5 Top-Performing High-Yield Bond Funds

Fidelity, BlackRock, and BrandywineGlobal stand out.

Amid an economy that has continued to avoid recession and expectations that the Federal Reserve will start cutting interest rates soon, high-yield bonds have been a rewarding option for investors.

Over the past several years, high-yield bonds have consistently outperformed the overall bond market, and 2024 has been no different. The category returned 10.31% over a year, while the overall bond market as measured by the Morningstar US Core Bond Index gained 3.53%. In this environment, the top high-yield bond funds have been particularly strong, with the top five all posting double-digit returns over the past year.

Meanwhile, contrary to many categories, where the best performers tend to be passively managed index funds, only actively managed strategies were at the top of our screen of high-yield bond funds. They include funds from BlackRock, Fidelity, and Artisan.

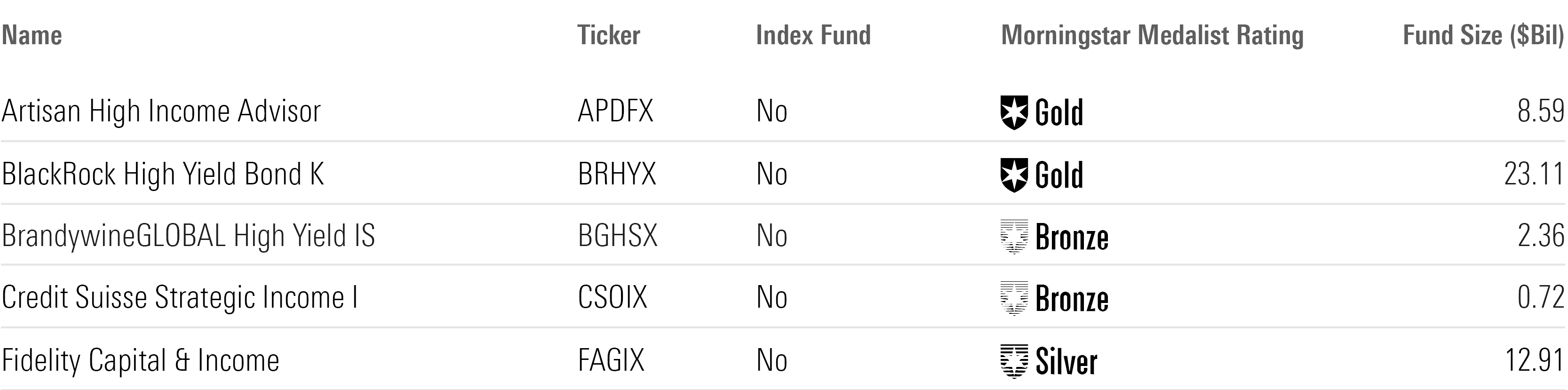

Here are the best-performing high-yield bond funds from our screen:

- Artisan High Income Fund APDFX

- BlackRock High Yield Bond Portfolio BRHYX

- BrandywineGlobal - High Yield Fund BGHSX

- Credit Suisse Strategic Income Fund CSOIX

- Fidelity Capital & Income Fund FAGIX

High-Yield Bond Funds vs. the Core Bond Market Index

What Are High-Yield Bond Funds?

Portfolios of high-yield bond funds focus on debt securities with at least 65% of bond assets rated BB or lower. Because of those lower-quality bonds, these portfolios carry higher risk than other types but also offer higher yields.

Screening for the Top-Performing High-Yield Bond Funds

We looked for the funds that have posted top returns across multiple periods. We first screened for funds in the top 33% of the category using their lowest-cost share classes over the past one-, three-, and five-year time frames. In addition, we screened for funds with Morningstar Medalist Ratings of at least Bronze. We also excluded funds with less than $100 million in assets. We highlighted the five funds with the best year-to-date performance. This group consisted only of actively managed funds.

Because the screen was created with the lowest-cost share class for each fund, some may be listed with share classes not accessible to individual investors outside of retirement plans. The individual investor versions of those funds may carry higher fees, reducing shareholder returns. A table with the funds’ returns is at the bottom of this article.

Top-Performing High-Yield Bond Funds

Artisan High Income Fund

- APDFX

- Morningstar Rating: 5 stars

- Morningstar Medalist Rating: Gold

The actively managed Artisan High Income Fund is up 11.94% over the past year, outperforming the average fund in the high-yield bond category, which rose 10.38%. The $8.6 billion fund has gained 3.33% over the past three years, while the average fund in its category is up 2.02%. Over the past five years, the Artisan Partners fund has climbed 5.86%, compared with the 3.74% gain for the category.

“Manager Bryan Krug guides the team’s investment style, which focuses on high-yield corporate bonds but can make heavy use of bank loans as well. That style also includes a preference for asset-light companies that carry lower credit ratings but generate substantial cash flow and require less capital reinvestment. More traditional hard-asset companies still play a role here, but the team prefers to buy them during periods of dislocation rather than hold them through a full market cycle. In addition, Krug builds a concentrated portfolio, with typically one-third of assets in its largest 10 issuers. This distinctive style courts risk, especially if a concentrated bet goes sideways.”

—Brian Moriarty, associate director

BlackRock High Yield Bond Portfolio

- BRHYX

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Gold

The $23 billion BlackRock High Yield Bond Portfolio rose 11.92% over the past year. The gain on the actively managed fund beat the 10.38% gain on the average fund in the high-yield bond category. Over the past three years, the BlackRock fund is up 2.85%, while the average fund in its category is up 2.02%. Over the past five years, the fund has climbed 4.63%, compared with the 3.74% gain for the category.

“Managers David Delbos and Mitchell Garfin set the portfolios’ top-down themes based on input from the high-yield team plus insights from across the firm’s broader fundamental fixed-income and equity platforms. The duo leads the day-to-day management as well, working with the team’s traders and research analysts to populate the portfolio from the bottom up. Given the roughly $55 billion in active global high-yield assets run by BlackRock, the strategy is less nimble than some of its competitors. It invests mainly in the market’s larger, more liquid issues, and it can be challenging for the team to express macro themes quickly and efficiently in the cash bond market. The process aims to overcome some of those limitations by including other sectors, including bank loans (in the US-domiciled vehicle) and CLOs (in the Luxembourg-domiciled fund), investment-grade corporates (which have gone as high as 15% of portfolio assets in 2020 and 2022), and even equities (up to 10%).

“The team also manages liquidity and tweaks exposures through a mix of high-yield ETFs, credit default swaps, and high-yield-focused total-return swaps. A risk committee reviews the portfolio, assessing market correlations, industry, and individual security exposure, and the portfolio’s overall level of market risk to ensure the managers are not taking unintended risks.”

—Jeana Marie Doubell, analyst

BrandywineGlobal - High Yield Fund

- BGHSX

- Morningstar Rating: 5 stars

- Morningstar Medalist Rating: Bronze

The actively managed BrandywineGlobal - High Yield Fund is up 13.25% over the past year, outperforming the average fund in the high-yield bond category, which rose 10.38%. The $2.4 billion fund has gained 3.59% over the past three years, while the average fund in its category is up 2.02%. Over the past five years, the Franklin Templeton fund has climbed 6.58%, compared with the 3.74% gain for the category.

“Comanagers Bill Zox and John McClain execute a disciplined value approach. They buy issues when their market prices are lower than the team’s estimate of intrinsic business value and sell them when their initial thesis has played out or when there are better opportunities in the market. When valuations get rich and opportunities get scarce, the managers may run a larger-than-peers allocation to investment-grade bonds to reduce the portfolio’s market risk, as they did at 2019′s year-end.”

—RJ D’Ancona, senior analyst

Credit Suisse Strategic Income Fund

- CSOIX

- Morningstar Rating: 5 stars

- Morningstar Medalist Rating: Bronze

The $714 million Credit Suisse Strategic Income Fund rose 11.12% over the past year. The gain on the actively managed fund beat the 10.38% gain on the average fund in the high-yield bond category. Over the past three years, the Credit Suisse fund is up 4.58%, while the average fund in its category is up 2.02%. Over the past five years, the fund has climbed 5.15%, compared with the 3.74% gain for the category.

“The team’s tactical and fundamentally driven approach has been in place since the strategy’s 2012 inception. Like many peers, its approach is rooted in bottom-up fundamental analysis coupled with a top-down macro-overlay. The analysts assign internal credit ratings to all potential holdings and focus on traditional metrics such as business model, free cash flow, enterprise value, leverage ratios, and capital structure. The team regularly meets with company management and creates proprietary models rather than relying on third-party research.”

—Saraja Samant, analyst

Fidelity Capital & Income Fund

- FAGIX

- Morningstar Rating: 5 stars

- Morningstar Medalist Rating: Silver

The $12.9 billion Fidelity Capital & Income Fund rose 12.31% over the past year. The gain on the actively managed fund beat the 10.38% gain on the average fund in the high-yield bond category. Over the past three years, the Fidelity fund is up 3.65%, while the average fund in its category is up 2.02%. Over the past five years, the fund has climbed 6.76%, compared with the 3.74% gain for the category.

“The strategy is more adventurous than most high-yield bond category rivals. The managers source ideas from Fidelity’s high-yield and equity research teams and allocate smaller stakes to in-house specialists in broadly syndicated bank loans and private credit, respectively. Industry-standard bottom-up considerations include positive fundamental trajectory, strong free cash flow generation, and solid covenant protections.”

—Max Curtin, analyst

Long-Term Returns of Top-Performing High-Yield Bond Funds

This article was generated with the help of automation and reviewed by Morningstar editors. Learn more about Morningstar’s use of automation.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NPR5K52H6ZFOBAXCTPCEOIQTM4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-24-2024/t_c34615412a994d3494385dd68d74e4aa_name_file_960x540_1600_v4_.jpg)