The 60/40 Portfolio: Bonds Are So Back

High-quality bonds show their mettle during recent market volatility.

Investors worried that the classic 60/40 portfolio is broken can breathe a sigh of relief—for now. During the stock market selloff that rocked portfolios for the first week of August, high-quality bonds returned to form and delivered the type of defense investors had grown accustomed to before the nearly four-year-long bond bear market. It was a short stress period, but the results are encouraging for investors who have stuck with the 60/40 portfolio through its recent diversification struggles.

From Aug. 1 through Aug. 5, the Morningstar US Market Index plunged 6.3%. The selloff was more notable for its speed than its depth. It was the worst five-day performance for the index since June 2022, when inflation fears peaked.

But for the first time in a long time, investors who owned high-quality bonds were rewarded during the volatility. The Morningstar US Core Bond Index rose 1.5% during the period as a flight to safety and the hope that the US Federal Reserve will cut interest rates this year boosted those bonds. As of Aug. 9, the odds of a 50-basis-point rate cut in September were over 50%, up from 3% a month earlier, according to CME FedWatch, which tracks the probabilities of changes to the bank’s overnight lending rate, as implied by 30-Day Federal Funds Rate futures prices. Interest rates fell in line with market expectations. For example, the US 10-Year Treasury Bond went from a yield of 3.99% to 3.78% during the market drawdown. When yields fall, bond prices go up.

Bonds Provide Shelter Again

Can Bonds Continue to Shake Off Stock Drawdowns?

The biggest question for 60/40 investors going forward is: Can they count on bonds to continue playing defense when volatility spikes?

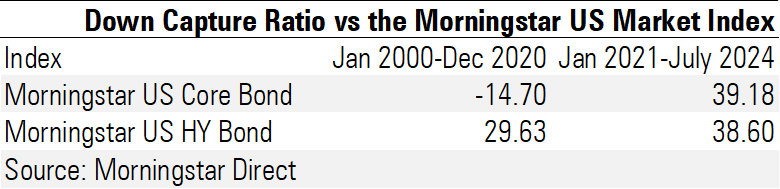

The exhibit below shows the down capture ratio for the US investment-grade and high-yield bonds compared with the Morningstar US Market Index. For nearly 20 years, investment-grade bonds averaged positive returns during months when US stocks lost money, but since January 2021, that’s reversed. The normally safe havens have done even worse than their riskier high-yield cousins.

Core Bonds' Tough Stretch

The Outlook

As my colleague Amy Arnott has noted, the biggest risk to stock and bond correlations is inflation. When inflation is higher than expected, interest rates typically go up, causing bond prices to fall, and stock valuations tend to react negatively to higher rates, too, as we saw in 2022. That’s been the crux of US core bonds’ diversification problem since the beginning of 2021.

The Road Rates Have Traveled

Going forward, with rates at a much higher point than they were at the start of 2021, and many signs pointing to rate cuts this year as inflation eases, it appears unlikely there will be another round of aggressive rate hikes that can throw core bonds off track.

Of course, that may be of little solace to investors if stocks continue to tumble. Bonds are not a panacea for a bear market, but when they are working as diversifiers, they can stem losses and help investors stick with their portfolios through rough patches, which could be the difference between reaching their long-term goals or not.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HBAEAVIJHFEBTPMEK2UMVQ3NFQ.png)

/d10o6nnig0wrdw.cloudfront.net/09-20-2024/t_2967a2ad4e954711b8ecfa5fefc0b298_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)