When Will the Supply Chain Recover in 2022?

Shipping bottlenecks could drag on into the second half of the year.

In late September 2021, we stated our belief that the supply chain crisis might persist until the middle of 2022. Now, full-year results from front-line shipping and logistics giants Maersk MAERSK B and DSV DSV have confirmed our thesis, with the former now believing that normalization of shipping markets won't take place until the second half of the year.

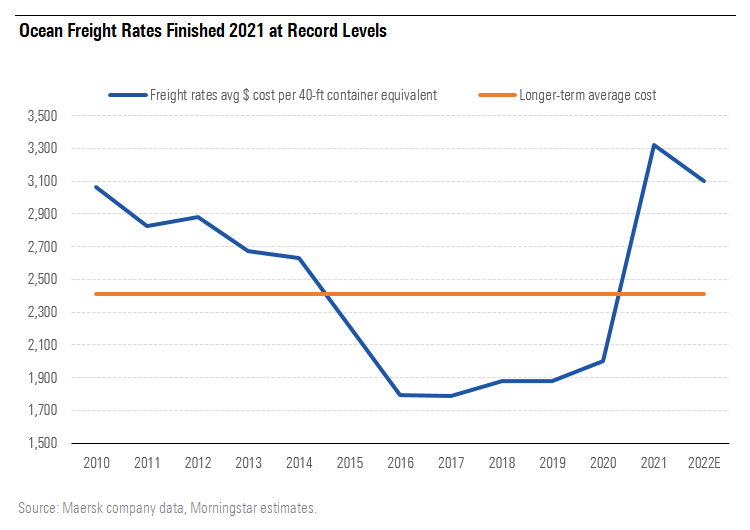

In the meantime, these companies are taking full advantage of tight capacity in shipping markets as a result of bottlenecks. Maersk’s ocean business delivered a return on invested capital of more than 45% in 2021, ahead of its long-term target of 7.5%, while the shipping industry as a whole has generated more profit in the last year than in the previous 10 years combined. While supply chain bottlenecks may subside in the second half of the year, causing downward pressure on freight rates, we fully expect another blowout year for shipping and logistics companies as these changes take time to filter through to the end client.

Additionally, the large shippers have been steadily converting clients to longer-term contracts, under the existential threat of the market driving rates higher and shipping capacity becoming harder to come by. Maersk expects 70% of volume to be shipped under long-term contracts in 2022, up from less than half before the COVID-19 pandemic, with most of these contracts locked in at relatively hefty freight rates. This effectively means that much of the input cost inflation we’ve seen across consumer and industrial products is likely to persist for some time.

The knock-on effects of the supply chain crisis have come to the fore recently, with commentary from companies as disparate as automaker Tesla, security provider Securitas, and asset manager Abrdn highlighting the disruption caused to end markets. It’s always darkest before the dawn, and while we believe the situation will improve in the second half of the year, we expect plenty more anecdotes of disruption to businesses between now and then.

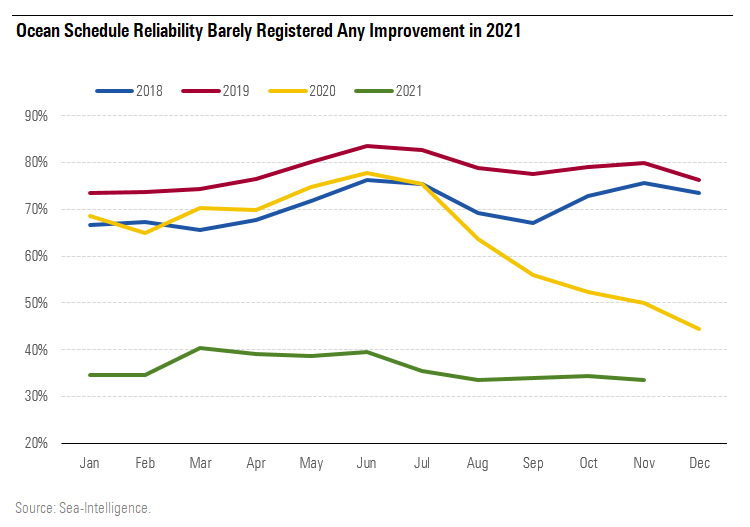

Ocean schedule reliability had barely registered any improvement in late 2021.

Ocean Schedule Reliability Barely Registered Any Improvement in 2021

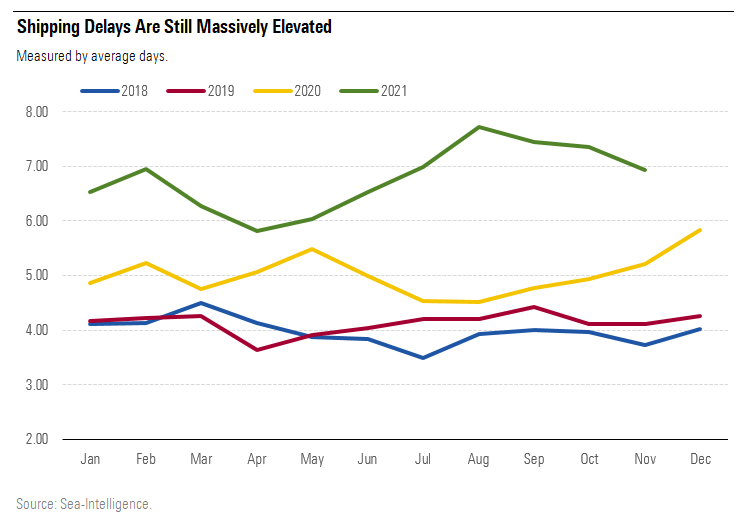

Shipping delays, as measured by average days, are still massively elevated relative to prior years.

Shipping Delays Are Still Massively Elevated

Freight rates finished 2021 at record levels. Although we expect them to decline over the course of 2022, they will remain elevated for the first half of the year.

Ocean Freight Rates Finished 2021 at Record Levels

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)