3 Specialty Chemical Stocks to Buy Now

Where the market sees caution, Morningstar analyst Seth Goldstein sees opportunity.

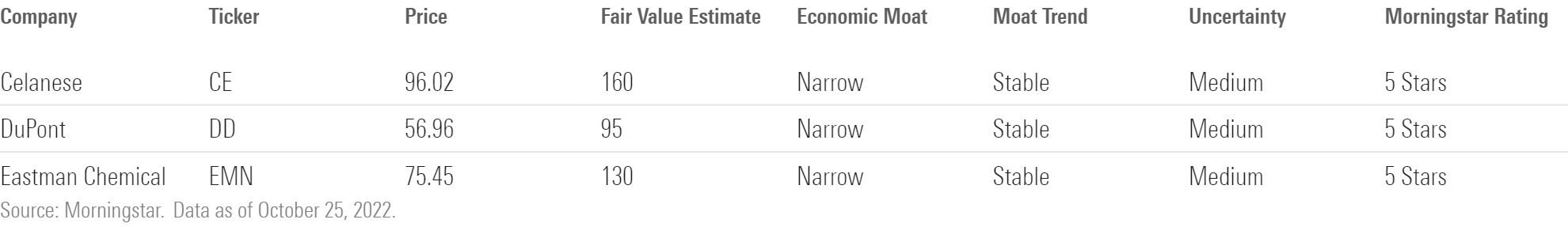

Shares of Celanese CE, DuPont DD, and Eastman EMN have plummeted this year as the market focuses on the near-term risks for the specialty chemical industry. Cost inflation, a global recession, and a potential European natural gas shortage all threaten to erode profits in 2023. While these risks could weigh on near-term results, we think a smaller decline is more likely to occur, as reflected in our base-case forecasts.

The recent selloff leaves prospective long-term investors with a very wide margin of safety. The market is pricing in a lower-for-longer scenario that implies a significant profit decline with a tepid recovery. However, our recession scenario analysis shows that while the decline typically lasts a few years, specialty chemical companies have made full recoveries and resumed long-term growth rates following a recession. Similarly, our EU natural gas shortage scenario analysis shows that while 2023 could see the worst potential production shutdowns, the European Union’s rapidly shrinking dependency on Russian natural gas would lead to markedly improved conditions in each subsequent year. Even when we combine the two potential macroeconomic downturns, all three stocks trade below our forecast valuation impact.

Where the market sees caution, we see opportunity for investors to pick up three high-quality, narrow-moat specialty chemical stocks, all trading in 5-star territory, at less than 60% of our fair value estimates. Celanese, while the most cyclical of the three companies, should benefit from the long-term auto recovery. DuPont is our top pick for exposure to semiconductor growth and increasing “Internet of Things” adoption. Eastman, the least cyclical of the three, has the broadest end-market exposure but should benefit from increased plasticization—the replacement of metal parts with plastics—as well as the growth in demand for more environmentally friendly plastics.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/237L6UCCT5DIJOTXSUHF5NKFYM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/R7HDJUUCAVCXZH56GSOH6M55CU.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)