2 Undervalued Stocks That Just Raised Dividends

Plus 10 more stocks under Morningstar’s coverage with big dividend increases.

With the big rally in technology stocks cooling and the Federal Reserve poised to cut interest rates, the prospects for dividend stocks are looking a bit brighter.

However, many of these stocks have continued to lag, providing opportunities for long-term investors to find undervalued names, including ones raising their payouts.

Dividend investing comes in various forms. Investors can look for stocks offering the highest yield, ones with a history of stable dividend payouts and strong finances, or companies raising dividends.

For this article, we screened for stocks that have increased quarterly dividends, which can signal a company’s confidence in its future finances. Here are two undervalued companies covered by Morningstar analysts that increased their dividends in August:

Dividend Stock Performance

Screening for Undervalued Stocks That Raised Dividends

We combined this screen with one for stocks trading below their fair value estimates, meaning they have attractive prices for long-term investors. These stocks offer investors the potential to benefit from both increased dividend yields and the possibility that their investment values will grow.

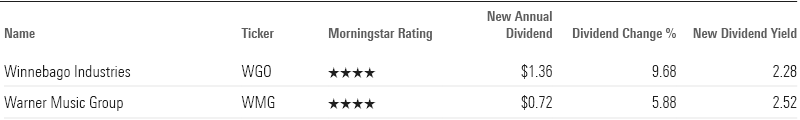

We started with the full list of US-based companies covered by Morningstar analysts and looked for names that pay a quarterly dividend to investors. We then tracked changes between any dividends declared in August. We then filtered for companies that saw a dividend increase of 5% or more to capture the most substantial changes. Stocks with dividend yields under 2% were then excluded. We picked companies considered undervalued by Morningstar analysts, meaning they are rated 4 or 5 stars.

In all, two undervalued companies with dividend increases made it through. A list of stocks covered by Morningstar that raised dividends by 5% or more can be found at the bottom of this article.

Undervalued Stocks That Raised Dividends

Here’s a closer look at these two undervalued stocks.

Winnebago Industries

- Morningstar Rating: 4 stars

- Fair Value Estimate: $82.00

- Morningstar Uncertainty Rating: Very High

- Economic Moat: None

“In fall 2014, we were pleased to see the company resume its dividend, which had been eliminated in October 2008 due to the Great Recession. Dividends continued throughout the pandemic because the company experienced so much demand for RVs and we like the large 50% increase in the dividend announced in August 2021 and again in August 2022 so shareholders can share in more of the wealth from the RV boom. More increases have occurred since that time.

“We expect dividends and some acquisitions to be priorities in addition to reinvesting in the business, including any acquisitions, with reinvesting as the top priority. Buybacks in fiscal 2022 accelerated to $214.3 million, including $70 million in the fiscal third quarter when the stock had fallen, which we like to see but spending fell off significantly in fiscal 2023 to $55.1 million. In August 2022, the company announced a $350 million repurchase program ($240 million remaining) that does not expire, so between that news and the dividend increase we see the board as very confident about Winnebago’s future.”

More of David Whiston’s take on Winnebago Industries can be found here.

Warner Music Group

- Morningstar Rating: 4 stars

- Fair Value Estimate: $37.00

- Morningstar Uncertainty Rating: Medium

- Economic Moat: Narrow

“With our view that greater success from heavier investment would be questionable, we believe the level of Warner’s capital return to shareholders is appropriate. As a percentage of free cash flow, Warner’s dividend payout ratio has remained in the 50%-60% range since its 2020 IPO. At our fair value estimate, this would result in a dividend yield of about 2%.”

Matthew Dolgin’s report on Warner Music Group can be found here.

Stocks That Raised Dividends

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7AHOQA64TFEQDMYMIMM6VUHYLY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JA7LQ2INFNFTZFBJLSDUZGIPJQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)