Coronavirus Poses Risk for P&C Insurers but Also Opportunity

Losses look manageable, and this could be a good time to buy.

Editor’s note:

Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

While significant uncertainty surrounds the impact of the coronavirus crisis on the insurance industry, several participants have said that they believe it will be the largest loss event in the industry’s history. Claims losses from COVID-19 are likely to be diffused across a number of insurance lines, but the hits will primarily center on commercial lines. We believe personal lines won’t see major negative impacts, and personal auto will in fact see a material reduction in claims.

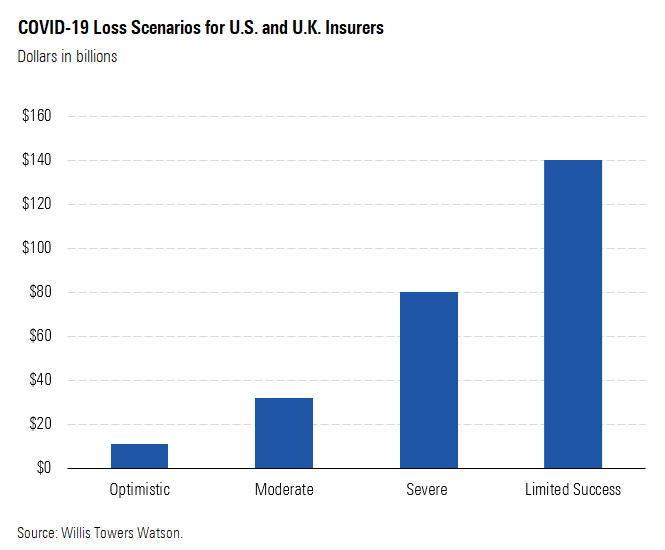

On the basis of Willis Towers Watson’s analysis, it doesn’t look as if COVID-19 claims losses will exceed past events as a percentage of industry capital except in a worst-case scenario. We believe the industry can absorb this event. Still, we don’t dismiss the risk; in a worst-case scenario, claims losses, combined with investment impairments, could stress balance sheets. Further, while we view wide-scale payouts on business interruption claims as a low-probability event, a negative outcome would pose an existential risk for insurers.

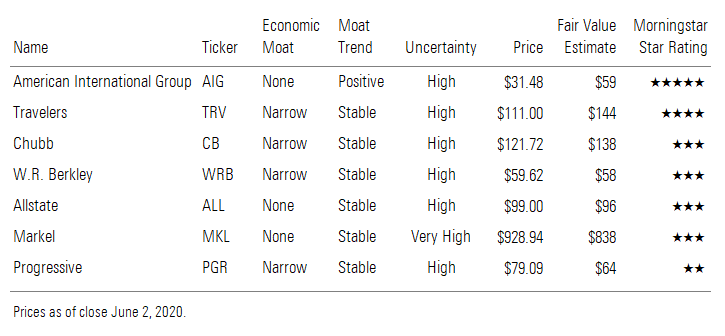

But if losses prove manageable, there is potential for a truly hard pricing market to emerge in the aftermath, especially as pricing was already showing momentum before the pandemic. Narrow-moat insurers like Chubb CB, Travelers TRV, and W.R. Berkley WRB could earn large excess returns in the years ahead if this occurs, and the current moment could represent the best buying opportunity since 9/11. We think the balance of risk and reward tilts in their favor from a long-term perspective, although a high level of uncertainty surrounds the industry until the COVID-19 situation is resolved. American International Group AIG is a potentially interesting deep-value name, with a price/book value that we believe is difficult to justify for any insurer, regardless of quality, unless financial distress is on the horizon.

Unprecedented Event With Wide Impact The insurance industry has historically taken large claims losses at times, and the ability to take on this risk is the key value they provide to customers. COVID-19 does differ from historical loss events in some key ways. First, as opposed to a natural catastrophe, COVID-19 is not necessarily constrained by time or space. For insurers, estimating exposure after natural catastrophes is relatively simple, and a reliable estimate is usually available in short order. In the case of COVID-19, the full extent of losses probably won't be known for some time, but we have an idea of the areas that will be most affected.

- Event cancellation: Essentially all large events have been canceled. Insurance for large events is typically highly syndicated, so losses will likely be spread across the industry.

- Business interruption: This area is very controversial. But at a minimum, insurers might face claims if a business property was contaminated with COVID-19 and had to be closed during the decontamination process, and a small number of policies include virus coverage.

- Workers' compensation: Companies will face claims from workers who contracted COVID-19 in the course of their duties. This is likely to be especially prevalent in the healthcare industry.

- Liability: Lawsuits surrounding management statements with regard to the COVID-19 crisis are likely. Companies could also face claims regarding employment practices and their efforts to contain COVID-19 transmission at work sites.

- Travel insurance: Insurers' liability is somewhat limited by the fact that under typical policies, canceled flights and customers canceling their plans due to fear of COVID-19 would not be covered. Only travelers who cancel because they have a documented case of COVID-19 would have a legitimate claim, although a small amount of "cancel for any reason" policies are sold.

- Surety: Insurers could face claims if construction projects are delayed.

This list is not exhaustive, and claims will potentially pop up in unexpected areas, especially as we do not know how exactly the COVID-19 crisis will play out, or what macroeconomic impacts the crisis will ultimately have. Additionally, at the margin, we believe claims activity in a number of insurance areas tends to pick up in times of economic stress, as people are more motivated to search any avenue to recover economic losses.

Still, we think this list shows the relatively wide impact of COVID-19, which is another factor that distinguishes this situation from a natural catastrophe. Given this, we don’t think any insurer will prove immune to the crisis, and claims losses are likely to be comparable across companies.

Within our coverage, the mix across commercial insurers can differ. For some critical areas, such as business interruption, exposure is very similar across companies, lying within multiperil and fire and allied polices. Other areas can differ materially in terms of mix. But given the multiple impacts across lines, we don’t see any company as particularly exposed or immune to the claims impact of COVID-19. Still, as the situation develops, the impact at a line-by-line level could contain some surprises, so keeping an eye on mix could be useful.

Significant uncertainty surrounds the magnitude of COVID-19’s impact on claims losses. While there seems to be rough consensus that it will be dramatic, ultimate losses will likely hinge on the duration of quarantine efforts, the number of people infected, and the resulting macroeconomic impact. As such, we think it is more realistic at this point to think in terms of a range of losses as opposed to a point estimate. We have seen a number of estimates, but we think the most comprehensive take has come from broker Willis Towers Watson, which provides several scenarios and details impacts across various line, focusing on the U.S. and U.K. markets.

- Optimistic: Social distancing efforts and an effective medical response are sufficient to reduce spread and lead to relatively quick containment.

- Moderate: Social distancing gradually reduces spread for about six months, with medical advancements over a longer period effective in controlling spread.

- Severe: Lockdowns are in place with varying degrees of strength through the end of 2020, as governments attempt to balance infections and economic effects.

- Limited success: Quarantine efforts are abandoned because of the economic impact, and slowing the spread hinges on ultimately developing herd immunity.

COVID-19 Loss Scenarios for U.S and U.K Insurers

Industry Capital Appears Sufficient to Handle This Event The range of losses in most estimates supports the idea that COVID-19 will probably be the largest loss event in history. However, the insurance industry is designed to absorb large losses, and while the situation is different in some key ways from historical events, we think looking at past events provides some context. Further, looking at industry capital provides a perspective on the industry's capacity to absorb these losses.

The property and casualty insurance industry has endured many large loss events historically. When we compare the largest loss events for the industry over the past 20 years with Willis Towers Watson’s scenarios, in every scenario except the optimistic one, losses will either approach or exceed Hurricane Katrina losses.

But to put these losses in the proper context, we need to compare losses with the industry’s capital base. As a percentage of industry surplus at the beginning of the year, COVID-19 doesn’t exceed the worst historical event, except in the limited success scenario. In our view, this supports the idea that the industry will be able to absorb these losses, unless COVID-19 plays out in worst-case fashion. This, in turn, suggests this is more of an earnings event for our coverage as opposed to a balance sheet event.

While the first quarter provided some indications of the claims impact for our coverage, we believe there is only limited information to be taken from the COVID-19 charges recorded by companies. It typically takes time for insurance claims to come in after an event, but to the extent possible, insurers want to make sure they are recording claims losses when they happened. For natural catastrophes, insurers will typically estimate the ultimate claims they expect to incur over time and record the full amount in the period in which the natural catastrophe occurred. The difference between this charge and actual claims received is called “incurred but not reported.” In the context of COVID-19, this is trickier, as the event is ongoing, and actual claims activity was minimal in the first quarter. Therefore, the relative charges individual companies took in the first quarter, in our view, are more reflective of their approach to recognizing IBNR, as opposed to their actual exposure. At one end, Chubb took a minimal claim, taking the stance that it did not have enough information to make an informed IBNR estimate, whereas we believe Markel MKL, on the other end, took the most aggressive approach in trying to fully estimate its losses.

Still, there is some information to be gleaned, and we see Markel’s estimate as the most interesting. On its call, management said its charge reflected its best estimate of the more immediate COVID-19 claims, particularly business interruption and event cancellation, but did not encompass more second-order effects in workers’ comp, liability, and surety. Still, while further losses are likely, Markel’s first-quarter estimate is very manageable at about 6% of annualized premiums and supports the idea that the industry can absorb these losses.

We believe our coverage enters this period with relatively strong balance sheets. In assessing financial strength, statutory figures are the most relevant, as they drive potential regulatory action if insurers suffer impairments. While most of our coverage has some international operations and therefore operates under multiple regulatory regimes, we will focus this discussion on U.S. regulatory metrics. For P&C insurers, the risk-based capital ratio is the key ratio in this respect. If it falls below certain thresholds, this prompts various levels of regulatory action. At 200% company action is required, at 150% regulatory action is required, and at 70% mandatory control kicks in. The specific details of what actions are initiated at each level are beyond the scope of this article and are not really operative at the publicly traded holding company level, as they are applied to operating subsidiaries. Credit rating considerations could also come into play at capital levels above the regulatory requirement. Still, we think these metrics are useful in providing a rough guide to the level of losses necessary to move capital bases to a point where companies might be considered distressed. The current risk-based capital ratios for the domestic P&C insurers we cover are well in excess of regulatory minimums, providing a significant cushion to absorb losses.

In turn, we can take the allowable level of capital reduction to reach the company action level and each company’s market share to estimate the level of U.S. industry losses from COVID-19 that these companies could absorb. The average across our coverage comes out at $179 billion. This exceeds even the limited success scenario estimate of $140 billion in industry losses, suggesting that financial distress should not become a major concern unless COVID-19 plays out in a worst-case scenario. However, given that the pandemic has potential implications for capital markets as well, we need to consider this factor.

Investment Portfolios Another Point of Uncertainty Another area of potential risk for insurers is their investment portfolios. During the first quarter, most of the domestic P&C insurers we cover saw their book values decline, primarily due to marks on their investments. The marks were mainly concentrated in equities and were modest in the context of overall balance sheet strength. Some insurers, whose equity holdings are concentrated in private investments, might see some further drops in the second quarter, as marks on these investments are often reported with a one-quarter lag. Still, we don't view investment losses as a major source of concern at this point.

We don’t believe it is appropriate to model any large impairments in fixed-income investments yet. In the near term, there could be significant volatility in the GAAP carrying value of fixed-income investments due to issues such as widening credit spreads. However, in terms of insurers’ financial health, actual impairments or defaults would be necessary to have a meaningful impact on financial strength. Insurers typically hold fixed-income investments to maturity, and only a reduction in the future cash flows from fixed-income investments would affect them economically. Additionally, statutory rules would govern any distress scenario, and statutory rules are not directly tied to market values.

However, the ultimate macroeconomic impacts of the COVID-19 crisis are not yet known, and the possibility for outlier capital market events cannot be dismissed. Further, if COVID-19 plays out in a worst-case fashion, investment losses will probably have some correlation with claims losses. Therefore, we believe it is worthwhile to consider the investment positioning of insurers.

On the fixed-income side, we believe that the insurers would face major difficulties only in an extreme scenario, and believe it is worth noting that P&C insurers largely passed through the financial crisis without major problems. Investment portfolios exist to service future claims, and most insurers construct their portfolios such that the bulk of their portfolios consist of high-quality fixed-income investments, in order to ensure their ability to service those claims. The insurers we cover provide differing levels of disclosure, but all provide some commentary on the ratings makeup of their fixed-income investments. All in all, we believe their fixed-income portfolios can be characterized as high quality, which should insulate the companies from major impairments on this side, barring an extremely adverse macroeconomic situation.

Insurers also tend to keep their fixed-income holdings highly diversified, with limited exposure to particular areas. For instance, with oil prices plummeting, there have been concerns around energy companies. But energy sector corporate debt makes up only 1.6%, 2.5%, and 4.3% of fixed-income investments for Chubb, Travelers, and AIG, respectively. AIG’s higher proportion largely reflects its greater allocation to corporate debt within its life insurance operations, and energy accounts for only 7.4% of its overall corporate debt portfolio.

At this point, it is difficult to foretell if any particular area of fixed-income investments will experience an unusually large amount of stress. P&C insurers typically allocate most of their fixed-income investments to municipal debt, corporate debt, and asset-backed securities. Municipalities could struggle in the aftermath of COVID-19, corporate defaults could rise, and the real estate market could also suffer. As such, it is hard to tell where any fixed-income impairments could arise.

COVID-19 Shows the Risks of an Equity-Heavy Investment Approach While most insurers are content to accept fixed-income returns in their investment portfolio, some insurers attempt to create value on both the underwriting and investment sides, or even focus more on the investment side. We believe this path is sometimes viewed too optimistically by investors because of the success of Warren Buffett. In our view, Buffett's success will be very difficult to replicate. We see higher allocations to equity investments as more risk-assumptive than value-creative and believe that the COVID-19 crisis is a good illustration of the potential downsides of this approach.

Within our domestic coverage, Markel best fits this bill, with something of a reputation as a "mini-Berkshire." Its relative exposure to its equity holdings is much higher than peers. Since the financial crisis, capital market conditions, characterized by low interest rates and a bull equity market, have mostly been ideal for the company’s equity-heavy approach.

The COVID-19 crisis shows how two seemingly uncorrelated risks (equity market movements and claims losses) can become quickly and unexpectedly correlated. We believe an equity-heavy approach significantly raises uncertainty for Markel, as it faces potential stress on both sides of the balance sheet, and we believe investors should look for a higher margin of safety relative to its peers. Investment portfolios are used to pay claims. We believe the strategy of most insurers is to maintain a high-quality fixed-income portfolio to cover its loss reserves (typically with a bit of a cushion) and only then look to invest the excess in higher-risk securities. Except for Markel, fixed-income portfolios fully cover loss reserves at the companies we cover.

In addition to having more of its claims-paying ability contingent on the value of its equity portfolio, Markel’s overall investment portfolio relative to its loss reserves looks low relatively to peers. This does not overly concern us for a couple of reasons. First, within our coverage, we believe Markel is the most conservative in setting reserve estimates, as demonstrated by the relatively high level of favorable reserve development it has recorded historically. As such, its loss reserves are probably modestly overstated on a relative basis. Second, in addition to its publicly traded stock investments, Markel historically has acquired noninsurance operations, and we believe management sees these acquisitions as part of its overall investment portfolio. These noninsurance operations generated $264 million in EBITDA in 2019. While these operations are diffuse and the company’s disclosures don’t allow for individual valuations, to get Markel’s overall ratio of investment portfolio to loss reserves in line with the peer group average, we would only have to assume an enterprise value/EBITDA multiple of 9 times for these businesses, which seems reasonable. Still, these businesses ramp up the portion of claims-paying ability tied to equity investments and could prove difficult to sell in a worst-case scenario.

We see Markel’s risk as elevated until we have more clarity on the impact of COVID-19 on the industry, economy, and equity markets, and our uncertainty rating is very high. It is notable that Markel was the only domestic insurer in our coverage to see a double-digit decline in book value in the first quarter. While equities should generate a higher return than fixed income over time, they also carry more risk. The current situation supports our view that the risks and rewards of Markel’s strategy are balanced, and that a higher allocation to equities is not inherently a value-creative decision. We believe Markel has generally enjoyed an overly optimistic market valuation in the postcrisis period, when conditions were largely favorable to its approach. But now that the risks are more plain, we question whether the market will reassess the multiple the stock has carried in recent years, even after this crisis has passed.

Business Interruption Claims Are a Low-Probability but Existential Risk The controversy around business interruption claims presents a risk to valuations. Insurers seem to have a strong case that most BI events are not covered and that they have limited liability. But we can't rule out a scenario where insurers are forced to pay on a wide scale.

Insurers have taken a hardline stance on paying out for most BI claims because they must. The American Property Casualty Insurance Association estimates that monthly closure losses for small businesses (100 employees or fewer) are $255 billion-$431 billion. Even using the low end of this range suggests that if insurers were forced to pay BI claims on a wide scale, the claims costs would deplete industry capital in three to four months. The insurers we cover could withstand about a 50% reduction in capital before tripping risk-based capital ratio regulatory triggers, so we are likely already past a stage where BI claims, if paid out widely, would lead to widespread financial distress among commercial insurers.

Standard commercial policies require physical damage to make a BI claim, and the effects of viruses are typically specifically excluded. Some have made the argument that the government has forced some businesses to shut down, and that could prompt a legitimate claim. But even in this case, the policy language seems to be clear that physical damage must be the underlying cause. Based on this, insurers have been denying most BI claims.

There will be some legitimate claims. There are some policies with virus coverage, but they are very few. Also, if a business must be closed because it is contaminated with COVID-19, that might be covered, but only for the cleanup period, which would be a few days. If claims are limited to these cases, the exposure looks manageable.

While insurers’ claims that COVID-19 is not covered seem strong, plaintiffs’ lawyers will attempt to craft legal arguments to force them to pay out. Also, there have been some proposals floated that the government should force insurers to pay, regardless of the policy language. Either way, the situation will likely be resolved in the courts (insurers would file lawsuits against any laws passed and would seem to have a strong case). This question probably won’t be fully resolved for some time, and legal outcomes can be difficult to handicap.

Regardless of the legality, crippling the commercial insurance industry (which would be a clear result of forcing widespread BI payouts) would be a bad idea, as it would likely materially hinder any kind of economic recovery. Widespread BI payouts seem like a low-probability event, but also one that could deeply affect valuations in a worst case.

Top-Line Pressure a Secondary Concern While we think most of the focus is on the bottom-line and balance sheet impacts of COVID-19, insurers' top lines will also come under some pressure. We view insurance as a relatively defensive industry, given that insurance is typically not a discretionary purchase. But the abrupt decline in commercial activity will hit volume across multiple lines. In our view, this is a secondary consideration. First, the industry has seen relatively strong price increases recently, which provides some ballast to the top line. Second, insurers don't typically outearn their cost of capital by a wide margin, limiting the valuation impact of growth or decline. Finally, costs structures are largely variable. But insurers do have some fixed costs, and based on management commentary, we don't expect the companies we cover to materially reduce head count, which turns some hypothetically variable costs into fixed costs. Therefore, insurers could experience some deleveraging and expense ratios could creep up, which might add some incremental pressure to underwriting profitability (or lack thereof).

This Could Be a Great Time to Buy P&C Insurers We've often heard it said that the best time to buy insurers is right after a catastrophe. While we think is generally a simplistic view, COVID-19 is such a dramatic and unexpected event that it could fulfill this truism. In this respect, we think 9/11 is the best historical precedent. Insurers endured a difficult period in 2001, as losses from 9/11, combined with a recession, poor pricing conditions, and some capital market turbulence, diminished industry capital. But this in turn set up a period of strong pricing increases and profitability.

Industry capital became constrained during this period but recovered fairly quickly in the following years. Over the past decade, capital has held at a strong level, which has arguably heightened pricing competition and limited industry returns during this period.

The good news for the P&C insurers is that pricing increases are already underway, and COVID-19 losses likely would only be a spur to further increases, especially if industry capital is materially reduced. Following a few years of declines, property lines have seen strong pricing increases since 2018. Casualty saw a shallower trough and has seen more modest improvements, but momentum has been building in pricing over the past two years.

If COVID-19 losses prove manageable but industry capital is diminished and a hard market follows, this could lead to a period of outsize excess returns for our coverage. We think more disciplined, narrow-moat underwriters such as W.R. Berkley, Chubb, and Travelers would be the best choice in this case, as we believe they would have the most leverage to this type of scenario.

The COVID-19 crisis has hit P&C insurance stocks relatively hard, with most of our coverage seeing much larger declines than the wider market. This suggests the market is primarily focused on near-term risks. For investors comfortable with these risks, this could create an opportunity. While we recognize the uncertainty of the industry’s current situation, we think most of our coverage is undervalued from a long-term perspective. Within our coverage, we see a fairly wide range of book multiples. We see Chubb, with its well-diversified book of business and strong underwriting record, and W.R. Berkley, with its history of disciplined underwriting potentially giving it the most leverage to a harder market, as relatively higher quality. But these two carry the highest multiples. We think Travelers is a quality franchise as well, but it entered this period with some underwriting stumbles independent of COVID-19. Across the three narrow-moat names, Chubb and Travelers look like the most undervalued, in our view. We think Markel’s equity-heavy approach raises its risk during this period, and we don’t see the current market price as compelling. Finally, AIG could be viewed as a potential deep-value name, but its life insurance operations create some different dynamics.

We believe our valuations are in line with a reasonable base case from this point forward. We largely assume sizable but manageable COVID-19 losses, with the industry gradually recovering those losses over time through better pricing. However, our fair value estimates do not hinge on the companies moving into a period as favorable as seen following 9/11, as we see this as more of a best case.

COVID-19 a Plus for Personal Auto, but Gains Will Be Given Back While commercial insurers will endure claims losses due to COVID-19, personal auto insurers will see significant claims benefits. Quarantine efforts led to a sharp reduction in miles driven, which has led to a corresponding reduction in accidents and claims. Progressive PGR said it saw abrupt declines in driving in mid-March, with miles driven down about 40% compared with the pre-COVID-19 baseline by the end of March. Since then, there has been some recovery, but miles driven remain well below the pre-COVID-19 level.

Progressive reports its underwriting results monthly, which provides some gauge of the impact on underwriting profitability. Its combined ratio dropped abruptly in March, with the loss ratio falling 18 percentage points sequentially. In April, the loss ratio declined 28% from the February level, but this was partially offset by a jump in the expense ratio from rebates.

Assuming Progressive saw two weeks of benefit in March and that its experience is representative of the industry, we can estimate that the monthly industry claims benefit was about $7.6 billion at the height of quarantine efforts, although this benefit started to taper off. Progressive’s April results suggest about a $6 billion monthly reduction in claims for the industry. This would represent a dramatic boost in profitability, but auto insurers have offered rebates to customers to account for the change in behavior. The Insurance Information Institute estimates that auto insurers have already committed to $10.5 billion in rebates for customers. On the basis of these figures, we believe that auto insurers will give back most of the benefit they would have otherwise seen and that we will see further rebate activity to maintain this balance if quarantine efforts persist.

We believe this is both the right and the smart thing for auto insurers to do. Being seen as profiteering off the situation could damage brands. More important, pricing for personal auto insurance is highly regulated, and in the absence of rebates, state regulators might look for price reductions in the future to offset insurers’ abnormal levels of profitability. These price reductions could then prove to be somewhat sticky and turn the near-term positive into a net negative from a longer-term perspective.

Coming into this situation, auto insurers were in an attractive spot, as a period of strong price increases had translated into relatively high profitability. Given the commodity nature of the product and the relative lack of moats in the space, we expected increasing price competition to lead to negative mean reversion in underwriting profits over time. The COVID-19 crisis will probably be a temporary disruption to this process, but if oil prices stay low past the lifting of quarantine efforts, we could ultimately see an increase in miles driven. Before the current favorable period, the industry endured a weak patch as several factors led to an increase in claims. One of the key factors in this period was a drop in oil prices that led to more miles driven. Ultimately, we believe there is potential for the COVID-19 crisis to restart the pricing cycle at a less attractive point. All in all, we see the short-term positives and potential longer-term negatives as relatively balanced and don’t believe COVID-19 materially alters valuations.

AIG Is a Lower-Quality Deep-Value Idea AIG is a composite insurer that has material P&C and life operations, with 56% of its core capital base attributable to its P&C operations. As a result, its exposure to the COVID-19 crisis has some different dynamics. Additionally, as it continues to struggle to generate acceptable returns in the postcrisis period, the company remains in turnaround phase. The current market price equates to 0.4 times book value at the end of the first quarter, a level that we think is difficult to justify for any insurer, regardless of quality, unless financial distress is on the horizon. While AIG's risk during this period might be somewhat elevated, we don't think financial distress is a realistic base assumption for the industry. Therefore, for investors willing to bear some risk, AIG could be viewed as an interesting deep-value name.

AIG’s P&C insurance operations have struggled for years due to weak underwriting profitability. In contrast, its life insurance operations have produced reasonable returns in recent years. The life insurance business has generally produced returns above 10%, while P&C insurance has rarely hit this mark and at times has taken substantial losses due to adverse reserve development charges and natural catastrophes.

In 2017, AIG brought in Brian Duperreault to facilitate a turnaround in its P&C operations. Progress was very slow in the first year or two of his tenure; in our view, improvement in underwriting margins was delayed by the need to address the excessive underwriting risks AIG was taking. During this period, Duperreault reduced policy limits and more aggressively reinsured the book. This had a net impact of resetting AIG’s underwriting profitability at a slightly worse level, but it provided a more stable base to build on. In 2019, his attention turned to improving underwriting margins, with the goal of an underwriting profit for the full year, which the company achieved. The underlying combined ratio (which excludes catastrophe losses and reserve development) has improved since the middle of 2018 and grown much more stable, although recent gains have been fairly modest. With the loss ratio already improving, management is turning to the expense ratio and expects to take out $1 billion in costs by the end of 2022, with 75% of this figure attributable to P&C operations. If achieved, this would equate to about a 3-percentage-point improvement in the combined ratio. We believe management has laid a path to adequate underwriting profitability over the next few years.

Of course, in the near term, COVID-19 claims losses are likely to swamp the operational improvements the company has made. We believe both AIG and the industry have enough capital to absorb these losses, and AIG would share in the benefits if a hard market develops afterward. However, with a lower earnings base, AIG likely has less room to absorb these claims in a worst-case scenario. Further, it will take time for expense reductions to work into results. We don’t see a catalyst for the market to reappraise the company in the near term. But longer term, the operational trends underway and the expected cost reductions support our view that AIG can lift P&C returns to an adequate level over time.

AIG’s life insurance operations have been a point of strength in recent years, but life insurers are fundamentally leveraged to capital market conditions, and the outlook on this front has dimmed materially because of COVID-19. For AIG, a 1% move in equity market affects pretax income by approximately $25 million-$35 million annually, and a 10-basis-point change in 10-year Treasury rates affects pretax income by approximately $5 million-$15 million annually. But these effects are not perfectly linear for larger capital market movements. So, AIG will probably face some significant near-term profitability pressure on this side of the business.

But absent impairments to the investment portfolio, this looks like a near-term earnings issue, and one that is likely to fade over time as capital market conditions normalize. As such, it does not have a major impact on our overall valuation. In our view, the primary risk on the life insurance side is outlier movements in the near term that prompt impairments to the investment portfolio. Life insurers’ balance sheets are significantly more leveraged than P&C insurers’, and the financial crisis showed the potential downside of this leverage, as a number of life insurers were forced to raise capital at that time. AIG’s overall leverage to the value of its investment portfolio is much higher, with its investment portfolio equating to 5.3 times tangible equity compared with a 3.1 average for its P&C peers. Additionally, the mix of investments for life insurers differs, and AIG has a much larger exposure to corporate debt. Overall, we think the risk on the life insurance side is likely just as high as on the P&C side, but it comes primarily on the investment side, which is more difficult to forecast at this point.

Given the uncertainties surrounding COVID-19 and the potential success of management’s turnaround efforts, we believe scenario analysis is especially useful in assessing AIG’s valuation.

- Base case ($59 fair value estimate): On the P&C side, AIG endures significant COVID-19 losses, roughly in line with Willis Towers Watson's moderate scenario, but management's efforts to improve underwriting profitability are reasonably successful over time. The life side of the business experiences a meaningful near-term contraction in profitability but recovers over a few years. The net result is that core ROE reaches an acceptable level over the next three years and holds there over time, with some year-to-year volatility owing to catastrophe losses. Core ROE averages 9% over the next 10 years, in line with our cost of equity assumption. AIG ultimately becomes a mediocre performer. Our valuation is equivalent to 0.9 times first-quarter book value.

- Bull case ($91 fair value estimate): COVID-19 losses are shallower, and a truly hard pricing market emerges in the aftermath. Management's turnaround efforts are highly successful and lead to underwriting results more in line with narrow-moat peers. Additionally, the life insurance side sees a quicker bounce back to solid results. Core ROE averages 13% over the next 10 years, with AIG able to generate solid excess returns over time. Our valuation is equivalent to 1.4 times first-quarter book value.

- Bear case ($35 fair value estimate): COVID-19 losses are deeper, though still not at a level that threatens solvency. Management's efforts to turn around the business are unsuccessful, with underwriting margins staying poor. The company also sees a longer period of poor profitability on the life side. Core ROE never materially improves, and AIG continues to destroy value throughout our projection period. Core ROE averages only 6% over the next 10 years, and our valuation is equivalent to 0.5 times first-quarter book value.

This scenario analysis doesn’t incorporate any dilution due to financial distress. The current market valuation is difficult to fully justify from a long-term perspective absent financial distress, and the current market price is below our bear case, which essentially assumes never-ending value destruction. This is an especially severe assumption, in our opinion, and supports our view that the stock potentially offers significant upside if AIG can survive the current period, which we believe will be the case.

American International Group, Travelers, Chubb, W.R, Berkley, Allstate, Markel, Progressive

/s3.amazonaws.com/arc-authors/morningstar/da2d065f-39a9-49e3-8551-1d3832fc658a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/da2d065f-39a9-49e3-8551-1d3832fc658a.jpg)