We Still See Value in Casino Operators After Cutting Outlook

Barring an extended and severe global coronavirus outbreak, we see the shares of Wynn, MGM, and Las Vegas Sands offering attractive long-term value.

We recently lowered our near-term forecasts for the online travel and hotel operators we cover to account for the global spread of coronavirus. Previously, we had factored some demand declines into travel operators' Asia-Pacific businesses. Now, in 2020 we expect North America to see travel demand decrease 5%, Europe to be down 10%, and the rest of the world to drop 25%. This view assumes that travel demand weakens through the second calendar quarter of this year before stabilizing and recovering in the second half of 2020, followed by a near full recovery in travel in 2021.

Our assumption is formed by recent travel operator earnings updates that discuss travel volume being down 15% year to date through February. It is also supported by ongoing conference cancellations by global corporations, which signal that demand is likely to weaken before getting better. Additionally, while we acknowledge that SARS might not be a perfect proxy for the new coronavirus, which is more of a global outbreak, we note that the SARS virus affected global system distribution (where many airline tickets are bought) industry volumes with a 10% drop in the first half of 2003, followed by flat levels in the second half of the year, and then a healthy rebound to 5.5% growth in 2004, according to Amadeus.

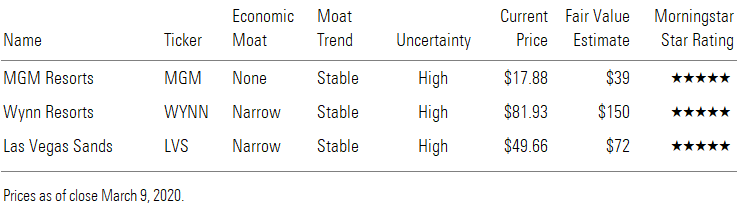

As a result, we have reduced our Las Vegas Sands LVS 2020 revenue projection to a 22% decline from a 6% drop prior. This reduces our Las Vegas Sands fair value estimate to $72 per share from $76. We have reduced our MGM Resorts International MGM 2020 revenue projection to an 8% decline from a 2% drop. This reduces our MGM fair value estimate to $39 per share from $40. Lastly, we have reduced our Wynn Resorts WYNN 2020 revenue projection to a 17% decline from a 4% drop. This reduces our Wynn fair value estimate to $150 per share from $160.

Barring an extended and severe global coronavirus outbreak, we see the shares of all three companies offering attractive long-term value.

MGM Resorts, Wynn Resorts, Las Vegas Sands

/s3.amazonaws.com/arc-authors/morningstar/2535f698-1e23-4470-9858-dc4e82afe213.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/2535f698-1e23-4470-9858-dc4e82afe213.jpg)