These Companies Can Box Their Way Out of a Corner

COVID-19 has taken a toll on containerboard producers, but we see opportunity.

Containerboard profit margins surged amid limited supply and robust demand growth from 2016 to 2018, and management teams seized the opportunity to convert a host of mothballed paper mills to containerboard production, as we expected. The industry is now staring down a wall of capacity growth not seen in decades. Meanwhile, the coronavirus pandemic has ravaged box demand. Opportunity has turned into threat, and the containerboard companies have a fight on their hands.

Hard decisions lie ahead, but we believe the companies we cover will rise to the challenge: All three generate plenty of cash and have wisely avoided overindulging in debt during good times. Furthermore, all three possess low-cost assets that should weather the storm to see brighter days and wider margins.

While market prices for containerboard stocks have swung from record highs in 2018 to recent record lows, our message remains the same: Reality lies somewhere between boom and bust. The recent collapse in confidence among market participants and the sell side is an opportunity for patient buyers. Over the coming years, we think box demand will strengthen with the economy. And while the wall of supply appears threatening, small, high-cost players will be the ones to wash out, much as they did in previous downturns.

We expect WestRock WRK, International Paper IP, and Packaging Corp. of America PKG to ride out the storm. Fearful investors have flocked to high-quality PCA, leaving abundant upside opportunity for buyers of WestRock.

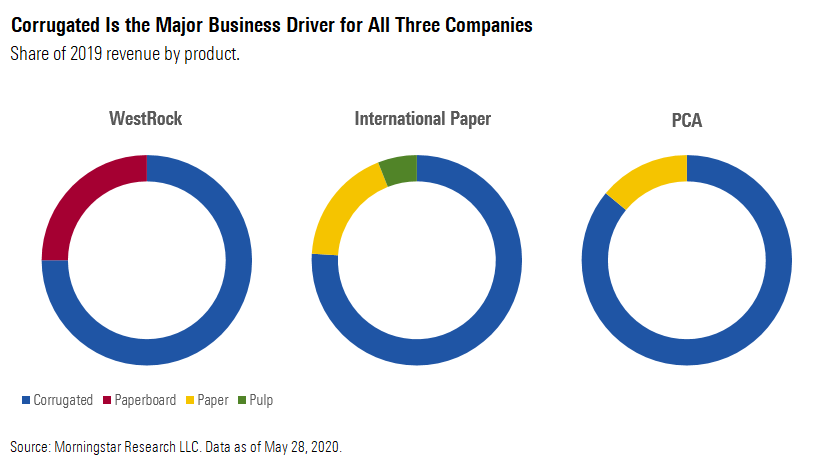

Corrugated Is the Major Business Driver for All Three Companies

Top Learnings About 3 Key Containerboard Companies

- WestRock. While WestRock's performance has lagged that of IP and PCA, we think it will become more cost-competitive following the replacement of three high-cost containerboard machines with a single advanced line at its Florence, South Carolina, mill. The swap will widen margins and reduce downtime throughout the economic cycle. Not only is the machine new, made with some of the lowest-cost technology in the business, but it replaces three antiquated machines. At an estimated 740,000 tons of capacity, it will represent more than 7% of WestRock's segment capacity.

- International Paper. Of the three containerboard companies we cover, International Paper is the least focused. The company is split among producing containerboard, paper, and pulp, generating middling results in each business line. Over the last few years, IP lost its footing as it pursued the poorly timed acquisition of Weyerhaeuser's fluff pulp business in 2016 and failed in its attempt to buy Smurfit Kappa in 2018. Ever since the acquisition, IP's pulp business has struggled to cover its costs. We think an increasingly divided focus could be part of what has weighed on recent EBITDA margins relative to WestRock. Nevertheless, we see some upside for investors despite the recent sell-off, with the shares trading modestly below our $43 fair value estimate. The market appears to mostly share our view that conditions across IP's segments will face near-term headwinds but expects a slower recovery in profitability than we do.

- Packaging Corp. of America. Over the last few years, Packaging Corp. of America has consistently garnered a premium valuation, partly deserved--the company is more profitable throughout the cycle than either of its large competitors, thanks to low production costs. However, we think the market is giving PCA too much credit relative to its peers. Over the next few years, as margins remain below recent peaks, we think the market will reassess PCA's long-term margins, or cash conversion, as it more closely approximates that of peers. Narrower long-term margins will support lower exit multiples, reducing the company's share price relative to IP and WestRock.

/s3.amazonaws.com/arc-authors/morningstar/1d297fbb-3ca6-4b00-8c51-21e8e65e343e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1d297fbb-3ca6-4b00-8c51-21e8e65e343e.jpg)