Integrated Oils' Yields Are Spiking. Are Dividends Safe?

It's likely to be a tough few years, but dividends should remain intact, meaning opportunity exists.

Integrated oils have fallen out of favor with investors in the past year as macroeconomic headwinds have depressed earnings across the entire portfolio, a rare occurrence. Difficult conditions are likely to persist in 2020 and 2021 as lower demand results in not only lower oil and natural gas prices, but also narrower margins on refined products and petrochemicals. However, at $30 a barrel currently, the Brent oil price sits well below our midcycle price estimate of $60/bbl, leaving the group trading at a steep discount to our fair value estimates. The recent sell-off has created a spike in dividend yields as well. We think concerns about dividend sustainability are largely misplaced, despite oil being below break-even levels, given the companies’ ability to lean on balance sheets in the near term as well as eventual capital expenditure reductions and potentially the reintroduction of the scrip dividend option.

Low Oil and Natural Gas Prices Not the Only Problem Before the drop in commodity prices over demand concerns related to the coronavirus outbreak and supply concerns from a breakdown in OPEC+ talks, integrated oil shares were already under pressure as most companies reported weak 2019 earnings in a difficult macroeconomic environment. Typically, one benefit of the integrated model is the countercyclicality of its upstream and downstream (refining and marketing and chemicals) segments, which offer cash flow support through a variety of price environments. Both segments registered earnings declines in 2019, however, leaving integrated companies suffering from not only weak oil and natural gas prices, but also narrow refining and chemical margins, driving a 25% average earnings decline for the year.

Near-Term Outlook Precarious Integrated oils were already facing headwinds in most of their key markets before the coronavirus outbreak. Oil markets were the exception; they had recovered on hopes of a balanced market as a result of slowing U.S. growth and OPEC+ cuts. Now, with the breakdown in the OPEC+ relationship and Saudi Arabia and Russia effectively engaging in an all-out price war, supply is likely to grow as both countries ramp up production. Meanwhile, the economic impact of the coronavirus is likely to result in tepid growth at least, but it could result in zero or negative demand growth this year, exacerbating the oversupply situation.

Global gas markets remain oversupplied as growing U.S. production makes its way into the global market thanks to a flurry of new liquefied natural gas projects. China's declaration of force majeure for LNG imports will only worsen the situation in the near term. U.S. prices might recover somewhat, given the likely greater-than-expected reduction in drilling in the Permian, which should reduce growth in associated gas volumes, but we do not expect a meaningful recovery in prices, and our long-term assumption remains $2.80 per million cubic feet for natural gas.

Similarly, integrated oil companies’ chemical segments' earnings have taken a hit as chemical supply has risen sharply in the last year; new projects designed to capitalize on cheap feedstock in the U.S. have come on line, overwhelming demand. A near-term recovery is unlikely with global economic growth slowing. Refined product demand has held up, with product margins flat year over year, but the wide crude spreads that drove refining profits over the past several years narrowed in 2019 on reduced heavy supply and greater light crude pipeline capacity. Now, with travel restrictions in place, weak refined product demand is likely to become an issue, pressuring margins.

We expect continued weakness across integrated oils’ upstream and downstream segments for the next two years. We have updated our models to reflect this view, including using the most recent strip prices for oil and natural gas. We have lowered our fair value estimates by an average of 10% as a result, but that is relatively modest considering the 50% drop in Brent prices year to date. The reason is twofold. First, the integrated business model makes cash flow less sensitive to oil and gas price changes compared with pure-play exploration and production companies. More important, our assumption of a recovery to midcycle conditions ($60/bbl oil), including downstream operations, drives a large part of our valuation. While we expect a recovery to midcycle conditions eventually as the fundamentals around oil supply costs and demand growth are unchanged, investors should prepare for the current difficult conditions to persist for the next two years.

Dividends Look Sustainable Although valuation is a concern, a company's near-term ability to cover the dividend is probably of more concern to investors. A steady, growing dividend is a key element of the integrated oil investment thesis, so an inability to fund the dividend through a downcycle would call into question the investment case. The spike in dividend yields to all-time highs suggests the market believes a dividend cut for many companies is likely. We disagree and think dividends are largely safe, thanks to an ability to increase debt in the near term. Furthermore, companies are likely to slow or stop dividend growth, reduce capital expenditures, sell assets, and if necessary, restore the scrip option to save cash. We've seen each of these actions occur in previous cycles as management teams are aware of the importance of the dividend to investors and are committed to preserving it as a result.

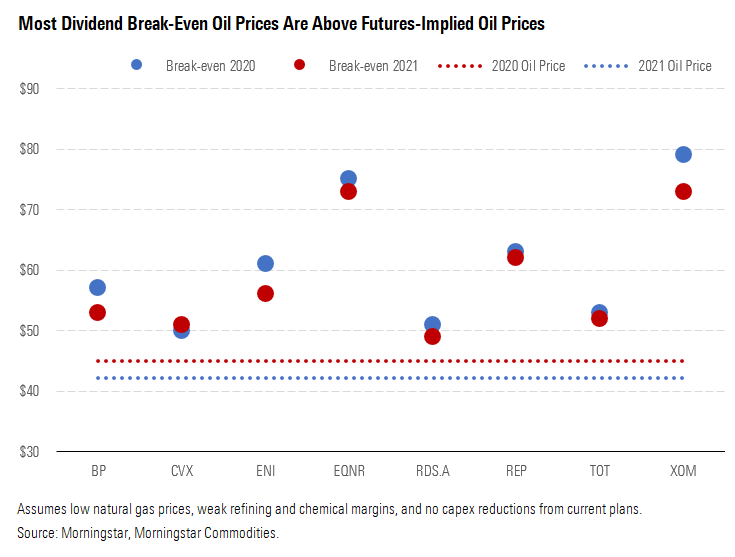

While we think the probability of a dividend cut is relatively low, it does vary by company, with those with more leverage and higher break-even prices at greater risk. Current futures prices for 2020 and 2021 are below what we estimate break-even levels to be for the integrated oils, implying that each company will be unable to fully cover its dividend with free cash flow at current levels.

Most Dividend Break-Even Oil Prices Are Above Futures-Implied Oil Prices

These levels assume a continuation of weak downstream earnings and low natural gas prices through 2021 but do not assume any reductions in capital spending from the current plan, which is likely to occur and would reduce break-even levels. That said, integrated oil companies’ ability to materially reduce capital spending in the near term is limited by their investments in multiyear large development projects. During the last decline in oil prices in 2014, the cash capital expenditure reduction averaged only 7% in the first year after oil prices fell. However, cash capital expenditures were lower on average by 30% the second year and 40% by the third year.

It might be more difficult to achieve reductions of that magnitude this time, however. Previous reductions were driven by the cancellation of higher-cost projects and a change in the method of project design, which placed greater emphasis on standardization and simplification and will be difficult to replicate. While savings from lower services prices played a smaller role previously, providers have been cutting capacity to support prices, which will somewhat offset the likely reduction in activity. This is all partially offset by integrated oils' increased investment in short-cycle projects like shale and brownfield offshore expansion, which can more quickly be dialed back. In total, however, we'd expect greater revisions to 2021 capital spending than 2020 and reductions to be less than what was realized in 2015-16.

With integrated oils unable to cover their dividend at current commodity prices and a reduction in capital spending likely to take time, the issue of sustainability largely falls to the strength of the balance sheet. While we expect slowing dividend growth as well as asset sales to support cash flow, increasing debt is likely to be the most relied upon lever to support the dividend. Most integrateds continue to maintain borrowing capacity, although some are in a better position than others.

Chevron CVX and Exxon XOM hold the greatest capacity to increase debt with net debt/capital ratios below 20%. Total TOT and Eni E are close behind with ratios of about 20%. The remaining companies are in a more precarious position with ratios around 30%. However, they still have capacity to increase debt as management teams typically target a range of 20%-30% through the cycle but can exceed that as needed. And we think they will. Dividends typically top the list of cash flow priorities, and management teams know they are a central tenet to the investment thesis. Those companies with higher debt ratios have also demonstrated a willingness in the past to issue a scrip dividend to save cash and protect total payouts as well.

We expect integrated oils to run free cash flow deficits over the next two years in order to fund the dividend (assuming no change in capital spending plans). Based on our estimates of free cash flow generation at various oil prices, we can estimate how high debt might rise to safeguard the dividend to determine whether this is feasible.

Based on our estimates, assuming $40/bbl oil through 2021, no integrated oil sees debt rise to 40%. In fact, only three companies—BP BP, Equinor EQNR, and Repsol REP--exceed 30%, the upper end of the typical targeted range. Shell RDS.A/RDS.B touches 30% but does not exceed it. Meanwhile, Chevron is able to keep its net debt/capital ratio below 20%. Given that even the highest debt levels remain manageable, and we are not assuming any proceeds from asset sales or reductions in capital spending, both of which are likely, these figures demonstrate that dividend cuts are unlikely, in our opinion.

Chevron and Total for Safety, Shell for Yield and Valuation, Exxon for Long Term Our updated fair value estimates indicate that the entire group is undervalued. However, we'd recommend being selective. For unparalleled dividend safety, Chevron is the way to go, given its strong free cash flow profile and low debt levels, followed by Total.

We think Shell demonstrates the biggest dislocation between yield and dividend safety: Its yield tops the group at more than 15% but the company has one of the lower break-even levels. Free cash will fail to cover the dividend this year at current oil prices, but Shell has balance sheet capacity to support the dividend. Investors will likely be left disappointed as its plans to repurchase $25 billion in shares during 2019-20 will be put on hold with the decline in commodity prices, which has probably further weighed on the shares.

Exxon trades at a steep discount to our fair value estimate and provides a countercyclical play on oil prices. Before the sharp fall in oil prices, Exxon reiterated its commitment to its previous plans to increase investment to double earnings (depending on commodity prices) by 2025. This will put pressure on cash flow and the balance sheet in the near term and likely result in lower dividend growth and higher debt levels, but they will remain manageable. However, Exxon has already announced plans to significantly reduce capital and operating expenses in the near term. Furthermore, the recent fall in oil prices holds the potential to further depress investment and create a greater supply shortage in a few years. If this ultimately is the case, Exxon will be the primary beneficiary among the group.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)