Funds That Channel Ben Graham

Popular dividend-oriented ETFs that tilt toward yield or dividend growth have their roots in the teachings of Ben Graham.

A version of this article was published in the July 2015 issue of Morningstar ETFInvestor. Download a complimentary copy of ETFInvestor here.

Ben Graham is often described as the father of value investing. He might also be described as the father of strategic beta. In his book "The Intelligent Investor"[1] he laid out a number of quantitative rules with which to evaluate stocks. While the precise implementation of his rules is open to interpretation, the general concepts are clear. These same concepts underlie the indexes that form the basis of many of the dividend-oriented exchange-traded funds investors use today. The rules (taken from page 114 of the 2003 edition of the book and shortened here) are:

- There should be adequate, though not excessive, diversification. This might mean a minimum of 10 different issues and a maximum of 30.

- Each company selected should be large, prominent, and conservatively financed.

- Each company should have a long record of continuous dividend payments.

- The investor should impose some limit on the price he will pay for an issue in relation to its average earnings over, say, the past seven years.

While the first rule advises against excessive diversification, Graham contradicted this view later in the book when he said that "Diversification is an established tenet of conservative investment. By accepting it so universally, investors are really demonstrating their acceptance of the margin-of-safety principle, to which diversification is the companion."

Warren Buffett, Graham's most famous student, also seems somewhat conflicted on the concept of diversification. While he has railed against investing in one's seventh-best idea, he has also advised the trustee of his estate (and Lebron James) to invest the bulk of his money in an S&P 500 index fund. Graham and Buffett make a distinction between a defensive and enterprising investor. Graham defined the defensive investor as "our passive investor, who wants both safety and freedom from concern," while the enterprising investor is one who "exercises maximum intelligence and skill." Certainly Warren Buffett falls into the latter camp.

Graham's second rule is especially important for dividend investors. Attractive dividend yields can be found among small- and mid-cap companies, but these higher yields reflect the fact that the underlying businesses are more volatile. Companies with more-volatile cash flows and/or excessive leverage are more likely to cut their dividends in a downturn. By "prominent," Graham meant that investors should look for companies that are leaders in their respective industries--blue-chip companies.

Rule 3 suggests investors should seek out companies with a long record of paying dividends. Companies that are able to consistently pay dividends throughout market cycles typically have stable, repeatable business models, such as utilities or consumer staples, or strong brands that give them pricing power. The Nasdaq U.S. Dividend Achievers Index holds stocks that have increased dividends for at least 10 consecutive years, and it has a much higher percentage of utilities and consumer staples stocks than the broader market, as well as companies with iconic brands such as

Rule 4 suggests investors should be valuation-sensitive and take stock of where current earnings multiples stand relative to their average level over a full market cycle (Graham suggests looking back seven years). Robert Shiller's cyclically adjusted price/earnings measure looks back 10 years. Graham also avoided using forward earnings estimates, which he thought were too often overly optimistic, and was skeptical of growth stock investing. Regarding growth stocks, Graham said, "the investor in shares, say, of public-utility companies at about their net-asset value can always consider himself the owner of an interest in sound and expanding businesses, acquired at a rational price--regardless of what the stock market might say to the contrary. The ultimate result of such a conservative policy is likely to work out better than exciting adventures into the glamorous and dangerous fields of anticipated growth."

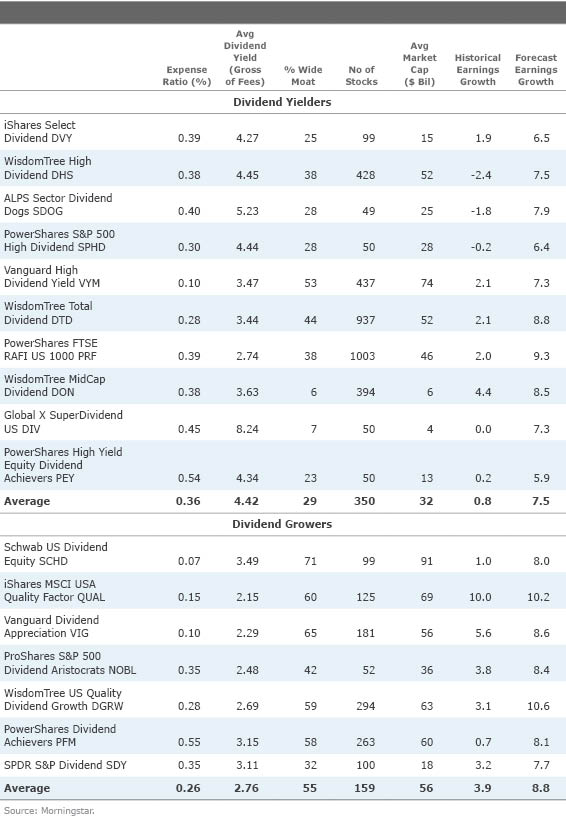

Graham's Teachings in Practice Many strategic beta ETFs put Graham's teachings to work in a highly efficient and low-cost manner. As dividends were central to his approach, I searched the Morningstar database for dividend-oriented funds. I looked to isolate ETFs tracking benchmarks that use dividends as part of their methodology, even if the overall objective of the fund was not dividend-focused. Dividend-oriented ETFs can generally be placed on a spectrum between those that seek out stocks with high dividend yields and those that seek out stocks with stable or growing dividends. Within these two broad objectives, funds use a variety of methods to try to achieve higher returns while limiting exposure to value traps. I've grouped funds along these broad lines below. Most funds use a blended approach, but I have included each fund in just one group, based on whether yield- or growth-related criteria dominate their makeup.

The average dividend yield for the stocks in the portfolio, gross of the fund expense ratio, is 4.42% for the dividend yielders group, versus 2.76% for the dividend growers. While the dividend yielders group had a higher starting yield, ETFs in the dividend growers group had a much higher percentage of assets invested in stocks that have a wide Morningstar Economic Moat Rating (55% versus 29% for the dividend yielders). Firms with a wide economic moat are those with a competitive economic advantage that allows them to earn returns on capital in excess of their cost of capital. While many firms can accomplish this over short periods of time, it is difficult to sustain economic profits in the face of competition. Firms that possess an economic moat are better able to fend off competition and preserve profits. Stocks in the dividend growers ETFs also have faster historical and forecast earnings growth and much higher return on invested capital. Below, we summarize the strategies followed by these ETFs.

Dividend Yielders

A naive strategy of simply buying stocks with the highest yield might produce above-average returns in the long run, but it also produces higher volatility and poor performance during market downturns relative to the total market. Funds that seek out stocks with the highest yields may not be appropriate as core portfolio building blocks, but they could be employed as a tactical tool to improve the yield of the overall portfolio. Good examples include

Spreading risk by diversifying over a large number of stocks can reduce the negative impact that might result from owning a few value traps, but it can also dilute funds' overall dividend yield. Some yield-seeking funds rely on diversification to dull the sting of catching falling knives.

Some funds tilt toward mid-cap companies in search of higher yields.

Dividend Growers Dividend growers aren't likely to offer the highest current yields; the hope is that their dividends will grow in the future. These stocks are likely to trade at higher valuation multiples, as their high-quality franchises are typically able to generate above-average dividend growth. While I have labeled these ETFs dividend growers, I could have also labeled them as quality or stable dividend ETFs. Within the Morningstar Style Box, several of the ETFs in the dividend growers group land in the blend or growth style, whereas all of the dividend yielders land in the value style.

The indexes designed to isolate these firms typically use several screens based on financial statement data, such as dividend payout ratio or debt/capital, to winnow down the field. For example,

[1] Graham, B. 2003. "The Intelligent Investor," Revised 2nd ed. Edited by J. Zweig (New York: HarperBusiness Essentials).

Disclosure: Morningstar, Inc.'s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RSZNI74R6FG7FDSWBUF6EWKDE4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NPR5K52H6ZFOBAXCTPCEOIQTM4.png)