Consumer Defensive: Bargains Harder to Come By

After another strong year for consumer defensive stocks, the sector remains relatively less attractive than our overall universe.

- The consumer defensive sector is currently slightly overvalued, in our opinion, trading at around 2% above our fair value estimate, versus a 2% market discount in the global universe.

- The emerging-markets slowdown is showing up in consumer product manufacturers' earnings reports, with broad weakness in Asia becoming a new headwind for many companies. Generally, we regard this as a cyclical impact, and we still believe emerging markets will drive long-term volume growth for the consumer staples firms with strong exposure and an appropriate product portfolio. Europe, on the other hand, appears to be stabilizing.

- With organic growth fairly limited, cost-cutting remains an important driver of earnings growth.

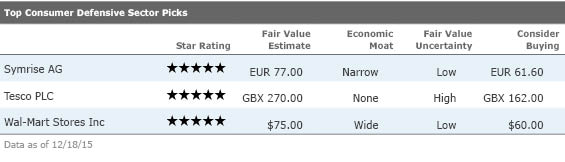

After another strong year for consumer defensive stocks, the sector remains relatively less attractive than our overall universe, with our sector coverage trading at 2% above our fair value estimate. Although the consumer staples space is often fairly defensive in a market downturn, we remain cautious of global consumer spending, particularly in emerging markets. Earnings reports this quarter began to show the emerging-markets slowdown impacting consumer firms' financial results. We generally recommend focusing on companies in the sector with narrow or wide moats that enjoy strong intangible assets and/or sustainable cost advantages.

Third-quarter earnings was the usual mixed bag, with performance largely driven by geographic exposure. Europe appears to be incrementally more positive from a consumer-demand standpoint, with several companies reporting that the troubled markets in southern Europe are stabilizing. The CIS region, however, remains weak.

New headwinds have appeared in the emerging markets in recent months, with volume growth in Asia and Latin America slowing. China is particularly concerning, with beer volumes in decline. High rates of inflation in some Latin American countries are boosting local currency cash flows, but the underlying health of the consumer remains poor.

We acknowledge that the downturn may be prolonged, particularly for commodity-linked economies, but we believe emerging markets will be an important driver of growth in the consumer defensive sector in the long term. Going forward, currencies will again have a heavy influence on reported results and cash flows. The weak euro is likely to remain a tailwind next year for companies reporting in euros, while companies reporting in dollars will likely face a currency headwind, albeit less strong than that in 2015.

In October, the boards of Anheuser-Busch Inbev and

The transformative deal in the beer industry is sharpening investors' focus on other potential deals in the consumer defensive industry. With the window of record-low interest rates beginning to close in the U.S., there may be an acceleration of merger activity in the coming quarters. We expect this activity to be centered around the more fragmented categories and around companies with the most balance sheet optionality. Household and personal care appears to be a clear area for mergers and acquisitions in the near term. Fairly low market shares allow for a great deal of consolidation, while several companies are either underleveraged relative to consumer defensive peers or have large cash balances. We regard M&A in household and personal care categories as being slightly less enhancing to cost advantages, however, because economies of scale are limited by the vast array of raw material inputs.

With the emerging-markets slowdown putting pressure on global organic growth, and the emergence of the AB InBev/3G model of rigid cost discipline, consumer defensive companies are paying closer attention to profitability as a driver of earnings growth. Several companies have implemented zero-based budgeting strategies, and many have adopted multi-year strategies to improve margins.

Symrise AG

(

)

Symrise is the world's third-largest supplier of flavors and fragrances, with a market share of 12%. Its narrow-moat rating is based on customer switching costs, which make the business stable and predictable as clients don't change ingredients providers easily due to the risk that they might suffer production disruption as a result or impair brand values. Symrise has exhibited among the most consistent operating metrics of the major ingredients companies, with the highest organic sales growth, a stable operating margin, and strong free cash flow generation. There is upside potential to ROIC once its two recent acquisitions have been successfully integrated. Symrise has exposure to the high-margin fragrance business, strong market shares in oral care ingredients, and high exposure to strong growth in emerging markets, which account for 47% of sales. Valuation looks appealing as P/FVE of 0.78 makes it among the most modestly valued of the ingredients stocks.

Tesco PLC

(

)

Trading at a near-50% discount to our fair value estimate, Tesco is one of the most undervalued stocks in our coverage universe, and we think risk-tolerant investors looking for exposure to U.K. retail should consider the stock. However, Tesco is in the early innings of its turnaround, and competition remains very intense from discounters Aldi and Lidl and other traditional grocers looking to stem market share losses.

U.K. and Ireland like-for-like sales declined around 1.3% in the first half, versus a decline of 4.8% in the first half of last year. More encouragingly, transactions and total volume are increasing 1.5% and 1.4%, respectively, in the United Kingdom, implying that basket sizes shrank slightly but deflationary pressures and Tesco's price cuts are the main drag on like-for-like performance. We expect additional price cuts to affect U.K. profit margins (0.8% in the quarter, but guided to about 2.0% for the year), but given that Tesco has considerable scale and operating leverage, we believe it can drive its U.K. margin to around 3% over the long term.

We still do not assign Tesco an economic moat, as we do not believe that its operating scale gives the firm a sufficient cost advantage to generate returns on invested capital that are materially above its cost of capital. However, we do believe Tesco will remain a strong competitor. Its U.K. convenience store like-for-like sales continue to increase around 4%, while its online grocery sales are increasing at a midteens rate; Tesco maintains about 50% market share in online grocery. The firm faces stiff competition from discounters, but with improved pricing and investments in service, it should be able to defend its turf.

Wal-Mart Stores

WMT

Shares of Wal-Mart have increased after the company reported third-quarter results, but they still trade at a 20% discount to our $75 fair value estimate. Investors remain concerned that Wal-Mart will need to continue investing larger and larger sums of money to generate the same level of sales growth. However, we believe Wal-Mart's earnings power has been underappreciated, especially as investments moderate over the medium and long term.

We think the discrepancy between the current share price and our fair value estimate stems from investors overemphasizing the fact that e-commerce firms are not burdened by store operating costs while underemphasizing the very costly last-mile shipping costs that e-retailers must overcome. High throughput, proximity to consumers, and store/shipment density are vital to winning the logistics game, but we believe Wal-Mart's capabilities in these regards have been overlooked.

We do believe

At 14.5 times trough earnings in fiscal 2017 (calendar 2016), Wal-Mart shares have a lot of pessimism baked in, presenting an opportunity for investors with a three- to five-year time horizon to generate solid risk-adjusted returns. We think many investors are underestimating Wal-Mart's ability to compete in multiple channels. Wal-Mart still generates about $12 billion in free cash flow, and it expects to buy back around $20 billion (10% of shares outstanding) over the next five years.

More Quarter-End Insights

Market Outlook: Late-Cycle Behavior?

Economic Outlook: Escape Velocity Not in the Cards for U.S. Growth

Credit Markets: Volatility and Spreads to Remain Elevated

Basic Materials: Fates Tied to Faltering China

Consumer Cyclical: Consumer Volatility Creates Investment Opportunities

Energy: Pain Persists as OPEC Refuses to Play White Knight

Financial Services and Real Estate: Fiduciary Standard Rule Could Have Drastic Impact

Healthcare: Even After Uptick, Some Great Values Remain

Industrials: Unsettled Global Economy Serves Up Individual Stock Bargains

Tech & Telecom: Cord-Cutting and Programmatic Advertising Trends Continue

Utilities: Don't Fear the Fed--Yield and Growth Still Look Good After 2015 Slump

/s3.amazonaws.com/arc-authors/morningstar/2ec7ca36-5bf1-45bb-8d9c-af7c8050dc31.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/2ec7ca36-5bf1-45bb-8d9c-af7c8050dc31.jpg)