Making the most of your subscription

Maximize your Investor experience with our top tips.

Your Morningstar Investor subscription includes independent research, analysis, and tools that can help you activate your strategy and make informed decisions. Here are some tips for getting the most out of your subscription.

Don't have a subscription to Morningstar Investor yet? Start your free trial today.

1. Stay current on investing knowledge and market conditions.

- Sign up for a free email newsletter to receive the best of Morningstar directly in your inbox.

- Learn about Morningstar’s approach to investing.

- Dive into our Investing Classroom to learn how to manage your portfolio in a way that best suits your life stage and risk tolerance.

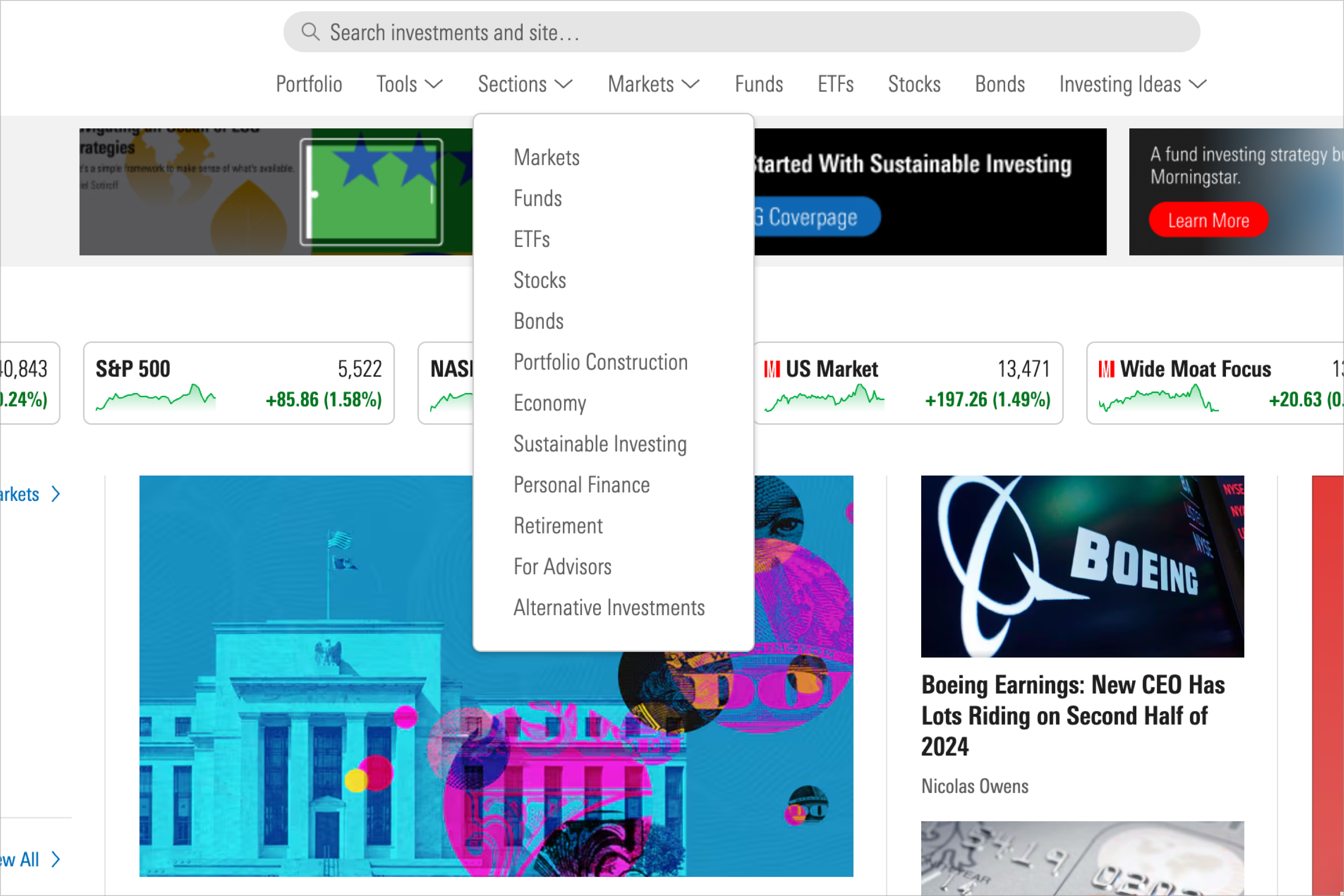

- Explore Morningstar.com's Sections tab for insights that span the financial spectrum. Topics include portfolio construction, retirement, and personal finance.

2. Monitor your holdings.

Once you've created a portfolio, use the following tabs to analyze your investments:

- Holdings: Add data points to determine important details about each of your holdings, such as how they stack up to their peers or if we expect them to outperform over a full market cycle.

- X-Ray: Get a deep dive into your portfolio’s asset allocation, sector weightings, and style, so you can pinpoint areas of risk.

- Stock Intersection: Instantly identify when your assets overlap, including how much any given security affects the overall position of your portfolio.

- Performance charting: Track return, both total and personal, with the ability to add select indexes for benchmarking.

For Morningstar’s guidance on managing your investment portfolio, check out our Portfolio Construction hub. You’ll learn how to find the right portfolio asset allocation for your goals, understand how market conditions can affect your portfolio positioning, and make sound decisions as market conditions change.

3. Find and evaluate new investment opportunities.

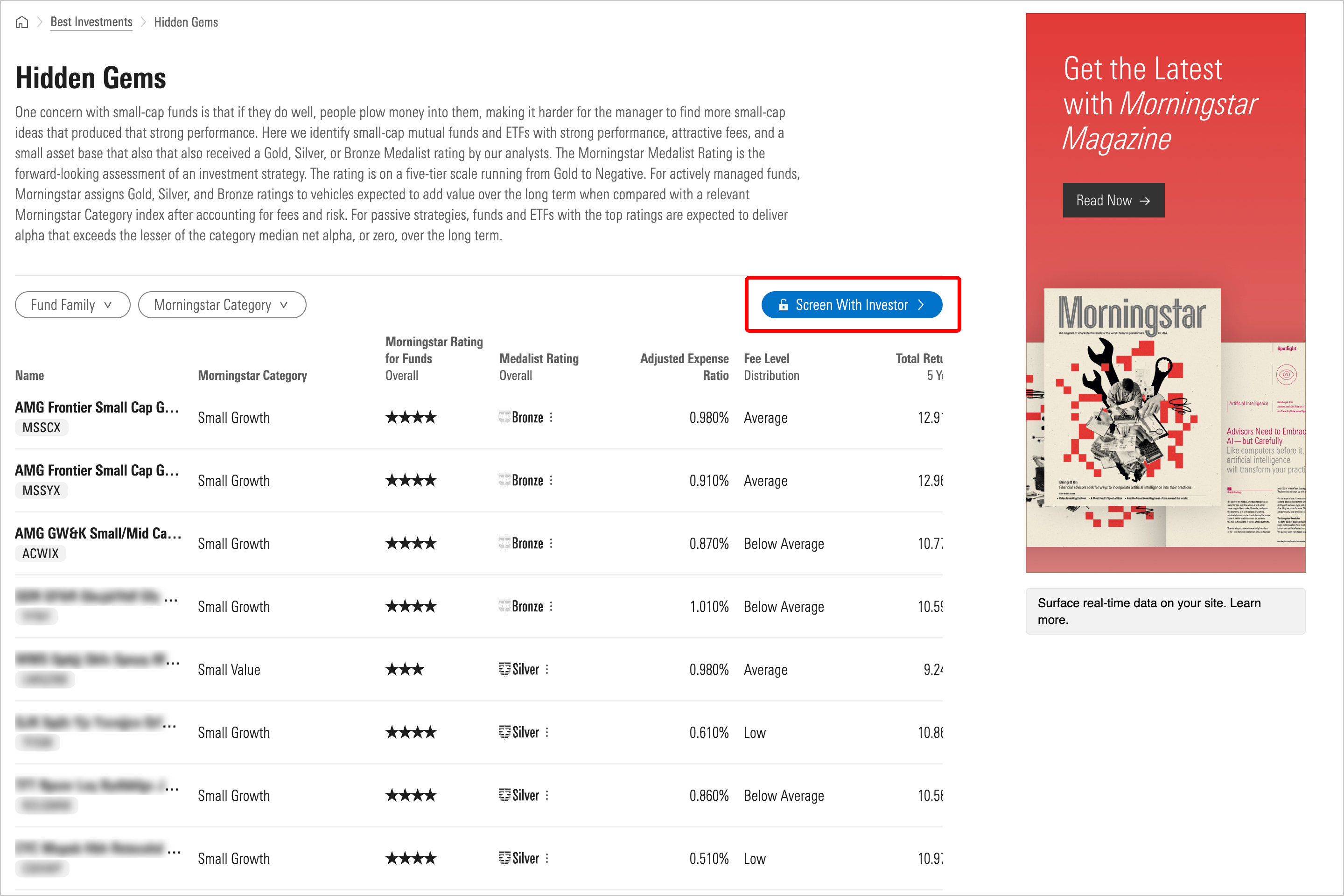

- Explore our Best Investments lists: To find your next best investment, peruse our expansive lists of investment ideas that span sectors, ratings, security types, and more. You can also open our lists in Screener to add your own criteria.

- Keep tending to your watchlists: Make sure your watchlists reflect your goals and interests. Add or remove investments while using Screener or reviewing individual security quote pages.

- Compare securities: There are four main ways to evaluate your next best investment: screening for securities, exploring the Comparables section of a security report, comparing options within fund families, and reviewing fund analyst reports.