What’s the Difference Between the CPI and PCE Indexes?

Inflation is top of mind for investors, but there’s more than one way to measure consumer prices.

When most investors think about inflation, they think about the Consumer Price Index. But for the Federal Reserve’s decisions on interest rates, another government report looms larger: the Personal Consumption Expenditures Price Index. When Fed officials talk about their 2% target for inflation, it’s the PCE inflation index they are referring to, not the CPI.

What complicates matters is that the PCE and CPI can paint different pictures of inflation pressures, especially in the short term. Case in point are the trends that kicked off 2024. Early this year, the CPI showed progress on inflation stalling, while the PCE offered a more optimistic picture. The two indexes are moving in the same direction again, but the CPI continues to paint a picture of more stubborn inflation compared with the PCE.

What Is the PCE Index?

The CPI generally makes front-page news. Compiled by the Department of Labor, it’s the most mainstream measure of consumer price changes. Annual CPI inflation clocked in at 2.9% in July and 2.6% in August.

Meanwhile, the PCE Index is part of the monthly Personal Income and Outlays report from the Bureau of Economic Analysis, which is usually put out about two weeks after the CPI report. In July, the PCE measured inflation at 2.5% on an annual basis, higher than the Fed’s 2.0% target but below the CPI reading. Economists are expecting PCE inflation to come in at 2.7% in August.

What’s responsible for the difference? Here’s what investors need to know.

PCE vs. CPI Inflation

CPI vs. PCE

The building blocks of the PCE and CPI inflation calculations are largely the same. Each index attempts to quantify changes in consumer prices by tracking changes in the prices of a specific basket of goods and services each month. When the prices in that overall basket rise more quickly over a certain period, so does the inflation rate.

“Over long periods, [the CPI and PCE] tend to naturally track each other because they’re using much of the same source data, but sometimes there can be big divergences,” says Preston Caldwell, chief US economist at Morningstar. Differences in the formulas, components, and weights of each index mean they can paint slightly different pictures of price pressures in the economy.

CPI inflation generally runs about 0.4 percentage points higher than PCE inflation. However, at its peak in the summer of 2022, CPI inflation was almost 2 full percentage points higher than PCE inflation (9.0% vs. 7.1%). The “wedge” between the two indexes narrowed in the second half of 2023 as inflation fell dramatically, then widened again to an average of 0.7 percentage points in December, January, and February. As inflationary pressured eased this summer, the gap narrowed once again.

Shelter Price Weights Cause PCE and CPI to Diverge

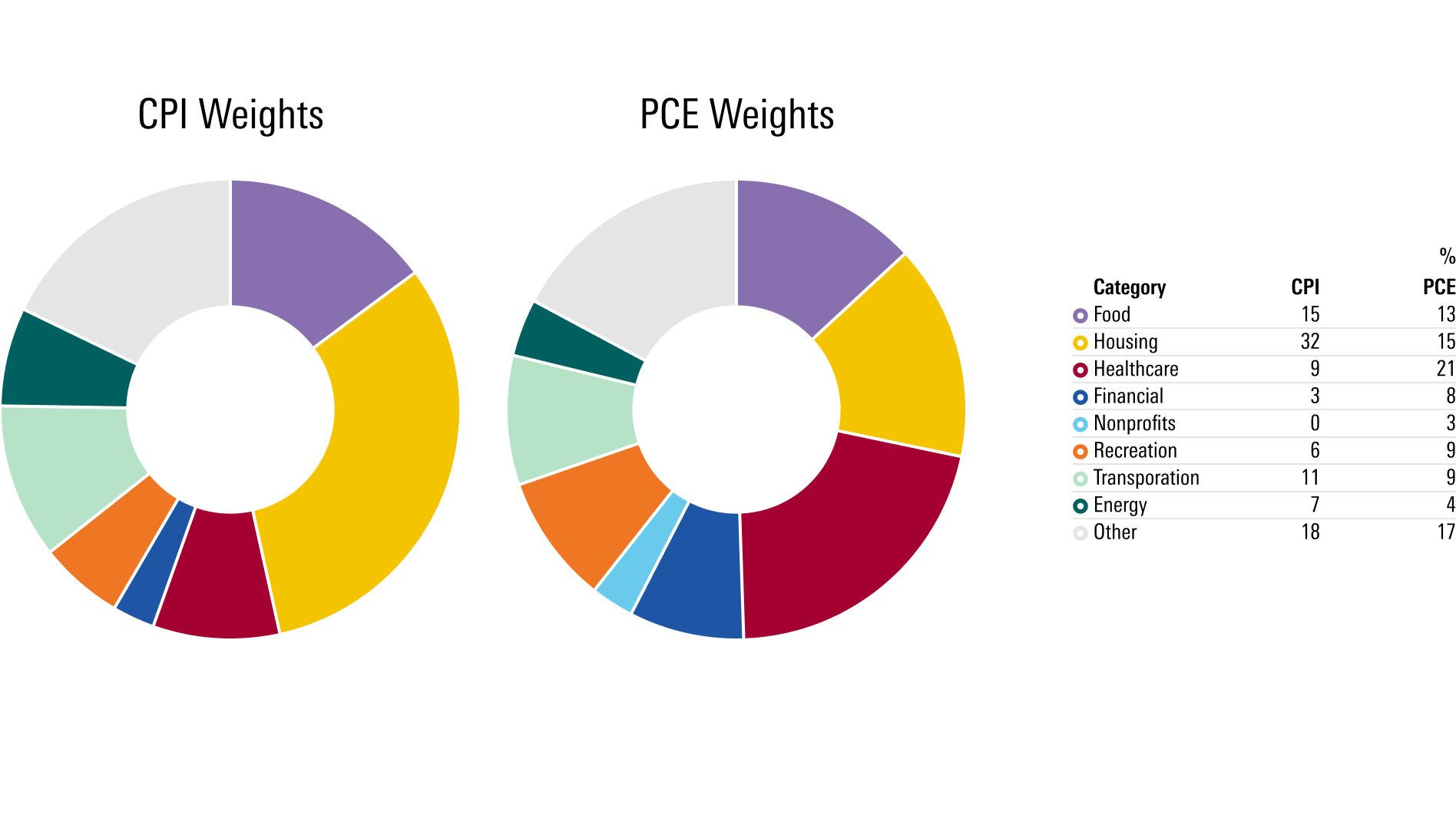

Differences between how components are weighted in the two indexes are often responsible for the differences between CPI and PCE inflation readings. That’s especially been the case in recent months. The most pertinent example is shelter prices, weighted roughly double in the CPI Index compared with the PCE Index.

“Housing is the biggest [factor] driving the divergence right now,” Caldwell says. He estimated that in February, 90 points of the 100-basis-point difference between the annual PCE and CPI readings was attributable to the higher weight housing has in the CPI. On the other hand, healthcare spending is weighted much more heavily in PCE data.

Inflation Index Weights

Other Factors Driving Differences in CPI and PCE

Analysts point to other elements responsible for the differences in the two indexes.

The indexes are calculated using different mathematical processes. For example, the PCE formula adjusts its weights monthly, while the CPI does so yearly. When grocery shoppers switch to chicken after beef becomes more expensive, that change shows up in the PCE Index first.

There are also differences in the scope of each index. The PCE report includes purchases made by urban and rural consumers, while the CPI report only tracks spending in urban areas. The CPI includes only out-of-pocket spending made directly by consumers, while the PCE accounts for expenditures made on consumers’ behalf. As a result, health insurance expenses made on behalf of employees by their employers or by Medicare and Medicaid are included in the PCE basket but not the CPI. PCE data also includes spending by nonprofit organizations on households’ behalf.

Other factors include the differences in seasonal adjustment methodologies and the price data used to calculate spending in similar categories. The insurance price calculations in the CPI index tend to produce more volatile price swings than the PCE index, as one example. “Health insurance was a big negative driver of the CPI last year, and now it’s been a substantial positive driver this year,” Caldwell says. “It swings around a lot more than the PCE.”

Factors Accounting for the Difference Between PCE and CPI Inflation

Why Does the Fed Prefer the PCE Over the CPI?

The Fed has used PCE inflation as its main measure of price pressures in the US economy since 2000. Former St. Louis Fed President James Bullard has named several reasons for this.

First, PCE data is more comprehensive than CPI data. It includes a broader subset of goods and services prices, as well as spending from both rural and urban consumers.

Second, the weights in the PCE are updated more frequently and can better account for consumer substitution. “The PCE can quickly reflect the impact of new technology or an abrupt change in consumer spending patterns,” Bullard wrote in 2022, citing how consumption shifted rapidly from services to goods at the onset of the covid-19 pandemic.

Lastly, the government can retroactively revise PCE data to account for new data or measurement techniques. CPI data is generally only revised to account for seasonal factors.

Should Investors Focus on CPI or PCE?

Investors have plenty of options for tracking inflation. CPI inflation tends to make headlines because it is released ahead of PCE inflation data and contains much of the same source material. “When you get the CPI release, most of the news about the PCE Index is already out,” Caldwell notes. As a result, unexpectedly good or bad CPI data can strongly impact financial markets.

But Caldwell adds that the PCE data is a more comprehensive picture of price pressures because of its larger scope and more thorough methodology. “Most price analysts generally favor the flexible substitution characteristic of the PCE formula,” White House economists wrote last fall. On the other hand, “the scope and weighting factors in the CPI tend to hew more closely to consumers’ actual out-of-pocket spending,” they said.

It’s clear that however you slice the data, both indexes have their merits. After three hotter-than-expected CPI reports to start the year, investors will closely watch PCE data in the coming months.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/84279ea2-135c-48d0-ab06-b618fe25a084.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UUSODIGU4REULCOR35PTDS7HW4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HBAEAVIJHFEBTPMEK2UMVQ3NFQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/84279ea2-135c-48d0-ab06-b618fe25a084.jpg)