It’s Been a Terrible Time for Bonds. Here’s Why You Should Own Them

Challenges in the bond market could set the table for stronger future returns.

Bonds provide diversification benefits and operate as a defensive anchor in portfolios. But lately, it feels more like bonds specialize in delivering pain.

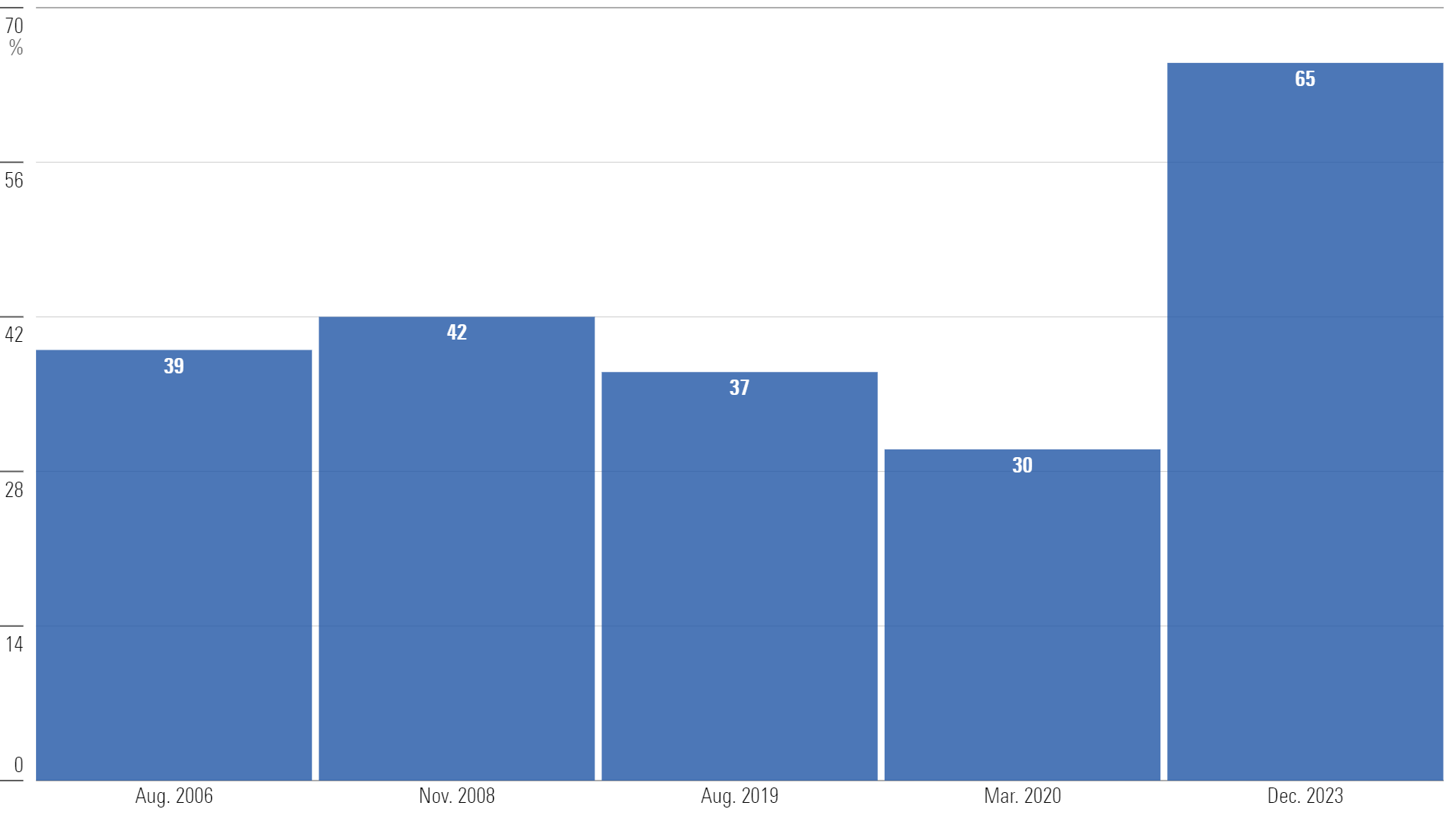

It’s been 46 months since the bond market made a new all-time high, as the drawdown stretches out to almost four years. It could be argued that we’ve been living through the most difficult period in bond market history. We can see this by looking at the “maximum drawdown,” which represents the maximum decline in the bond market from peak to trough.

Bloomberg US Aggregate Bond Index—Drawdown Periods (1976-2024)

How are investors responding? In a word: capitulation. New dollar flows into cash - as measured by money market funds - broke records last year.

The flows into cash are a normal investor behavior, for the simple reason that nobody invests to lose money. It’s comfortable to earn a risk-free 5% in cash. It’s uncomfortable to live through a multiyear bond bear market.

But a funny truth about investing is that what’s comfortable is rarely rewarding. And sometimes the most critical insight is not a unique one: Investing is about the future, not the past. Abandoning bonds now might be a bit like giving up on Steve Jobs when he was ousted from Apple in the 1980s.

There might be a second act!

The Case for Bonds

Investors should recognize that two realities might be true at once:

- It has been a terrible time for bonds.

- The damage inflicted potentially lays the foundation for better times ahead.

Why?

Let’s go back to July 2020 when bonds made their last all-time high. The rate on the 10-year Treasury was 0.64% at that time.

While the stock market is governed by cash flows and growth rates, the bond market is more heavily governed by math. Simple bond math tells us that a bond’s starting yield is about 90% predictive of returns five to 10 years from now.

Pimco’s chief investment Officer Daniel Ivascyn discussed this on a recent episode of Morningstar’s The Long View podcast, stating:

“Fixed-income is a less complicated segment of the financial markets than many other areas. The starting yield in a high-quality bond portfolio is usually a very reasonable floor as to what you’ll earn over a five-year holding period. If you have a high-quality [bond] portfolio earning 5%, 6%, 7% over the next five years, you have a very good shot of earning at least 5%, 6%, 7%.”

Dan Ivascyn

The prospects of strong future returns in July 2020, given the starting yields, were bleak.

The bond market was running out of room. Rates would have needed to push into negative territory to deliver meaningful returns to investors. And in that scenario, the equity market would have likely been suffering, as continued negative yields could have foreshadowed a recession-type event.

In short, something had to change.

The thing that changed was rates. They’ve now adjusted higher after an 18-month Fed tightening cycle. This, in effect, has potentially planted the seeds for the bond market to harvest better returns.

Predicting the direction and magnitude of interest-rate movements is a difficult thing to do. You could even argue it’s impossible.

As Yogi Berra once said, “Predictions are hard, especially about the future.” The quote was made in jest, but it holds some truth.

Interest rates are a great example. Entering the year, nearly 65% of all fund managers in the Bank of America manager survey predicted rates would fall before year-end. That’s the highest percentage in the history of the survey.

Fund Managers Expecting Lower Long-Term Rates

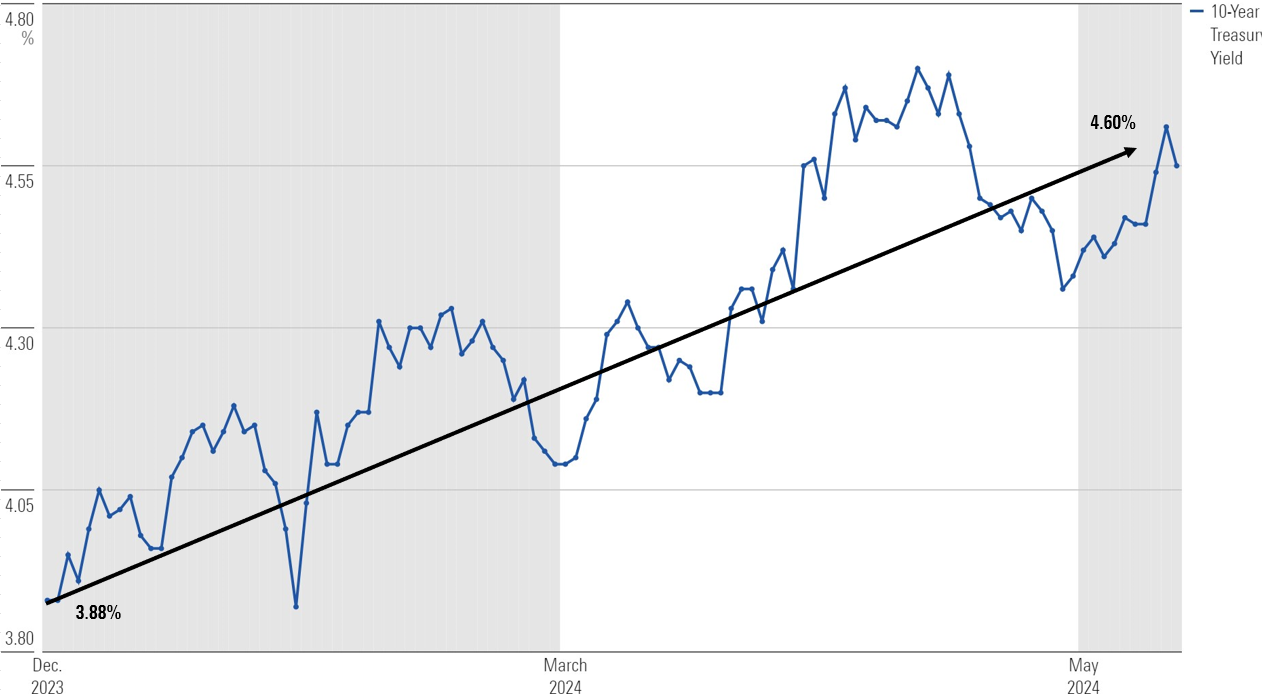

How does that prediction look? Not good.

The 10-year Treasury yield has risen nearly 70 basis points, from 3.9% in December to 4.6% through the end of May.

10-Year Treasury Yield

What’s the Bond Market Outlook?

Of course, much of 2024 has yet to be written. Rates could certainly end up below where they started the year. But it’s a stark reminder that investing based on a singular view is not a sound investment strategy.

There are no free lunches in this business. What appears obvious is not always correct.

While we do significant research into every corner of the bond market, we still understand that a range of outcomes exists.

What to do?

Like our approach to equities, we will remain diversified across the fixed-income asset class (short-term, intermediate-term Treasuries, and so on) and within the asset class (emerging-markets high-yield debt and US high-yield debt).

First, we would say that it is OK to have a base case. Having no understanding or opinion of what is driving the economy, inflation, or interest rates will leave you unprepared to react to new information and unable to take advantage of opportunities. But we believe you must pair that central path with:

- An understanding of valuations and what is priced in

- Robust scenario analysis

How are we thinking about positioning a fixed-income portfolio right now? We still like having dedicated exposure to the short end of the curve. The income there is appealing and will provide a cushion if the Fed is more hawkish than current expectations. However, the continued rerating of intermediate-term bonds has shifted the reward for risk balance, in our estimation. When we think about the potential paths forward for inflation, the economy, and monetary policy, and couple that understanding with current yield levels for intermediate-term Treasuries, we believe the range of outcomes favors taking on more duration than we currently have been. (Duration is a measure of interest-rate sensitivity in bonds. Longer-term bonds are generally more sensitive to changes interest rates than short-term bonds.)

While higher-for-longer may not be our base case, we are now being compensated for that risk, and the potential reward for our base case has increased. So, where we can, we have shifted some exposure from the short end of the curve to a more balanced exposure across different maturities. But we would not have been able to add duration now if we had not considered this possibility at the beginning of the year. So, preparing for multiple scenarios not only has an impact on our portfolios today, but it also puts us in a position to shift our allocations as a scenario plays out.

What about credit sectors? The reality is that spread sectors have held up well through this turmoil in the Treasury market. Fundamentals look good: Corporate balance sheets are strong, many companies have high levels of cash on hand, and they are displaying higher-than-average interest coverage despite increased rates. There is also a reduced need for them to borrow as many corporates termed out debt at historically low interest rates in 2020 and 2021. Of course, the market knows this and has priced it in, so the incremental return available by moving from Treasuries to investment-grade or high-yield corporates is near historic lows. In other words, corporate bonds are expensive, the potential for excess return is limited, and we would rather take risks in other spots.

(Credit spreads reflect the difference in yield between bonds of similar maturities but different credit ratings. Lower-quality bonds often require a higher yield premium to compensate investors for risk.)

For example, agency mortgage-backed securities are looking reasonably attractive, and we have focused our high-quality spread exposure within this sector. For lower-quality exposure, we prefer emerging-markets debt over high-yield corporates. Spreads look reasonable in the hard-currency space, and local-currency emerging-markets debt should benefit from potential dollar weakness when the Fed eventually lowers the policy rate.

Just as the high bond returns in 2018 and 2019 weren’t the new normal, the negative bond returns observed recently likely aren’t the new normal either.

Higher rates for longer might not be investors’ base case. After all, the market still expects multiple rate cuts over the next 18 months. But the recent rise in yields demonstrates just how unpredictable markets can be in the short term and how dangerous it can be to bet it all on one scenario.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2TUAYYD4PVBTFEBHVOLROKDOY4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QJ55VWEVNNCDRHHUYR5SOVC77U.png)