How to Avoid Unintended Distributions from Inherited IRAs and 401(k)s

Making the wrong move can be costly.

If you inherit an IRA or employer-plan account, you can let it continue to grow tax-deferred and take only required minimum distributions. Depending on your beneficiary profile, tax-deferred growth can continue for up to 10 years—more for some beneficiaries. However, using the wrong method to move your inherited account will result in unintended distributions and cause you to lose opportunities for tax-deferred growth.

How should you move your inherited IRA and employer-plan account? The following guide can help you stay on the right path.

Move Inherited IRAs Via the Transfer Method

For IRA purposes, a transfer occurs when assets are moved from one IRA directly to another IRA. The issuing custodian must make the assets payable to the receiving IRA as it is titled, and neither custodian should report the transfer to the IRS.

Both person and nonperson (a trust, estate, or charity) beneficiaries may transfer their inherited IRAs to beneficiary IRAs.

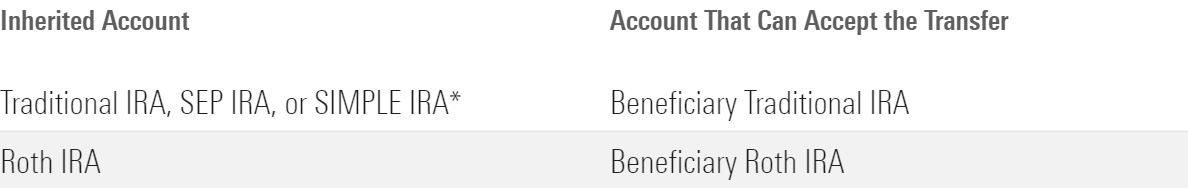

The following is a summary of allowable transfers:

Allowable Transfers

*A savings incentive match plan for employees, known as the Simple IRA, cannot be transferred to a traditional IRA unless the Simple IRA has been funded for at least two years. Presumably, an inherited Simple IRA would need to remain in a Beneficiary Simple IRA if this two-year requirement has not been met.

Caution! Avoid Unintentional Distribution

If you take a distribution from an inherited IRA, you must include the amount in your income for the distribution year, as nonspouse beneficiaries cannot roll over such distributions.

Example: In 2024, 45-year-old Sara inherited a Roth IRA with a market value of $500,000 from her uncle Ray, who died at age 70.

Sara is a designated beneficiary (who is not an eligible designated beneficiary) and, therefore, has 10 years to distribute her inherited Roth IRA. For Sara, distributions before 2034 are optional.

She decided to let the account grow tax-deferred until 2034.

This strategy would allow the Roth IRA earnings to be tax-free, providing her with a tax-free income of $983,575 in 2034, assuming a rate of return of 7%.

Ray’s Roth IRA was held with ABC Custodian, where it was transferred to Sara’s beneficiary Roth IRA. However, Sara wanted to move it to her financial advisor at XYZ Custodian.

Sara made a wrong move: Sara contacted ABC Custodian in 2024 and told them she wanted to roll over the inherited Roth IRA. They had her complete a distribution request form and gave her a check for $500,000.

Why this is wrong: Sara is a nonspouse beneficiary; the $500,000 distribution cannot be rolled over and, therefore, will not benefit from the potential tax-free growth of $283,575.

Sara must include the $500,000 in her income for 2024. She must pay income tax on the earnings portion if the distribution is nonqualified. See Is Your Roth IRA Distribution Taxable?

What Sara should have done: Sara should have told her advisor at XYZ Custodian that she wanted to transfer the Roth IRA and have them request the transfer on her behalf.

Use the Direct Rollover Method for Inherited 401(k), 403(b), and Other Employer Plans

If you inherit a 401(k) or other qualified employer plan, 403(b), thrift savings plan, or governmental 457(b) plan (employer plan), you may roll it over to a beneficiary IRA.

Such a rollover must be done as a direct rollover.

A direct rollover from an employer plan occurs when the plan administrator pays the distribution to the IRA as registered. For example, IRA FBO John Brown (Deceased), Susan Bailey (Beneficiary), ABC Co. as custodian.

If the amount is paid to the beneficiary, it cannot be rolled over. Such a rollover (indirect rollover—where the assets are paid to the individual who then rolls over the amount) is available only to a spouse beneficiary.

Caution: Neither a direct rollover nor an indirect rollover is available to a nonperson beneficiary. If the beneficiary is the decedent’s estate, any distributions must be made to the estate, never to a beneficiary IRA.

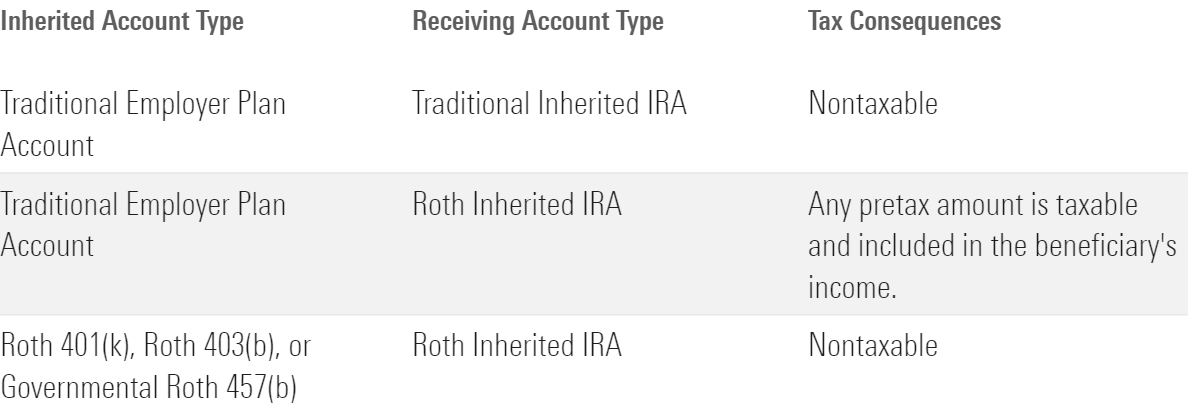

You must ensure that a rollover from an employer plan is made to the right type of beneficiary IRA.

Rollover Options for an Inherited Employer Plan

For a rollover from a traditional employer plan account, consult with your tax advisor to determine which receiving account type is suitable for you.

Caution for RMDs: Any required minimum distribution due to the participant or beneficiary must be taken before the rollover to a beneficiary IRA. Ask the plan administrator if any RMD is due and ensure such an amount is distributed to you and not included in any rollover.

Ensure Your Beneficiary IRA Is Properly Titled

Your beneficiary IRA must be registered in both your name and the name of the IRA owner, showing which of you is the beneficiary. This registration lets the IRS know whom you inherited the IRA from.

Example: Darlene Jones inherited an IRA from her cousin, Tim Brown. ABC Company is the custodian. The registration of Darlene’s inherited IRA would be IRA FBO Darlene Jones as Beneficiary of Tim Brown, ABC Company as custodian.

Some custodians use different formats. For example, IRA FBO Tim Brown (Deceased), Darlene Jones (Beneficiary), ABC Company as custodian.

Any format is acceptable, providing it indicates whom the decedent and the beneficiary are.

If the beneficiary is a nonperson, such as an estate, an example of an acceptable title is IRA FBO, The Estate of Tim Brown, ABC Company, as custodian.

If your beneficiary IRA is not registered properly, it might have been set up incorrectly. If so, contact your IRA custodian immediately and notify them of any error.

Knowing the Limitations for Your Account Can Be Tax-Saving

Nonspouse beneficiaries have limited options for moving their inherited IRA or employer-plan account. Using the wrong method can result in a loss of opportunities for efficient tax planning for your distributions. For example, it might be more tax-efficient to spread an inherited IRA over several years—or, in the case of a Roth account—wait until you must before you take distributions. However, all that tax-planning opportunity could be lost if the wrong method is used to move the account.

If you want to move an inherited account, be clear about your objectives when discussing such movements with IRA custodians and plan administrators. Have your advisor review all forms before you submit your instructions.

Denise will be speaking about “Maximizing the Benefit of Inherited Retirement Assets” at the Wealth Counsel 2024 Symposium in Las Vegas, Sept. 24–26, 2024.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

Denise Appleby is a freelance writer. The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T6LOA5ZYUZEWPLNEAQHTZASGTY.png)

/d10o6nnig0wrdw.cloudfront.net/09-16-2024/t_dfa7464cdf714550aa17147bbf0892e9_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-16-2024/t_f4bff959970341438335b5c352bbd465_name_file_960x540_1600_v4_.jpg)