Possible Biden Win May Spur Cannabis Industry Growth

Companies with U.S. exposure are better positioned to benefit from easing prohibition.

The upcoming U.S. presidential election could lead to important regulatory changes that would grow the budding cannabis industry. Democratic presidential candidate Joe Biden and vice presidential candidate Kamala Harris have proposed decriminalizing cannabis. Although this would simply reduce incarceration for low-level possession crimes, it could signal the easing of federal prohibition. However, we continue to think that a change to U.S. federal law, removing prohibition and allowing states to choose their own cannabis legality, won’t come until at least 2023. Nevertheless, interim changes can reduce legal risk and ease access to banks and other ancillary services for the cannabis industry.

We think the U.S. market will prove to be the largest and will offer rapid growth. We forecast nearly 25% average annual growth for the U.S. recreational market and nearly 15% for the medical market through 2030.

Presidential election aside, Arizona, Montana, and New Jersey are voting on recreational legalization, Mississippi is voting on medical, and South Dakota is voting on both. Successful votes open new legal markets but don’t significantly benefit cannabis companies, since it is federally illegal to sell cannabis across state lines. Additional state legalizations create new markets but require companies to apply for new cultivation and dispensary licenses in each state.

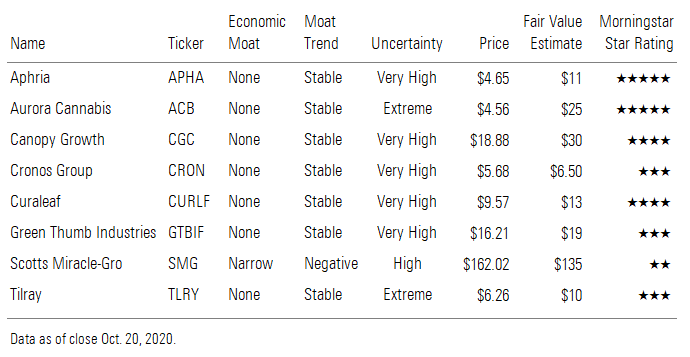

A Democrat election win will be best for the U.S.-based THC cannabis companies, such as Curaleaf CURLF and Green Thumb Industries GTBIF. Canopy Growth CGC is the only Canadian company we cover that has direct exposure through its deal to acquire U.S.-based Acreage Holdings immediately upon change to federal law. We think Canopy paid a good price and acquired an attractive option for an accelerated entry into the U.S. cannabis market.

Cronos CRON, Tilray TLRY, and Aurora Cannabis ACB have some exposure to the United States but only through hemp-derived CBD. We view CBD as less attractive than THC, given the massive amount of competition and low barriers to entry. Aphria APHA has no meaningful U.S. exposure but is actively looking for a THC partner in the country.

The removal of U.S. federal prohibitions is a primary catalyst in our bullish outlook for companies with exposure to the U.S. cannabis market. Once U.S. federal prohibition is removed, there will be significant competition for U.S. THC cannabis companies. Not only could incumbents be richly valued in acquisitions, but they would likely enjoy far stronger liquidity, driving intense bidding for cultivation and dispensary licenses at play.

Lastly, regulatory changes could permit cannabis stocks to trade on U.S. exchanges as opposed to being limited to the over-the-counter market and Canadian exchanges. This would allow for greater access to capital markets. Currently, many institutional investors are precluded from investing in over-the-counter stocks due to the lack of sufficient liquidity. Thus, we could even see increased institutional ownership in cannabis companies, which remains notably low.

Aphria, Aurora Cannabis, Canopy Growth, Cronos Group, etc.

/s3.amazonaws.com/arc-authors/morningstar/220f0649-85f9-4004-a281-b91d9bc53139.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7AHOQA64TFEQDMYMIMM6VUHYLY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JA7LQ2INFNFTZFBJLSDUZGIPJQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/220f0649-85f9-4004-a281-b91d9bc53139.jpg)