Biopharma Companies With COVID-19 Treatments See $10 Billion Market in 2021

We expect quickly declining sales potential after that, however.

In the second of three articles, we assess the market for COVID-19 treatments. (Click here for our outlook for coronavirus vaccines and distribution.) The final article will cover prospects for the companies involved.

As with most viruses, developing COVID-19 treatments has been difficult, but several drugs have shown strong enough efficacy to gain regulatory support. Historically, one of the best ways to control viruses is through vaccines, and we believe the vaccines emerging will significantly lower the need for COVID-19 treatments by 2023 and beyond. Nevertheless, treatments are in high demand currently and are likely to remain so through 2021 and into 2022. Currently, several drugs are used to treat COVID-19, but most have limitations in efficacy and timing of use relative to the disease progression.

- We forecast over $10 billion in sales potential for newly authorized treatments, led by antibody treatments from Eli Lilly LLY, Regeneron/Roche REGN/RHHBY and GlaxoSmithKline/Vir GSK/VIR for mild to moderate patients and Merck's MRK CD24Fc, Lilly's Olumiant, and Gilead's GILD Veklury for hospitalized patients.

- Despite significant sales potential in 2021, the uncertain market duration prevents significant impact on our discounted cash flow-based fair value estimates. That said, several biopharma companies with COVID-19 treatments (Gilead, Roche, Glaxo, and Merck) look undervalued, based on strong potential for their core businesses.

Sales Potential of COVID-19 Drugs: Strong 2021 but Poor Long-Term Outlook As global cases of COVID-19 rise internationally, we expect the need for treatments to spike in 2021. However, following heavy vaccination in 2021 and 2022, we expect a relatively quick decline in treatment demand. As a result, the fastest treatments to the market with the most supply will likely gain a short-term windfall of sales. By 2022, we expect sales to fall roughly 75%, followed by another steep decline in 2023.

Overall, we see the highest sales potential for antibody treatments for mild to moderate COVID-19 patients at more than $6 billion in total 2021 antibody treatment sales, with Eli Lilly and Regeneron (partnered with Roche) leading the class. Additionally, while further strains of COVID-19 could emerge, we believe both vaccines and treatments will still be effective.

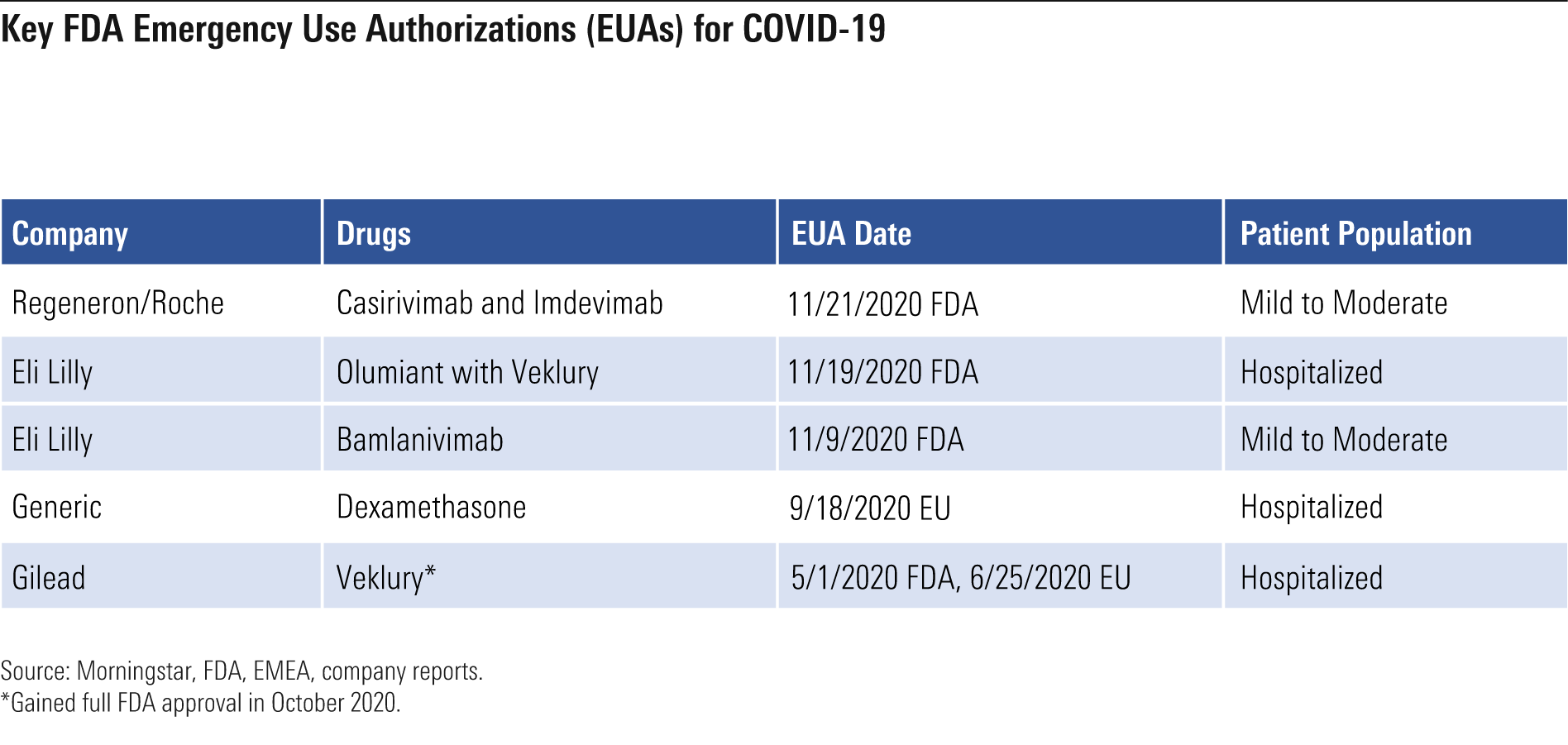

Authorized Treatments for COVID-19 The COVID-19 pandemic has affected millions of people worldwide with a speed and severity that caused government regulators to issue several emergency use authorizations for drug treatments. EUAs are typically provided during times of extreme threats, such as wars and pandemics. Emergency use authorization doesn't require the same level of efficacy and safety data that a full approval would require. The Food and Drug Administration announced in February that the COVID-19 pandemic would support emergency use authorizations, given the severity and how widespread the disease would likely become. Biopharma companies have acted quickly to test drugs as potential COVID-19 treatments. While several drug treatments have failed in clinical studies, a handful have generated enough positive data to support EUAs. In addition to these therapies, the IL-6 drugs Actemra (from Roche) and Kevzara (from Regeneron and Sanofi SNY) have produced largely negative data in company-sponsored studies, but they appeared to improve survival rates in the recent REMAP-CAP study. Based on the conflicting data, we haven't made major projections for these drugs in treating COVID-19.

Key FDA Emergency Use Authorizations for COVID-19

With the severity and disease progression of COVID-19 ranging significantly across patients, different types of drugs are needed to limit the severity of the virus. An estimated 77 million people in the United States exhibited mild to moderate COVID-19 symptoms between February and November 2020, according to the Centers for Disease Control and Prevention. Of these, 3.4 million went on to need hospitalization.

Mild to Moderate COVID-19 Therapy Options: Antibody Treatments The FDA has granted emergency use authorization for two antibody treatments: Eli Lilly's bamlanivimab and Regeneron's (with partner Roche) combination of casirivimab plus imdevimab for mild to moderate COVID-19 patients with high-risk factors who have not been hospitalized. In theory, the antibodies should neutralize the receptor binding area of the spike protein within the coronavirus, blocking the virus from entering the cells. However, most patients who progress to hospitalization have had time to develop enough antibodies internally, reducing the need for antibody drug treatment.

While studies have supported the use of these antibodies in mild to moderate patients, Lilly’s ACTIV-3 study of bamlanivimab in hospitalized patients failed and was stopped due to lack of efficacy in October 2020. Regeneron’s drugs and next-generation antibody drugs remain in studies in the hospitalized setting, but we are less optimistic that the drugs will work well in the advanced setting.

The overall group of patients with mild to moderate disease is large, but only a subset of this group (with high-risk factors) would be eligible for the antibody treatments. The risk factors include obesity, kidney disease, diabetes, immunosuppressive disease, and age (55 and older with other diseases or 65 and older overall). We estimate close to 50% of mild to moderate COVID-19 patients will be candidates for antibody treatment, given the high number of risk factors included in the emergency use authorization and the prevalence of these risk factors cited by the CDC.

The potential market for antibodies is very large, but delivery challenges and skepticism over existing data are likely to narrow the opportunity. As a result, the U.S. Department of Health and Human Services has stated that only 5%-20% of the available antibody supply had been used through mid-December.

The National Institutes of Health and the Infectious Diseases Society of America have not fully recommended using the antibodies in normal practice. We believe the limited data has resulted in less support from these major medical groups.

On the delivery side, the antibodies need to be infused intravenously; this generally occurs at hospitals and outpatient centers. However, with hospitals swamped with caring for severe patients, the ability to infuse mild to moderate COVID-19 patients is diminished. Further, many outpatient centers focus on cancer and immunology care, necessitating a higher level of segmentation between current patients and new COVID-19 patients, as any infections from COVID-19 patients in this immune-compromised patient group would likely have more severe consequences. Complicating matters even more, the Medicare reimbursement rate set for infusion centers is $309 for the cost of administering the drug, which is high enough to support large established centers, but may not offset the increased costs needed to ready other centers for COVID-19 patients.

Antibody Treatment Market Should Grow in 2021 Despite early challenges with the utilization of the antibody treatments for COVID-19, we expect increased use in 2021, followed by a decline in 2022 as vaccines reduce the incidence rate of COVID-19. Hospitalizations are likely to continue at a high level in 2021 with the increase in severe COVID-19 patients, and antibody treatments hold the potential to reduce the need for hospitalization for COVID-19 patients if used early enough in the disease progression, which could ease the strain on the limited number of intensive care beds.

In clinical studies, Lilly’s bamlanivimab reduced the need for hospitalization to 1.6% of patients versus 6.3% for those on placebo. Regeneron/Roche’s casirivimab and imdevimab cut the need for hospitalization in half. Given the increasing strain on the hospital systems, we expect the government to help overcome the supply challenges of the antibodies through increased reimbursement and more funding to help outpatient centers adapt more easily to infusing antibodies into COVID-19 patients.

The U.S. government has already stepped in to purchase antibodies, driving near-term demand, and we see significant antibody sales potential in late 2020 and 2021. The U.S. government has committed over $1.1 billion to Eli Lilly for bamlanivimab. The U.S. government also initially contracted with Regeneron for $450 million to supply up to 300,000 doses for treatment, which was followed by an additional contract for 1.25 million doses. These government purchases mean patients and insurance companies will not be responsible for the cost of the drug but may need to pay the drug infusion administration fees.

While currently the delivered doses are not being fully used, we expect utilization to improve to the point where limited antibody supply will cap total sales. We estimate that Eli Lilly and Regeneron/Roche could produce close to 500,000 doses a month in 2021 based on ramping capacity seen in 2020 and Regeneron’s partnership with Roche (one of the largest antibody manufacturers). In the U.S., we expect demand to peak in early 2021, then shrink as vaccines slow the spread of the disease. However, we expect continued demand globally throughout 2021 due to supply capacity limits of the vaccines. We expect pricing will fall when the antibodies are sold globally, but we still see over $6 billion in antibody sales potential in 2021.

On the supply side, we expect manufacturing capacity limitations. IQVIA IQV has estimated that about 53 million doses of monoclonal antibodies were sold in the U.S. in 2019 in total, meaning that several million doses of targeted antibody therapy for COVID-19 would represent a significant percentage of the total capacity for all such therapies in indications like oncology and immunology. The Duke-Margolis Center for Health Policy estimated as of August 2020 that hospitalized COVID-19 patients in the U.S. would require 0.71 million doses over the next year (which may fall, given the poor clinical data so far in this patient population), in addition to 12.8 million doses for nonhospitalized patients and about 55 million doses for those with close exposure to confirmed cases.

Next-Generation Antibody Treatments for Mild to Moderate COVID-19 While first-generation antibodies have already cleared EUAs, we expect next-generation drugs will emerge to treat the mild and moderate patients. We believe treatment efficacy related to keeping patients alive and out of the hospital system will be the main factors driving potential EUAs for next-generation drugs. Eli Lilly has already shown improved data by adding etesevimab to bamlanivimab, cutting the need for hospitalization to 1% versus 6% for placebo. We expect an EUA for etesevimab in the first quarter of 2021. From a sales perspective, we expect Lilly to fold etesevimab into bamlanivimab, creating a cocktail combination.

GlaxoSmithKline (partnered with Vir) and AstraZeneca are also developing antibody treatments, but we think Eli Lilly and Regeneron will retain first-mover advantages due to stronger near-term demand. Astra’s AZD7442 could have the advantage of prolonging the duration of therapy efficacy relative to Lilly and Regeneron/Roche antibody treatments. However, we expect the strength of vaccines to significantly reduce demand for COVID-19 treatments by 2022, so we don’t expect much in sales for Astra’s next-generation COVID-19 antibody treatment.

Glaxo and Vir’s antibody VIR-7831 is also designed to potentially provide an advantage over Lilly and Regeneron’s drugs. VIR-7831 binds to part of coronavirus that is shared with SARS, which may mean the area is well structured to stop resistance. Also, the drug has been engineered with the potential to enhance lung bioavailability and have an extended half-life. We expect data for VIR-7831 in early 2021, making the drug still a viable treatment option ahead of the expected decline of COVID-19 cases as the vaccines slow the disease.

While the vast majority of ongoing antibody clinical studies in COVID-19 are outpatient or prophylaxis, Regeneron’s 2066 study is continuing in low-flow oxygen hospitalized patients. Regeneron’s cocktail is also being studied in hospitalized patients as part of the U.K.’s Recovery trial, and Glaxo and Vir announced in December 2020 that VIR-7831 is now being studied as a treatment for hospitalized patients in the ACTIV-3 study. While we are encouraged by preliminary findings for efficacy of antibodies among low-flow oxygen patients who are seronegative, we’re waiting for more definitive data from the larger Recovery trial before incorporating their use in this setting into our forecasts.

Treatments for Hospitalized COVID-19 Patients As some COVID-19 patients progress, different treatment options are needed. A significant dividing line for most patients is the decision for hospitalization due to disease severity. The CDC estimates 3.4 million people infected with COVID-19 in the U.S. needed hospitalization through November 2020, creating a major need for drug treatment to help hospital intensive-care efforts.

Two established drugs in this area include:

- Gilead's Veklury (remdesivir) looks best positioned to target patients hospitalized with COVID-19 but not yet on mechanical ventilation; these patients constitute the vast majority of those hospitalized. Veklury gained full FDA approval in October 2020 following an EUA in the U.S. in May as a treatment for severely ill hospitalized patients with COVID-19. However, the World Health Organization recommended against the use of the drug in November, based partly on a large controlled WHO study showing no mortality benefit. The Infectious Diseases Society of America continues to recommend Veklury based on the drug's ability to reduce recovery time in hospitals, which is important given the strains on the hospital system. Balancing Veklury's mixed data with the fact that there are few authorized treatments for severe COVID-19 patients, we model $2.9 billion in Veklury sales in 2020, followed by $2.1 billion in 2021.

- Generic dexamethasone is another treatment for hospitalized COVID-19 patients that will likely be used if ventilation is needed. Dexamethasone showed positive results in the Recovery trial in June 2020. In patients needing invasive mechanical ventilation and oxygen, dexamethasone reduced the death rate by 18%-36%. The timing of dexamethasone treatment appears important as the drug looks potentially harmful if given to patients not needing respiratory support. Several follow-up studies have shown conflicting data, making the optimal use of dexamethasone and other steroids less clear. Since dexamethasone and other steroids are largely generic, we don't expect a major windfall of sales for branded biopharma companies, and we believe generic companies will probably only marginally benefit from increased demand.

Next-Generation Drugs for Hospitalized COVID-19 Patients Emerging data from several drugs should complement Veklury and dexamethasone, with Eli Lilly and Merck leading the way for the next generation of drugs for hospitalized COVID-19 patients.

Eli Lilly’s repurposed immunology drug Olumiant (baricitinib) has shown favorable data that led to the EUA of the drug in November 2020. In the ACTT-2 study (1,033 hospitalized patients), Olumiant plus Veklury improved median time to recovery from 8 to 7 days compared with Veklury alone. Also, the odds of improvement in clinical status at day 15 were 30% greater for the combo with a numerical decrease in death of 35% through day 29. The reduction in mortality was more pronounced for patients receiving oxygen. On the safety side, the combination of Olumiant plus Veklury provides fewer serious adverse events (16% versus 21% for placebo) and fewer infections (6% versus 11%). Additional trials should help provide a clearer picture of the drug’s potential in treating COVID patients.

We project sales potential of close to $1 billion in 2021 for Olumiant for COVID, followed by a steep decline in 2022 with the expectation that vaccine use significantly limits demand for COVID-19 treatments. With less concern about Olumiant manufacturing capacity constraints, since the drug is a small molecule that is fairly simple to manufacture, we believe demand will be the key factor. We estimate the drug will follow similar demand patterns as Veklury since the EUA was for combination use.

OncoImmune reported such strong data in September 2020 for CD24Fc that Merck acquired the company for $425 million up front and additional milestone payments related to the success of the drug. CD24Fc is a biological immunomodulator that works to fix the inflammatory response to tissue injuries or danger-associated molecular patterns that can occur in severe COVID-19 patients. While these severe patients appear to have enough antiviral response, the damage of COVID-19 appears to have exhausted the body’s immune response, suggesting that an immunomodulator like CD24Fc could help. We estimate a 90% probability the drug will gain emergency use authorization following the complete data set from the study based on the strong interim data set. The U.S. government shares our optimistic outlook for the drug, securing 60,000-100,000 doses of the drug in December 2020 for $356 million to be delivered through June 2021 if the drug gains emergency use authorization.

Several new drugs are emerging as potential COVID-19 treatments with a higher focus on hospitalized patients. Merck/Ridgeback Biotherapeutics' molnupiravir looks like one of the most compelling new drugs in the late-stage pipeline. Molnupiravir is an oral nucleoside analog that has shown preclinical efficacy as treatment and preventive antiviral in SARS and MERS as it improved pulmonary function, decreased weight loss, and reduced the amount of virus in the lungs. The drug has moved into a phase 2/3 study with data expected in May 2021. Roche also formed a collaboration with Atea Pharmaceuticals AVIR for oral antiviral AT-527, which should have phase 2 data in hospitalized patients and initiate a phase 3 study in nonhospitalized patients in the first quarter of 2021.

/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)