The 2024 Proxy Season in 3 Charts

Anti-ESG resolutions climb in proxy voting—but support for them falls.

Now that the 2024 proxy-voting season is over, it’s time to zoom out, look at the major trends for the proxy-voting year that just ended, and assess what they could mean for the future. Most US asset managers have still yet to publish their voting records for the 2024 proxy year (which closed on June 30).

But even with the data still rolling in, we’re already able to identify some key marketwide themes among environmental, social, and governance topics. We’ve picked out three. We’ll follow up with a deeper dive into hidden trends. (If you’d like to see more of Morningstar’s coverage of proxy season, read this.)

- ESG shareholder resolutions are still growing in number, but for the first time, the growth is primarily driven by “anti-ESG” proponents. Overall support for ESG proposals stayed flat in 2024 at 23%.

- Resolutions seeking to bolster shareholder rights were popular, leading to a rebound in support for governance-focused proposals, from 30% in the 2023 proxy year to 34% this year. The decline in shareholder support for environmental and social resolutions continued in 2024, but it appears to be slowing. Average support for environmental and social resolutions fell to 16% this year from 19% in the 2023 proxy year.

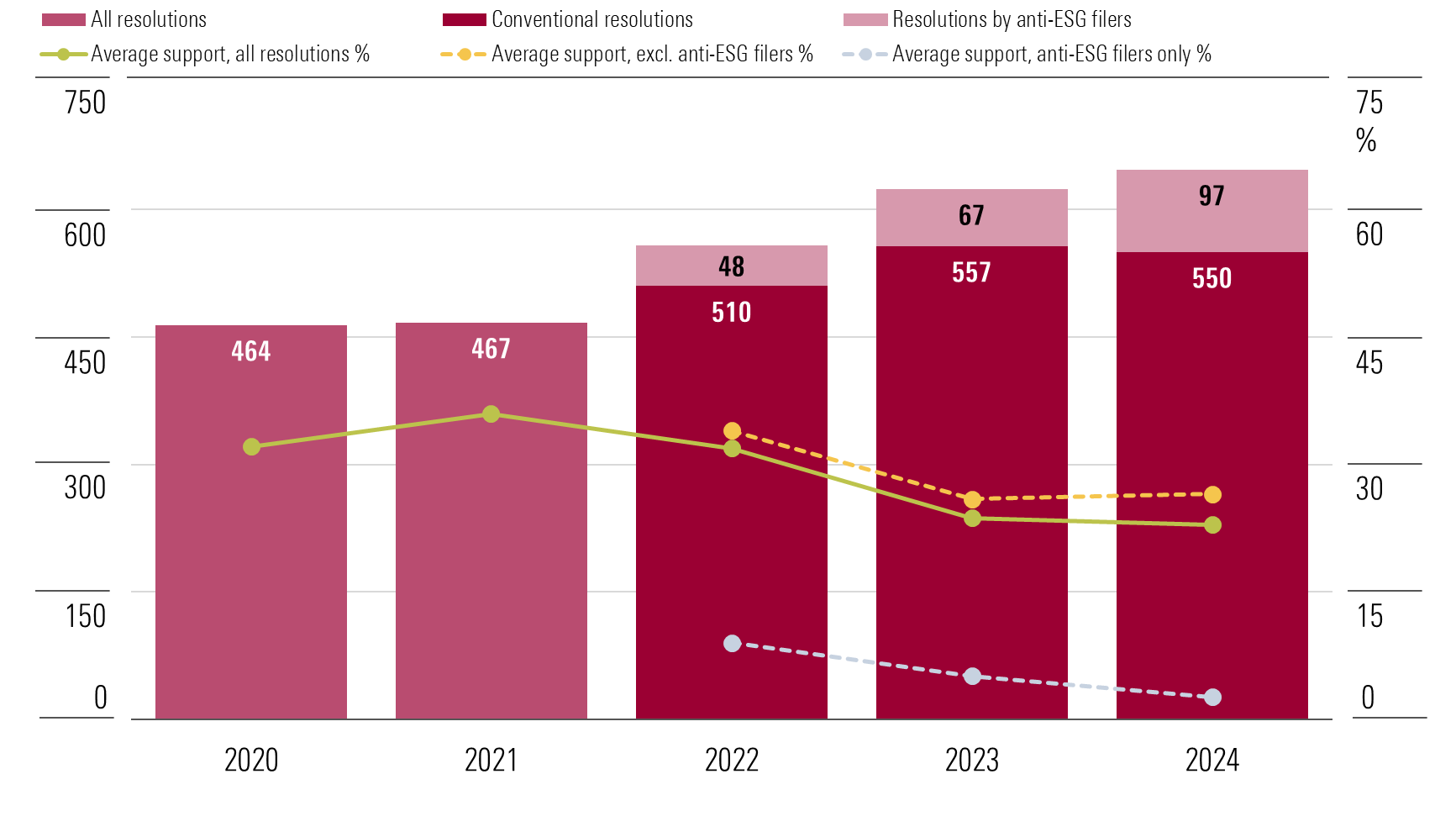

1. ‘Anti-ESG’ Drives Overall Volume Growth

We’ve seen steady growth in the number of ESG shareholder resolutions since 2022, after the SEC eased some of the restrictions on which kinds of resolutions could be filed. That growth continued in 2024, but at a slower pace compared with the previous years.

According to the Morningstar proxy-voting database, the number of ESG shareholder resolutions voted on at US companies grew by 23, or 3%, in the 2024 proxy year. This represents a slowdown from 12% in the 2023 proxy year and 19% in 2022.

But there was a twist in the tale this year. For the first time, the growth in new resolutions was dominated by proposals from “anti-ESG” filers—those seeking to advance strongly conservative, or net-zero-skeptic social policy aims.

ESG Resolutions: Volume and Average Support

As shown on the chart above, the number of resolutions by anti-ESG filers increased to 97 in the 2024 proxy year, from 48 in 2022 when they first started to appear in number. Despite their rising volume, shareholders appear uninterested in these proposals. In 2024, they averaged only 3% support, falling from 9% two years prior. But, having seen over 200 such proposals voted on in three years, it’s reasonable to conclude that their point is to gain attention rather than shareholder support.

Average support for ESG resolutions overall appeared to stabilize in the 2024 proxy year at 23%, or 27% excluding anti-ESG. This comes after two years of decline from a 2021 peak in support at 36%. But, as the next chart shows, that stable average this year is a blend of two very different populations of votes.

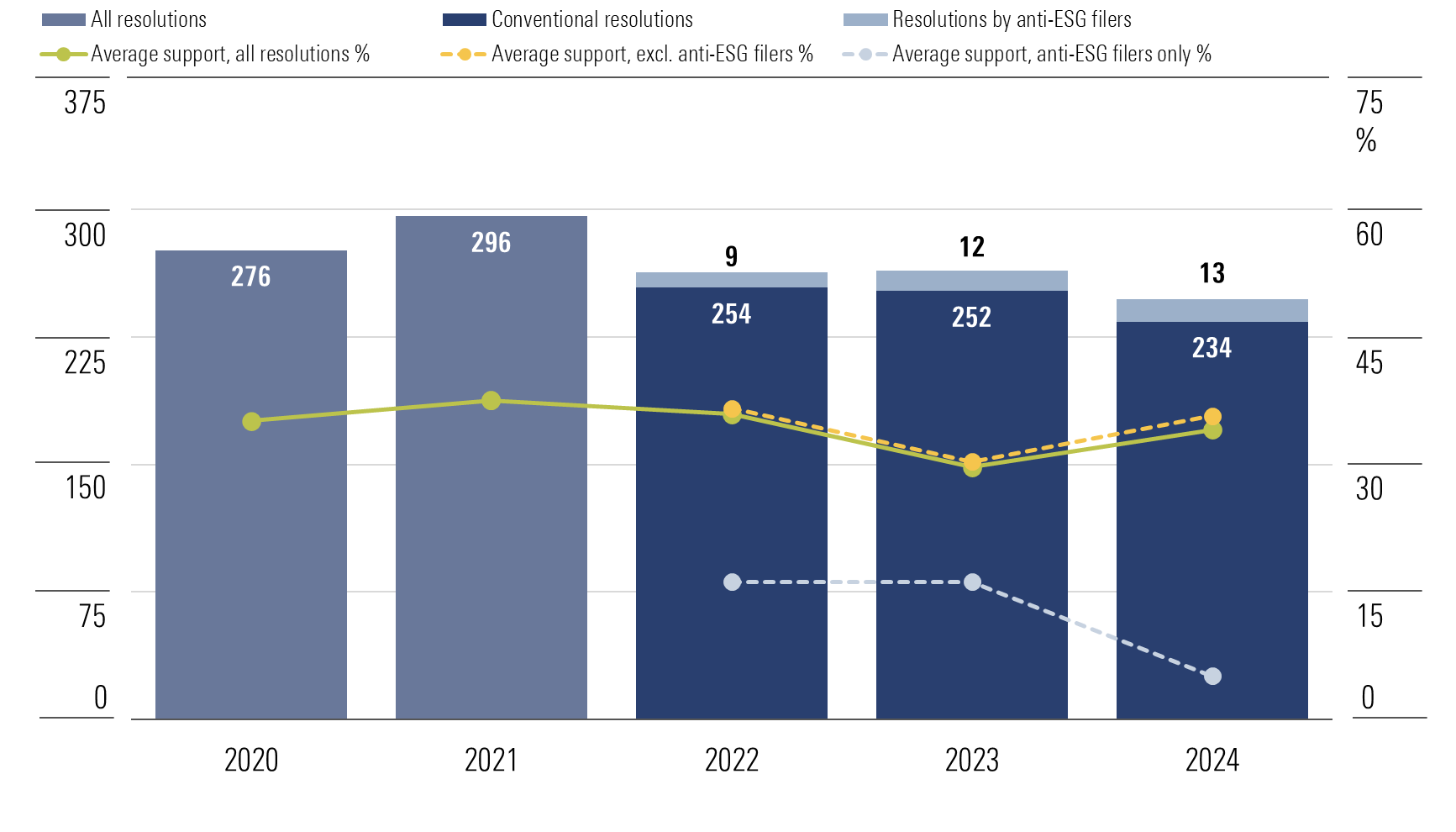

2. The G in ESG Makes a Comeback

Corporate governance has long been the primary focus of annual shareholder meetings, so many shareholders will cheer the rebound in support for governance-focused proposals in 2024, shown on the chart below.

Governance Resolutions: Volume and Average Support

The number of governance-focused shareholder resolutions has decreased in recent years, such that since 2022, they have comprised less than half the total number of shareholder proposals each year.

Average support for these proposals also fell over the same period, from a 2021 proxy-year peak of 37% to a low of 30% in 2023. The average jumped back up to 34% in 2024 because of a large number of very well-supported proposals focused on safeguarding shareholder rights. We’ll examine this trend in more depth in future research.

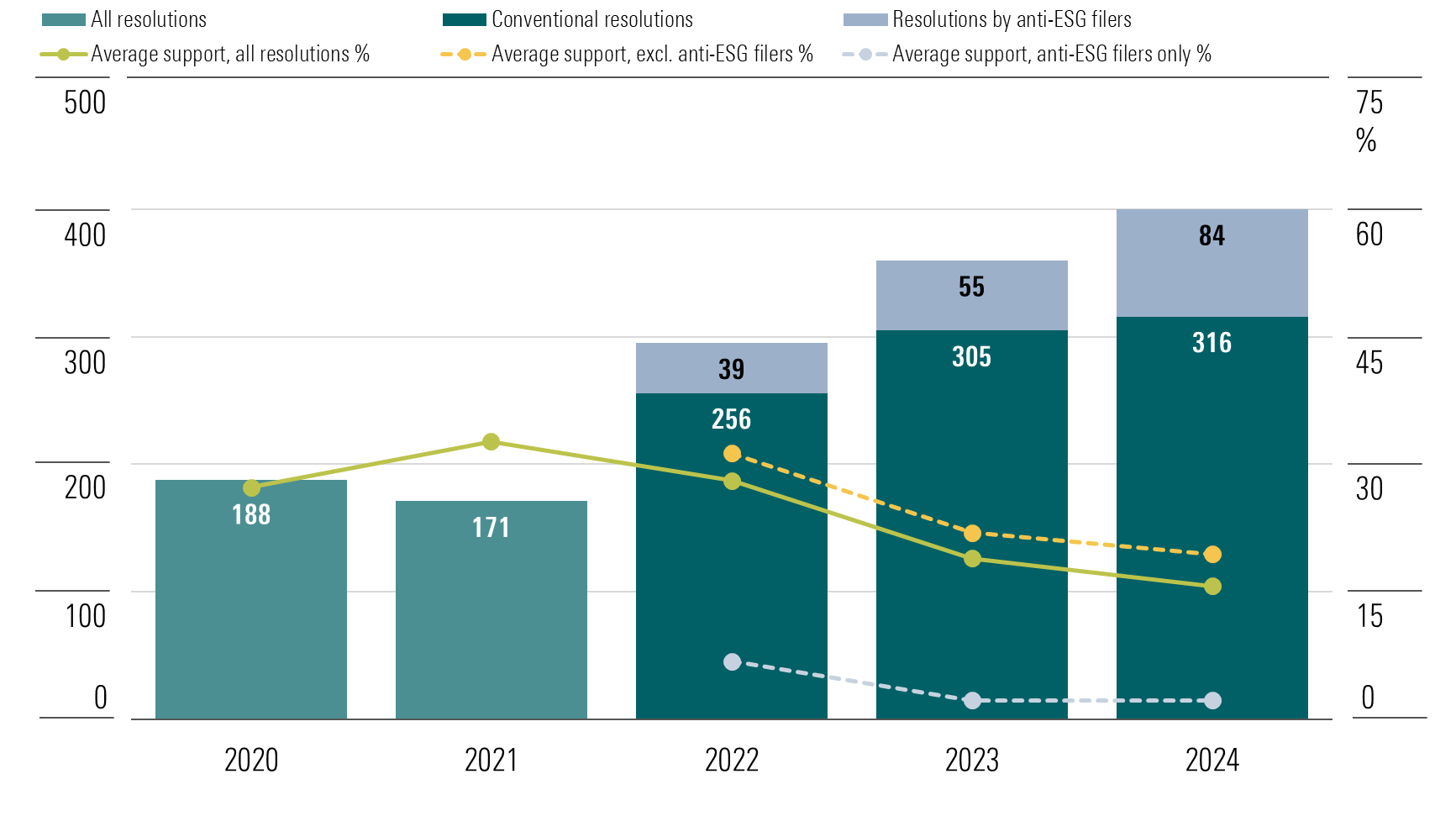

3. Decline in Support for E&S Proposals Slows

Overall, the rise in shareholder support for governance-focused resolutions was canceled out by a continued, but slowing, fall in support for those targeting environmental and social outcomes.

This comes amid signs of increasing exasperation on the part of some targeted companies, the most prominent example being Exxon Mobil’s XOM unprecedented decision to sue two “serial proponents” of environmental and social resolutions that it accused of “abuse” of the proposal system.

Exxon’s move was condemned by several institutional shareholders—including CalPERS and Norges Bank, two of the largest—as an attack on both sustainability and shareholder democracy. However, this year’s voting results indicate that other such shareholders may think that Exxon had a point regarding the growing number of environmental and social proposals with contestable aims.

E&S Resolutions: Volume and Average Support

As the chart above shows, the continued fall in support for environmental and social proposals is not solely down to a growing number of poorly supported anti-ESG resolutions.

Average support for environmental and social resolutions as a whole fell to 16% in proxy-year 2024, down from 19% last year and 28% in 2022, and having halved from a peak of 33% in 2021. In each of the last three years, though, excluding resolutions filed by anti-ESG proponents has the effect of raising average support for environmental and social proposals by 3 percentage points.

Last year, BlackRock and Vanguard—along with several other large, but less vocal, asset managers—lamented a high volume of what they perceive as “low quality” or “redundant” environmental and social resolutions, both pro- and anti-ESG. Based on this year’s data, it looks safe to assume that they still hold that view. We’ll know for sure at the end of the summer, when annual proxy-voting records are published.

There are important hidden trends, too. Stay tuned for our analysis of those in a forthcoming article.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FPI4DOPK5VFUNIOGY5CVTI6NCI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKF5TFZDABBAHA6TLTRJH2OZHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)