The Number One Way Americans are Becoming Millionaires

The best investing may not always be thrilling.

Patience and discipline are easily understood but hard to put into practice. Investing serves as the perfect litmus test. One could reasonably argue that these two traits are among the most important factors driving long-term investment success.

The number-one way Americans become millionaires isn’t through timely real estate purchases or being early investors in startups. The formula is much simpler: consistent buying, usually in the form of automatic contributions from every paycheck into a retirement account.

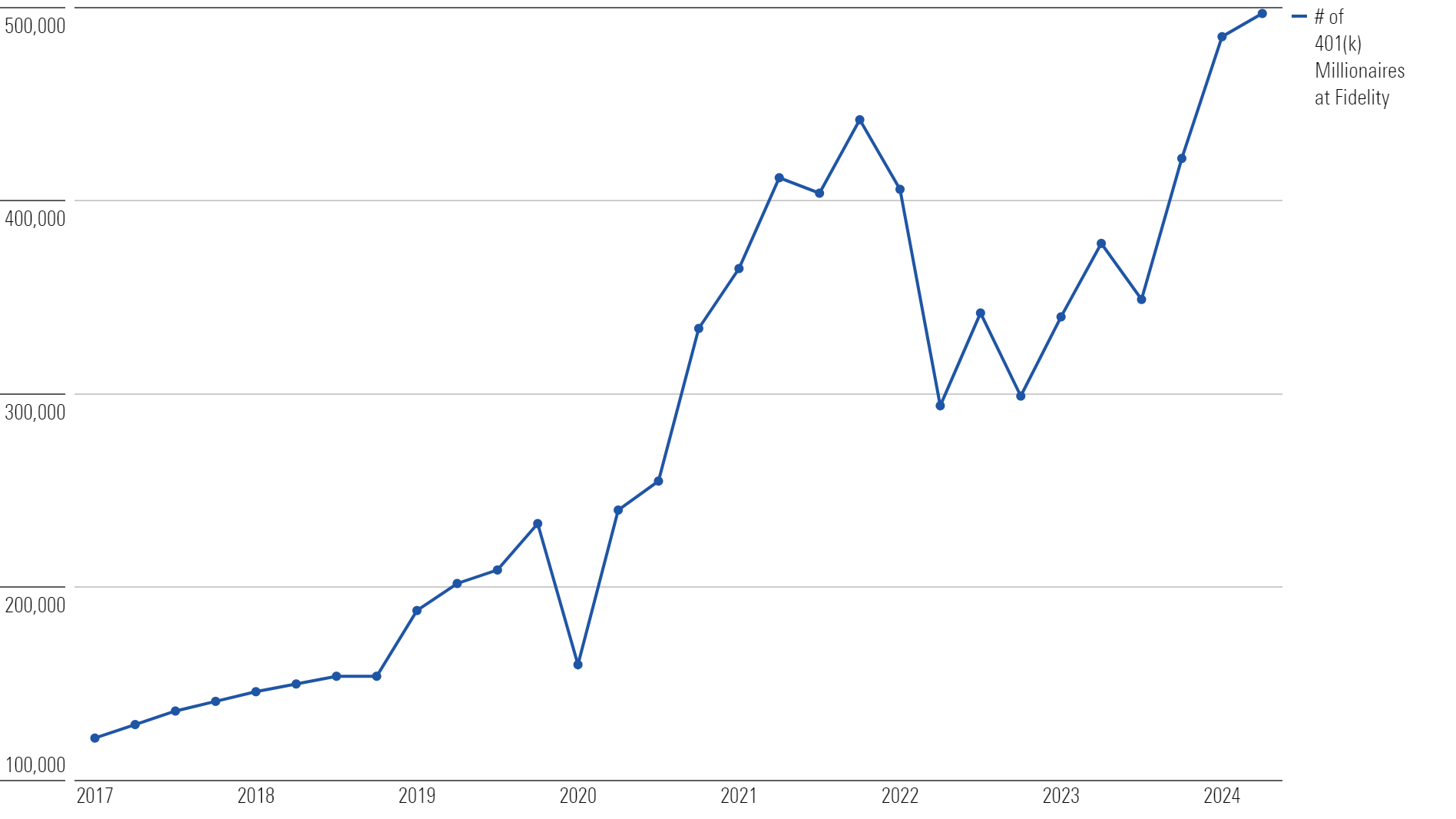

Look no further than a recent report from Fidelity, which shows that there are more 401(k) millionaires on its platform than ever before.

Number of 401(k) Millionaires at Fidelity

But the investing world is filled with distractions, and it’s easy to get tripped up. Rising markets often invite bad behavior, with some investors making no point of differentiation between the stock market and a casino.

One timely example is leveraged and inverse exchange-traded funds, which have surged in popularity. According to Direxion, a provider of these products, there are now more than 200 leveraged and inverse ETFs in the marketplace, managing approximately $100 billion in assets.

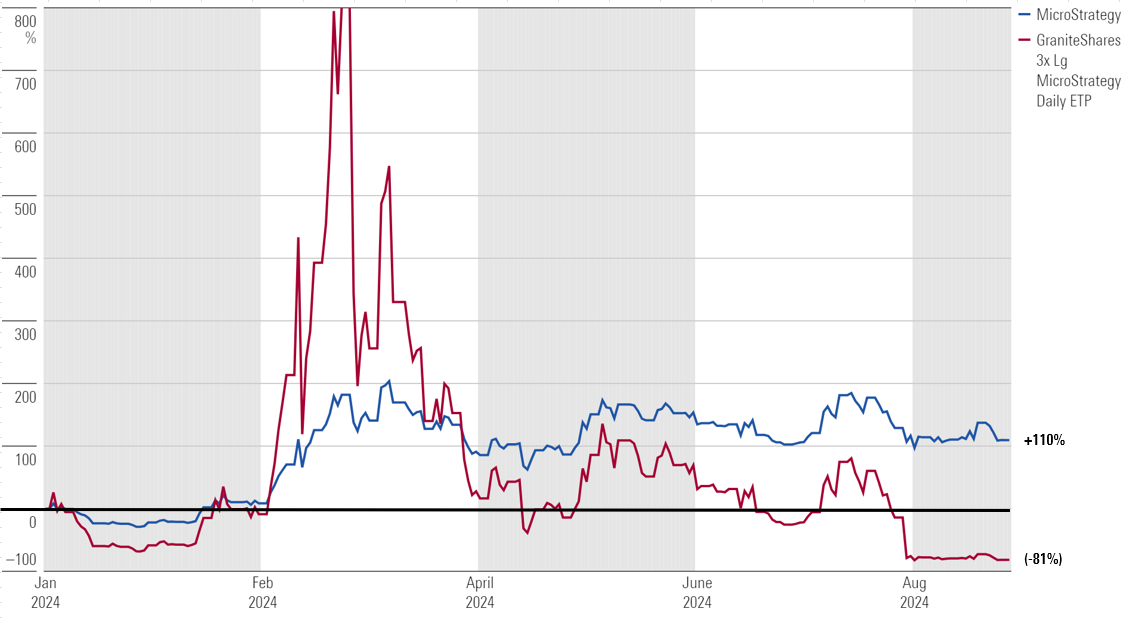

A recent Bloomberg story highlighted one of these investment vehicles that’s designed to give investors 3 times the daily return of MicroStrategy MSTR—a single stock that is often associated with bitcoin because it holds a large amount on its balance sheet.

MicroStrategy stock is up over 100% this year, yet the product that provides 3 times leverage to its stock price is down more than 80%.

Performance (YTD): MicroStrategy Share Price vs. 3x MicroStrategy Fund

How is that possible? Compounding works in reverse, too.

The answer lies in the mechanics of leveraged funds. These products are designed for short-term traders, not long-term investors. They aim to deliver multiples of daily performance, but over time, the compounding effect of daily resets destroys returns. Investors who jump into these funds seeking blowout returns are often left disappointed, trapped by the short-term fluctuations they sought to exploit. Instead of letting the market work for them, they chase quick profits. Unfortunately, the pursuit of fast money can spectacularly backfire.

On the other hand, the 401(k) millionaires stayed disciplined, purchasing stocks every two weeks through their retirement contributions, regardless of market conditions. Whether markets were bumpy or booming, they remained consistent. Over time, their patience and discipline compounded into substantial wealth. The same will likely be true for many generations that follow.

The best investing may not always be thrilling, but that’s for the better.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/A5UY22L42ZASPAW6OW75IQHR2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/D2LTTSE6C5DCHLGAVEOTXWRVGA.png)