5 Top-Performing TIPS Funds

Short-duration TIPS funds from Vanguard and iShares delivered for investors through a difficult market.

While investors turn to funds focused on Treasury inflation-protected securities, or TIPS, as a cushion against inflation, lately the biggest factor for performance has been a fund’s sensitivity to changes in interest rates.

In recent years, this has meant the top ranks among TIPS funds have been dominated by short-term funds. They are the least sensitive to interest rates, with their performance more closely tied to changes in inflation. This has offered investors the opportunity to earn positive returns at a time when most traditional bond funds have suffered losses.

What Are TIPS Bonds?

TIPS offer a direct hedge against inflation because their principal is linked to the Consumer Price Index, a widely watched inflation gauge. The value of a TIPS principal is adjusted higher when the CPI rises, resulting in increased coupon payments. TIPS bonds will likely outperform Treasury bonds with similar maturities when inflation exceeds expectations. However, Treasury bonds will likely outperform when inflation is lower than anticipated because the market’s expectation for inflation was already baked into its price.

TIPS Funds Performance

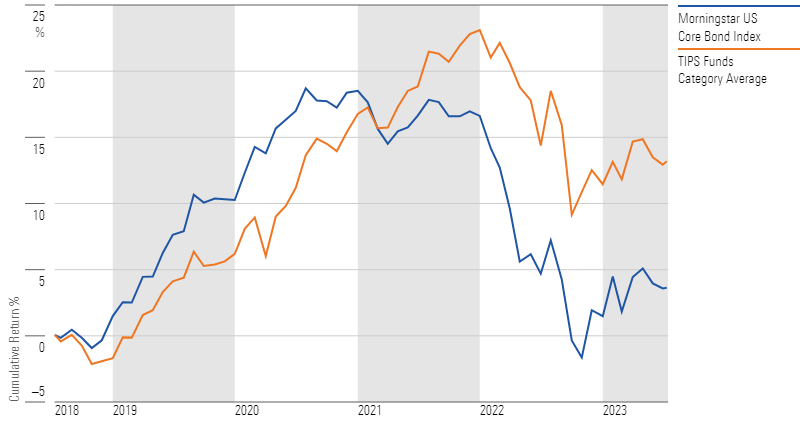

As the name suggests, the goal of a TIPS fund is to protect investor returns from rising inflation. During a period of high inflation—such as 2022, when it hit a four-decade high—investors expect these funds to have solid returns. However, that was not the case in 2022, as the average TIPS funds lost 9.5%. That was better than the 13% loss on the Morningstar Core Bond Index, but a far cry from positive returns.

The issue for TIPS funds is that while these bonds expect inflation, interest rate changes also have a significant influence on their performance, and those changes can potentially overwhelm the benefits of an inflation adjustment. That was the case in 2022, when the Federal Reserve raised interest rates at its fastest pace in history, leading to big losses among longer-term bonds, which are more sensitive to changes in rates. The fall in longer-term TIPS bond prices was greater than the adjustments made to the principal amount.

The result was that within TIPS funds, short-duration funds have outperformed long-duration ones. Short-duration TIPS funds tend to be less sensitive to interest rate risks and more correlated with inflation.

So far this year, the average TIPS fund has gained 1.6% while the overall bond market has gained 12.1%, leaving TIPS funds 1.3% down for the last 12 months while the bond market lost 1.2%.

TIPS Funds vs. the U.S. Core Bond Index

5 Top-Performing TIPS Funds

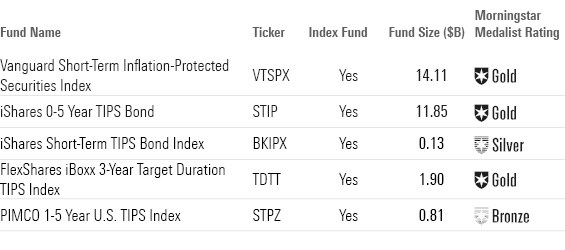

To screen for the best-performing funds in this Morningstar Category, we looked for the ones that have posted the best returns across multiple time periods.

We first screened for funds that ranked in the top 33% of the category using their lowest-cost share classes over the past one-, three-, and five-year time frames. In addition, we screened for funds with Morningstar Medalist Ratings of Gold, Silver, or Bronze for those classes. We also excluded funds with less than $100 million in assets.

From this group, we’ve highlighted the five funds with the best year-to-date performance. The selection only consists of passive funds. TIPS are a narrow sector of the bond market; fee plays a key differentiating role. The lower expense ratio of index TIPS funds makes them more attractive to investors.

Because the screen was created with the lowest-cost share class for each fund, some may be listed with share classes not accessible to individual investors outside of retirement plans. The individual investor versions of those funds may carry higher fees, which reduces returns to shareholders. A table with the funds’ returns can be found at the bottom of this article.

Top-Performing TIPS Funds

Vanguard Short-Term Inflation-Protected Securities Index

- Ticker: VTSPX

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Gold

“This fund’s low-risk strategy resulted in less volatility, meaning it outperformed its average peer by even more on a risk-adjusted basis. TIPS have virtually no credit risk since they are backed by the U.S. government. As a result, interest rate risk is the primary driver of category-relative returns. During times of increased interest rate volatility, the fund’s exposure to the shorter end of the curve has aided its performance.

“In 2022 through September, the fund held up better than its category peers by 7.33 percentage points. Its shorter-duration portfolio shielded the fund from rising interest rates.

“But the fund’s defensive stance isn’t always rewarded. In 2020, it trailed its average category peer by 4.94 percentage points as interest rate risk paid off. Still, the fund’s short-term focus provides purer inflation protection than TIPS funds with higher interest-rate risk.”

—Mo’ath Almahasneh, associate analyst

iShares 0-5 Year TIPS Bond

- Ticker: STIP

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Gold

“The portfolio maintains a cost advantage over competitors, priced within the least-expensive fee quintile among peers. The fund seeks to track the investment results of the ICE U.S. Treasury 0-5 Year Inflation Linked Bond Index.

“Over the past five years, the fund beat the category index, the Bloomberg Barclays U.S. Treasury Inflation-Protected Securities Index, by 20 basis points, and exceeded the category’s average return by 17 basis points. More importantly, on a 10-year basis, this share class mirrored the index. One-year performance does not largely affect the rating of this share class. However, its impressive 1.2% loss is worth mentioning—a 2.5-percentage-point lead over its average peer, placing it within the top 10% of its category.”

—Morningstar Manager Research

iShares Short-Term TIPS Bond Index

- Ticker: BKIPX

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Silver

“This strategy offers exposure to the short end of the curve, which more closely correlates with inflation than portfolios that include longer-term TIPS.

“This share class mirrored the category average’s 2.7% return over the five-year period and its 2.3% return over a seven-year period. This share class mirrored the Bloomberg Barclays U.S. Treasury Inflation-Protected Securities Index, which returned 2.6% over the five-year period, as well as its 2.3% gain over a seven-year period.”

—Morningstar Manager Research

FlexShares iBoxx 3-Year Target Duration TIPS Index

- Ticker: TDTT

- Morningstar Rating: 4 stars

- Morningstar Medalist Rating: Gold

“This strategy has a 5.7% 12-month yield, higher than its average peer’s 5.5%. Higher yields typically come at the cost of higher credit risk, but that isn’t always the case. Over the past 12 months, the average yield of the fund has been higher than the average yield of its peers. The portfolio has a higher average surveyed credit quality of AAA, compared with the category average of A, and it holds no non-investment-grade assets despite the average peer’s 1%. Lower-credit-risk strategies are often able to navigate bear markets more effectively.

“Over the past five years, the fund led the Bloomberg Barclays U.S. Treasury Inflation-Protected Securities Index by 30 basis points and outperformed the category average by 27 basis points.”

—Morningstar Manager Research

PIMCO 1-5 Year US TIPS Index

- Ticker: STPZ

- Morningstar Rating: 4

- Morningstar Medalist Rating: Bronze

“This fund tracks the ICE BofA 1-5 Year U.S. Inflation-Linked Treasury Index, which includes TIPS that have between one and five years until maturity. The fund weights qualifying bonds by their market value, which promotes lower turnover and mitigates transaction costs. This is a sound approach because the TIPS market is liquid and does a good job of pricing these bonds.

“Targeting short-term TIPS strengthens the fund’s sensitivity to inflation because short-term interest rates are more correlated with inflation than long-term rates. This provides investors with better protection and lowers the fund’s volatility. In addition, the fund’s low 0.20% expense ratio is 38 basis points cheaper than the category average fee, giving the fund a lower hurdle to keep pace with peers.”

—Mo’ath Almahasneh

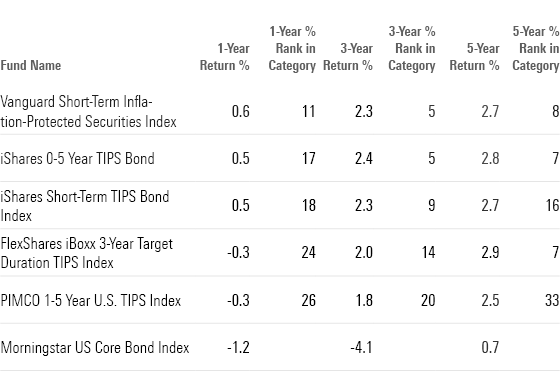

Long-Term Returns of Top-Performing TIPS Funds

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KVRQ726W7RFHLPM2IY7EGD7SQU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UUSODIGU4REULCOR35PTDS7HW4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)