Are Independent Refiners' Dividends Safe?

High yields indicate opportunity as the probability of cuts is low.

Refining market conditions remain dour as the coronavirus pandemic continues, but with the vaccine rollout underway, there is light at the end of the tunnel. Although we expect an economic recovery is likely to begin in 2021, an improvement in refining market indicators such as inventory and utilization levels are likely to lag and could keep a lid on margins in the near term. Ultimately, though, we see petroleum product demand recovering toward prepandemic levels, normalizing inventory and utilization levels and lifting refining margins toward midcycle levels. The equity markets are less sanguine, however, and continue to price refiners’ shares as if margins will not recover, keeping dividend yields near historical highs. We see little risk of dividend cuts thanks to large cash balances and improving cash flow. As such, at current levels, refiners continue to present an opportunity as a play on economic recovery. Valero VLO continues to stand out on valuation, quality, and dividend safety.

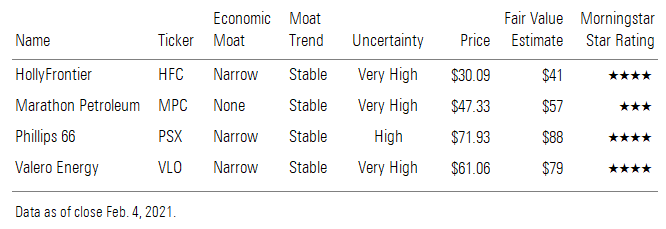

HollyFrontier, Marathon Petroleum, Phillips 66, and Valero Energy

Market Recovery Stalls The recovery in refined product demand in the early summer after the United States partially emerged from lockdown has stalled. Demand levels for gasoline and jet fuel remain lower than the year before, before the outbreak, and at about same rate they were during the summer. Distillate continues to be an outlier as it has been at times on a par with or above previous years. The lack of further recovery for gasoline and jet fuel is not surprising, as COVID-19 infections began to rise again after the end of summer and now sit at high levels. As a result of the acceleration in infections and in part due to typical seasonal weakness, absolute demand levels also began to decline at the end of 2020.

The inability of demand to improve further has also stopped utilization rates from increasing. Although rates steadily rose through the summer on the improvement in demand, additional gains did not continue into the fall. In addition, utilization levels dipped during the latter part of the year, as they typically do, due to seasonal factors. As such, utilization as a percentage of the 2019 level improved from earlier in the year but is still at only about 85%. Any improvement to normalized levels remains dependent on a return of demand and a concurrent decrease in inventory levels.

The utilization discipline exerted by refiners has had a positive influence on inventories, however. Absolute gasoline inventory levels fell within the five-year range by year-end, although unsurprisingly demand-adjusted inventory (days of supply) remains well above historical ranges and worsened into year-end, but this is typical and likely related to seasonality. Distillate inventories tell a much more sanguine story, with absolute inventory and demand-adjusted inventory levels within historical ranges. This also reflects the disparity in demand figures and is explained by the fact that while people are staying at home and not driving, global commerce is largely continuing, as e-commerce has soared. The exception is commercial passenger flight travel, which remains depressed and has resulted in an abundance of jet fuel. However, as Valero has indicated, at lower utilization levels it produces little jet fuel, which in turn is helping to keep distillate inventories in check as surplus is no longer being mixed into the distillate pool as it was earlier in the year.

The movement in margins has reflected the inventory situation, with distillate margins showing improvement and gasoline weakening since the summer. Neither is a surprise, given that distillate demand is strong and inventories reasonable while gasoline’s performance has deteriorated and is at much more risk as the pandemic drags on. Regardless, both remain well below historical levels. It’s worth noting that fourth-quarter 2020 gasoline margins are actually slightly higher than levels at the same time the year before. However, that is more a reflection of how bad the fourth quarter of 2019 was for gasoline as opposed to any comment on a recovery this year. Gasoline margins had been relatively weak the last few years before the pandemic-related demand decline. Strong distillate margins and wide crude differentials encouraged refiners to run at high utilization rates, which led to gasoline overproduction and high inventories. Refiners still did well, however, as strong distillate margins more than offset poor gasoline margins. With distillate margins now depressed as well, refiners are struggling.

Our outlook is largely unchanged even as a vaccine is currently being administered. We continue to expect demand to recover but the refining margin recovery is likely to lag. Although inventories look close to normalized levels, low utilization rates essentially are acting as shadow inventory, which will need to be worked down before the market normalizes and margins approach historical levels. This could take well into 2022. Still, valuations and safe dividends mean this is an opportunity.

Cash Balances, Improving Cash Flow Should Keep Dividends Safe Refiner yields are trading near historical highs, implying the market is calling into question the sustainability of refiners' dividends. We think the probability of a dividend cut for any of these companies is lower than what is being discounted by the market, however, as management teams remain committed to maintaining current payouts, cash flow should improve during 2021-22 as market conditions begin to normalize, and an increase in leverage has left each company with a cash balance it can use to cover any shortfalls.

Refiners responded to the crash in margins in early 2020 by increasing debt and cutting capital expenditures. Refiners reduced 2020 capital spending by 25%-30% compared with initial budgets while also reducing capital spending guidance for 2021 and 2022. HollyFrontier HFC is the only exception as it plans to double capital spending in 2021 to $1.05 billion-$1.15 billion from its 2020 capital budget of $475 million-$550 million as part of a push into renewable diesel.

Each refiner raised debt this year to bolster balance sheets and prepare for an uncertain future, but debt levels remain manageable as net debt/capital ratios (excluding consolidated master limited partnership debt) remain below 35% for U.S. refiners. Given management teams’ desire to maintain investment-grade credit ratings and a likely improvement in cash flow, we do not expect any further material increases in debt. Meanwhile, the higher debt levels have left each refiner with large cash balances to supplement any cash flow shortage.

Although that cash might be needed in the near term during the seasonally weak part of the year, we expect a margin recovery during the next two years that should improve cash flow. Still, margins are unlikely to reach our assumed midcycle levels during the next two years as demand remains depressed, keeping inventory levels above normal ranges.

Incorporating each of the aforementioned elements--reduced capital spending, large cash balances, and improved cash flow--into our models suggests that refiners have sufficient financial capacity to maintain dividends during the next two years.

Valero stands out as being able to cover capital spending and dividends solely from operating cash flow by our estimates. If cash flow falls short, the company holds $4.0 billion of cash after issuing $5.5 billion in debt through the first three quarters of 2020.

HollyFrontier’s operating cash flow will fall short of covering dividends during the next two years as a result of the doubling in capital spending in 2021. However, it had a cash balance of $1.5 billion at the end of the third quarter in 2020, which can cover the $230 million annual dividend through 2022 if the cash flow does not materialize, meaning a dividend cut is unlikely. Furthermore, with a net debt/capital ratio of 10.6%, it has ample capacity to increase debt if need be.

Marathon Petroleum’s MPC operating cash flow will be insufficient to cover the dividend, by our estimate, due to lower refining earnings but also the loss of Speedway cash flow in early 2020. Although the company has a relatively small cash balance at $618 million, in early 2021 it should receive $16.5 billion in aftertax proceeds from the sale of its Speedway segment. This should be sufficient to reduce debt from $11.6 billion at the end of the third quarter to management’s target of $5 billion as well as fund the annual dividend of $1.65 billion through 2022. However, a dividend cut is still possible, as management might decide to reset the dividend to a lower level given the loss of Speedway’s annual $1.5 billion in EBITDA (based on fiscal 2019).

Phillips 66’s PSX operating cash flow during the next two years is also unlikely to fully cover $1.7 billion in annual dividends, falling about $500 million short for the two years. However, its cash balance of $1.5 billion should cover the shortfall, and the company has capacity for additional debt. As such, we do not expect a dividend cut.

Despite Postelection/Vaccine Pop, Refiners Remain Undervalued The conclusion of the U.S. presidential election and subsequent announcement of the first vaccine sent refining shares higher. The latter is particularly understandable as it signals a return to normal, but we've seen rallies before, only to stumble. The shares remain below their early June 2020 highs, which marked the top of a relief rally. Is this time different? We don't know. The present escalation in infections could further slow the economic recovery, which the latest round of stimulus might be insufficient to offset. However, a path to normalization does appear more certain now with a vaccine.

What we do know is that assuming a return to midcycle conditions, which we continue to believe will occur, refiners’ shares are inexpensive on the basis of discount to our fair value estimates as well as asset values. Our healthcare team expects the U.S. to achieve herd immunity around midyear, which should lead to an economic recovery. Although refining stocks could retreat once more if the vaccination program stumbles, for example, we expect the overall trend to be higher as inventories should decline over time, while utilization levels recover. During this time, margins will continue to fluctuate but ultimately close in on midcycle levels.

Given that all refiners appear relatively cheap, we’d lean toward quality, which means that of the refiners we cover, we prefer Valero for its superior assets and dividend safety. A rising tide of improved product demand, lower inventory levels, and higher margins will lift all boats, but as a pure-play refiner with the highest-quality assets, Valero stands to benefit while offering protection if the difficult environment persists for longer than expected.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)