5 Value Stock Picks from Oakmark’s Bill Nygren

Citi and Delta are among Nygren’s favored stocks.

The past decade hasn’t been easy for active management or value investing, but Oakmark’s Bill Nygren has made both work. Here are some of the stocks he’s got his eye on.

Nygren manages the $23 billion Oakmark Fund OAKMX, an actively managed large-value fund with a gold medalist rating from Morningstar. The fund is part of Harris Associates, an affiliate of Natixis, where Nygren is a partner and CIO for US equities. Since the fund’s August 1991 inception, it’s had a 12.9% annualized average return, compared with 10.6% for its benchmark, the S&P 500. This performance puts it in the 3rd percentile in its category over the past 15 years.

We asked Nygren to share his process, along with two stocks that have been good calls for the fund, one that’s underperformed, and two others of his choice.

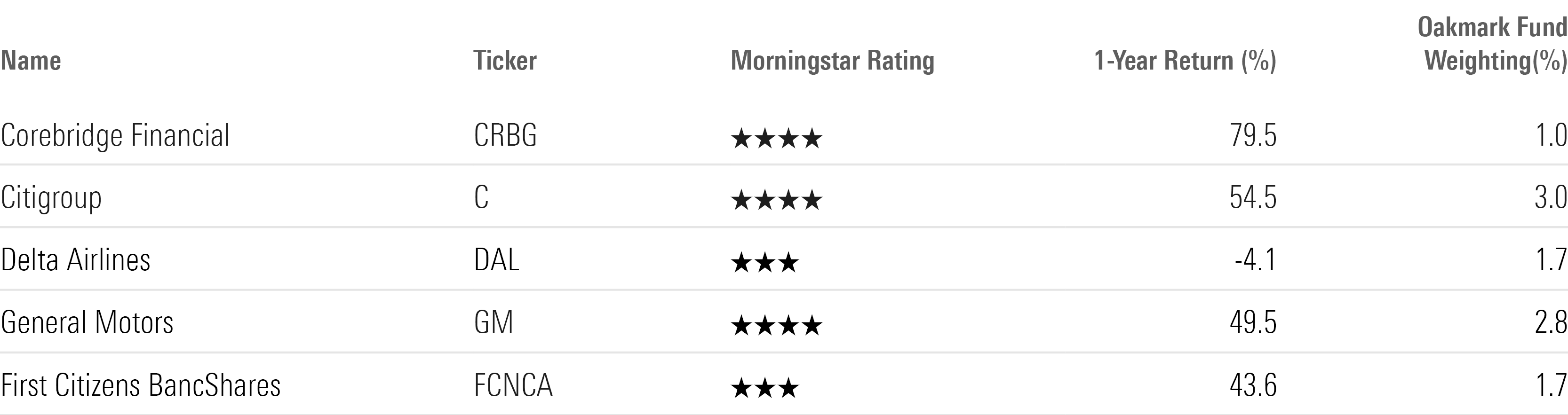

Oakmark table

The Oakmark Process

To make it into Oakmark’s portfolio, a stock must meet three qualifications. First, Nygren and the two other managers, Michael Nicolas and Robert Bierig, look for companies trading at a discount to their business value. “We think about it as what the business would be worth if it was acquired in an all-cash transaction. We don’t buy in unless we think the discount is at least, ballpark, 30% from fair value,” Nygren explains.

The second requirement is that the stock’s total return exceeds what they expect from the S&P 500. “We would say at its current multiple, dividends are less than 2% and growth is 6%-7% [a year]. So right now, we’d be talking about an 8%-9% return,” says Nygren.

One-Year Trailing Returns

Finally, on a more qualitative level, he looks at management that he thinks acts like company owners and not just professional managers. “Typically, the larger the company becomes, the higher the CEO’s pay. And most ways that you get bigger are also good for shareholders, but some aren’t. If you double the size of the business with an acquisition but overpay, the company grows in a way that helps the shareholders. If you use cash to buy back stock, that shrinks the company’s balance sheet but can be very good for investors,” Nygren says. He also looks at management with payment and bonus structures that align their interests with those of shareholders.

Two Winning Stocks

Oakmark has bucked the trend of value investing in recent years, which has suffered as growth stocks outperformed. The Morningstar US Growth Index outperformed the Morningstar US Value Index over five-, 10-, and 15-year trailing periods. But Oakmark has outperformed both other value funds and the S&P 500, which has been anything but value-centric in recent years.

Nygren explains: “We’ve been through a very unusual multi-year period where growth, momentum, and size have dominated, especially the last six months. The mega-cap companies that did well in 2023 continued to do so in the first half of this year … It’s our view that the mega-cap names that make up the top half of the S&P 500 are living in a different world than the rest. You’ve got those companies selling well over market multiples, and there’s another portion with unusually low P/Es and good cash flow yields.”

Corebridge Financial CRBG

Corebridge exemplifies all the traits of the non-mega-cap S&P 500. The company went public in 2022 when insurance giant AIG AIG, deciding to focus more on property and casualty insurance, spun off its life insurance, annuities, and retirement planning business. A majority of the company’s stock is owned by AIG, with private equity firm Blackstone BX holding about another 10%.

Even after returning more than 80% in the past year, Nygren says the stock still has a rock-bottom valuation. “Consensus estimates for earnings in 2026 are $6.50 [in earnings per share], so it’s at about 4 times 2026 earnings, and a book value of $40 per share, so it’s selling at 60% of book value. Life insurers in general trade at pretty low multiples, because so many of them got involved in variable annuities and committed to higher returns to policyholders than they ended up being able to achieve when rates went down. Corebridge has very little of that business.”

Another reason for the low valuation is that the firm is not well-known. “People haven’t heard of it, and when they hear it’s an insurance company, they don’t want to,” says Nygren.

Corebridge has taken advantage of its valuation by aggressively repurchasing shares. Just through the first half of this year, it repurchased $940 million in shares, according to its second-quarter earnings release. That’s about 5% of the firm’s current market cap of $17.3 billion. “People see buybacks this big, they tend to think the company has ruined its balance sheet. But all of these are done using earnings cash, so the balance sheet isn’t impaired,” Nygren says. He jokes that if buybacks continue at this rate, in 5-10 years, Oakmark will be Corebridge’s only shareholder.

Citigroup C

Another financial stock that’s been paying off recently is Citigroup. Oakmark first invested in the bank a decade ago, and it was a dud for much of that period. From August 2014 through August 2023, it was down 1%, compared with the 184% return for the fund’s benchmark index, the S&P 500.

However, Citi has been a much stronger performer recently. The stock has returned more than 55% over the past 12 months, more than the broad market. Nygren believes this turnaround is due to restructuring undertaken by CEO Jane Fraser since she joined the company three years ago. “It takes a while for a CEO to evaluate the talent around them and make the replacements necessary. And we think usually, as you hit two or three years, the CEO is just hitting their stride and investors are giving up on the turnaround.” He identifies the recruitment of outside talent, changes in leadership and their pay incentives, and restructuring the business into five distinct units as positive changes.

“We think its earnings will double over a two-year period—certainly not something you expect for a company selling at a single-digit P/E ratio,” Nygren says.

A Stock That Has Underperformed

Delta Air Lines DAL

One business turnaround that’s yet to pay off is Delta. The airline’s stock is down more than 4% over the past 12 months. Nygren sees some reasons to expect this to change. Currently trading at about $42 a share, that’s about five times 2026 earnings.

“[The airline] industry has historically been somewhat like the auto industry, in that even though it tends to report fairly decent earnings, most of that cash is not accessible to the shareholders because it has to be invested in fleets that are more expensive than the ones already on the balance sheet. Delta has done an excellent job refreshing its fleet. So we think they are entering a period when their capital expenditure needs won’t exceed their depreciation,” he says. He thinks that, combined with Delta’s efforts to repair its balance sheet after it took on debt to get through the covid-19 freeze on air travel, this means the firm will have more of its earnings freed up.

“We expect Delta to make meaningful share repurchases sometime in the next year,” says Nygren.

Two More Picks

General Motors GM

Like with Citi, Oakmark first bought GM about a decade ago. Also like Citi, the stock massively underperformed for most of that period. From August 2014 through August 2023, it rose just 22%. GM couldn’t return much money to shareholders because two main things ate up profits: covering pension costs and reestablishing a financing subsidiary after the firm divested its original one during bankruptcy restructuring.

However, the past year has been good for GM, with the stock returning 49.5%. “Earlier this year, management announced that they’re repurchasing 20% of their stock and will do the same next year if the same opportunity exists,” Nygren explains. “The result is that even though the net income of auto companies isn’t growing much, earnings per share at GM is going to be up something like 20% this year.”

First Citizens Bancshares FCNCA

One more financial name rounds out the list: regional bank First Citizens, which has returned nearly 44% over the past year. It started in Raleigh, North Carolina over a century ago and has been substantially owned and run by the Holding family. “It was a largely family-held business, good old-fashioned conservative banking, not much credit risk,” says Nygren.

One thing that spurred the firm’s growth was its acquisition of CIT Financial, which complemented its business strengths. According to Nygren, Citizens was great at gathering deposits, but its lending business was weaker. CIT was the opposite. “Both companies were then able to earn at a greater spread. Over a couple years, book value and earnings roughly doubled.”

This firm footing has helped First Citizens acquire troubled banks from the Federal Deposit Insurance Corporation. The most prominent recent example is its purchase of Silicon Valley Bank, whose liquidity issues and collapse were a major cause of the regional banking crisis in early 2023. “First Citizens is probably the only bank in the United States that could say they have a core competency of buying failed banks from the FDIC,” Nygren observes. In the press release announcing the acquisition, First Citizens said, “We have partnered with the FDIC to successfully complete more FDIC-assisted transactions since 2009 than any other bank.”

According to Nygren, the FDIC’s strict criteria on who could acquire ailing banks meant First Citizens was one of the few firms in a position to purchase Silicon Valley Bank. The FDIC isn’t just looking to maximize profit, but to ensure that whoever acquires troubled banks can stay stable after doing so.

“This transaction again roughly doubled the company’s book value and earnings, so over a four-year period, you had earnings roughly quadruple,” says Nygren.

Why We Still Like Oakmark Select

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e2a46c58-1092-4fff-8b59-58f347e66304.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NPR5K52H6ZFOBAXCTPCEOIQTM4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-24-2024/t_c34615412a994d3494385dd68d74e4aa_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e2a46c58-1092-4fff-8b59-58f347e66304.jpg)