Are Two Cryptos Better Than One for a 60/40 Portfolio?

Spot ether ETFs are here. Should you pair them with bitcoin ETFs?

The US Securities and Exchange Commission approved nine spot ether exchange-traded funds in May 2024, following the approval of 11 spot bitcoin ETFs in January 2024. Ether is the second-largest cryptocurrency by market cap after bitcoin and has outperformed the crypto heavyweight over the trailing five years through June 30, 2024, though both cryptocurrencies have delivered mountainous highs and craterous lows over their histories.

Investors can now easily buy and sell the popular cryptocurrencies in the same brokerage accounts they buy stock and bond ETFs and mutual funds (unless Vanguard is your brokerage). Since the bitcoin ETFs started trading on Jan. 11, 2024, investors have poured in more than $14 billion through June 30, 2024. Total assets in the new ETFs, including Grayscale Bitcoin Trust ETF GBTC, which converted from a closed-end fund, were just over $58 billion.

While ether and bitcoin’s high-flying returns may be appealing to investors, those looking to add exposure could send tremors through their portfolio. We found that even a small bitcoin exposure could dramatically change a traditional 60/40 portfolio’s risk profile. Now that investors have easier access to ether, should they look to have more than one digital currency in their crypto basket?

In this article, we’ll look at how an even mix of ether and bitcoin in a portfolio compares with holding just one or the other, and the impact on a traditional 60/40 portfolio’s volatility and returns.

Crypto: A Tale of Booms and Busts

Bitcoin’s returns have been mouthwatering, but ether has done even better. They’ve enjoyed some exceptional returns, including jaw-dropping 1,400% and 8,700% gains in 2017, respectively. But this rocket ship doesn’t only go up, and the crashes can be painful. In 2018, for example, ether and bitcoin declined 81% and 74%, respectively, testing even the sturdiest diamond hands.

Exhibit 1 depicts massive differences in how bitcoin, ether, and a 60/40 portfolio perform. It shows the rolling one-year standard deviation—a measure of volatility—over the trailing five years using monthly returns of the S&P Bitcoin Index and S&P Ethereum Index, comparing the indexes and a basic 60/40 stock/bond portfolio composed of the Morningstar Global Markets Index and Morningstar US Core Bond Index (two broadly diversified indexes representing the global stock and US bond markets), rebalanced monthly.

Rolling One-Year Volatility

Ether and bitcoin have been on average 8 and 6 times more volatile over the last five years, respectively, a stark contrast to the 60/40 portfolio’s relatively smooth ride.

What Happens When You Add Ether to a 60/40 Portfolio?

The sources of risk for a 60/40 portfolio can be deceiving. It’s easy to assume that 60% of the portfolio’s risk comes from equities and 40% from bonds. However, it is more like 80% of the portfolio’s risk comes from equity because equities are more volatile than bonds. In light of this, adding bitcoin and ether, which are much more volatile, can dramatically shift the portfolio’s risk profile.

Exhibit 2 depicts bitcoin and ether’s risk contribution to the 60/40 portfolio when holding bitcoin, ether, and a 50/50 blend of the two at various weights (1%, 2%, 5%, 10%, and 25%) assuming the crypto is sourced from the stock sleeve (funding something as volatile as cryptocurrency from bonds is not a good idea). Exhibit 3 shows how each hypothetical portfolio’s standard deviation changed over the period, given the varying allocations to bitcoin.

Ether and Bitcoin - Contribution to Risk (%)

A small dose of 1% or 2% in crypto doesn’t have a big impact on your portfolio and results in a minimal change to overall volatility, as shown in Exhibit 3. Ether contributes to risk more than bitcoin and a blend of the two at smaller weights, accounting for nearly 5% and 10% of total risk at 1% and 2% weights, respectively.

Ether and Bitcoin's Impact on Standard Deviation

5% Is the Tipping Point

While a little crypto can go a long way, it is at greater exposures where investors will see the largest shifts in the total risk toward bitcoin. A 5% allocation to bitcoin or a bitcoin/ether blend contributes over 20% of the portfolio’s total risk and produces a volatility of roughly 10% and 13%, respectively, over the 60/40 portfolio. Ether alone eclipses both at that level, soaking up 26% of the risk. A 10% allocation increases volatility by an average of 32% across the three portfolios.

With a 25% crypto allocation split evenly between bitcoin and ether, the contribution to risk leaps to 77% when sourced from equities. The overall volatility is more than double that of the 60/40 portfolio. Interestingly, a blend of bitcoin and ether over the five-year period contributed less to risk than if an investor had only allocated to bitcoin or ether, which contributed 83% and 82%, respectively. That isn’t a huge difference but does suggest there may be some kind of diversification benefit at higher weights. And, across all weights up to 25%, it appears that adding bitcoin to accompany ether does produce small diversification benefits. However, the outsize contributions to risk and overall impact on portfolio volatility should serve as a warning to investors that even a small amount could disproportionately increase the volatility of the portfolio, therefore changing the risk composition.

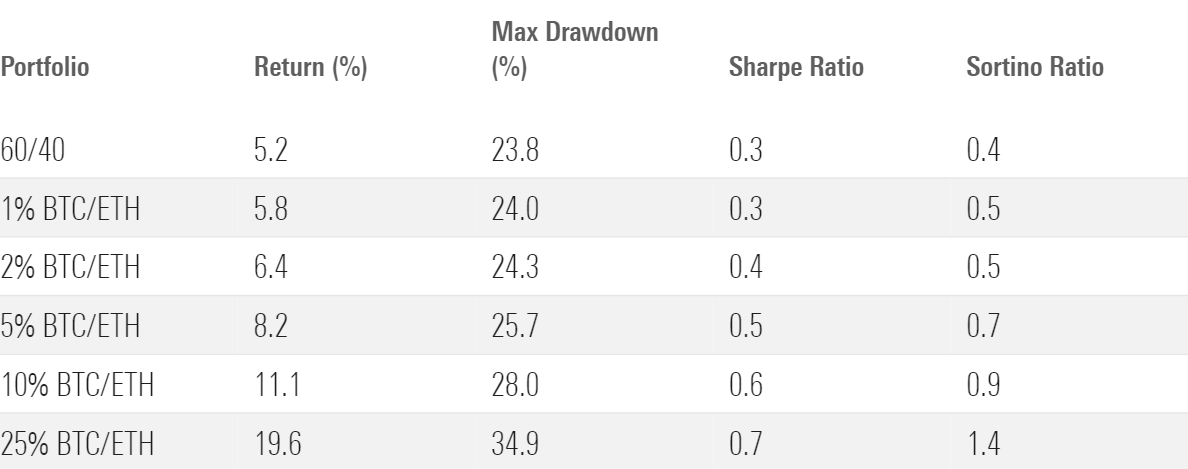

Portfolios With Exposure to Crypto Have Outpaced the 60/40 on Paper

Exhibit 4 shows returns of portfolios with 1% to 25% exposures to a 50/50 basket of bitcoin and ether sourced from the equity sleeve from July 2019 through June 2024. The higher the allocation to crypto, the higher the return of the portfolio. Curiously, despite bitcoin and ether’s wild volatilities, risk-adjusted returns measured by the Sharpe and Sortino ratios were higher for the crypto portfolios than the baseline 60/40. But this assumes monthly rebalancing, so one would be theoretically buying low and selling high, while holding on to both cryptos during their many drawdowns, requiring nerves of steel. The portfolio with a 25% allocation to bitcoin experienced a maximum drawdown for the period of 35%, 11 percentage points more than the 60/40s.

Blended Crypto Portfolio Returns and Risk (7/1/2019 - 6/30/2024)

Ether and bitcoin are no stranger to drawdowns over 50%. While it can be easy to get skittish in the face of gargantuan losses, holding on and even buying the dip have generally worked well for investors who could handle it. Morningstar research has shown that investors typically have more trouble holding on to volatile portfolios, though.

Exhibit 5 shows the returns of portfolios with a 5% allocation to bitcoin, ether, or a mix funded from stocks compared with the baseline 60/40 during the latest “crypto winter” from November 2021 to November 2022.

Returns During the 2021-2022 Crypto Drawdown

During the period, the 60/40 portfolio declined 18.7%, while bitcoin declined by 77% and ether sank 76%, dragging the portfolios with 5% allocations down by 3 percentage points at least. The fall of crypto, and the 60/40, was spurred on by the Federal Reserve’s aggressive rate hikes to stem inflation. Crypto’s failure to add diversification when both stocks and bonds were declining by double digits shows that it can’t be counted on as a panacea when the broader economy is going through tough times. In this instance, diversification within crypto did not materially change results either.

Stocks, Bonds, and Crypto

It was once thought that crypto could offer returns that were uncorrelated to both stocks and bonds. Bitcoin’s correlation with broader equity and fixed income hovered around zero from its 2009 inception through much of the 2010s and the early days of ether after its 2015 launch were similar, meaning the impact of funding from stocks or bonds was negligible. But things have looked different recently, particularly on the equity side. Exhibit 6 shows rolling one-year correlations of the Morningstar Global Markets Index and Morningstar US Large-Mid Cap Broad Growth Index to a 50/50 blended benchmark of ether and bitcoin using monthly returns.

Rolling One-Year Correlations to 50/50 Blend of Ether and Bitcoin

Correlations peaked in 2022 and 2023, coinciding with the growth stock crash and subsequent recovery in those two years. While correlations have come off their peaks recently, ether and bitcoin’s one-year rolling correlation to broader equity markets has generally risen, hovering between 0.22 and 0.78 from July 2020 through June 2024. That is a wide range, and there is always a chance their correlations will settle back in around zero, but it’s still significant that correlations to equity have been elevated for five years. It would make sense that a risk asset like crypto would have a higher correlation to another risk asset like equities. The pattern of their correlations also points to how similar their behavior can be, calling into question the value of diversifying within crypto.

Given crypto’s extreme volatility, instead of sourcing from broad equities, an investor could pull from the riskiest areas of the equity sleeve like innovative growth companies. One might assume that the cryptocurrencies have a higher correlation to riskier stocks. However, bitcoin and ether’s correlation to the broad growth index from July 2020 through June 2024 is similar to the broad global index, ranging from 0.33 to 0.82, so this avenue likely wouldn’t result in a different outcome.

Bitcoin and ether’s galactic returns may be compelling to investors, but their volatility can have a colossal impact on a standard 60/40 portfolio, and diversifying within crypto still leads to a heightened risk profile. Their newfound accessibility through ETFs has many investors eager to add one or both cryptocurrencies to their portfolios, but one must be aware of how they change the risk composition.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e29c5118-c52b-4431-99f9-23960f2bcb09.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/P627737FXRBCJMMKIHW7537BJU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/SIEYCNPDTNDRTJFNF6DJZ32HOI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WFC7QPLI3Z7OFQIJYFW66JXOY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e29c5118-c52b-4431-99f9-23960f2bcb09.jpg)