Why Do Clients Think Advisors Are Valuable?

Investors value advisors who attend to their financial and human needs.

In the past, I’ve likened a client’s view of a financial advisor to watching a duck swim across a pond. To the observer, it looks like the duck is effortlessly gliding across the water, but beneath the surface, the duck is rapidly kicking its webbed feet.

Similarly, an advisor is frequently hard at work doing things their clients will never witness. Unlike a duck, though, advisors face the additional difficulty of needing to demonstrate their value to their clients while much of the work that contributes to their value isn’t apparent to clients. This can lead to a mismatch between what clients think about an advisor’s work and what an advisor thinks. Therefore, advisors must understand what clients think an advisor’s value is so they can better highlight that value.

In our new report, we examined how investors value different capabilities of advisors. To uncover a holistic understanding of what investors think, we synthesize findings from three different measurements (ranking, willingness to pay, and open text) across four studies. Using different measurements allowed us to discover major themes in what investors value in an advisor, to help advisors better respond to them.

4 Main Things Investors Value in Advisors

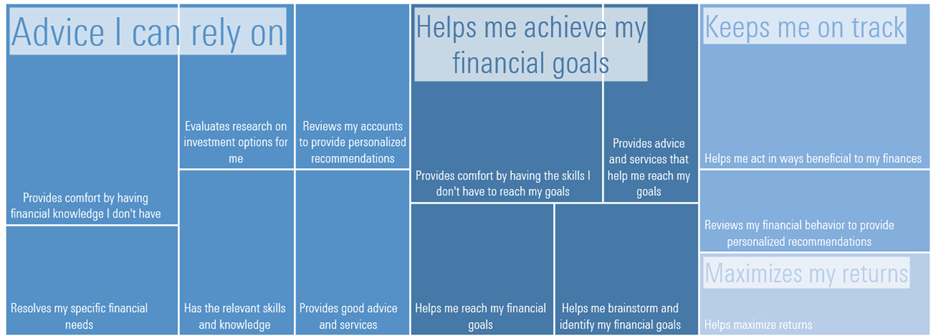

Based on converging evidence across the four studies, we identified four major themes that reflect what investors are looking for in their advisors:

- “Advice I can rely on.” Across all four studies, we found investors were looking for personalized financial advice that brings them comfort. Finances are a big cause of worry, and people often don’t feel they can handle their finances on their own, so they value advisors who bring them peace of mind.

- “Helps me achieve my financial goals.” Clients in all four studies also valued advisors who can help them articulate their goals as well as support them along the way to finally achieve these goals. People tend to invest for a reason (not just to have more money but to have the money they need to live out their dreams), so advisors who can help bring clarity to these goals and help them come to fruition are valuable to investors.

- “Keeps me on track.” In three of four studies, we found behavioral coaching was one of the most valuable things to investors. Though investors may not like the “behavioral coaching” label specifically, they recognize the need for help managing their financial habits, and they value advisors who can help them do so.

- “Maximizes my returns.” Though returns are often in the spotlight, we found only one study in which investors saw maximizing returns as a top value-add of advisors. Given the hidden nature of much of an advisor’s job, it’s not too surprising some investors may value something visible and measurable like returns.

Based on the evidence across the four studies, we created the “mind map” below to help advisors think about what clients value in their services. The size of each section of the mind map reflects how much evidence we found for each theme—the larger the section, the more evidence to support it.

Though all these concerns are worth addressing, keep in mind how much weight should be given to each concern based on the evidence. For example, though returns may show up in the mind map (they’re in the lower right corner), this section’s size compared with the other three values indicates it should receive less attention. Advisors may be better served by focusing on values that take up more space, such as “provides comfort by having the skills I don’t have to reach my goals.”

Mind Map of How Investors Think About Advisors' Value

How to Provide Clients the Value They’re Looking For

The next step is for advisors to use the findings in this mind map to demonstrate their value—especially when it comes to contributions that can be opaque to clients.

To that end, we recommend advisors keep the following in mind to show their value to clients:

Advisors should demonstrate their ability to tailor plans to clients’ needs. Investors are looking for advice they can rely on for their situation, but if they can’t see exactly how their needs and circumstances are considered, they may fear that they’re receiving cookie-cutter solutions. Therefore, advisors should find ways to pull back the curtain to show clients how your processes account for them as individuals. For example, when you present plans to clients, let them know the client-informed factors you accounted for, such as their risk tolerance, timelines for their financial goals, and so on. Clarity on how your advice relates to each client will build confidence in the advice you provide.

Advisors should highlight goals in their client interactions. Investors see goal achievement as integral to the value of an advisor, so advisors should bring goals to the forefront of each step of the financial planning process, not just during goal-setting conversations. For example: How should clients respond to new circumstances to get them to their goals? How should they view the market given their goal progression? By putting goals at the heart of interactions with clients, advisors can better demonstrate the unique value they bring.

Advisors should show (not tell) clients the benefit of behavioral coaching. Investors recognize advisors can help them make better decisions with their finances. Still, they can chafe at the concept of behavioral coaching when it’s not introduced properly because they don’t like the implication that they are prone to mistakes. Therefore, it’s necessary for advisors to thoroughly illustrate the value of behavioral coaching. For example, advisors may talk about how they serve as a sounding board for clients when they make decisions. This not only gives clients the sense of how an advisor adds value by supporting their decision-making, but also does so in a way that does not feel like a negative judgment on the client’s own abilities.

Advisors should address returns in a productive way. Some clients will inevitably see returns as a key value-add for advisors, so advisors must be prepared to help clients think about returns productively. One way to do so is to help clients set better expectations for returns by giving them a meaningful benchmark. For example, advisors may focus clients on benchmarks that track toward their goals instead of beating the market more generally. In doing so, advisors speak to the value that clients see in returns without catering to unrealistic expectations for maximum returns.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/57c62327-64fd-443e-8cd7-e0a2807bc566.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/A5UY22L42ZASPAW6OW75IQHR2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/SRXFRUTTFZGPPK6U6Y5EG4WGMY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/57c62327-64fd-443e-8cd7-e0a2807bc566.jpg)