What Trump’s Proposed Tariffs Would Mean for the Economy

We see a low chance that he will implement uniform tax hikes but a higher chance of tariff hikes on China.

Could Trump’s tariff plans come to fruition? Maybe—but it’s far from a sure thing.

If Republican nominee Donald Trump wins the presidency, we see a 7.5% probability of a 10% uniform tariff hike and a 32% probability of a China tariff increase to 60%.

Though these tariff hikes are far from assured, we assess the probability-weighted impact on real gross domestic product at 0.13%. Combined with a baseline level of rising protectionism (regardless of who wins the presidential election), we’re subtracting a cumulative 0.2% from our forecasts for GDP growth over the next five years.

In our latest Economic Outlook, we analyze the potential future of trade, which we consider the most salient issue of the 2024 elections. This is because a new president can enact huge changes with the stroke of a pen—tariffs don’t have to go through the extensive congressional approval process.

What Are Trump’s Tariff Proposals?

When he was in office, Trump imposed several tariffs, including a 25% tariff on steel and a 10% tariff on aluminum imports from most countries.

Since then, Trump has expressed support for implementing additional tariffs. During his 2024 campaign, he proposed a 10% tax hike on all US imports and a 60% tariff on imports from China.

Democratic presidential nominee Kamala Harris, for her part, hasn’t provided many specifics on her stance toward tariffs. However, The New York Times has reported that a Harris spokesperson described plans to “employ targeted and strategic tariffs to support American workers, strengthen our economy, and hold our adversaries accountable.”

We Have Low Confidence That Trump’s Proposed Uniform Tariff Hikes Will Happen

If Trump wins the presidency, we see a 7.5% probability of uniform, or across-the-board, tariff hikes. That’s a 15% probability that Trump seriously pursues these tariffs, and if he does, a 50% chance that they’re successfully implemented.

There’s a high likelihood that this 10% tariff talk is mere bluster. He talked about similar tariffs during his first term, but they were never seriously pursued.

There are several reasons why he may not choose to pursue them:

- The proposals could be campaign rhetoric or a hard-line negotiating stance designed to extract concessions from trading partners.

- Trump could be dissuaded by opposition from congressional Republicans, business groups, and members of his inner circle (namely, former National Economic Council Director Larry Kudlow).

- Other advisors may cite tariffs’ conflict with foreign policy goals like supporting Israel or countering Iran or China.

However, if he does seriously pursue these tariffs, we see a 50% probability that they are implemented.

Legislative approval looks virtually impossible, so successful implementation depends on whether executive action passes legal muster.

The justifications cited for recent tariffs—that is, national security, China’s unfair trade practices, and intellectual property theft—don’t seem applicable to the 10% across-the-board tariffs. But the president does have a litany of statutory authorities available to him in adjusting tariff rates.

Given the high uncertainty, this is something of a coin flip.

There’s a Greater Chance That Trump Will Pursue China Tariff Hikes

If Trump wins the presidency, we think there’s a 32% probability of the China tariffs being implemented. We put them at a 40% probability of being seriously pursued, and if they are, an 80% chance that they’re implemented.

That’s more than quadruple the chances of a uniform tax hike.

We think Trump is much more likely to seriously pursue the China tariffs because of the increasing bipartisanship of anti-China sentiment. And given the large jump in China tariffs already implemented in his first term, there’s more reason to think Trump will follow through with his newest threat on China.

Still, a host of voices will try to dissuade Trump from pursuing the 60% tariffs. Particularly, we expect massive pushback from business groups because of China’s likely retaliation, not just on US exporters but also on US firms operating within China. And it’s certainly true that China may conclude it has little to lose with severe retaliation.

At the same time, China also has very strong incentives to offer meaningful concessions that would dissuade Trump from the tariffs. Unlike in 2018-19 during the first trade conflict, other countries are now stepping up protectionist measures against China. But China needs foreign trade to compensate for a deflating domestic real estate bubble.

Should Trump pursue the 60% China tariff plan, we see an overwhelming (80%) probability of success.

Unlike the across-the-board tariffs, there could be a case for executive action here via Section 301, which authorizes the president to “investigate and take action to enforce US rights under trade agreements and respond to certain foreign trade practices.”

The Section 301 authority was used for Trump’s 2018-19 tariff hikes and was even expanded upon during Joe Biden’s administration, so there’s reason to believe it could be used again.

Trump’s Tariff Hikes Could Cause a 1.9% GDP Decline

We project a 1.4% decrease to the level of US real GDP in the case of the uniform tax hike, and we project a 0.5% decrease in the case of the China tariffs.

We expect a lower impact from the China tariffs because of the probability that many companies will dodge these tariffs by rerouting through third countries.

The probability-weighted impact of the Trump tariffs amounts to 0.13%, which we’re rounding up to a full 0.2% hit to our long-run GDP forecast. This reflects a higher likelihood of protectionist measures regardless of the party in power (as shown by the recent Biden administration tariffs on electric vehicles and other goods).

Higher tariffs unambiguously cause a reduction in real GDP and are often thought to increase inflation.

Still, we think that the magnitude of any resulting inflation depends on many factors, including the Federal Reserve’s response. We’ve factored a small impact into our inflation forecast, but it’s not material.

| Scenario | Impact (% GDP) | Probability if Trump Wins | Probability-Weighted Impact (% GDP) |

|---|---|---|---|

| 10% Uniform Hike | 1.4% | 7.5% | 0.05% |

| 60% on China | 0.5% | 32% | 0.08% |

| Total | 1.9% | 0.13% |

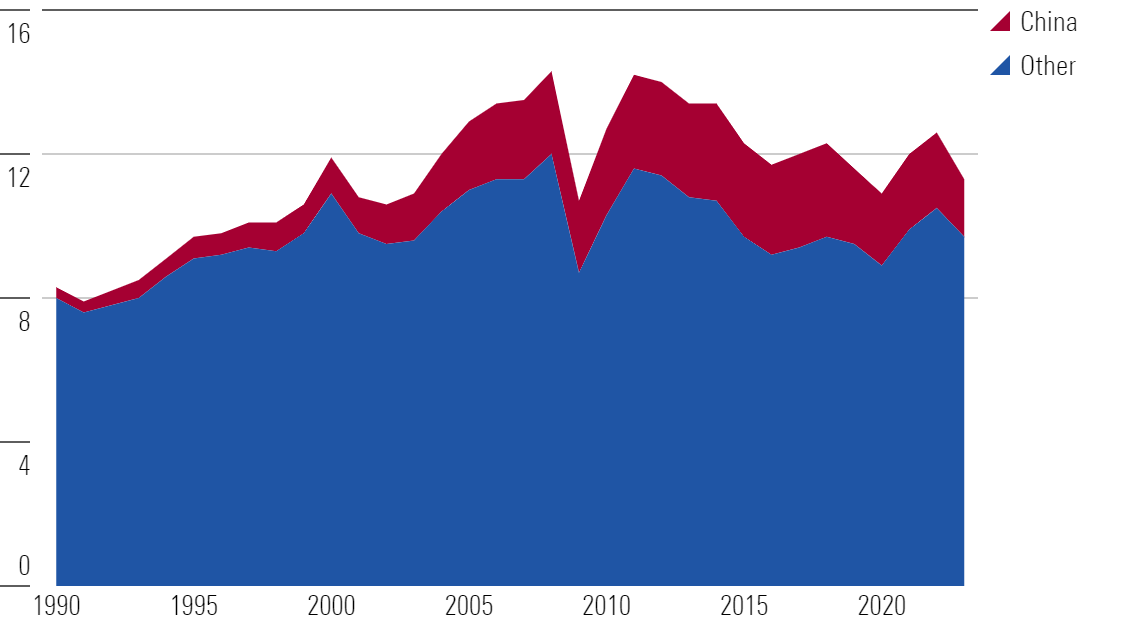

US Goods Imports, % of GDP

What We Expect for Fiscal Policy in the Next Presidential Administration

Other issues that may impact the economy during the next presidential term include fiscal policy and immigration.

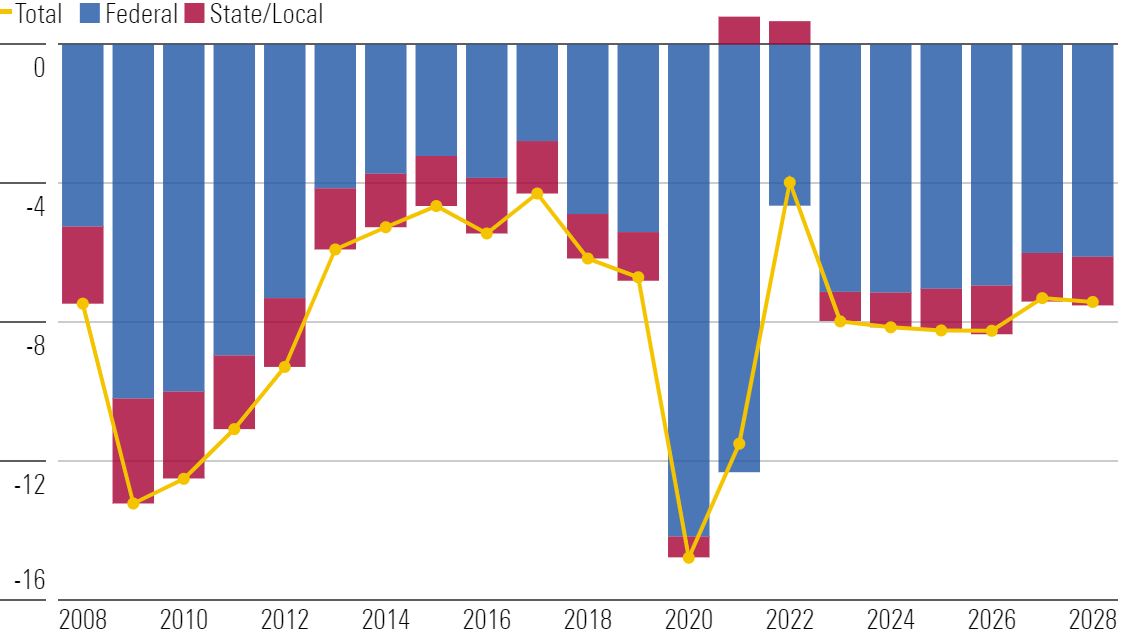

In terms of fiscal policy, we project the combined US government deficit as a share of GDP to average 8.2% over 2025-26 and then drop to 7.4% over 2027-28 as interest rates fall. That’s moderately above the prepandemic average of 6.4%.

US Government Budget Balance (% GDP)

However, the 2017 Tax Cuts and Jobs Act is set to expire in 2026, and it’s likely that politicians will intervene to avoid a massive tax hike.

Full renewal of the act would cost around 1.3% of GDP. We expect a partial renewal of the act with some offsets, adding about 1.0% of GDP to the deficit. On the other hand, we expect lower interest expenses than the Congressional Budget Office does, owing to our interest-rate forecast.

With the hefty increase in the deficit and debt over the past decade constraining politicians’ options, we don’t think a large further increase in deficits is likely, regardless of who wins the presidency.

Large Divergence on Immigration Seems Less Likely in the Next Presidential Term

Immigration is another potentially salient issue of the upcoming presidential election.

Trump’s current calls for mass deportation echo the messaging of his 2016 campaign. But we saw little of those proposals come to fruition during his first term, owing to several obstacles that remain in place.

A large step up in deportation would require massive new resources—which would require new legislation to access—and even if that happens, there are daunting logistical impediments.

We also saw Trump do little to obstruct the flow of legal immigration during his first term, which continued at about the same rate as in Barack Obama’s second term.

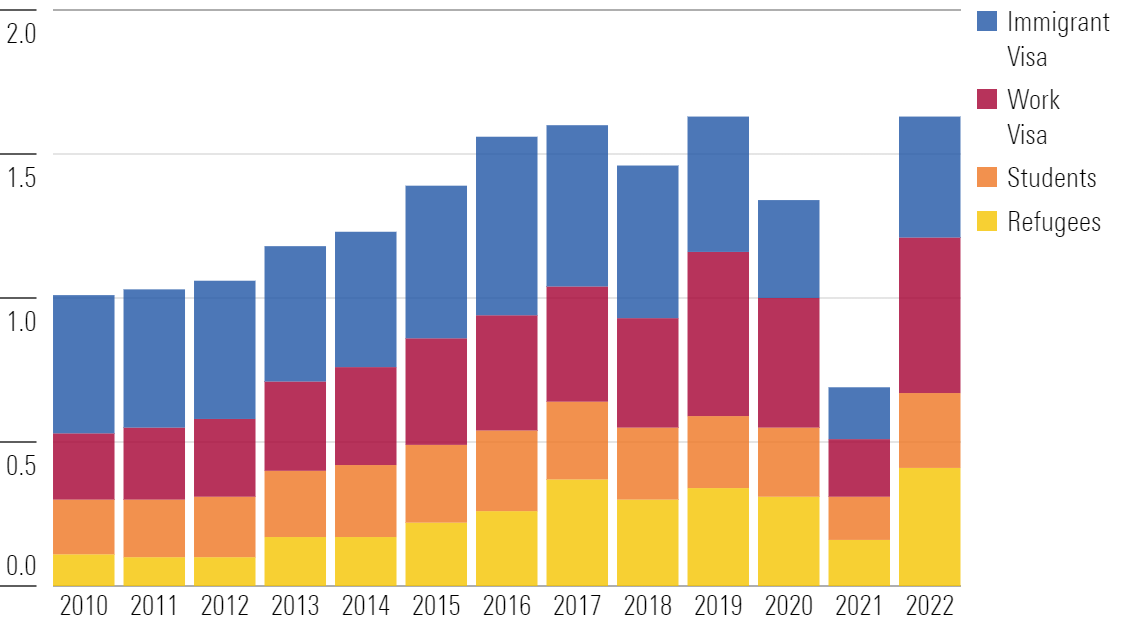

Gross Legal Immigration Into the US (Million)

On the flip side, there’s a broad political consensus that the surge in unauthorized immigration occurring over 2022-23 was unacceptable.

As of mid-2024, data shows border encounters had receded to 2019 levels. We expect this development to continue regardless of whether Harris or Trump wins.

This article was compiled by Emelia Fredlick.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HBAEAVIJHFEBTPMEK2UMVQ3NFQ.png)

/d10o6nnig0wrdw.cloudfront.net/09-20-2024/t_2967a2ad4e954711b8ecfa5fefc0b298_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)