Consumer Cyclical: China Growth Concerns Present Buying Opportunities

The market is now pricing in long-term cash flow assumptions that are more conservative than those baked into our longer-term consumer cyclical valuation assumptions.

- Our consumer cyclical universe trades at a median price/fair value ratio of 0.89, remaining modestly undervalued over the past several months.

- Although we still see China as a key driver of investor concern, especially in the luxury goods space, where Chinese consumers represent 30% of global purchases, we believe these names, along with others, are well positioned, given the strength of their powerful brand intangible assets.

- The apparel sector has been challenged, and we still see headwinds into 2016. We think that warm weather, poor inventory management, a lack of new fashion trends, and shifts to other distribution channels and product lines have contributed to the weakness.

- The recent pullback in equity markets across the globe has opened up buying opportunities across Morningstar's global e-commerce coverage.

After trading at a median price/fair value estimate above 1.00 for the first half of 2015, Morningstar's consumer cyclical universe has pulled back and now trades at a median price/fair value estimate of 0.89. We attribute much of the recent weakness to concerns about slowing economies across the globe and foreign-currency headwinds, which we believe have triggered a rotation into less discretionary categories.

Although we acknowledge the possibility of more-volatile consumer spending trends than we've become accustomed to across the globe, as well as supply/demand inventory imbalances during 2016, we believe the market is now pricing in long-term cash flow assumptions that are more conservative than those baked into our longer-term consumer cyclical valuation assumptions.

China's Consumption Potential While the macroeconomic environment, currency, and the correction in the Shanghai index in China have remained concerns for investors, we believe they have led to attractive opportunities in companies with exposure to the region. Using Morningstar's forecast for Chinese consumption growth of 7% as a basis, we make the assumption that middle- and upper-income consumers can outpace the whole economy for the long run. We believe factors such as increased investment in private businesses, saving rates and increased access to credit; increased government share of social welfare and healthcare costs; better investment returns for the middle class; and further returns for the upper class can all contribute to the high end of consumption outpacing the whole.

We acknowledge that the overall pace of China's consumer spending was slowing before recent stock market volatility, and we believe that China is entering a period of normalized GDP growth in the mid-single-digit range as it transitions away from being a government- and export-driven economy. However, we do not believe that consumption trends will permanently decline as economic growth decelerates.

Although we think the devaluation of the yuan in August and December and equity market volatility in the back half of the year triggered a pullback in spending--particularly among higher-end consumers and corporations--we believe that the uneven pace of consumption has more to do with consumer sentiment and less to do with the inability to spend. We remain constructive on the longer-term spending potential of the Chinese consumer, as China's consumer saving rates remain some of the highest in the world, suggesting that purchasing power will remain intact even during periods of economic volatility.

Additionally, several factors position China as one of the most fertile regions for consumer consumption over a longer horizon, including a doubling of China's consuming class to 500 million-600 million individuals over the next decade; an urban population that could eventually exceed 800 million individuals; government regulation changes, including transferable rural property laws that could drive wealth creation and easing of one-birth policies; and technological advances.

The lack of visibility surrounding

Yum Brands YUM against an uncertain macroeconomic backdrop remains an overhang on the stock. However, we view Yum as one of the most mispriced opportunities in the consumer space today, anchored by a wide moat rating derived from a portfolio of powerful brands, meaningful economies of scale, and exposure to the markets with the highest potential for consumer spending over the next several decades. Yum remains one of the most direct ways to play the Chinese consumer's increased spending power. Competition, online aggregators, and the pace of the Chinese economy are admittedly concerns, but we believe the market is overlooking Yum's various same-store sales drivers, including value platforms, menu simplifications, alternative restaurant formats, and digital marketing. We think the dual catalyst of improving China same-store sales trends--the key driver behind stock outperformance--and meaningful cash returned to shareholders will be too much for the market to overlook in 2016.

Although luxury names have recently rebounded, many still trade at discounts to our fair value estimates, given their exposure to China and fears of slowing growth in the region. We admit that the long-run health of the Chinese economy is significant to our luxury names and their corresponding valuations, but we believe the firms are well positioned to weather the highs and lows of annual sales trends, given the strength of their powerful brand intangible assets, which in many cases have endured for decades or even centuries (these also provide the foundation for our sectorwide wide- and narrow-moat ratings).

Apparel Challenged Mainstream apparel retailers reported slowing traffic to stores in the fourth quarter and an excess of inventory in the market. We think this is due to a few factors. First, unseasonably warm weather has pressured sales of cold weather merchandise including boots and jackets. Second, many retailers had expected demand to increase on the heels of strong employment numbers and improving wages. However, this theory did not pan out. We think that increases in rents and healthcare costs have offset some of the upside. Now retailers have too much inventory. Third, there is a lack of newness in fashion and, with closets overflowing with skinny bottoms and loose tops, the consumer is bored with the offering and doesn't need any more. We note that big-ticket items, like travel and home goods have been strong. Finally, we think that the shift to shopping online continues.

That being said, there are some standouts in the apparel retail space. We note that off-price retailers (such as

E-commerce Opportunities The idea of e-commerce as a disruptive force is not exactly a new concept, with consumers becoming increasingly comfortable making everyday purchases online or through mobile devices across many developed economies.

However, as we take a step back and examine the various states of digital commerce across different geographies, we find a number of constants, not only in how winners in the digital commerce space rise to the top in each region, but also in how these players develop lasting network effects that serve as the foundation of the wide economic moats we assign to many of the leading digital commerce players across the globe. Our analysis further shows that economic downturns can act as conduits to springboard e-commerce adoption, an important investment consideration that we believe has been overlooked by the market amid growing fears about a global recession.

We believe the recent pullback in equity markets across the globe has opened up buying opportunities across Morningstar's global e-commerce coverage.

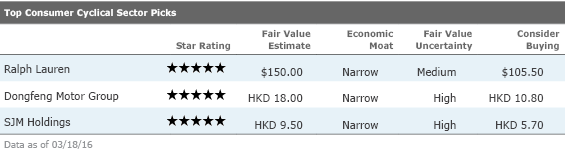

Ralph Lauren

RL

The apparel industry has been experiencing a recent slowdown resulting from warm weather and a lack of new fashion trends, and Ralph Lauren has not been immune. Additionally, price action on luxury shares has recently been more volatile, given the segment's exposure to China and the increased uncertainty of economic growth in the region. That said, given the discount to our fair value estimate and our view that the company possesses a narrow moat because of its strong brands, with growth opportunities in Asia and Europe, as well as in product categories such as women's and accessories, we find shares attractive at these levels for long-term investors.

Over the past four decades, Ralph Lauren has constructed a considerable portfolio of brands, most of which incorporate the Ralph Lauren and Polo brand names. The brands and the distinctive style they project have become embedded in consumers' minds, both domestically and abroad; we view this as important, given the competitive marketplace and low customer switching costs in apparel and accessories. The company has developed a long record of top-line growth and profits over the years through a combination of internal growth and acquisitions, which we believe can continue. Ralph Lauren has delivered midteen or higher returns on invested capital, ahead of our cost of capital estimate, supporting our narrow economic moat rating.

Dongfeng Motor Group

(

)

China ballooned into the world's largest automobile market after it joined the World Trade Organization in 2001. A high base, coupled with headwinds including air pollution and license plate curbs in major cities, leads some to believe that demand growth in China is at risk of losing steam. We have a more optimistic view. On a per-inhabitant basis, China's vehicle density still substantially trails all Organization for Economic Cooperation and Development member countries. Regulations limiting car sales in large metropolitan areas do not affect the high-growth potential for sales in the interior of China, including rural areas. In light of the automobile industry's pivotal role in China's economy, we believe the government will maintain a calculated approach to limiting vehicle sales. Instead, traffic and environmental challenges will be tackled through roadway network expansion, adoption of telematics solutions, and new energy technology. Rising incomes and steadily growing vehicle demand will continue to drive industry growth, in our view. State-owned manufacturers play a vital role in China's automobile industry. Eight of China's 10 largest automobile manufacturers are state-owned, and including joint ventures, they accounted for 82.5% of domestic market share in 2013. These companies are highly reliant on joint ventures with their global automobile partners. In 2012, joint ventures accounted for 70% of Dongfeng's sales volume. Partnerships with multiple global manufacturers allow Dongfeng to wield a diversified product line that caters to the needs of a wide range of consumers and reduces the downside risk if one car model fails to resonate in the showroom. A 2013 joint venture with Renault and the 2014 acquisition of a 14% stake in French manufacturer PSA reinforced this advantage.

SJM Holdings

(

)

As one of six casino license holders in Macau, SJM Holdings benefits from insatiable Chinese demand for gaming, underpinned by our forecast of a more than 10% rise in per capita disposable income in China from 2015 to 2020. Macau had a penetration rate of merely 1.5% in 2014, compared with Las Vegas' 12%. Excluding the neighboring Guangdong province, where only 7.5% of China's 1.39 billion population resides, the penetration rate is merely 1%.

The 50%-plus increase in hotel rooms in the next few years will accommodate higher visitation rates of tourists from these provinces, increase the length of their stay, and drive the top line for integrated resort operators like SJM. With the completion of the Hong Kong-Zhuhai-Macau bridge and light railway transit at the end of this decade, Macau's carrying capacity for tourists will increase. In addition, the neighboring Hengqin Island, 3 times the size of Macau, is under rapid development to complement Macau's growth.

SJM has lost Macau gaming market share primarily to Sands China and Galaxy, going from 32.1% in the first quarter of 2011 to 23.1% in the first quarter of 2015. We expect market share losses to continzue until the opening of SJM's new casino complex in Cotai, Lisboa Palace, in early 2018. Currently, SJM's casinos and satellite casinos are all located in the Macau Peninsula. Being the last major casino project to open in Cotai, SJM could face more difficulties in hiring dealers, who are required to be locals by the government. Given our table grant forecast of 250, we expect Lisboa Palace to drive adjusted EBITDA growth for the group of around 41% in 2018-19. The new resort includes three hotels with 2,000 rooms, more than 4 times the current room count at Grand Lisboa, giving SJM more complimentary rooms for premium mass customers, who are 4 times more profitable. Lisboa Palace and the group's current casinos in the Peninsula are expected to target different markets; the former will target families who enjoy entertainment amenities and are more likely to stay overnight, while its casinos in the Peninsula will target day-trippers and hardcore gamblers.

More Quarter-End Insights

Stock Market Outlook: Stocks Start to Look More Attractive

Credit: Corporate Bond Markets Recuperate

Basic Materials: The Recent Commodity Rally Shouldn't Give Investors Hope

Consumer Defensive: Lofty Valuations Persist, but a Handful of Bargains Remain

Energy: Don't Expect a Quick Recovery for Crude Prices

Financial Services: Global Bank Rout Is Overdone

Healthcare: Drug Reform Worries Are Overblown

Industrials: An Uneven Start to 2016, but Compelling Values Remain

Real Estate: Companies With Enduring Demand Will Persevere

Tech, Telecom & Media: Long-Term Opportunities Amid Software's Storm

Utilities: Dividends Still Attractive, but Headwinds Remain

/s3.amazonaws.com/arc-authors/morningstar/2535f698-1e23-4470-9858-dc4e82afe213.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/2535f698-1e23-4470-9858-dc4e82afe213.jpg)