ESG Funds Bleed Less Money in Q2 2024

Redemptions from US sustainable funds continue but are down by half from the first quarter.

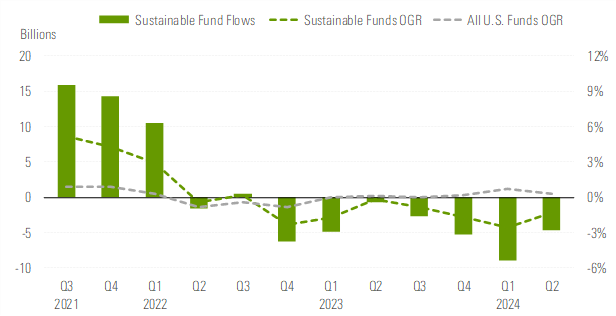

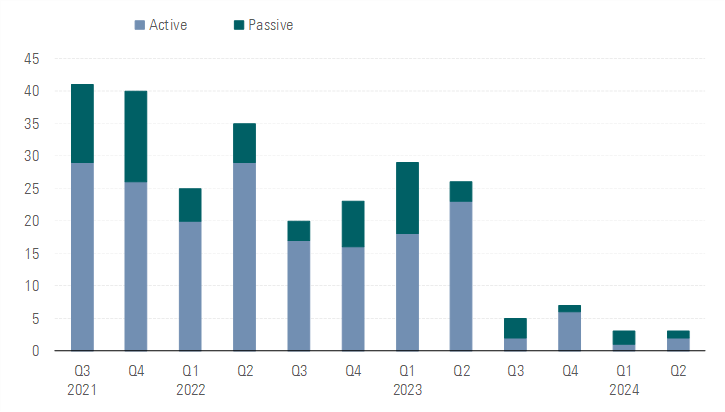

Investors pulled $4.7 billion from US sustainable funds in the second quarter of 2024, making it the seventh-consecutive quarter of outflows. These outflows, however, were half of those experienced in the first quarter, which amounted to almost $9 billion.

Meanwhile, the overall US market of funds posted organic growth of 0.3% in the past three months, after expanding by 0.7% in the first quarter of the year. (Quarterly organic growth is calculated by dividing quarterly flows by assets at the beginning of the quarter.)

US Fund Flows: Sustainable Vs. All US Funds (USD Billion)

Although the motivations behind outflows cannot be precisely quantified, several key factors contribute to this trend. These include high interest rates, which have made alternative investment options more appealing and diminish the attractiveness of sustainable funds. Additionally, the mediocre returns of sustainable funds in 2023 have led to investor dissatisfaction and subsequent withdrawals. Concerns about greenwashing have also contributed to reduced investor confidence, as skepticism grows regarding the genuine sustainability credentials of some funds. Furthermore, the increasing politicization and regulatory scrutiny of ESG investing have prompted some investors to reevaluate their positions, resulting in further outflows.

Active ESG funds experienced outflows of $3.7 billion in the second quarter, which is $1 billion less than the redemptions recorded in the previous quarter. Similarly, outflows from index-tracking products slid to $960 million from the restated $4.3 billion of outflows in the first quarter.

ESG bond funds kept positive momentum with inflows of $320 million, down from the restated $868 million in the first quarter. Meanwhile, sustainable equity funds shed $4.7 billion.

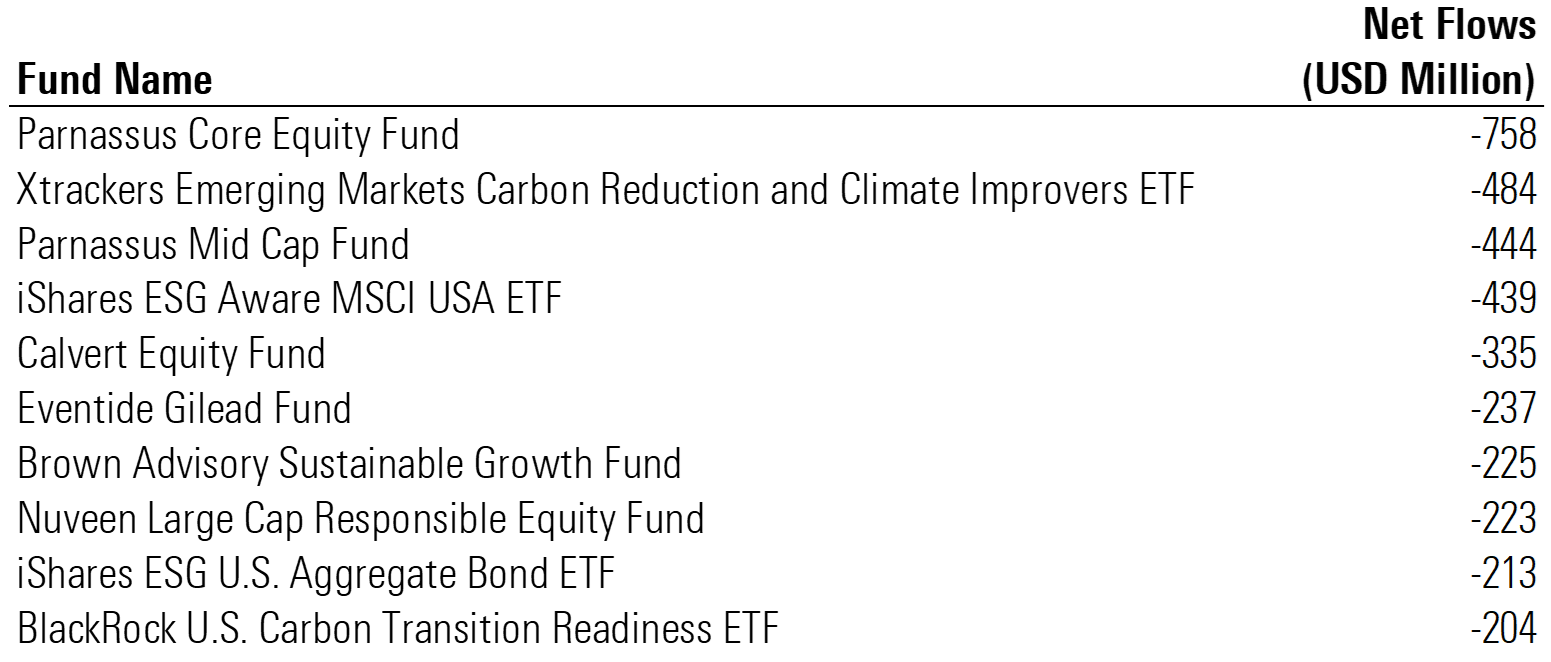

The Largest Sustainable Funds Extend Their Outflows

Topping the outflows table was Parnassus Core Equity Fund PRBLX, with redemptions of $758 million. Long known as the largest US sustainable fund, Parnassus Core Equity has been one of the 10 biggest losers in terms of redemptions for more than two years straight, shedding more than $5 billion over that period. Parnassus attributes a portion of the fund’s outflows to the launch of a less expensive collective investment trust and the subsequent conversion of investors from one vehicle to the other. Our data includes only open-end and exchange-traded funds. Parnassus Core Equity Fund focuses on large-cap US companies with sustainable competitive advantages, quality management, and positive ESG performance.

It is followed by Xtrackers Emerging Markets Carbon Reduction and Climate Improvers ETF EMCR, which bled $484 million in the last quarter. The fund focuses on companies that operate in accordance with market standards on ESG controversy screens, emphasizing sustainability and climate improvement.

Bottom 10 US Sustainable Fund Flows

Meanwhile, iShares ESG Aware MSCI USA ETF ESGU suffered net withdrawals of $439 million, after bleeding $1.8 billion in the previous quarter. The fund experienced outflows for a sixth-consecutive quarter. In 2023, iShares ESG Aware MSCI USA ETF experienced outflows of more than $9 billion. The fund favors stocks with high ESG ratings.

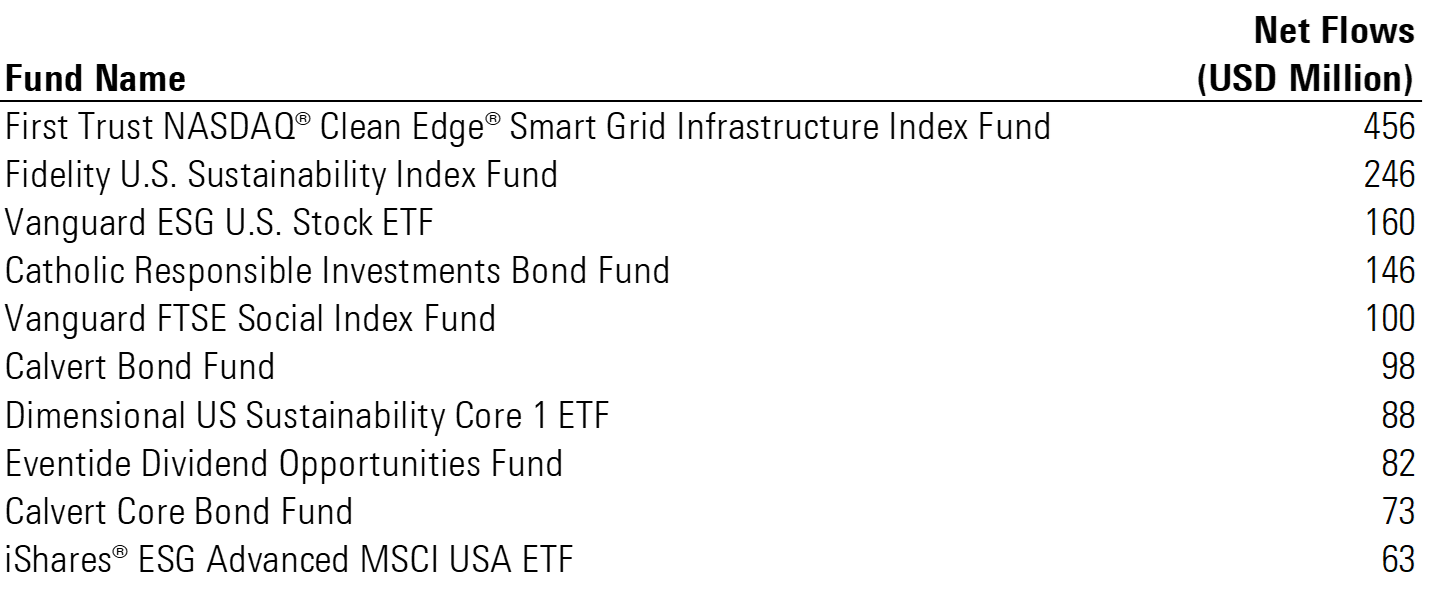

Leaders and Laggards for Q2 Flows

The sustainable fund that collected the largest net flows for the second quarter was First Trust Nasdaq Clean Edge Smart Grid Infrastructure Index Fund GRID, which garnered $456 million. This fund employs a modified market-capitalization-weighting methodology, emphasizing companies engaged in significant smart-grid-related activities.

Next was Fidelity U.S. Sustainability Index Fund FITLX with $246 million in inflows, after collecting more than $430 million in the previous quarter. The fund invests in US companies with high ESG performance relative to their sector peers.

Top 10 US Sustainable Fund Flows

Vanguard continues to have two funds in the bestselling league table: Vanguard ESG US Stock ESGV and Vanguard FTSE Social Index Fund VFTNX. The duo gathered $260 million in the second quarter, after attracting $512 million in the previous quarter.

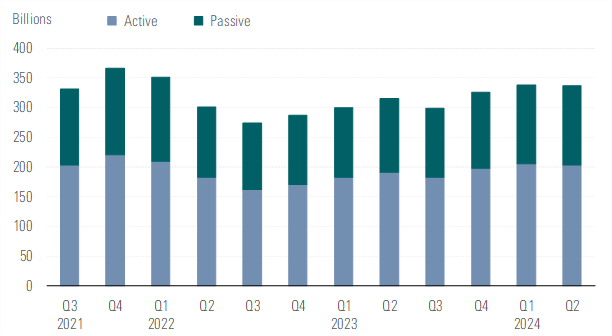

Assets in Sustainable Funds Remain Roughly Unchanged

In the past three months, assets in US-domiciled sustainable funds remained roughly unchanged at $336 billion at the end of June 2024, helped by market appreciation.

US Sustainable Fund Assets (USD Billion)

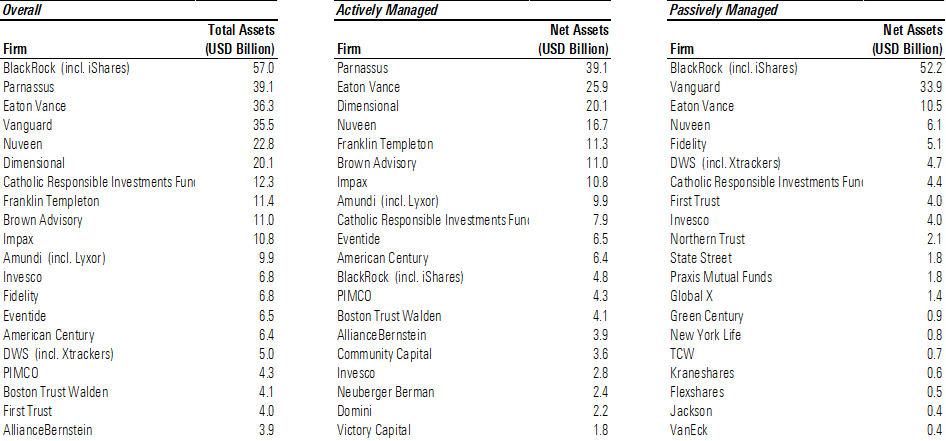

BlackRock, Parnassus, and Eaton Vance Are the Top Managers in the Space

Below, we list the top asset managers that are marketing sustainable funds in the United States. BlackRock, the world’s largest manager, tops the list, with $57 billion of assets in ESG-focused open-ended assets and ETFs, at the end of the second quarter. It is followed by Parnassus and Eaton Vance, which includes the Calvert brand, with approximately $39 billion and $36 billion, respectively.

Top Asset Managers by Sustainable Fund Assets in the US

Still Few New Sustainable Fund Launches

The second quarter of 2024 mimics the first quarter, with three new sustainable fund launches.

US Sustainable Fund Launches

Carbon Collective Short Duration Green Bond ETF CCSB focuses on sustainability by investing primarily in investment-grade green or sustainable corporate bonds with an average duration of five years or less. The fund includes bonds that are either self-labeled as green, in line with International Capital Markets Association guidelines, or certified under the Climate Bond Standard.

Invesco MSCI Global Climate 500 ETF KLMT focuses on companies that minimize exposure to physical and transition risks associated with climate change, including those achieving benchmarks for yearly reductions in greenhouse gas emissions relative to their revenue.

Meanwhile, the second quarter saw 12 US sustainable funds being liquidated, including BlackRock Global Impact Fund (BGIMX), JPMorgan Small Cap Sustainable Leaders Fund (VSSLX), and Xtrackers S&P Small Cap 600 ESG ETF (SMLE). The former focused on a wide range of SDG themes, including affordable housing, education and training, green energy, pollution remediation and prevention, as well as sustainable food. Furthermore, ClearBridge All Cap Growth ESG ETF (CACG) and Abrdn Emerging Markets Sustainable Leaders Fund (GIGSX) have been merged with other ESG strategies offered by the same managers.

Regulatory Update

There were no regulatory developments in the United States to report in the second quarter. Climate disclosure regimes (California SB 253 and 261 and the SEC) litigation is still pending. As a reminder, in September 2023, the State of California passed two bills requiring public and private companies to disclose their greenhouse gas emissions (Senate Bill 253) and climate-related financial risks (SB 261) based on a company’s size. While the requirements will not take effect until 2027, investor and regulatory groups have begun to file lawsuits seeking relief from the two bills. On Jan. 30, 2024, groups such as the US Chamber of Commerce, the California Chamber of Commerce, and the American Farm Bureau Federation filed a complaint in the Central District of California against the two bills, arguing that the laws violate the First Amendment by forcing companies to engage in costly speech on climate change. Although these lawsuits seek to challenge only SB 253 and SB 261, the impending ruling may have a broader implication for the SEC’s proposed climate disclosure rules.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FPI4DOPK5VFUNIOGY5CVTI6NCI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKF5TFZDABBAHA6TLTRJH2OZHE.jpg)