Our Ultimate Stock-Pickers' Top 10 Buys and Sells

Funds see value in a diverse range of sectors.

For the past decade, our primary goal with Ultimate Stock-Pickers has been to uncover investment ideas our equity analysts and top investment managers find attractive, in a manner timely enough for investors to gain some value. As part of this process, we scour the quarterly (in some cases, the monthly) holdings of 26 different investment managers: 22 managers oversee mutual funds covered by Morningstar's manager research group and four Stock-Pickers run the investment portfolios of large insurance companies. As holdings data becomes available, we attempt to identify trends and outliers among their holdings as well as any meaningful purchases and sales that took place during the period under examination.

In our last article, we walked through our early read on our Ultimate Stock-Pickers' purchasing activity during the fourth quarter of 2020. The piece itself was an early read on individual purchases—focused on high-conviction and new-money buys—that were made during the period, based on the holdings of almost all our top managers. Now that all but one Ultimate Stock-Pickers have reported their holdings for the period, we think it is appropriate to examine our managers' high-conviction purchases and sales in aggregate. As stock prices have changed since our Ultimate Stock-Pickers made their buying and selling decisions, we urge investors to analyze securities at current valuation levels before making any investment decisions and provide our fair value estimates, moat ratings, stewardship ratings, and uncertainty ratings to help investors along the way.

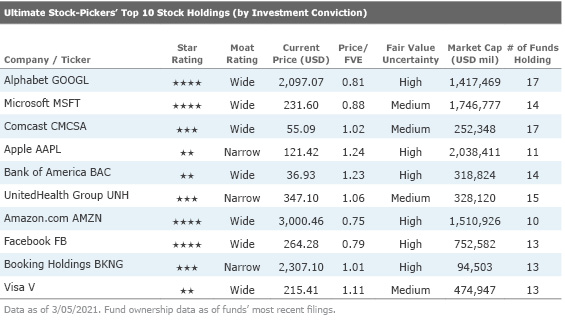

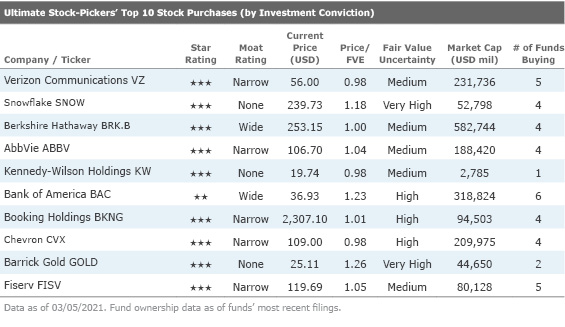

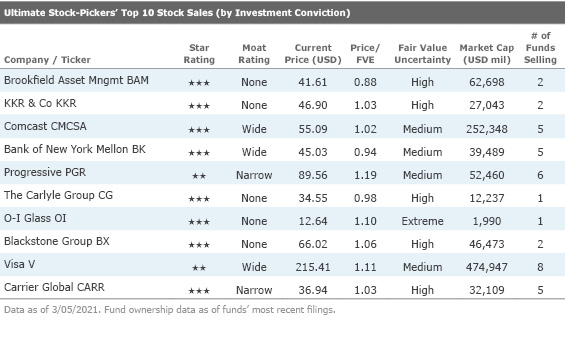

Our Ultimate Stock-Pickers continued their long-standing trend of buying and holding high-quality companies that Morningstar believes have developed sustainable competitive advantages. Morningstar's analysis shows that all the top 10 high-conviction holdings have either a narrow or wide economic moat and that seven of the top 10 conviction holdings have a wide economic moat. Additionally, seven of the 10 companies composing the top 10 high-conviction purchases list and five of the companies on the top 10 high-conviction sales list have been granted either a narrow or wide economic moat by Morningstar analysts.

From a sector allocation perspective, our Ultimate Stock-Pickers are taking about as active of a stance as they were last quarter. The Ultimate Stock-Pickers remain meaningfully underweight in the technology sector relative to the S&P 500. There has been a shift away from the communication services sector and toward the basic materials sector, with our managers overtaking the S&P 500 in this arena. The Ultimate Stock-Pickers remain meaningfully overweight in the industrials and financial services sectors.

As many of the Ultimate Stock-Pickers are long-term investors, we were not surprised to see that the composition of our top 10 conviction stock holdings was largely the same as the prior quarter, with Facebook FB, Booking Holdings BKNG, and Visa V replacing Berkshire Hathaway BRK.B, Johnson & Johnson JNJ, and Mastercard MA. We noticed that the relative ordering of the top 10 stock holdings changed somewhat, with Apple moving down the list, and Microsoft MSFT and Comcast Corp CMCSA moving up. However, Google’s holding company, Alphabet GOOGL, maintained its number one spot on the list. Our Ultimate Stock-Pickers indicate a preference for communication services, with three communications companies on our top 10 list. Managers also continue to hold companies from the financial services, technology, and consumer cyclical sectors with conviction, each contributing two stocks to our list.

Our current fair value estimates suggest that four names from the top 10 conviction holdings list—Alphabet, Microsoft, Facebook, and Amazon AMZN—are undervalued. Our research indicates that wide-moat rated Bank of America BAC and Visa along with narrow-moat rated Apple AAPL are overvalued at the time of writing. As Microsoft continues to be undervalued and was in the top two of our top 10 conviction holdings list, we believe it is worthwhile to discuss the company's performance and take a closer look at Morningstar analyst Dan Romanoff’s outlook on the company.

Wide-moat Microsoft was held by 14 funds at the time of this article’s writing. This medium-uncertainty stock currently trades at a 12% discount to Morningstar analyst Dan Romanoff’s fair value estimate of $263. According to Romanoff, Microsoft’s ability to generate excess returns for the foreseeable future is a result of the firm’s switching costs, networks effects, and cost advantages. Satya Nadella, who took over as Microsoft’s CEO in 2014, has reinvented the technology giant into a cloud leader.

With that in mind, Romanoff sees Azure, Microsoft’s cloud computing offering, as the centerpiece of the new Microsoft that has leaned heavily on the shift away from legacy products to cloud-based products and services. The centrality of Azure to Microsoft’s overall business is underscored by the staggering 56% growth the segment generated in 2019. Romanoff also contends that Microsoft’s massive installed base allows it to leverage its existing network as it grows Azure. Further, secular trends such as AI, business intelligence, and Internet of Things also add further tailwinds behind Azure’s meteoric growth. With the wind of these secular trends behind its back, Romanoff believes that Azure will be the single most critical revenue driver for Microsoft over the next 10 years. With regard to the economic moat around the Azure segment within the larger Microsoft business, Romanoff believes Azure merits a wide moat rating based on high customer switching costs and cost advantages.

It is worth noting, however, that the public cloud build-out remains in its early phases. AWS has taken the market by storm, with Azure trailing, but the two are seen as clear leaders. This is a rapidly evolving market, and Microsoft must continually adjust its offerings, add solutions to the stack, and compete with a company that has built a business around aggressive pricing.

Another key part of the overall Microsoft business is its Office 365 offering. Microsoft’s dominance in the office productivity market is well noted. Office 365 already has more than 165 million subscribers, with users paying a minimum of $70 per year. We are impressed with the company’s pricing power and believe it supports our wide moat rating, especially when free versions that are generally similar in terms of features and interface are available. Microsoft Office also benefits from high switching costs. Because of the significant installed base, and the fact that critical business processes are often centered around Microsoft Excel, we believe it would be highly disruptive for a company to pivot to an office suite other than Office 365. Broadly speaking, critical reports within the financial function of countless enterprise users are pulled from an Oracle ORCL, SQL, or other popular database into an Excel file that can then be manipulated and analyzed further.

Lastly, Romanoff thinks that Office 365’s moat is supported by a network effect. A large installed base draws in software developers to create products specifically for Microsoft Office. For example, in the financial community, a wide variety of add-ins for Excel are designed to smoothly integrate popular platforms such as Factset, Bloomberg, and CapitalIQ.

As we previously mentioned, our Ultimate Stock-Pickers' top 10 conviction stock purchases list is primarily composed of names that have been given moats by Morningstar equity analysts. We found that our Ultimate Stock-Pickers made two purchases in the technology and the financial services sectors. Since Verizon Communications VZ resides on the top of our top 10 stock purchases list with five funds buying the stock last quarter, we think it is pertinent to take a deeper dive into the company.

Narrow-moat rated Verizon Communications currently trades at a 2% discount to Morningstar analyst Michael Hodel’s fair value estimate of $57. Verizon is primarily a wireless business (70% of revenue and nearly all operating income). It serves about 89 million postpaid and 4 million prepaid phone customers and connects another 24 million data devices, like tablets, via its nationwide network, making it the largest U.S. wireless carrier. According to Hodel, Verizon’s narrow moat stems from cost advantages in its wireless business and the industry’s efficient scale characteristics. The business can be split into wireless and fixed-line dimensions. The wireless business produces about 70% of total revenue and accounts for a similar portion of invested capital but contributes nearly all of Verizon’s profits. We peg the segment’s returns on invested capital at about 16%, or about 18% excluding goodwill, by far the strongest in the U.S. wireless industry.

Verizon, AT&T T, and the new T-Mobile TMUS dominate the U.S. wireless market, claiming roughly more than 90% of the retail postpaid phone market. Providing solid nationwide coverage requires heavy fixed investments in wireless spectrum and network infrastructure. While a larger customer base does require incremental investment in network capacity, a significant portion of costs are either fixed or more efficiently absorbed as network utilization reaches optimal levels in more locations. In addition, Verizon’s relatively straightforward corporate history and consistently strong financial position have enabled it to deploy its network in a highly coordinated manner over the past 15 years, making it more efficient on average than its rivals.

On the other hand, Verizon’s fixed-line operations are challenged on a standalone basis, in Hodel’s view. These businesses account for a bit more than 20% of the firm’s invested capital base but at a loss in terms of operating profit and likely contribute little to operating cash flow. Fifteen years ago, fixed-line services, including directory publishing, formed Verizon’s core, producing $18 billion in EBITDA. Today, the business is less than one third that size. Hodel believes Verizon has pursued a rational strategy for this business, spinning off or selling assets where it had no plans for future investment while investing heavily in the remaining operation. For context, Verizon has realized more than $30 billion in proceeds for shareholders since 2005, equal to about three fourths of the invested capital remaining in the business. However, only shareholders who followed Verizon’s lead, washing their hands of these assets by selling spun-off shares in firms like Idearc and FairPoint, fully realized this value.

The Ultimate Stock-Pickers’ top 10 conviction sales list contains some new names compared with the previous quarter. Two of the conviction sales are also conviction holdings—wide-moat Visa and Comcast Corp appear on both lists. Much of the selling activity came from the financial services sector, which contributed seven names to the conviction sales list. Seven of the 10 names on this list are overvalued according to Morningstar estimates. As our Ultimate Stock-Pickers sold out of their financial services sector positions the most, we find it pertinent to discuss a financial services stock. One name that six managers have sold is narrow-moat rated Progressive Corp PGR, which trades at a 19% premium to Morningstar analyst Brett Horn’s fair value estimate of $75.

Progressive underwrites private and commercial auto insurance and specialty lines; it has over 20 million personal auto policies in force and is the fourth-largest auto insurer in the United States. Progressive markets its policies through independent insurance agencies in the U.S. and Canada and directly via the Internet and telephone. The firm is one of the strongest franchises in the insurance industry, and it is currently firing on all cylinders.

In an industry marked by fierce competition and commodification, Horn believes that Progressive has set itself apart from the industry by its scale in the direct channel and efficiency in the agent channel. This contrast is of particular relevance as in general, property-casualty insurers do not benefit from favorable competitive positions. This is driven by insurance companies not actually knowing their cost of goods sold for a number of years, which can lead to pricing errors with a recognition lag that can harm the overall business. Horn thinks that Progressive’s scale is important as given a high level of variable costs, scaling is difficult for most insurance companies. Personal line insurers, such as Progressive, are better able to spread fixed costs over a wider base as their business model does not require as many specialized underwriters and human capital. Scale has also helped the firm manage its expenses more efficiently with its expense ratio averaging 21% over the last five years, a number far below industry averages.

Another aspect of Progressive’s competitive advantage highlighted by Horn is the ability to continually innovate. Through continuous innovations, Progressive has built a data edge that has at times given it a leg up on competitors. While this has helped results, we think an edge from underwriting innovations is usually difficult to sustain, as those innovations are rather easily replicated.

Disclosure: Malik Ahmed Khan and Eric Compton have no ownership interests in any of the securities mentioned here. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NSVUOQPZGJF7LCEGN76XGJKQII.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7IH7AVNNZEQ3ALFR77S3T5V7I.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)