How Vanguard’s Charitable Endowment Program Stacks Up

It’s arguably the best donor-advised fund affiliated with an asset-management firm for donors who plan to maintain higher account balances.

With $15.2 billion in assets as of June 30, 2022, the Vanguard Charitable Endowment Program ranks as the third-largest donor-advised fund affiliated with an asset-management firm in the United States, falling behind Fidelity Charitable Gift Fund and Schwab Charitable Fund. For investors who plan to maintain larger account balances, though, it’s arguably the best option. It offers the lowest administrative costs for higher account balances as well as a rock-solid investment lineup.

As I covered in a previous article, donor-advised funds have several advantages. Donor-advised funds are public charities that qualify as section 501(c)(3) organizations. That means donors can benefit from an immediate tax deduction when they contribute cash or other assets to the fund. Although contributions are irrevocable (meaning you can’t withdraw donations if you change your mind or need extra cash), the donor retains an advisory role and can recommend how to invest the assets and how much to contribute to various charities over time.

In this article, I’ll dig into how the Vanguard Charitable Endowment Program stacks up in terms of its underlying investment options, as well as the administrative fees and account minimums.

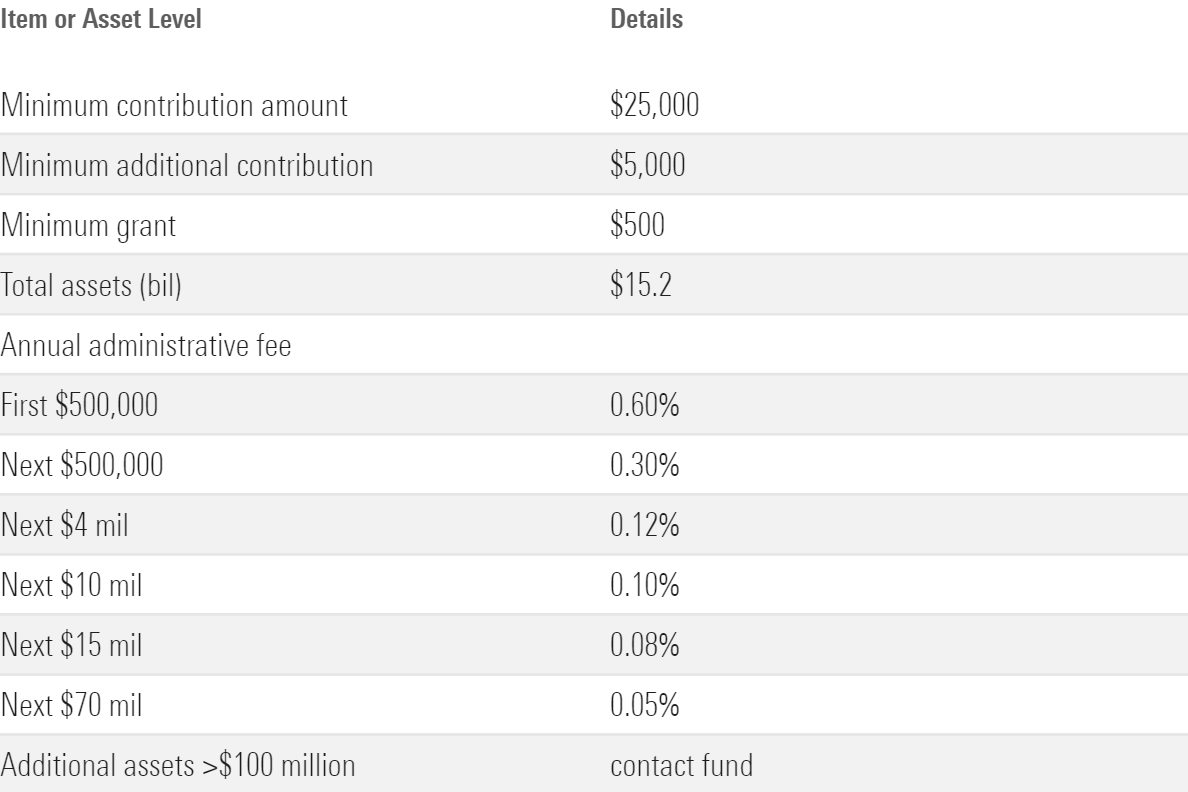

Nuts and Bolts

Vanguard’s donor-advised fund caters to a more elite group of charitable donors than its peers. While Fidelity Charitable Gift Fund and Schwab Charitable Fund don’t currently require a minimum dollar amount to set up a new account or make additional contributions, Vanguard requires a $25,000 minimum for new accounts and $5,000 for additional investments. Donors also are required to maintain a $25,000 account balance; accounts open for more than six months that drop below that value are subject to a $250 account maintenance fee. Vanguard Charitable officials believe these higher minimums lead to more committed donors who can make a greater charitable impact with their donations over time.

Like nearly all donor-advised funds, Vanguard’s fund also comes with an additional layer of administrative costs. For lower balances, Vanguard’s fee structure is identical to those of Schwab and Fidelity. The fund charges a 0.60% annual administrative fee for accounts with balances up to $500,000, and 0.30% for the next $500,000 in assets.

Fees and Investment Minimums

These charges are in addition to the fees on the underlying investments (operating expenses for mutual funds and exchange-traded funds, or trading commissions for individual stocks and bonds). All of these fees come out of the amount donated, making donor-advised funds less cost-efficient than donating directly to a charity.

That said, Vanguard Charitable’s fee structure steps down at a pretty generous rate, making it a more compelling option for donors who plan to maintain account balances of $1 million or more. These tiered fees are 12 basis points for account balances between $1 million and $5 million, 10 basis points for the next $10 million in assets, 8 basis points for the next $15 million, and 5 basis points for assets between $30 million and $100 million.

Investment Options

Vanguard Charitable offers two main investment types: diversified asset-allocation pools with a range of risk levels (which it calls Portfolio Solutions) and single-asset pools for a variety of asset classes (which it calls Portfolio Building Blocks). The program offers both index funds and actively managed funds for each type of pool. In contrast to Fidelity and Schwab, Vanguard’s lineup consists almost exclusively of in-house funds, although the quality of the menu is tough to quibble with.

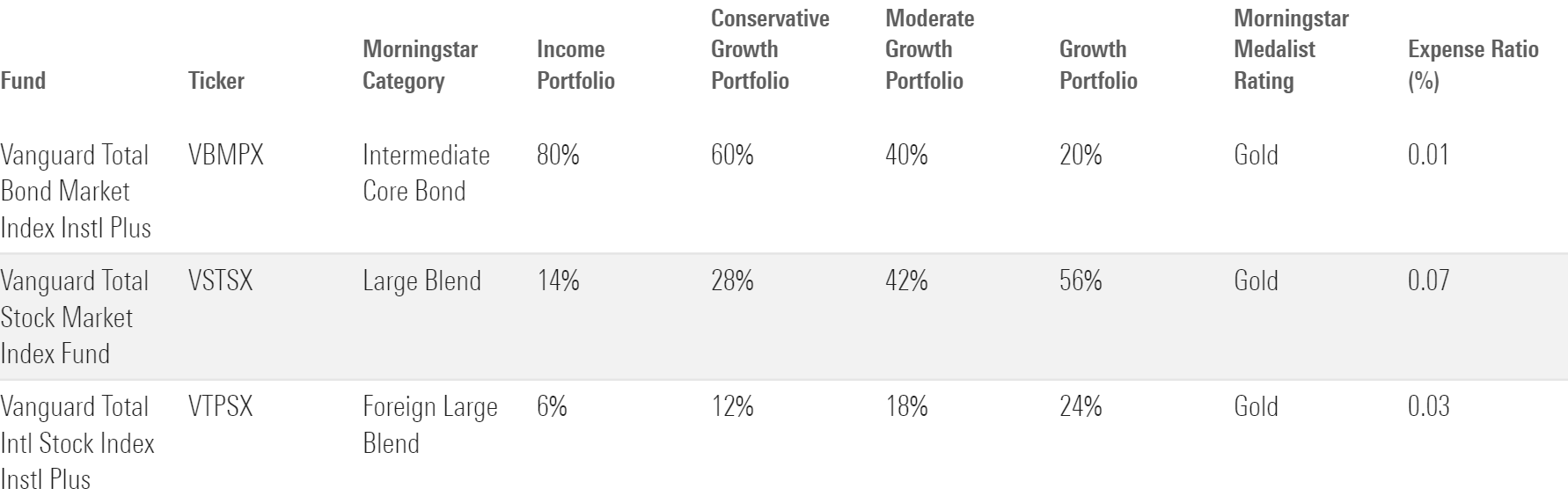

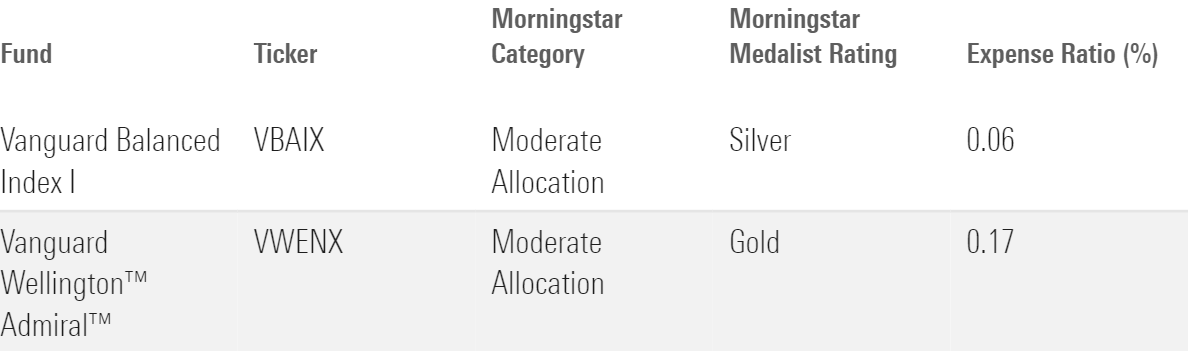

Asset-Allocation Pools

The six asset-allocation pools offer a diversified mix of equities and fixed-income securities, with risk levels ranging from conservative to more aggressive. Four of the six are ultrasimple combinations of three index funds focusing on U.S. stocks, international stocks, and bonds. The other two are actively managed stalwart Vanguard Wellington VWENX and Vanguard Balanced Index VBAIX (with a Morningstar Medalist Rating of Silver).

Multi-Asset Portfolio Solutions (Index Portfolios)

Multi-Asset Portfolio Solutions (Other)

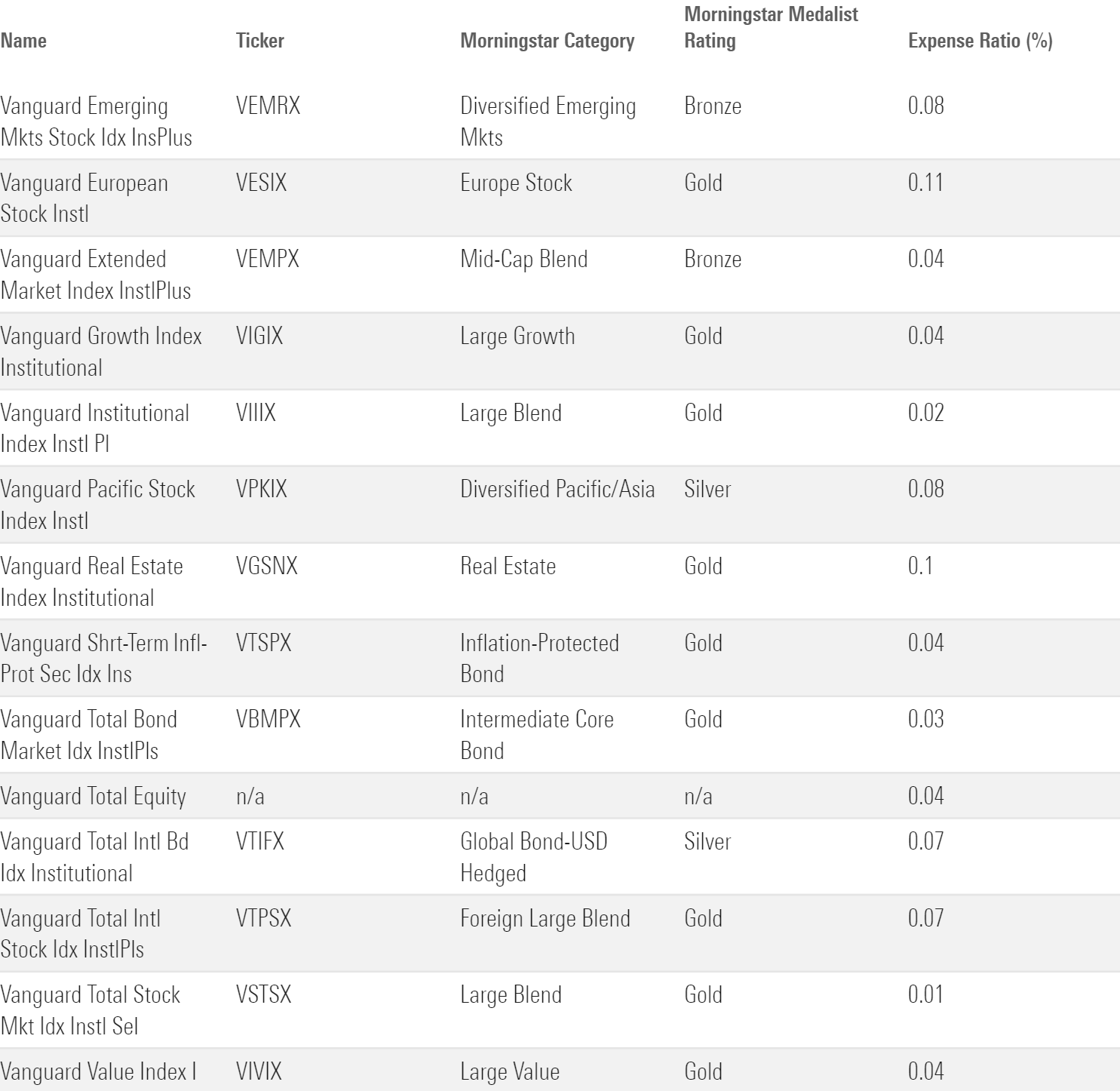

Single-Fund Options

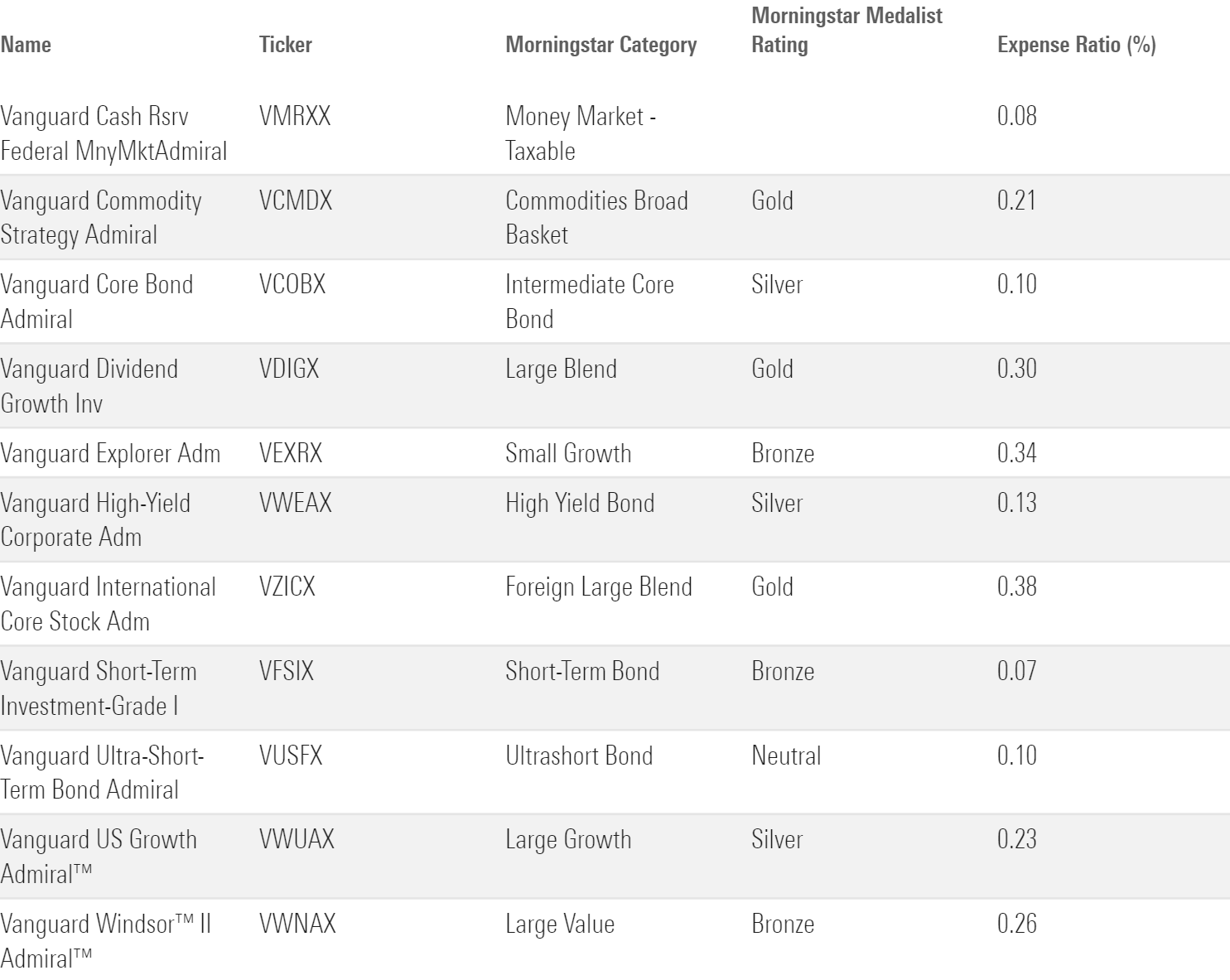

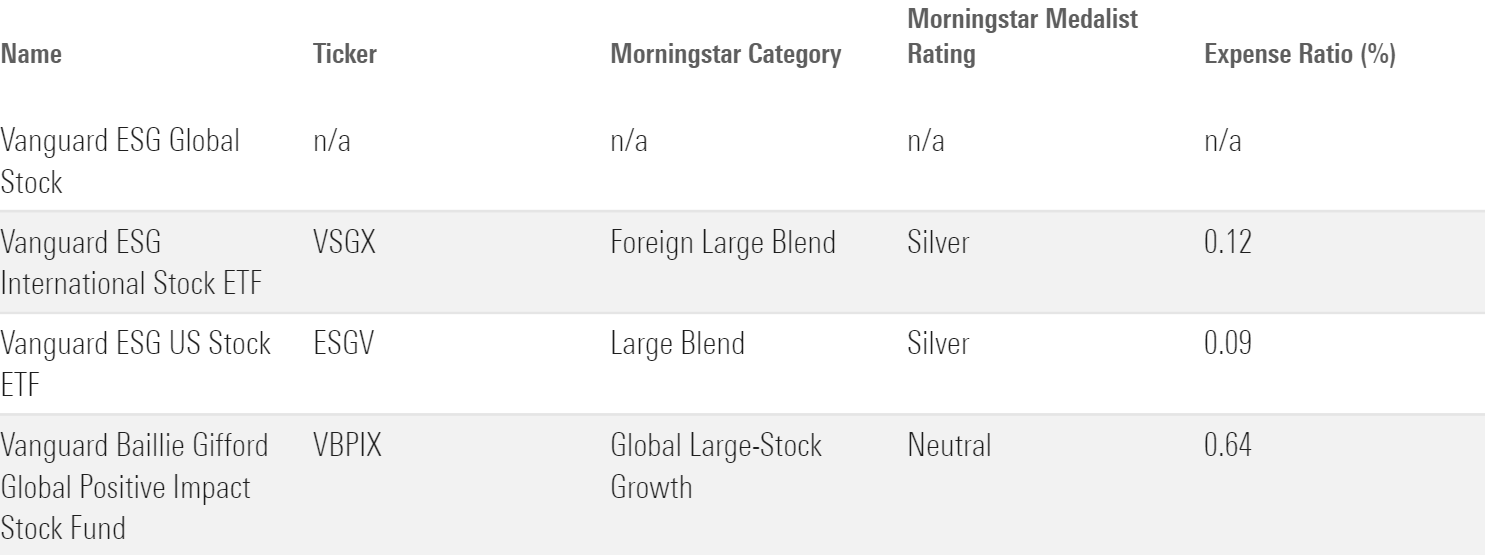

For investors who prefer to build their own portfolios, Vanguard Charitable offers an extensive lineup of options covering most major asset classes, including commodities and real estate. The firm recently added numerous actively managed options, including Vanguard Dividend Growth VDIGX and Vanguard Windsor II VWNAX. The lineup now encompasses nearly 30 funds in total, including index funds; actively managed funds; and environmental, social, and governance-focused offerings for both domestic and international stocks. Overall, the single-fund options earn an average Silver rating, with slightly better average ratings compared with Fidelity and Schwab.

Index Building Blocks

Active Building Blocks

ESG Investment Options

Conclusion

For charitable donors who can pony up the $25,000 minimum, the Vanguard Charitable Endowment Program offers a compelling lineup of top-quality investment offerings, as well as lower administrative costs than most competing donor-advised funds.

A version of this article was previously published on Jan. 9, 2023.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZLDA7BGZZFCDHCDRMM4AZLHG4A.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)