Why More Target-Date Funds Are Underweighting US Stocks Today

For funds from Vanguard, Fidelity, and others, home bias has nearly vanished.

There used to be no place like home for target-date funds. After more than a decade of US stocks outperforming the rest of the world, however, target dates’ long-held home bias has nearly vanished—and some of the largest series are now underweight US stocks relative to their global market cap.

With more than $3.8 trillion in assets, target dates are one of the most popular ways investors save for retirement. These set-it-and-forget it funds are popular for a good reason: They make it easy for investors to access a professionally managed portfolio that gradually reduces risk until, or sometimes through, retirement at a low cost for investors who otherwise might not be able to afford it.

Home Sweet Home

One of the distinguishing features of target-date funds has been their large exposure to US stocks relative to their weight in global equity markets. Having a home bias, or overallocating to local stocks, is a common phenomenon across the globe. In July 2014, for example, the average 2050 target-date fund had 67% allocation to US equities [1]. Meanwhile, the US stock weight in the Morningstar Global Target Market Exposure Index was 48%. It’s worked well for US investors, even as having a large home bias has met its fair share of criticism. One common theory for why home bias exists is that investors like owning what they know, and they know their home markets the best.

For US target-date investors, that 18-percentage-point overweight has been a huge tailwind for returns, as US stocks have been exceptional performers relative to the rest of the world since then. The exhibit below shows the growth of a $10,000 investment in the Morningstar US Target Market Exposure Index and Morningstar Global ex-US Target Market Exposure Index over the last decade.

US Stock Outperformance Has Been Staggering

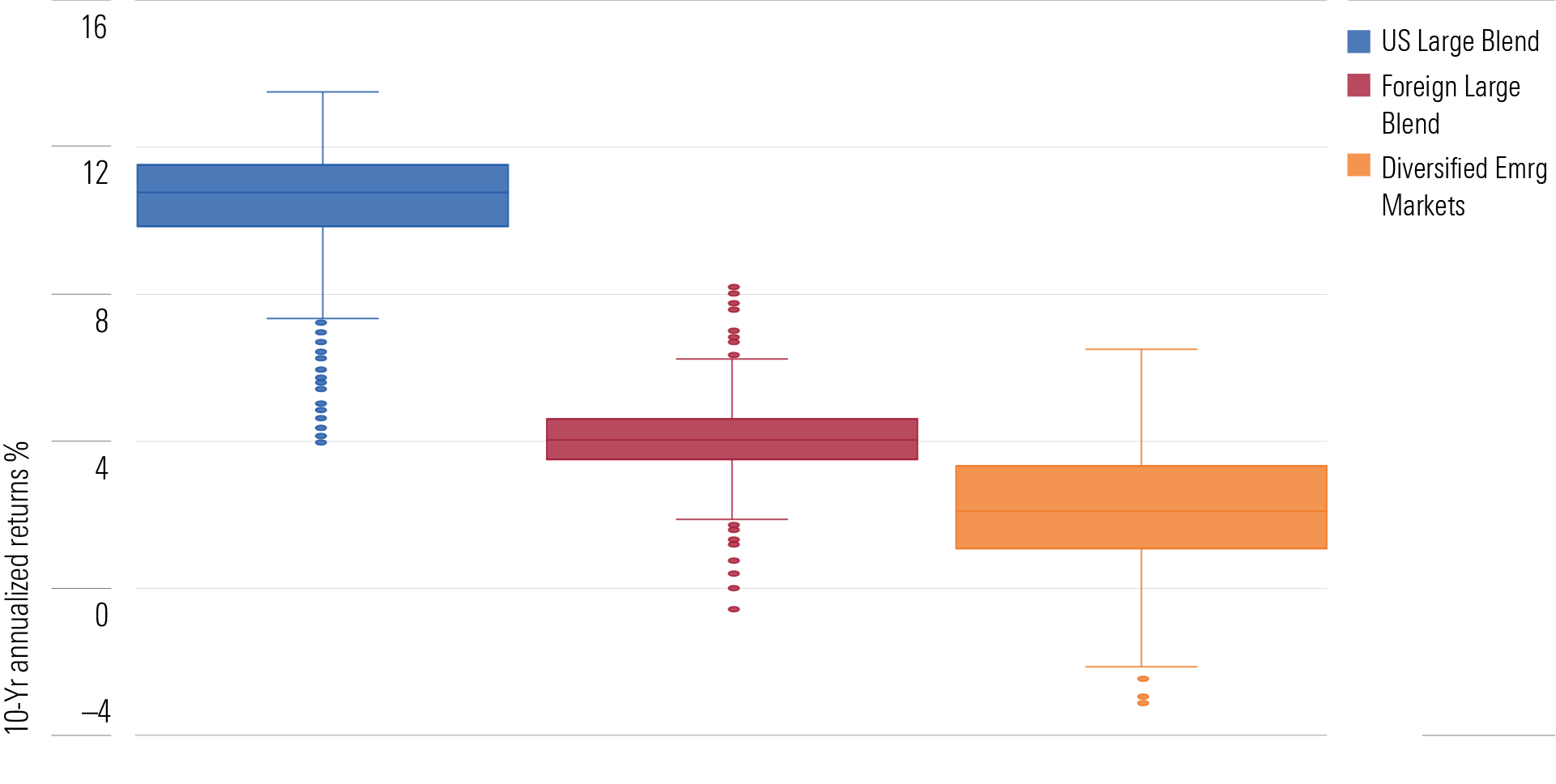

The Morningstar US TME gained 12.15% annualized over the decade ended June 2024, more than 3 times the 4.03% annualized return of the Morningstar Global ex US TME. Even selecting top-performing funds outside the US would have left investors behind. For example, the best-performing foreign large-blend and diversified emerging-markets funds over the same 10-year period trailed more than 90% of US large-blend funds. The next exhibit shows the dispersion of 10-year annualized returns for the three core building-block equity categories.

Equity Funds Outside the US Have Struggled to Keep Up

3 Must-Knows Before Investing in Target Date Funds with Annuities

As the World Turns

While US stocks have surged, the average target date’s exposure to US stocks has stayed relatively the same. As a result, the massive outperformance of US stocks has practically wiped out the average target date’s home bias, as shown below.

The Disappearing Home Bias

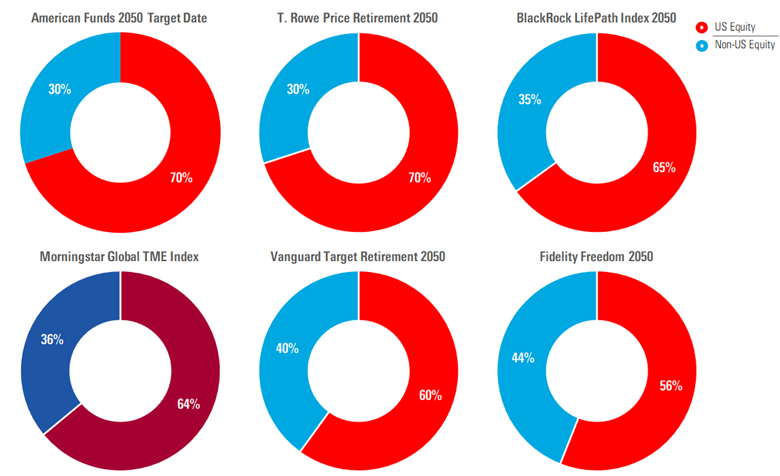

Most target-date series have kept their US stock allocation steady as they have become a larger part of the global stock market. There are some notable exceptions, though. Vanguard Target Retirement, the largest target-date series, reduced its strategic US stock exposure to 60%, from 70%, in 2015. At the time, 60% was still a significant home bias. In 2019, Fidelity’s lineup of target dates followed suit; its Freedom series, the fourth-largest target-date series, also includes the team’s tactical views, which have also been bearish on US stocks in favor of non-US stocks. As a result, it was one of the series with the largest underweighting to US stocks at the end of June. Exhibit 4 shows the breakdown of the five largest target-date series’ 2050 funds’ stock portfolios.

The 5 Largest Target-Date Series' Home Bias

Among the top five, American Funds and T. Rowe Price continue to prefer US stocks more than their weight in the global stock market, while BlackRock is now about even. American Funds’ stock exposure is more fluid than the others, as it’s driven by the views of their underlying managers that have greater flexibility to invest across borders than most peers. Like Fidelity Freedom, T. Rowe’s target-date managers can tactically adjust their exposure when they see opportunity, but the 70%/30% split is their starting point. BlackRock increases its US equity exposure as it gets closer to retirement, up to 67%, to damp the additional volatility international stocks may bring, particularly those in emerging markets.

Uncharted Waters

With target-date funds’ home bias largely gone, what does the future hold? If there continues to be a wide dispersion between the returns of US stocks and the rest of the world, regardless of which is winning, then how managers position their portfolios could have a bigger impact on whom the top performers are.

But remember, the stock portfolio is only one factor that affects target-date performance. How the managers change the overall stock allocation on the way to retirement is also important, and so is the composition of the bond portfolios. For the most part, target dates have maintained their strong bias toward US bonds there, but duration and credit risk can vary greatly between series.

In the long run, investors can still count on target dates to help them reach their retirement goals.

You can find Morningstar’s top picks for target dates here.

[1] To calculate the average target-date fund’s US stock exposure, we rescaled the equity portfolio of each 2050 100% to account for differences in the overall equity exposure between target-date funds.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NPR5K52H6ZFOBAXCTPCEOIQTM4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-24-2024/t_c34615412a994d3494385dd68d74e4aa_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)