Investors Ask Amazon to Explain Working Conditions

With proxy season looming, group refiles proposal after the retail giant refused to engage last year.

Amazon.com AMZN is being asked by investors to provide an independent report on working conditions for warehouse employees. The same proposal, filed by Tulipshare, the activist investor platform, won 44% of the vote at the company’s 2022 annual meeting.

Tulipshare refiled its proposal because Amazon failed to proactively engage with it about its requests, it said in a news release. Tulipshare is a London-based investment platform that operates through a mobile app. Retail investors can buy stocks for as little as GBP 1, and Tulipshare leverages the collective shares to file proposals at various companies.

“Despite decades of criticism over the treatment of Amazon employees, precedent-setting unionization efforts led by the company’s workers, and a strong turnout of investors pushing for change at the company, Amazon’s board and executive team has failed to proactively engage with Tulipshare on this issue,” the advocacy group said. It added that Amazon initially tried to exclude the proposal from the proxy ballot, but the SEC rejected Amazon’s no-action request, “setting a huge precedent for ‘human capital management’ proposals.”

When contacted for comment, Amazon said that it had responded to Tulipshare every time it had written to the company, and in fact Tulipshare has not responded to Amazon. The company further pointed to its 2022 Proxy Statement, which said, “We believe that effective corporate governance includes year-round engagement with our shareholders and other stakeholders. We meet regularly with both large and small investors to discuss business strategy, performance, compensation philosophy, corporate governance, and environmental and social topics. This direct engagement helps us better understand our shareholders’ priorities, perspectives, and issues of concern, while allowing us to elaborate on our many initiatives and practices and to address the extent to which various aspects of these matters are (or are not) significant given the scope and nature of our operations and our existing practices. We take insights from this feedback into consideration and regularly share them with our board as we review and evolve our practices and disclosures.”

Tulipshare maintains that Amazon has failed to have meaningful engagement around its proposal.

Results of Vote on Amazon Working Conditions

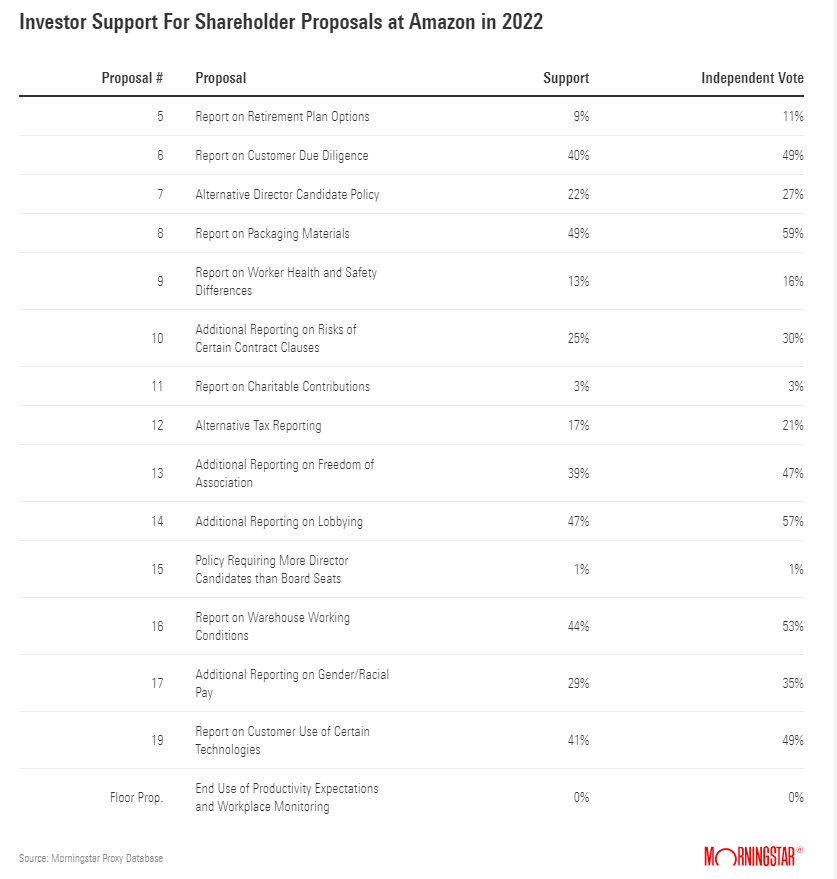

The 44% support earned at the company’s 2022 annual meeting of shareholders represented 53% of the independent vote after accounting for Amazon founder Jeff Bezos’ 9.8% stake in the company. The proposal was one of five that received 40% or more of support, including requests for reports on customer due diligence, packaging materials, lobbying, and customer use of certain technologies.

Typically, companies meet investors whose proposals receive wide support. “If investors feel unheard, this raises a governance red flag that can spill over into votes against board nominees or pay approval,” said Jackie Cook, director of stewardship and product strategy and development at Morningstar Sustainalytics. “Companies definitely want to avoid this. But an enlightened board will want to hear from investors, put their position across and also learn.”

Without Bezos’ vote, most of the proposals that received 40% or more of support would have passed with a majority. To highlight the difference Bezos’ votes made to the outcome, take a look at the overall support versus the independent vote in the table below.

What does all this mean for proxy voting as a tool and the interests of Amazon shareholders? With the proxy-voting season poised to begin, Morningstar talked to Tulipshare CEO Antoine Argouges about why Amazon’s decision to decline its meeting request is important, and what’s next from here. The following is an edited excerpt of the conversation.

Ruth Saldanha: Why has there been a lack of interest in engagement from Amazon?

Antoine Argouges: While we can’t speak for why Amazon has failed to have meaningful engagement around our proposal, we’re here to engage with Amazon to understand its strategy on addressing these issues so we can help uncover a path forward that focuses on increasing Amazon’s ESG credentials and long-term value for its shareholders. Companies with better ESG credentials have more-stable cash flows and a lower chance of going bankrupt and are more resilient to external ESG shocks like tightened regulations. Given all that has happened in the past year at Amazon, we were hopeful that Amazon would engage more meaningfully around this issue, but sadly they have not.

Saldanha: How are you reading the increased attempts at unionization at Amazon’s facilities?

Argouges: Increased unionization at Amazon’s facilities increases the reputational risk of the company as it is shining a light on the fact that its workers aren’t being heard. This, paired with Amazon’s extreme annual employee turnover rate (as a result of their current human capital management system), poses even further financial risk to shareholders. This is a huge issue that cannot be ignored.

Saldanha: How should investors view this issue of insider controlling votes? Can they do anything about it?

Argouges: Investors need to work together and be more transparent earlier on around their views. I think the challenge today is that there are so many investors one needs to engage with, it’s hard to uncover all of the proposals ahead of the annual general meeting, and lastly, retail voting is on the rise, meaning there are even more investors that need to be considered.

I think it’s becoming more important for larger institutions to be transparent about their voting guidelines as well as in considering the views of their underlying investors.

However, retail investors should feel confident that they can exert their own influence, the rise in engagement in shareholder proposals signals that retail investors do have real power.

Saldanha: Why is Amazon’s failure to engage with you important?

Argouges: Amazon’s failure to engage reflects extremely poorly on [Amazon CEO] Andy Jassy and even more so on Amazon’s board. Amazon’s owners are its investors. Instead of proactively engaging, coming up with a plan to address concerns, and building trust with their investors, it’s as if Amazon has looked to ignore them. As it relates to our proposal more specifically, no meaningful change has happened this year—in fact, it has gotten worse—and investors are beginning to feel the pinch as Amazon’s ability to retain its employees is falling apart.

There are also clear parallels here as Amazon is not listening to its employees, which is why they’re resorting to unionization. Similarly, Amazon is not listening to its investors (or shareholders), given there were a record number of proposals filed last year with the near-majority proposals refiled this year.

Saldanha: What does this mean for proxy voting as an engagement tool?

Argouges: Proxy voting remains a good tool for engaging with companies. The decision from Johnson & Johnson JNJ earlier this year to end the global sales of its talc-based baby powder following shared calls from both investors and campaigners after warnings that the product was linked to cancer, is just one example of how this can be effective.

However, the industry as a whole is in need of a shakeup, and we believe this level of change is beginning to happen.

The rise of retail investors is changing this, and when retail investors leverage their collective power and come together, they can have a real impact and make companies engage. We hope that companies will continue to listen more to their retail investors.

Year over year, shareholder proposals have been on the rise, and each year individuals become increasingly aware of the power the private sector holds, and further, the reality that investors are the owners of public companies. Thus, the way companies engage with their investors must shift as a result.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/52a57b68-8d99-4364-96af-9ffc6a124531.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JPJHXR5CGSNR4LKQF5ZKLCCVYQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KWOIHC3SK5CHJPXXNSL3RJ7VPQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/52a57b68-8d99-4364-96af-9ffc6a124531.jpg)