ongoing pandemic conditions will probably encourage some orthopedic surgeons to perform more procedures on an outpatient basis, either in the hospital setting or in ambulatory surgical centers. An acceleration in the shift to outpatient for low-complexity patients could peripherally offset the lower throughput for orthopedic inpatients.

Finally, we remain mindful that with hospitals under significant financial stress due to the hiccup in profitable elective procedures, there may be some vulnerable hospitals that might not survive the near term. In the U.S., the most vulnerable hospitals are smaller and serve rural areas. While these hospitals are generally not high-volume centers for orthopedics, if some of them are wiped out, that will make access more difficult for patients, which could result in a small drag on procedure growth.

Zimmer Bionet, Smith & Nephew, Stryker

/s3.amazonaws.com/arc-authors/morningstar/adf521c2-d9af-477d-a6bc-03ec7ca34c40.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/adf521c2-d9af-477d-a6bc-03ec7ca34c40.jpg)