9 Top-Performing Small-Value Stock Funds

Funds from Invesco, DFA, and Pimco are among those with the best returns.

After holding up relatively well during the bear market, small-value stock funds have lagged the broader market’s big tech-driven rally. But some funds have been able to outpace the market over the last few years. Among the ranks of the top performers are Invesco, Hotchkis & Wiley, Dimensional Fund Advisers, and Pimco.

Some of these have seen a recent boost thanks to heavier weightings in the basic materials and industrial sectors. That’s taken some skill, as basic materials stocks are more exposed to volatile commodities prices.

Small-Value Stock Fund Performance

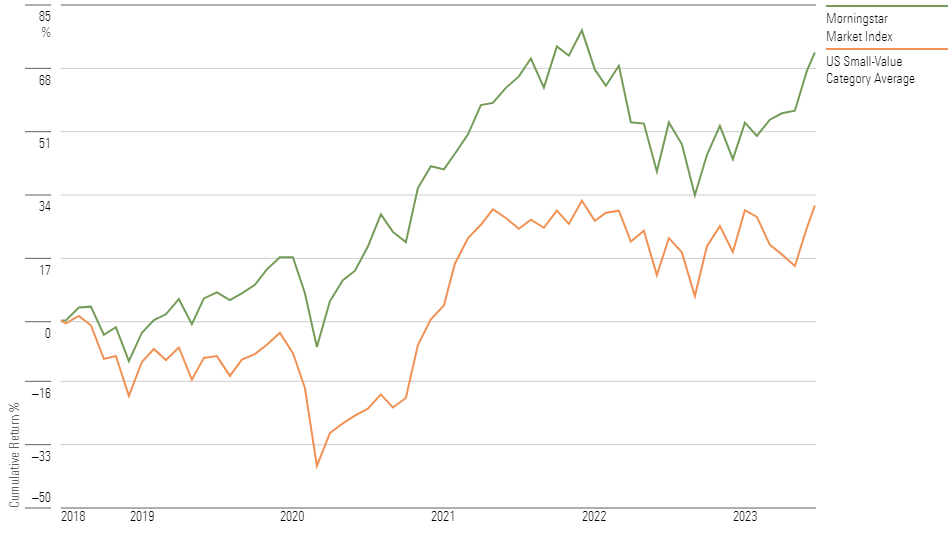

Until mid-March, investors in small-value stock funds had been having a great 2023, with the category putting up returns ahead of the US Morningstar Market Index. However, as big-company growth stocks have powered ahead, small-value funds have been left in the dust.

So far this year the average small-value fund has gained only 9.8%, compared with the 19.7% gain of the market index. This is a turnaround from 2022, during which small-value funds lost only 10.4% while the overall stock market lost 19.4%. The gains of 2023 have evened out these performances over the 12-month trailing period ending July 18. During this period, the average small-value fund returned 15.3% while the overall stock market gained 20.9%.

What Are Small-Value Funds?

Small-cap stocks are those in the bottom 10% of the capitalization of the U.S. equity market. These portfolios invest in small U.S. companies with valuations and growth rates below their peers. Value is defined based on low valuations (low price ratios and high dividend yields) and slow growth (low growth rates for earnings, sales, book value, and cash flow).

Small-Value Funds vs. the U.S. Stock Market

9 Top-Performing Small-Value Funds

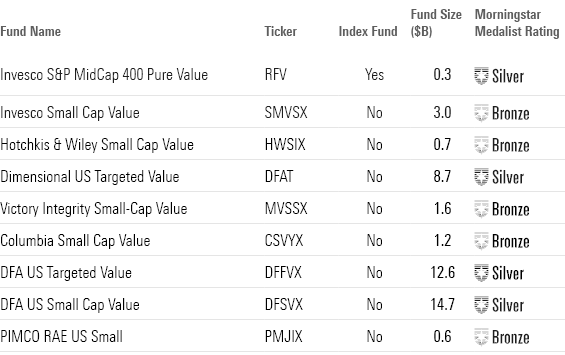

To screen for the best-performing funds in this category, we looked for those that have posted top returns across multiple time periods.

We first screened for funds that ranked in the top 33% of the category using their lowest-cost share classes over the past one-, three-, and five-year time frames. In addition, we screened for funds with Morningstar Medalist Ratings of Gold, Silver, or Bronze for those classes. We excluded funds with less than $100 million in assets and those whose ratings had no input from Morningstar analysts.

From this group, we’ve highlighted the nine funds with the best year-to-date performance. There are eight active funds and one index fund.

Because the screen was created with the lowest-cost share class for each fund, some funds may be listed with share classes not accessible to individual investors outside of retirement plans. The individual investor versions of those funds may carry higher fees, which reduces returns to shareholders. Those share classes may also carry different Morningstar Medalist Ratings.

Top-Performing Small-Value Funds

Invesco S&P MidCap 400 Pure Value

- Ticker: RFV

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 4 stars

“This share class outpaced its average peer by 2.8 percentage points annualized over a 10-year period. It also exceeded the return of the category benchmark, the Russell 2000 Value Index, by an annualized 2.9 percentage points over the same period. Although the overall rating does not hinge on one-year performance figures, it is notable that this share class lost 0.4%—an impressive 7.2-percentage-point lead over its average peer—placing it within the top 10% of its category.

“An analysis of the strategy’s portfolio shows it has maintained a significant overweight position in liquidity exposure and yield exposure compared with category peers. High liquidity exposure is attributed to stocks with a high trading volume, lending managers more flexibility. And a high yield exposure is rooted in holding high dividend-paying or buyback stocks.”

—Morningstar Manager Research

Invesco Small Cap Value

- Ticker: SMVSX

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 4 stars

“The A shares’ 9.9% annualized return handily topped the Russell 2000 Value Index’s 5.3% and the typical category peer’s 5.7%. However, this strategy tends to be amongst the most volatile in its category, at least in terms of standard deviation of returns. The fund typically delivers during rising markets, and it captured 134% of the index’s gains in the period. But its elevated risk levels make it prone to substantial declines during down markets, and it captured 120% of the index’s losses during the same period.

“The strategy bucked that trend for the year to date through July 2022, though, when its 0.7% loss outpaced the 9.3% loss of the Russell 2000 Value Index. Strong stock picking aided performance. An allocation to Rheinmetall, which nearly doubled during this period, exemplifies the team’s ability to find out-of-favor names and profit as the stock appreciates.”

—Andrew Redden, analyst

Hotchkis & Wiley Small Cap Value

- Ticker: HWSIX

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 3 stars

“The strategy chalked up another impressive year. Its institutional share’s 7.9% gain during the trailing 12 months through February trounced the index and typical peer by 12.3 percentage points and 8.8 percentage points, respectively. Lead manager Jim Miles’ patience with mercurial oil and gas exploration and production stocks paid off as global oil demand outstripped tight supply. Soaring share prices of high-conviction energy holdings, such as Kosmos Energy KOS and Range Resources RRC, drove the strategy’s recent outperformance. Investors here need a stomach for volatility, though, as this strategy has been more volatile than most during Miles’ tenure.

“The fund beat its benchmark in 60% of the 268 rolling five-year periods from Miles’ start through February 2023 and has often led the way in market rallies. Over Miles’ tenure, its upside-capture ratio was 112%, though it lost 109% (as much as the benchmark) in down markets during that time. As a result, investors must be prepared to endure underperformance during downturns.”

—Paul Ruppe, analyst

Dimensional US Targeted Value

- Ticker: DFAT

- Morningstar Rating: Silver

- Morningstar Medalist Rating: 4 stars

“The portfolio lands among the broadest and most diversified in the small-value Morningstar Category. It holds more than 1,300 stocks, while its 10 largest positions represent about 6% of assets. The fund’s price/book ratio has been similar to that of the Russell 2000 Value Index. But including mid-cap stocks and tilting toward profitable firms means the portfolio’s average profitability has been higher than the index’s.

“Collectively, all of these characteristics have provided a long-term advantage. The fund beat the Russell 2000 Value Index by almost 1.8 percentage points per year over the trailing 10 years through December 2022. Holding mid-cap names contributed to its outperformance. Its 0.29% expense ratio lands in the cheapest quintile of the small-value category and should provide a long-term edge.

“The portfolio underperformed the Russell 2000 Value Index during the COVID-19-driven selloff, trailing by 2.3 percentage points between Feb. 1 and March 31, 2020. But it rebounded at a stronger clip during the ensuing rally and continued to outperform in 2022. It beat the index by almost 8.2 percentage points over the full year.”

—Daniel Sotiroff, senior analyst

Victory Integrity Small-Cap Value

- Ticker: MVSSX

- Morningstar Rating: Bronze

- Morningstar Medalist Rating: 3 stars

“This share class outpaced its average peer by 1.1 percentage points annualized over a 10-year period. It also beat the Russell 2000 Value Index by an annualized 1.2 percentage points over the same period.

“This strategy does not differentiate itself from its category peers in terms of size and style exposure. Analyzing additional factors, this strategy has consistently overweighted the volatility factor compared with peers over the last few years, meaning it invests in stocks with histories of a higher standard deviation of returns. Such exposure tends to pay off when markets are hot and be costly when they are not. In recent months, the strategy also was more exposed to volatility than its peers.”

—Morningstar Manager Research

Columbia Small Cap Value I Inst3

- Ticker: CSVYX

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 4 stars

“Over a 10-year period, this share class outperformed the category’s average return by 1.5 percentage points annualized. It also outperformed the Russell 2000 Value Index by an annualized 1.6 percentage points over the same period.

“The main driver of the rating is the fund’s impressive long-term risk-adjusted performance. This can be seen in its 10-year alpha calculated relative to the category average, which suggests the managers have skillfully allocated their risk.

“The risk-adjusted performance only continues to make a case for this fund. The share class outstripped the index with a higher Sharpe ratio (a measure of risk-adjusted return) over the trailing 10-year period.”

—Morningstar Manager Research

DFA US Targeted Value I

- Ticker: DFFVX

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 4 stars

“This strategy avoids holding companies with poor profitability, which should steer the portfolio away from the riskiest names, and it weights final constituents by market cap. This low-turnover approach captures the market’s collective opinion of each stock’s value while cutting back on trading costs.

“It outperformed the Russell 2000 Value Index by almost 1.9 percentage points per year over the trailing 20 years through December 2022. However, its standard deviation was 7% higher than that of the index over that period.

“The fund underperformed the Russell 2000 Value Index during the COVID-19-driven selloff, trailing by 3.2 percentage points between Feb. 1 and March 31, 2020. But it rebounded at a stronger clip during the ensuing rally and continued to outperform in 2022. It beat the index by almost 9.9 percentage points over the full year.”

—Daniel Sotiroff

DFA US Small Cap Value I

- Ticker: DFSVX

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 3

“The portfolio lands among the broadest and most diversified in its category. It holds more than 900 stocks, and its 10 largest positions represent about 8% of its assets. The fund’s price/book ratio has consistently been lower than that of the Russell 2000 Value Index. But avoiding stocks with poor profitability tilts the portfolio toward more profitable names on average.

“Compared with the index, the portfolio has greater exposure to the value factor. It trailed the index by 3.1 percentage points per year between October 2014 and March 2020, when stocks trading at lower valuations performed poorly. More recently it beat the index by 11.1 percentage points annualized between December 2020 and March 2023, when the value factor came back to life.

“Despite large and persistent outflows, the firm has remained steadfast in its philosophy and responded in a way that benefits clients while improving its competitiveness.”

—Daniel Sotiroff

PIMCO RAE US Small

- Ticker: PMJIX

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 4

“This share class led its average peer by an annualized excess return of 2.9 percentage points over a seven-year period. It also outperformed the Russell 2000 Value Index by an annualized 3.2 percentage points over the same period.

“The portfolio is overweight in energy and consumer cyclical relative to the category average by 8.7 and 7.0 percentage points, respectively. The sectors with low exposure compared to category peers are financial services and industrials, underweighting the average by 15.5 and 8.0 percentage points of assets, respectively.

“The most significant contributor to the rating is the fund’s strong long-term risk-adjusted performance. This can be seen in its five-year alpha calculated relative to the category index, which suggests the managers have properly allocated risk. The management team’s stability also bolsters the process.”

—Morningstar Manager Research

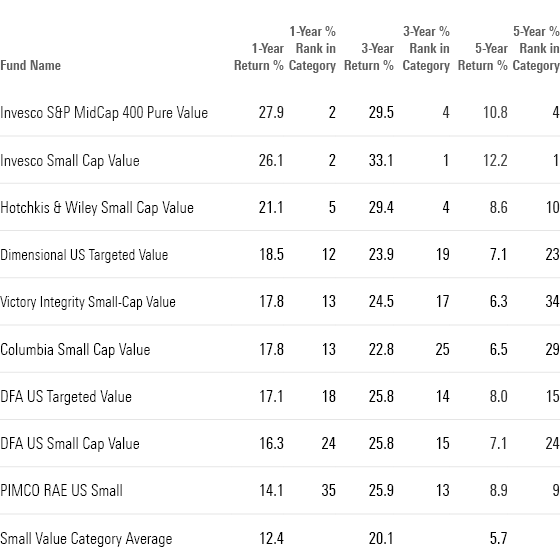

Long-Term Returns of Top-Performing Small-Value Funds

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KVRQ726W7RFHLPM2IY7EGD7SQU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UUSODIGU4REULCOR35PTDS7HW4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)