Fund Fees Are Still Declining—but at a Slower Pace

5 key fee trends from the past year.

Investors are doing well for themselves when it comes to fees.

Over the last 20 years, the average fee paid by fund investors has more than halved—from 0.87% in 2004 to 0.36% in 2023. Because fees compound over time, detracting from returns, this represents a multibillion-dollar savings for fund investors.

While fund investors are generally paying lower fees than before, we saw several new developments emerge in 2023:

- Investors are paying less overall, but the pace of fee declines appears to be slowing.

- There were more fund fee increases than fee decreases in 2023.

- New mutual funds are getting cheaper, and new exchange-traded funds are getting more expensive.

- Vanguard remains the low-cost leader.

- The emergence of spot bitcoin ETFs shows that under the right circumstances, asset managers still fiercely compete to be cheapest.

Here’s a closer look at these takeaways from Morningstar’s latest annual fund fee study.

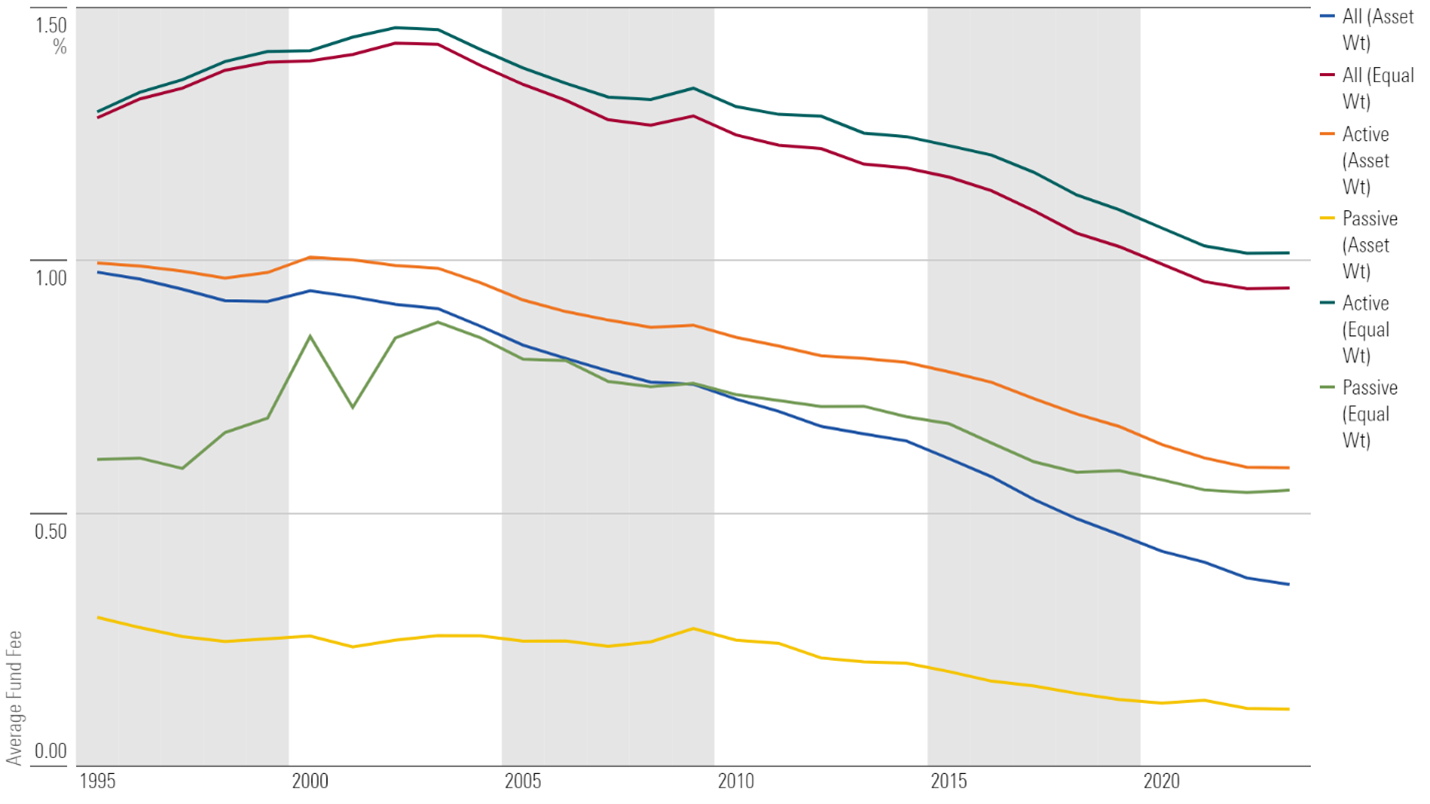

Fund Fees Decline, but More Slowly

Investors paid lower fund expenses in 2023 than ever before.

Our study of US open-end mutual funds and ETFs found the asset-weighted average expense ratio across funds was 0.36% in 2023, a 3.4% decline from 2022—a solid fall but less pronounced than the 7.8% decline a year earlier. Still, we estimate that investors saved nearly $3.4 billion in fund expenses last year.

Fund Fees Edge Lower

Source: Morningstar. Data as of Dec. 31, 2023.

The mass migration to lower-cost funds and share classes has been a key driver of falling costs, but asset managers are growing reluctant to compete fiercely on price. In 2023, there were more fee increases than decreases by both active and passive funds, contributing to an increase in each’s equal-weighted average expense ratio.

Fund Fee Increases Accelerate

It’s only natural that fees have been reduced to next to nothing among broad market index funds. These funds are commodity-like in nature, which explains why their prices would be pushed down to the marginal cost of managing them and why assets would consolidate in the hands of a few large-scale manufacturers.

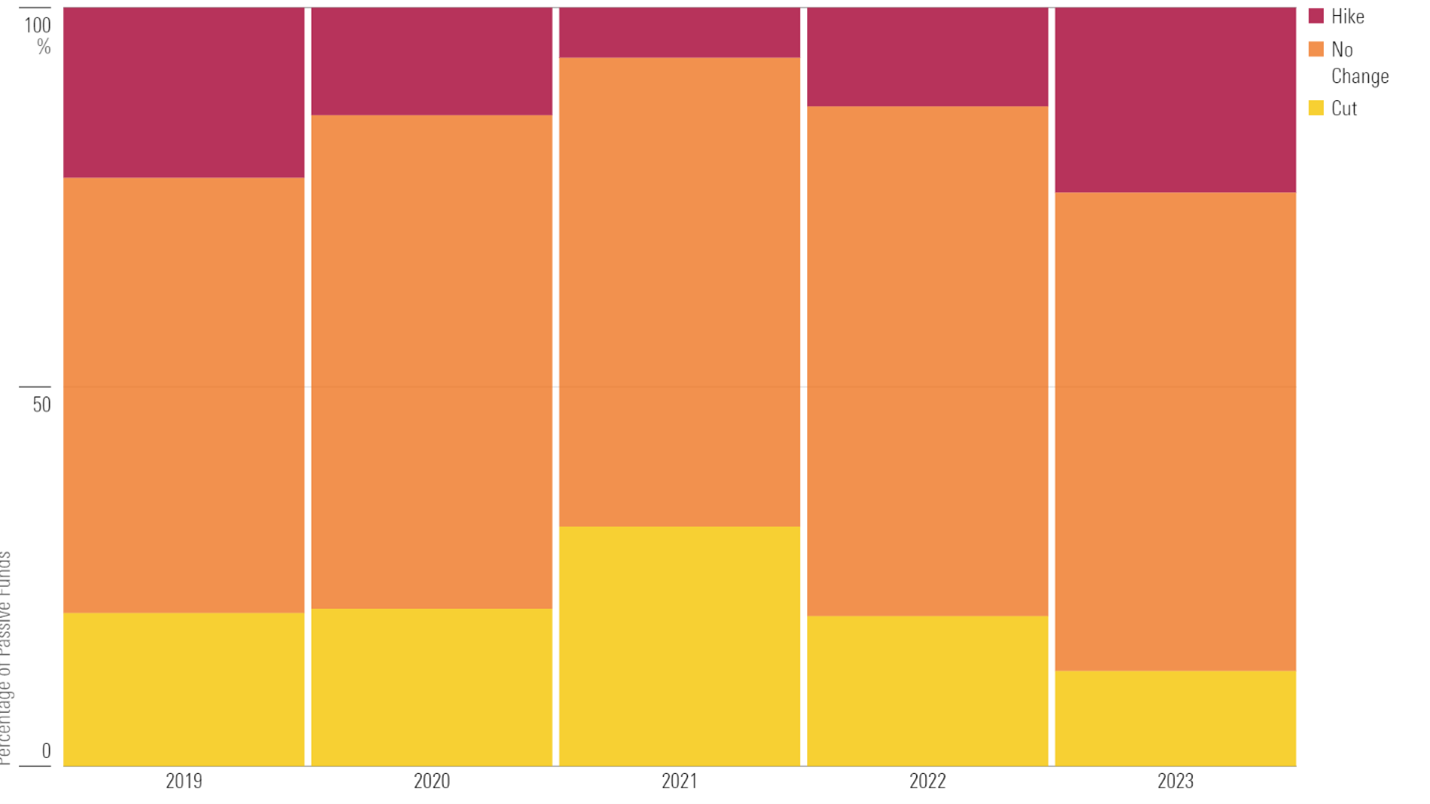

Passive Funds Have Been Less Likely to Cut Fees in Recent Years

Source: Morningstar. Data as of Dec. 31, 2023.

More recently, this same degree of fee pressure has spread into other corners of the market, most notably within the realm of strategic-beta ETFs. Although the marginal cost of managing strategic-beta funds is only incrementally greater than it is for their more-vanilla counterparts, this space has seen mounting fee pressure and will continue to see this in coming years.

That said, there are countervailing forces to consider. The proliferation of new, higher-priced index ETFs helped nudge passive funds’ equal-weighted average fee almost a basis point higher in 2023.

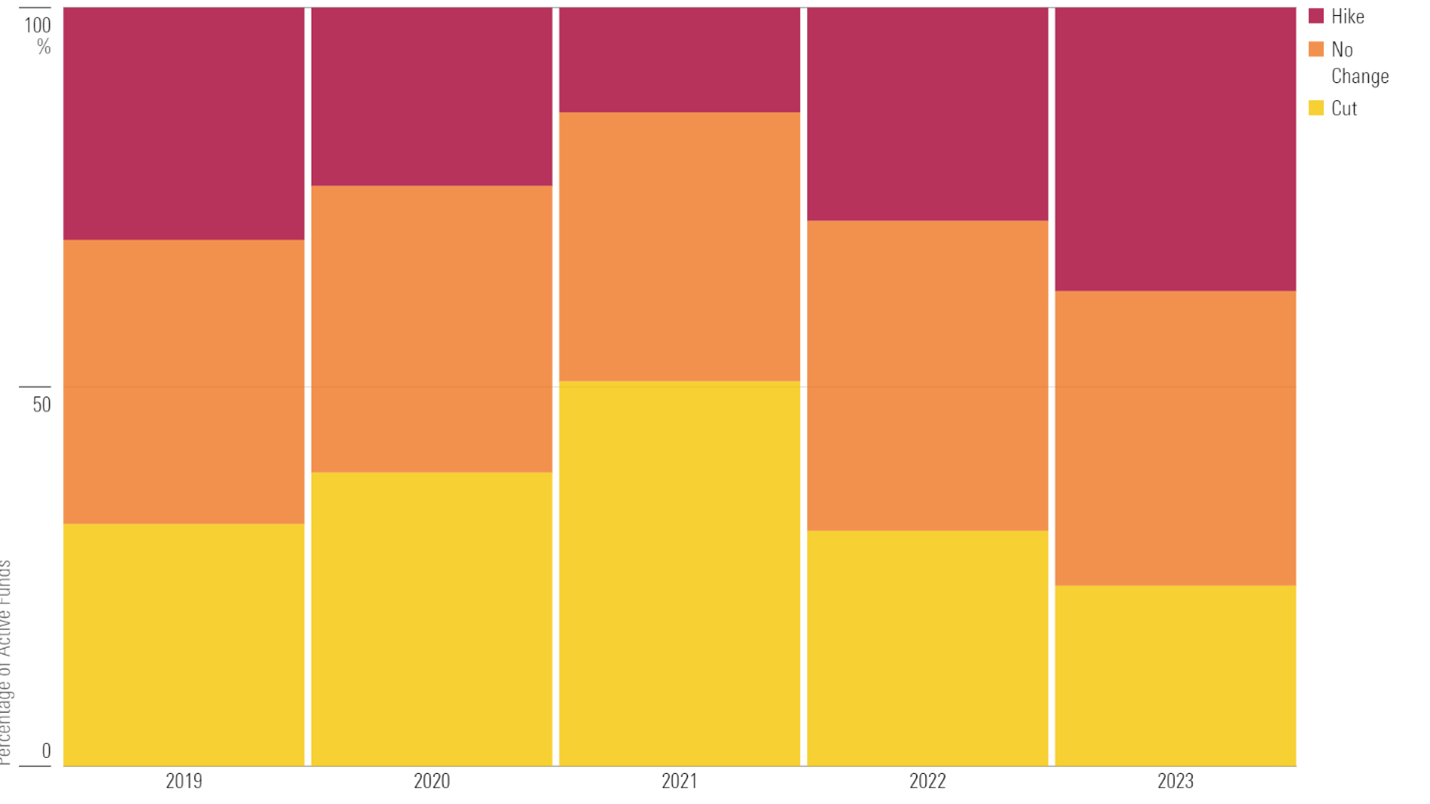

Active Funds Have Been More Likely to Cut Fees in Recent Years

Source: Morningstar. Data as of Dec. 31, 2023.

The percentage of active funds that reported lower annual expenses decreased to 24% in 2023 from 31% in 2022. Only 13% of passive funds reported a lower fee in 2023, down from 20% in 2022.

Meanwhile, 37% of active funds and 24% of passive funds reported a fee increase, the first time increases outpaced decreases since 2019. Fees were higher for several possible reasons, such as fee hikes, expired waivers, outflows below fee breakpoints, and fund accounting anomalies.

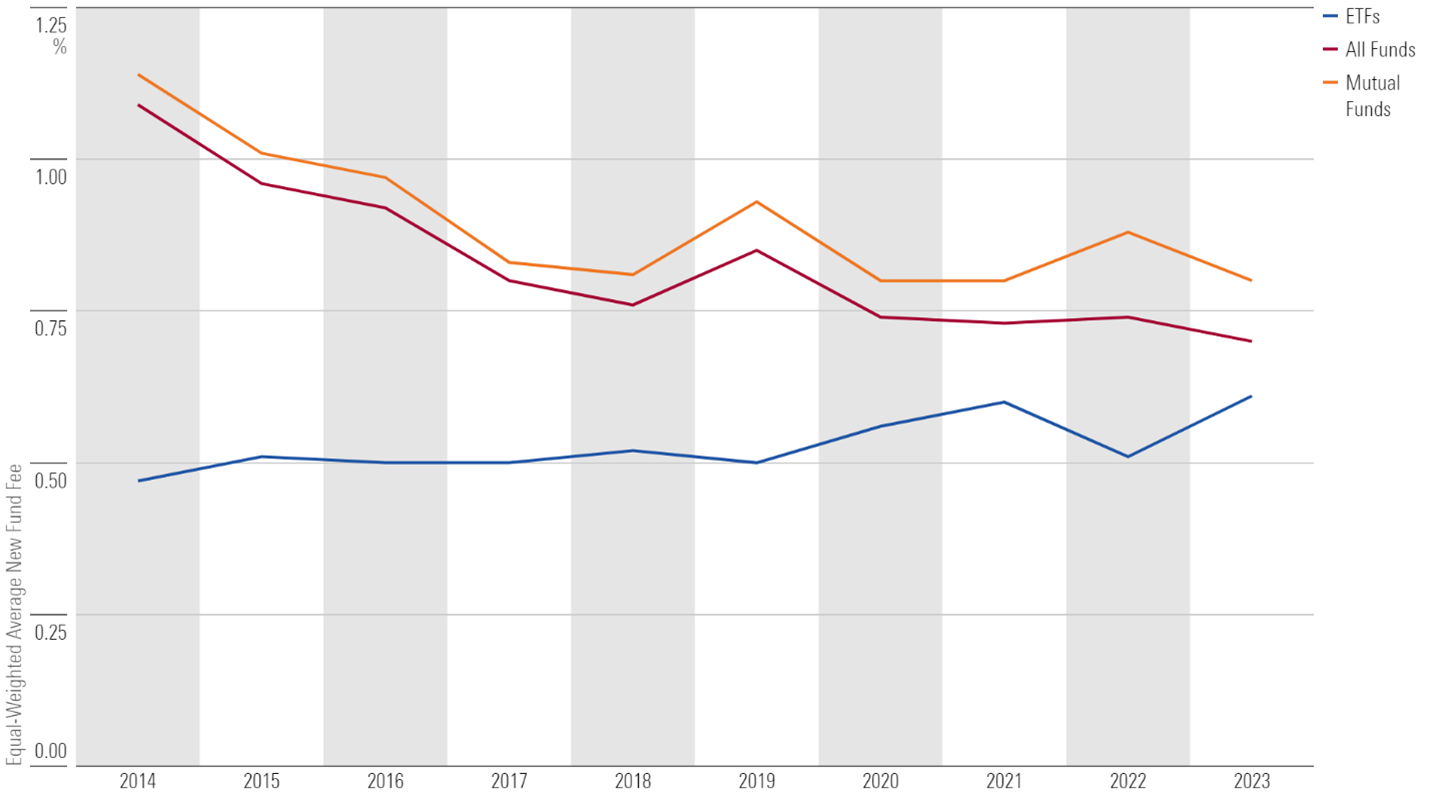

Fees for New Mutual Funds Decrease; Fees for New ETFs Increase

Each year, the number of new mutual fund share classes launched has been decreasing, but so have their average fees.

In 2023, the average fee of newly launched mutual funds and ETFs was 0.70%, a 36% decrease from 10 years prior, when it measured 1.09%, and an even steeper discount to last year’s equal-weighted average fund fee of 0.95%, down from 1.18% in 2014. Fees are not shrinking everywhere, though.

Equal-Weighted Average Fee of New Funds

Source: Morningstar. Data as of Dec. 31, 2023.

The fee gap between newly launched mutual funds and ETFs shrank by 71% in the last 10 years: from 0.67% to 0.19%.

In 2014, new ETFs charged just 0.47% on average, while new mutual funds charged 1.14%. Fast-forward 10 years, and new ETF fees rose by 28% and new mutual fund fees fell by 30%. The emergence of active and alternative ETF strategies, which tend to be pricier than broad index strategies, contributed to higher new ETF fees.

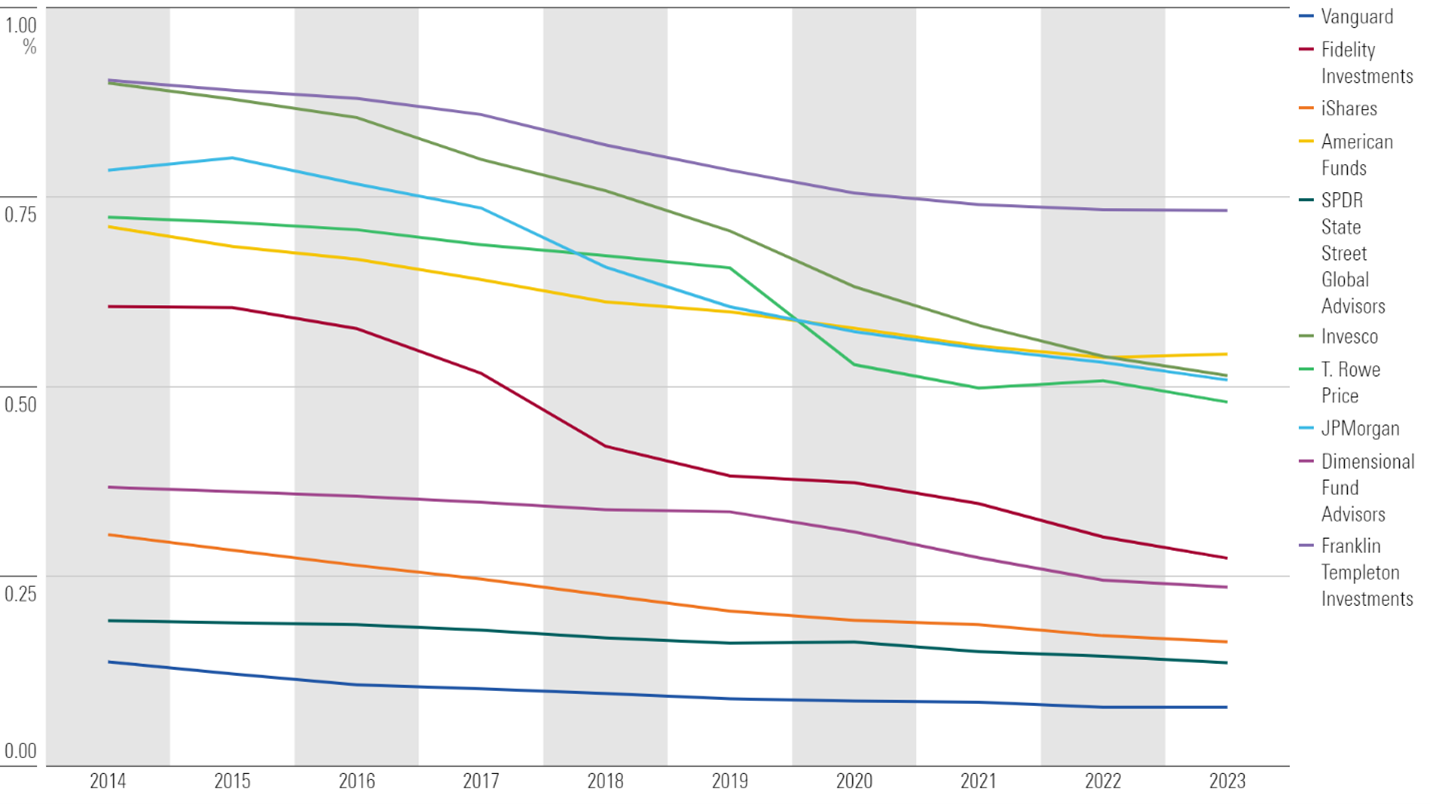

Vanguard Remains the Low-Cost Leader

Among the ranks of the largest asset managers, Vanguard continues to wear the low-cost crown. In 2023, the firm’s asset-weighted expense ratio was 0.08%, down from 0.09% in 2018.

In addition to Vanguard, other low-cost providers include:

- SPDR State Street Global Advisors (0.14%)

- iShares (0.16%)

- Dimensional Fund Advisors (0.24%)

Vanguard’s competition continued to gain ground in 2023. As these firms jockeyed for position, investors have come out in front, benefiting from an ever-wider menu of cheap options offering wide market exposure.

Asset-Weighted Average Fee by Asset Manager

Source: Morningstar. Data as of Dec. 31, 2023.

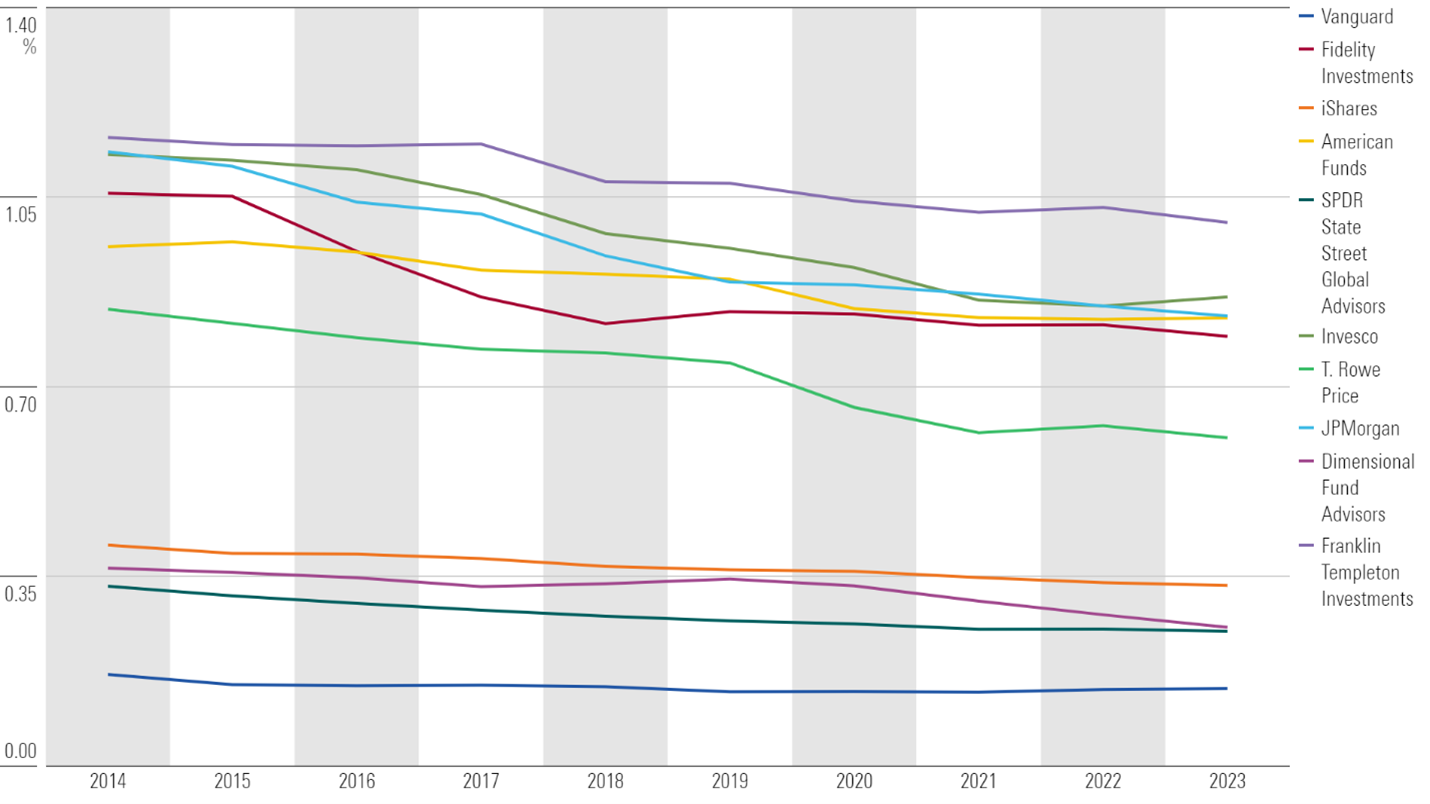

Equal-weighted average fees show the general price level of the funds on offer from each firm. We find:

- Index fund champions Vanguard, State Street, and iShares rank among the cheapest firms.

- Predominantly active mutual fund shops, like Franklin Templeton, charge the most for their funds, on average.

- Dimensional is an anomaly. It offers active funds, but their systematic offerings rank comfortably among the cheapest passive providers.

Equal-Weighted Average Fee by Asset Manager

Source: Morningstar. Data as of Dec. 31, 2023.

The 10 largest asset managers decreased their average fund’s fee substantially in the last 20 years. However, that rate of decline has begun to slow.

With many core strategies already commoditized, passive shops have barely decreased fees recently, if it all. For example, Vanguard’s equal-weighted average fee even ticked up in 2022 and 2023. Still, asset managers with a more expensive menu are launching relatively lower-cost funds or cutting fees on existing ones.

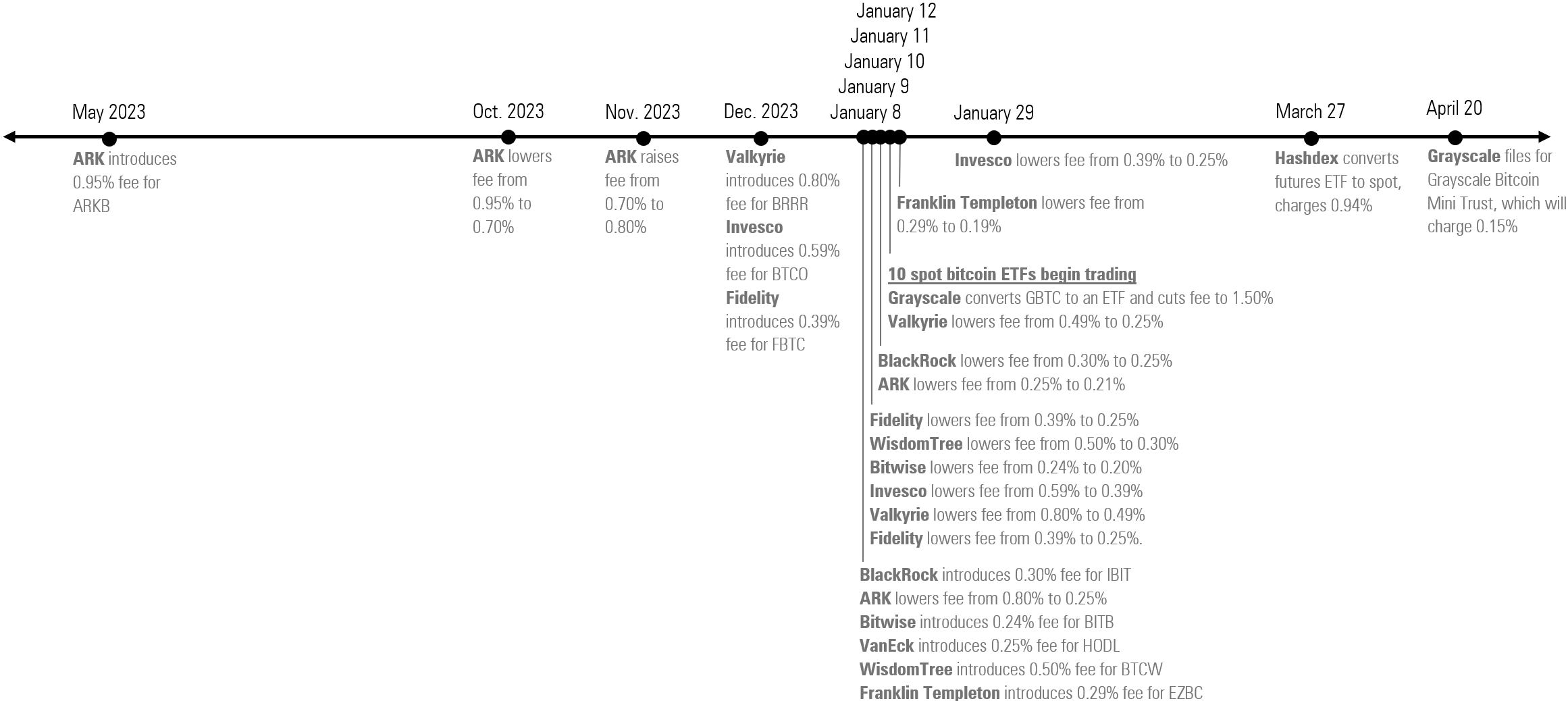

Fee Wars Alive and Well for Bitcoin ETFs

Spot bitcoin ETFs began trading on Jan. 11, 2024, to much fanfare. Prior to launch, each of the 10 providers jockeyed to be the lowest-cost offering.

For a product that’s essentially a commodity, fees matter, with the cheapest product likely to earn the bulk of investor dollars. To not tip off competitors on where each might land, many providers opted to unveil their ETF fee only days ahead of its scheduled debut. Even still, each lowered its fee at least once prior to launch. ARK adjusted its fee four times since ARK 21Shares Bitcoin ETF’s ARKB May 2023 filing.

Timeline of Bitcoin ETF Fee Adjustments

Source: Issuer Form S-1s. Securities and Exchange Commission EDGAR Online. Data as of June 13, 2024.

While less frequent lately, fee wars still happen. Bitcoin ETFs proved the perfect storm: Investor interest, commercial opportunity, and blanket SEC approval pitted nine asset managers against one another to earn investor dollars.

When the conditions are right, asset managers will still compete fiercely to be the cheapest.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5db00d6b-9c2f-4da7-8f94-da4290cf3b4a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5db00d6b-9c2f-4da7-8f94-da4290cf3b4a.jpg)