U.S. Sports Betting Worth a Wager for Investors

We don't think the market appreciates Caesars' and MGM's leading presence in domestic athletic gambling.

With U.S. professional sports resuming action and our view that more states will legalize athletic betting in the next few years, it’s a good time for investors to understand the large and growing opportunity that domestic sports wagering presents. The desire to bet on sports has a long history in the United States, dating back to 1665 when the first horse racetrack was built. This has historically been captured through the illegal sports betting market, with placed bets measuring around $150 billion last year (based on government-commissioned reports). The dynamic changed when the Supreme Court overturned the Professional and Amateur Sports Protection Act in May 2018, allowing states to legally offer sports betting. Since then, 22 states and the District of Columbia have legalized athletic wagering, and we expect another 17 states will do so by 2023.

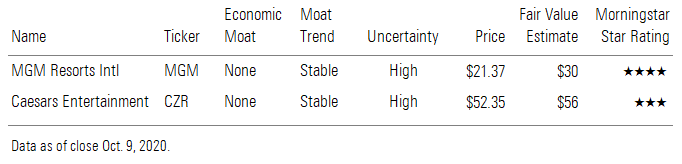

We see a $6.2 billion industry revenue opportunity for U.S. sports betting in 2024 ($35 per adult in legalized states), derived from our forecasts for individual states using data on both illegal and legal sports wagering. Although this doesn’t alter our no-moat ratings on the U.S. gaming markets, investors seeking exposure to this growth area should review Caesars Entertainment CZR (trading near our $56 fair value estimate) and MGM Resorts MGM (trading nearly 30% below our $30 fair value estimate).

Sports Betting Is Ingrained in U.S. Culture Although the expansion of legalized sports betting across the U.S. has rightfully become an increasing focus, many investors might not realize that athletic wagering has a long and prominent legal (horse racing) and illegal (all other sports) history in America. The American Stud Book (known today as the Jockey Club), formed in 1865, allowed horse racing betting to flourish as this organization assured fair and structured breeding, bringing increased confidence to bet on the sport.

The integrity of horse wagering was buoyed when pari-mutuel wagering was introduced in the U.S. in 1871, which saved the industry after bookmaking was made illegal due to concerns about the unstructured nature of odds setting. Pari-mutuel effectively removed bets against the house and instead placed bets against one another in a structured way.

Other sports lacked such structure, and this led to an extended history of unstructured illegal sports wagering in America. More than two dozen baseball players have been banned due to gambling fraud and corruption, which provided ammunition to prevent legalized sports betting across the U.S. And corruption was not exclusive to baseball, as evidenced by a handful of known college basketball scandals starting in the 1950s through 1980s, when players were bribed to help influence outcomes of games. A 1999 University of Michigan survey found that more than 45% of male collegiate basketball and football athletes said they bet on sporting events, despite the NCAA prohibiting such activity. Over 5% said they gave inside information for gambling purposes, bet on a game they were participating in, or received money for throwing a game.

Nevada legalized sports wagering in 1949, 18 years after it allowed other forms of gambling. But at the outset, legal sports wagering in Nevada was anemic, as the federal government instituted a 10% tax on these wagers in 1951; this proved too aggressive for an industry that at the time was only producing a low-single-digit hold rate. Even after the tax was reduced to 2% in 1974, legal sports bets placed in Nevada still greatly lagged those done illegally. In 1986, Nevada had 59 locations offering sports betting, resulting in about $1 million in total bets placed (roughly $2.3 million in today’s terms). This compares with the American Gaming Association’s current estimate of the illegal sports betting market at $150 billion (about $65 billion in 1986 terms).

In 1961, Congress passed the Interstate Wire Act, which said any sports bet placed across state lines could be punishable by up to $10,000 and two years in prison. In 1992, Congress passed the Professional and Amateur Sports Protection Act, which banned sports betting in all states. Delaware and New Jersey started efforts to repeal PASPA in 2009, as they faced increasing competitive pressure from casino gaming expansion in nearby states and weakening revenue from the Great Recession. The Supreme Court reversed PASPA in May 2018, and many states have quickly moved to allow sports betting.

We don’t think the pandemic has hindered the opportunity of legalized gambling. For instance, gambling data in New Jersey shows that during April through June, when retail casinos and sporting events were largely shut down, online bets in the state averaged fairly consistent 122% year-over-year growth, a noteworthy acceleration from the 64% increase averaged during the first three months of this year. Just as important is that this pickup in online wagers was sustained in July and August as retail casinos began to open at limited capacity, allowing total gaming revenue to improve to a 10% drop in August from the 60%-plus decline averaged during the COVID-19 casino shutdown.

It’s not just gambling in general that is showing recent signs of life, but sports betting as well. In Indiana, for example, the $14.5 million in Major League Baseball bets placed during July, as the sport returned to action June 24, far outpaced the $10.5 million wagered in October 2019 during the playoffs and World Series. Further, parlays (bets that link two or more individual wagers) and other sports wagers skyrocketed in July to $15.6 million and $33.4 million, respectively, from $6 million and $20.4 million in June. This helped drive a 138% month-over-month pickup in July athletic wagers placed in the state of Indiana. The strength continued through August as NBA and NHL games resumed, with total sports bets jumping another 137% month over month to $166.9 million, almost back to the pre-COVID-19 high of $186 million in February. With the NFL resuming games in September, we are optimistic that sports betting will make a full recovery this year.

Legalized Sports Betting Will Equal Amount Spent on Lottery We expect the current recovery in U.S. sports betting to continue, with U.S. athletic events seeing an estimated roughly $81 billion in legal placed bets in 2024, approaching the roughly $90 billion Americans spent on the lottery (which appears to be growing at an average low-single-digit rate annually, based on several sources) in the 45 states where it was available in 2019, according to the North American Association of State and Provincial Lotteries. This wagered amount will generate $6.2 billion in revenue (assuming a 7.5% hold rate, around what we estimate occurred in 2019) in 2024, up from around the $900 million in legalized sports betting sales achieved in 2019 (according to various reports), driven by our expected implementation across 39 states and the District of Columbia versus 22 states that have launched athletic betting today. Our 2024 forecast assumes that the 176 million adults currently populating these states and the District of Columbia will place $466 in wagers on average annually, leading to $35 in per capita sales.

To frame the revenue opportunity for U.S. legalized sports betting, we think it is helpful to first understand the size of the illegal U.S. sports wagering industry, as this is the addressable market opportunity for legalized athletic betting. While the exact size of the underground network is tough to ascertain, it appears that Americans spend a large amount on illegal sports wagering, which supports the view that its legalization is a meaningful opportunity for U.S. gaming operators.

A 1999 report by the U.S. government’s National Gambling Impact Study Commission referenced estimates of illegal sports bets placed in America ranging from $80 billion (around $123 billion in 2020 dollar terms) to $380 billion ($586 billion). It is this commissioned report that forms the basis for the America Gaming Association’s current $150 billion market forecast. This implies that the 254 million adults in the U.S. (those 18 years and older) on average wager between $484 and $2,307 on illegal sports betting each year (with AGA’s forecast at $591), equating to between 0.8% and 3.7% of the average $61,224 expenditure of an adult in this country in 2018, according to annual data from the Bureau of Labor Statistics.

Our 2024 estimate of $81 billion in legal sporting event wagers assumes that around 70% of the adult population has access to placing bets and that 54% of the AGA’s estimated $150 billion underground market is penetrated, aided by technology and experience benefits (such as real-time in-game betting). We still think nearly half of illegal sports betting will remain as such over the next five years, as many individuals will prefer confidentiality, the potential convenience of not having to visit retail locations, and perhaps lower costs of the underground market (that is, no risk of sports integrity fees or gaming tax/license fees being passed down to the bettor).

We also evaluate existing legalized sports betting and total U.S. casino gaming revenue data to help substantiate our 2024 $6.2 billion legal sports gambling sales forecast. To begin, we estimate that the roughly 1,000 combined tribal and commercial casinos in the U.S. will generate around $90 billion in gambling revenue in 2024, with our $6.2 billion in sports betting sales that year representing around 7% of the total. This appears reasonable, given that legalized sports betting at casinos in Nevada and Mississippi represented 1%-3% of total 2019 revenue, while athletic wagering amounted to 11% of total gaming revenue in New Jersey last year, driven by the state’s robust online offering, traffic flow from New York (which doesn’t have online or convenient retail locations), and destination status (its enclave of resorts). Given we expect around half of the 40 regions offering legalized sports betting will include online wagering, and that the industry will increase revenue by the high single digits on average versus low single digits for total domestic gaming, we think it is reasonable that around 7% of total domestic gaming sales in 2024 can come from athletic wagering, thereby supporting our 2024 $6.2 billion sports betting revenue forecast.

Our 2024 $6.2 billion sports betting revenue forecast is also derived from a bottom-up individual state forecast that is constructed using existing sports betting revenue data. Analyzing states that were among the first to implement legalized sports betting in 2018-19, we find that the revenue opportunity was influenced by a handful of key variables--whether there was the tailwind of an online offering in addition to a physical retail presence, neighboring state competition headwinds, and sports betting tax/license fee challenges.

One variable having an impact on the sales per capita opportunity was whether online wagering was offered in addition to retail locations, with the combination resulting in increased revenue. We’ve found that states offering both online and retail locations generated annual bets per adult of around $265-$425 versus $150-$175 for those offering just retail. We incorporated these ranges across states that we expect to legalize sports betting in the future, which is mostly based on legislative progress. After establishing a state’s online/retail presence, we incorporated whether a given state faced competition from neighboring states, which reduced the wagered per adult amount by $50-$100, based on what was seen in early adopter states like Arkansas (legalized in 2019), Delaware (2018), Pennsylvania (2018), and North Carolina (2019). Additionally, we found that low-double-digit gaming taxes, control through a lottery system, or high license fees presented a headwind to demand opportunity, knocking another $50-$100 off per capita adult handle.

Once incorporating our analysis of key variables, we applied an average annual growth rate of around 8% over the next five years, which takes into account slower near-term demand due to COVID-19 and future competition as more states legalize athletic wagering, as well as the prepandemic sports betting revenue growth realized during September 2019 through February 2020. Our bottom-up approach yields a total market revenue opportunity of $6.2 billion in 2024.

Our 2024 estimate of $6.2 billion is well below DraftKings’ forecast of an $18 billion revenue opportunity for sports betting in the U.S. at maturity in 2023. However, we believe the assumptions underpinning this forecast are flawed. For one, DraftKings’ number extrapolates New Jersey revenue trends across all states legalizing sports betting, which is unreasonable, in our view, as this state benefits from a few specific drivers. First, New Jersey is a destination state, which drives higher visitation. Second, New Jersey offers online gaming, which includes wagering on games other than sports and drives up its betting volume and sales. Third, New Jersey currently benefits from low competition, as New York does not offer online gaming or retail locations in proximity nor does Connecticut have sports betting (although we think this dynamic is likely to change). Additionally, DraftKings extrapolates a healthy 28% revenue compound annual growth rate through 2023 to its New Jersey extrapolated figures, which seems unlikely as competition increases. If we applied the same rationale and extrapolated our 2024 New Jersey sports revenue per adult estimate of $75 (versus $35 for the industry as a whole) across the entire current 254 million U.S. adult population, it would equate to a $19.1 billion opportunity. Applying the New Jersey forecast across the existing 176 million adult population that we expect to live in states legalizing sports betting through 2024 would imply a $13.2 billion sales opportunity, more than 2 times our forecast.

We’ve also assessed our outlook against regional casino operator Penn National Gaming’s retail/online sports betting forecast, which strikes us as more reasonable. While Penn’s January presentation didn’t provide detail behind assumptions, its base-case scenario (based on a Robinson Humphrey report) was $6 billion, near our $6.2 billion forecast, while its upside scenario (based on a Union Gaming forecast) was $8 billion.

Investors Can Gain Exposure Through Caesars or MGM Of the companies we cover, Caesars and MGM stand to benefit the most from sports betting expansion in the U.S., given their respective 100% and 79% EBITDA exposure to domestic gaming markets in 2019.

We estimate that Caesars’ 2021 sports betting revenue will amount to $550 million, or 5.9% of its total revenue (this figure excludes an estimated $100 million in nonsport online gaming revenue at the company’s New Jersey and Pennsylvania properties). In 2021, we project that 40 of Caesars’ 51 properties (including three divestures in Indiana in 2020-21) will be in states already allowing sports betting, representing a $2.16 billion industry revenue opportunity, of which we think Caesars will collect 25.5% share. Its high share is driven by its strong presence in two large existing sports betting markets: New Jersey (where it operates 4 of the 11 industry resorts) and Nevada (where it has 18 large Reno and Las Vegas properties), as well as an industry-leading loyalty database of over 60 million members and its partnerships with online operator William Hill, ESPN, and professional sports associations.

We expect 10 of the remaining 11 Caesars properties currently in states without sports betting will legalize the activity by 2024, adding another $2.5 billion in industry revenue opportunity. Within this incremental $2.5 billion opportunity, we estimate Caesars will collect another $237 million, or roughly 10% market share. The lower 10% share of this incremental market versus the 25.5% we estimate the company holds in existing markets is due to Caesars holding only one casino in the larger California and Ohio sports betting markets, as well as our thought that the former state will not allow online wagering. Still, we project that outsize growth of the existing sports market, along with the addition of newly launched ones, will drive Caesars’ total sports betting revenue to $878 million by 2024, representing a high teens share of the $4.7 billion total addressable sales opportunity across the 17 sports betting states the company will compete in that year, and nearly 8% of our forecast for its total sales in 2024.

Our $56 fair value estimate assumes EBITDA margins expand to the high 30s in 2024 from the high 20s in 2019, driven by cost synergies from the July deal between legacy Eldorado and legacy Caesars and maintained by the neutral impact of sports betting overall, based on management’s recent commentary that its online New Jersey athletic wagering operations are currently generating mid- to high 30s margins. It assumes revenue growth of 59% and 131% in 2020 and 2021, respectively, driven by the acquisition of legacy Caesars by legacy Eldorado, before settling to around 4% sales growth on average in 2023 and 2024.

Although we are favorable on Caesars’ opportunity in the growing U.S. sports betting market, we think investors could wait for a larger margin of safety, as the shares trade near our valuation.

We think that MGM also stands to benefit from the expansion of sports betting in the U.S., although not to the degree of Caesars. Currently, 18 of MGM’s 21 domestic properties are in states that already allow sports betting, addressing a $1.7 billion revenue opportunity. Lead by its strong portfolio of 13 Vegas properties, one of only three industry Detroit casinos in Michigan, its Borgata resort in New Jersey, a loyalty database of 34 million members, and its mobile platform that has partnered with major professional sports associations, we see MGM capturing a 22% share of this existing revenue opportunity, resulting in $365 million in sports revenue in 2021, or 3.4% of our forecast for its total sales that year.

MGM’s exposure to future state legalization of sports betting is limited to Massachusetts in 2021, Ohio in 2022, and Maryland in 2022, where the operator has only one casino in each region. That said, MGM will benefit from having one of only three casinos in Massachusetts and the relatively new National Harbor resort in Maryland, which we believe will leverage the company’s loyalty program. As a result, we expect MGM to capture 22% of the incremental $505 million in 2024 revenue opportunity from the launch of sports wagering in these three states. In total, we expect MGM’s 2024 sports betting revenue to amount to $541 million, equating to 25% share of the addressable market opportunity and 4% of the company’s total sales that year.

Our $30 fair value estimate already accounts for the MGM’s U.S. sports betting opportunity, which we calculate equates to around $3 per share. As a result, we think investors are largely discounting the opportunity, with the shares trading nearly 30% below our valuation, offering a chance to place a bet on this growing market. Further, we believe continued legalization of sports betting in other states, along with a full recovery in domestic gaming revenue by 2023, could provide catalysts for the shares. Our fair value estimate assumes 2024 EBITDA margins reach 27% in 2024 from 23% in 2019, with revenue growth averaging in the low single digits in 2023-29 (after the 2021-22 recovery years after COVID-19 and before the opening of a Japanese resort that we model to open in 2026).

MGM Reports Intl, Ceasars Entertainment

/s3.amazonaws.com/arc-authors/morningstar/2535f698-1e23-4470-9858-dc4e82afe213.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/2535f698-1e23-4470-9858-dc4e82afe213.jpg)