Consumer Cyclical: Regulatory and Economic Uncertainty Leads to Opportunity

For patient investors, an attractive industry is travel and leisure.

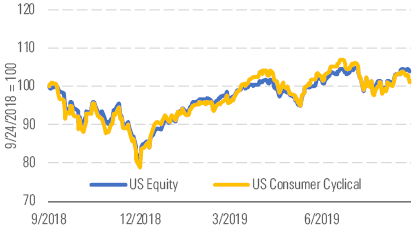

The Morningstar U.S. Consumer Cyclical Index slipped 3% quarter to date, underperforming the broader U.S. equity market's 1% gain (Exhibit 1). We attribute the sector's relative struggles to increased concerns about tariffs and amplified volatility in international markets stemming from events such as Brexit.

Returns in the sector slightly trail the market. - source: Morningstar

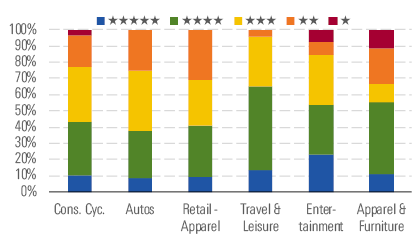

For investors willing to take a longer-term view, discounts are abundant. Roughly 40% of all stocks in the sector currently carry a 4- or 5-star rating. The most attractive industry is travel and leisure, where two thirds of the companies under our coverage trade in 4- or 5-star territory (Exhibit 2), but opportunities can be found in any area.

Overvalued stocks are hard to come by in the sector. - source: Morningstar

Tariffs and international uncertainty are not the only sources of risk in the consumer cyclical arena. Increasingly dominant online players like Amazon remain a persistent threat.

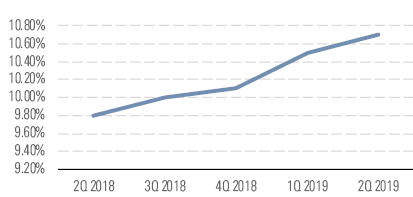

That said, we believe the growing allowance for third-party sellers on leading e-commerce consumer platforms can be an opportunity rather than a hindrance to some consumer cyclical firms, especially as e-commerce as a percentage of retail sales continues to grow (Exhibit 3).

Retail e-commerce as a percentage of retail sales continues to grow. - source: Morningstar

Though we acknowledge that this may allow for increased competition, we believe the increased reach is still a clear benefit for firms. Also, given that gross margins for third-party seller services run at 70% at companies such as Amazon, we don’t foresee leading e-commerce platforms limiting the number of third-party sellers, which should provide an ample opportunity for all.

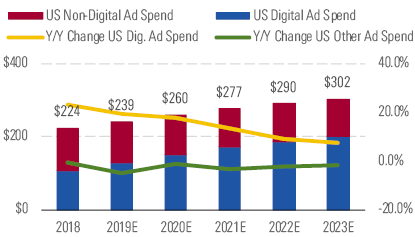

In our view, digital and physical retail is becoming more intertwined, bringing with it other changes such as in advertising, where digital ad spending is expected to exceed nondigital ad spending in 2019 (Exhibit 4). Ultimately, the confluence of large digital e-commerce sites and third-party sellers creates opportunities across the consumer cyclical space.

Changes in advertising show a need for physical and digital presence. - source: Morningstar

Top Picks

Hanesbrands HBI Economic Moat: Narrow Fair Value Estimate: $27.50 Fair Value Uncertainty: Medium Hanesbrands continues to be overlooked by the market despite its brand expansion efforts and its market-leading share of the innerwear market in the United States. We believe Hanesbrands achieves pricing power through the strength of its brands. We also think its Champion brand benefits from the athleisure fashion trend and will account for more than 25% of Hanesbrands' 2019 revenue. Moreover, by optimizing its production model and reducing costs in acquired businesses, we expect Hanesbrands' adjusted operating margins to rise to 15.7% in 2024 from 13.9% in 2018.

L Brands LB Economic Moat: Narrow Fair Value Estimate: $42 Fair Value Uncertainty: High With aims to rejuvenate some of its struggling segments, L Brands shows clear potential for returns in the medium term. Although the operating margin of its Victoria's Secret brand has continued to decline, our valuation accounts for this with conservative expected sales growth of 2% over the next five years. We find particular potential in the company due to opportunities to grow within China as well as various areas to explore with regards to innovative bra introductions and swimwear. Additionally, we find it promising that its Victoria's Secret Beauty segment is improving, suggesting stability may be ahead.

Mattel MAT Economic Moat: Narrow Fair Value Estimate: $21 Fair Value Uncertainty: High We find Mattel to be a particularly attractive stock in the consumer cyclical space. Although hindered by the liquidation of Toys R Us, Mattel's turnaround continues, with an increased focus on improving profits through supply chain initiatives. We expect $850 million in cost savings set to be realized by 2020. Because of these efficiency improvements, we forecast that operating margins will improve slowly to nearly 15% in 2024 and that the company will maintain its narrow economic moat.

/s3.amazonaws.com/arc-authors/morningstar/2535f698-1e23-4470-9858-dc4e82afe213.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/2535f698-1e23-4470-9858-dc4e82afe213.jpg)