Trends in Star Ratings for U.S. Stocks

There were fewer opportunities as the third quarter ended.

This article originally appeared in Morningstar Direct Cloud and Morningstar Office Cloud.

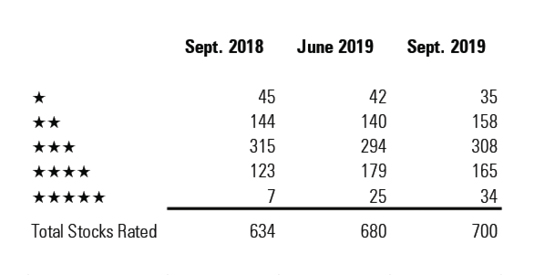

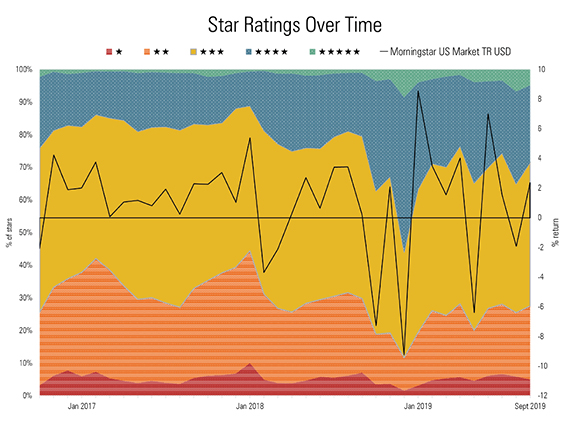

After a roller-coaster ride in the U.S. equities market, the third quarter ended with fewer undervalued stocks in the Morningstar U.S. coverage universe than at the end of June, based on the Morningstar Rating for stocks, also known as the star rating.

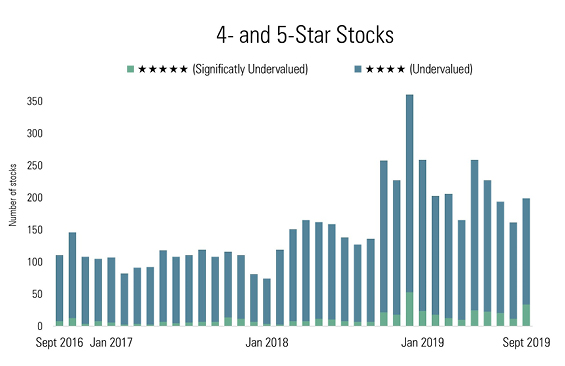

The down market in August did present investors with their widest swath of opportunities to buy undervalued names since the start of the year. But by the end of the quarter, many of those names were off the undervalued list.

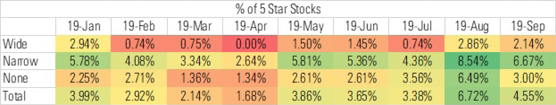

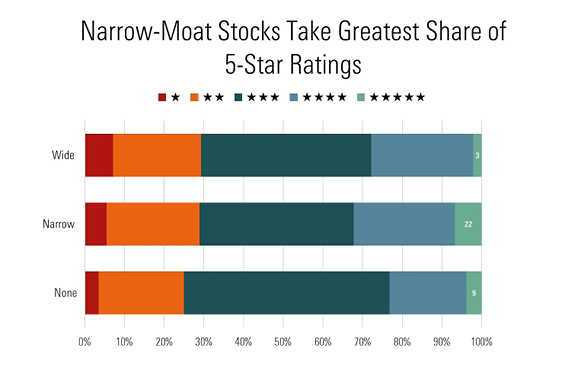

Still, it has been much easier for investors to find opportunities in 2019 than in 2018. At the end of the third quarter in 2018, 20% of stocks were trading below their fair market value; this year, 28% of stocks are undervalued as of the end of the third quarter. Energy and consumer discretionary stocks, and companies with Morningstar Economic Moat Ratings of narrow, took the greatest share of 5-star stocks through the quarter.

The Morningstar Rating for stocks compares a stock’s current price against its fair value. Stocks of 4 and 5 stars trade below their fair market value, while 1- and 2-star stocks trade above what we deem the stock is worth. Three-star stocks are what we determine to be fairly valued.

Source: Morningstar

Star ratings are calculated daily, but in this analysis, we use month-end and quarter-end data points as a way to capture a snapshot of trends.

Source: Morningstar

Source: Morningstar

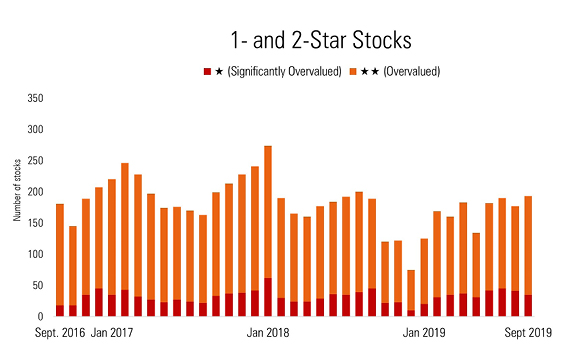

Throughout 2019, there has been a larger percentage of undervalued stocks than overvalued stocks, representing an easier time for investors. That wasn’t the case in 2018, when the percentage of 1- and 2-star stocks edged out that of 4- and 5-star stocks.

As of Sept. 30, of the 700 stocks that we cover, 199 were trading below their fair market value, down from 204 undervalued stocks in June. Undervalued stocks peaked in August at 245 but evened out by quarter-end.

Source: Morningstar

At the other end of the spectrum, the number of 1- and 2-star stocks--companies that trade above their assigned value--increased slightly from June to September.

- source: Morningstar

Q3's Biggest Movers A handful of stocks finished the quarter two star ratings away from where they had started. In the healthcare sector alone, three stocks moved two notches up on the star scale. Patterson Companies PDCO and Veeva Systems VEEV both moved to 4 stars from 2; The Cooper Companies COO went to 3 stars from 1. Patterson and Cooper both experienced price declines, whereas Veeva Systems' fair value was increased to $180 from $118 a share.

Paychex PAYX, which provides payroll solutions to small businesses, moved to 3 stars from 1. The stock hasn’t been “fairly valued” at a month-end in three years. Morningstar analyst Colin Plunkett, CFA, who covers the stock, affirmed the company’s wide economic moat rating in September.

Within materials, International Flavors & Fragrances IFF moved to 4 stars from 2. Andrew Lane revised the stock’s fair value in August, decreasing it to $131 per share from $135.

Source: Morningstar

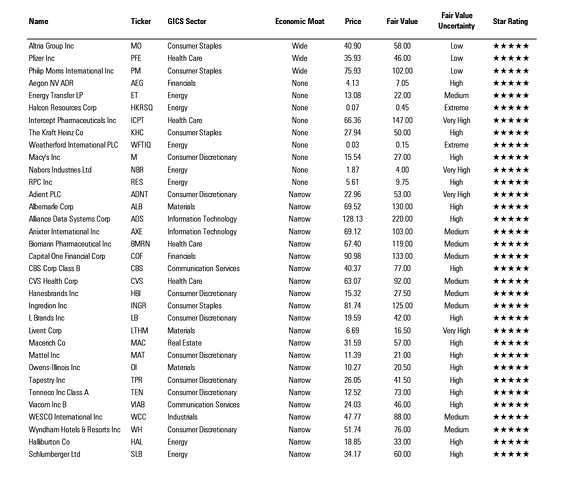

As the gradient below shows, there has been a gradual increase in 5-star stocks across all moat categories throughout 2019 and especially in the third quarter. The increase is most evident with narrow-moat stocks, with a 1.3-percentage-point increase in 5-star stocks from last quarter. Five-star narrow-moat stocks offer an opportunity to buy discounted stocks with a sustainable edge over their competitors. Almost 7% of all narrow-moat stocks were rated 5 stars as of Sept. 30. This translates to about 22 stocks. Notable names include Wyndham Hotels & Resorts WH and Alliance Data Systems ADS.

Source: Morningstar Analysts

Wide-moat stocks also saw an increase of 5-star stocks. In June, Kellogg K and Philip Morris PM were the only 5-star wide-moat stocks. At September-end, Philip Morris remained significantly undervalued, but Kellogg dropped to 4 stars. Altria MO, another tobacco company, and Pfizer PFE, the pharmaceutical giant, maintained their wide moats and joined as 5 stars.

Source: Morningstar

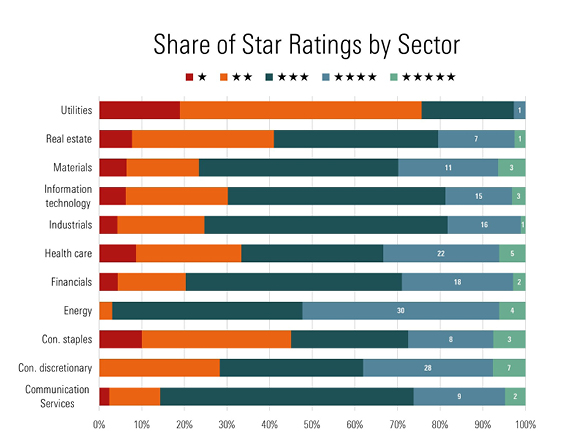

Star Ratings by Sector

Source: Morningstar

The hardest sector to find opportunities throughout the quarter was utilities. At the end of the third quarter, 75% of covered utilities stocks were trading above their respective fair values. Eight stocks, or 18% of all utility stocks covered, were considered significantly overvalued. Trailing utilities were consumer staples stocks, with 45% of the companies in the sector trading above fair market value.

Bargains were more easily found in energy and consumer discretionary stocks. At quarter-end, 54% of energy stocks were priced below their fair value. Morningstar’s US Energy TR Index lost 5.3% for the quarter, and stocks stayed well below their fair value. Likewise, consumer discretionary stocks would have been a good place to invest: 35% of companies were undervalued. Notable names include Mattel MAT and Adient ADNT, both rated 5 stars.

Here's a list of all 5-star U.S. stocks as of Sept. 30, 2019.

Source: Morningstar

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)