CITs Dethrone Mutual Funds as the Most Popular Target-Date Vehicle

Top picks for target-date CITs and what the shift means for investors.

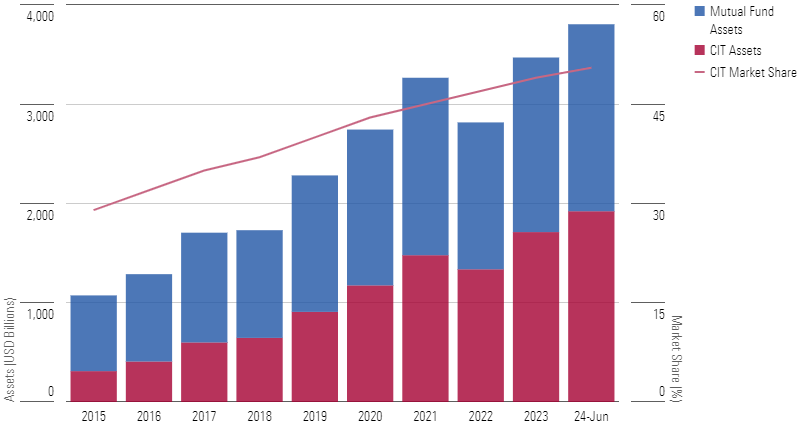

It’s no secret that collective investment trusts have been gaining traction across the target-date landscape. At the end of 2023, they had USD 1.7 trillion, or 49%, of target-date assets. Now, as target-date assets swelled to about USD 3.8 trillion as of June 2024, CITs inched past mutual funds with about USD 1.9 trillion, or 50.5%, of target-date assets. This left mutual funds with 49.5% of the target-date market share, down from 71.0% in 2015.

Morningstar’s annual target-date landscape report took note of target-date CITs’ growth trend, which isn’t slowing. Their market share rise has been steady since 2015, gaining about 2 to 3 percentage points each year. The chart below illustrates their growth since 2015.

Target-Date Assets

Target-date CITs have been capturing most of the target-date net flows since at least 2020. For example, in 2023, they collected 67% of total target-date net inflows. Flows aren’t the only indicator of their success. Based on reported data, more than USD 22.6 billion in target-date mutual funds converted to CITs in 2023. Despite their shrinking market share, target-date mutual funds still hold a large part of the market and likely won’t be obsolete soon.

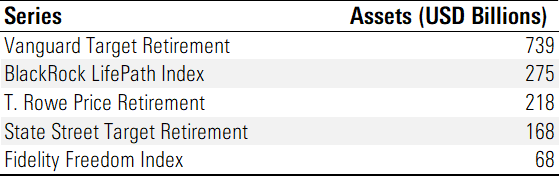

Some firms have been more successful with target-date CITs than target-date mutual funds. Vanguard’s Target Retirement series dominates no matter the vehicle, but other players, such as BlackRock and State Street, have gathered more assets in target-date CITs than they have in their mutual fund counterparts. BlackRock LifePath Index has the second most assets among target-date CITs, and State Street Target Retirement has the fourth most, but neither of the firms’ mutual fund versions of those series breaks the top five in mutual fund target-date assets. T. Rowe Price Retirement also has a larger asset base in its CIT version but breaks the top five for its mutual fund version, too. The table below outlines the five series with the most assets for target-date CIT offerings.

The Top Five Series With the Most Target-Date CIT Assets

Advantages and Disadvantages of CITs

Why the migration? CITs tend to be cheaper because they don’t have to follow the reporting standards of the Investment Company Act of 1940 that governs mutual funds. Plan sponsors and other clients can negotiate CIT fees with the providers, so, particularly for large retirement plans, CIT expenses are often lower than those of mutual funds. They also tend to have lower administrative costs. These lower fees have driven CIT growth, especially since plan sponsors loathe lawsuits accusing them of offering overpriced investment options in their retirement programs. This is a good trend because lower costs mean more money for retirees.

Here’s the shadow side, though. CITs are less transparent. For example, unlike mutual funds they don’t have to disclose their managers, their experience, if they’ve joined or left the strategies recently, or if they invest in the portfolios. It’s impossible to assess a management team without this information.

Within Morningstar’s target-date CIT database, 88 out of 141 strategies—or 62%—do not disclose manager names. Since CITs are exclusively offered in qualified retirement plans like 401(k)s, plan sponsors are likely deciding which target-date strategies are featured in the lineups. Plan sponsors are held to the fiduciary standards under the Employee Retirement Income Security Act of 1974, which requires them to conduct the same level of due diligence on mutual funds and CITs. That doesn’t help investors know and understand what they own, though.

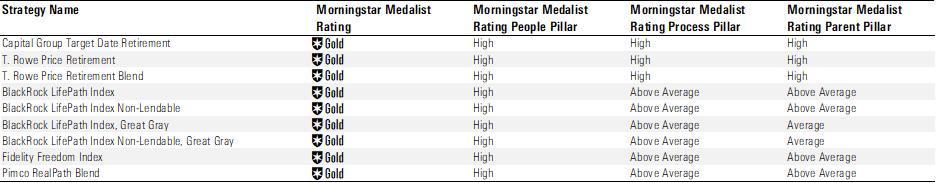

Morningstar’s Top Picks for Target-Date CITs

To help investors better understand their options, Morningstar analysts currently rate 27 target-date CIT series. In most cases, they are clones of their mutual fund counterparts, though there are a few exceptions. Currently, nine series earn Morningstar Medalist Ratings of Gold.

Target-Date CIT Series With a Morningstar Medalist Rating of Gold

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HRIVHHHVD5EKFATQH4SHWN44ZQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)