A Not-So-Magnificent Third Quarter for Large-Growth Funds

Small- and mid-cap-value funds led the way during the quarter.

US stocks performed well again in 2024′s third quarter. However, small- and mid-cap equities drove the markets higher this time, not large-cap growth stocks.

Of the nine Morningstar Style Box categories, the average fund in the mid-value Morningstar Category gained 9.0% over the quarter, and small-blend funds were up 8.4%. Meanwhile, large-growth funds surrendered the top-performing style box category slot that it held for three consecutive quarters, gaining 3.7%.

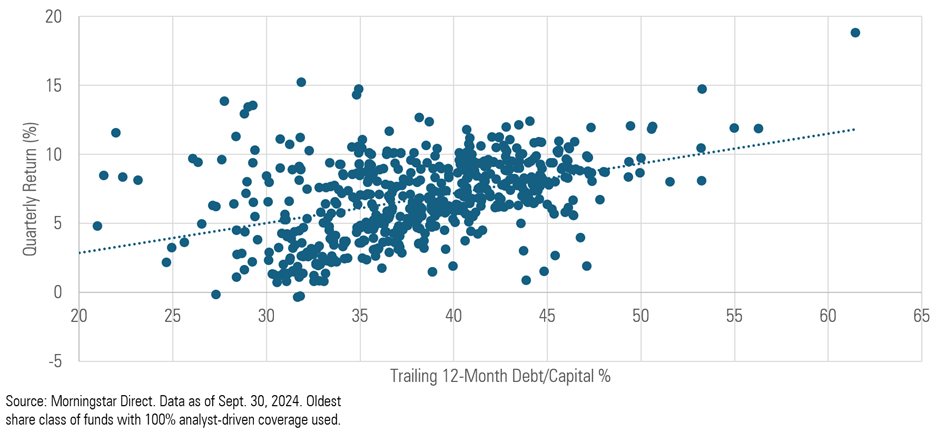

Expecting lower interest rates, investors favored industries with more debt and interest-rate risk. Homebuilders, gold miners, and REITs were among the best-performing industries in the third quarter. Conversely, tech stocks—particularly semiconductor firms—lagged the broader market after driving many growth funds higher over the past year.

Equity Funds' Trailing 12-Month Debt/Capital % Versus Q3 2024 Performance

Hennessy Focus HFCSX was among the best-performing mid-blend funds, posting an 18.4% gain. In June 2024, its portfolio had a debt/capital ratio of more than 60%, among its category’s highest. The prospect of lower interest rates helped insurance holdings Brookfield BNT and Aon AON, as well as REIT American Tower AMT. The fund also owned AST SpaceMobile ASTS, which gained more than 120% during the quarter. Similarly, Ariel Fund’s ARGFX portfolio, which had a debt/capital ratio of 49%, beat 95% of its mid-value peers with a 12.1% gain. Homebuilding firm Mohawk Industries MHK and real estate services company Jones Lang LaSalle JLL were among the fund’s best-performing holdings in the quarter.

Some value-leaning funds missed this shift toward value. BNY Mellon Opportunistic Midcap Value DMCVX gained 5.8% but trailed 92% of its mid-blend peers in the quarter, as holdings like Mobileye Global MBLY and Dollar Tree DLTR fell more than 30%. Royce Small-Cap Opportunity’s RYPNX 2.8% gain trailed 98% of its small-value category peers as DZS DZSI and Comscore SCOR fell more than 45% each in the period.

Meanwhile, many of the large-growth funds that had been atop the leaderboard faltered. Fidelity Blue Chip Growth ETF’s FBCG 0.8% gain trailed 95% of its large-growth peers. Its 21.7% stake in semiconductor and semiconductor equipment stocks in August 2024 weighed on performance; semiconductor companies such as Micron Technology MU and Qualcomm QCOM fell more than 10% each. BNY Mellon Research Growth’s DREQX 0.2% loss this quarter trailed 98% of its large-growth peers. In addition to its 15.3% allocation to semi and semi equipment stocks, holdings such as Celsius CELH, Pinterest PINS, and Pure Storage PSTG fell more than 20% each.

International Stocks

International stocks tended to fare better than their US counterparts in the third quarter. The Morningstar Developed Markets ex-US Index finished the quarter up 8.2%, while the Morningstar Emerging Markets Index gained 8.1%.

After a sluggish start to the quarter, China’s government announced a stimulus package that boosted its equity market. Indeed, the Morningstar China Index’s 22.7% gain was among the best-performing country indexes in the world. Most of those gains came over the past few weeks; since Sept. 17 through the end of the month, the index gained an astonishing 27.3%.

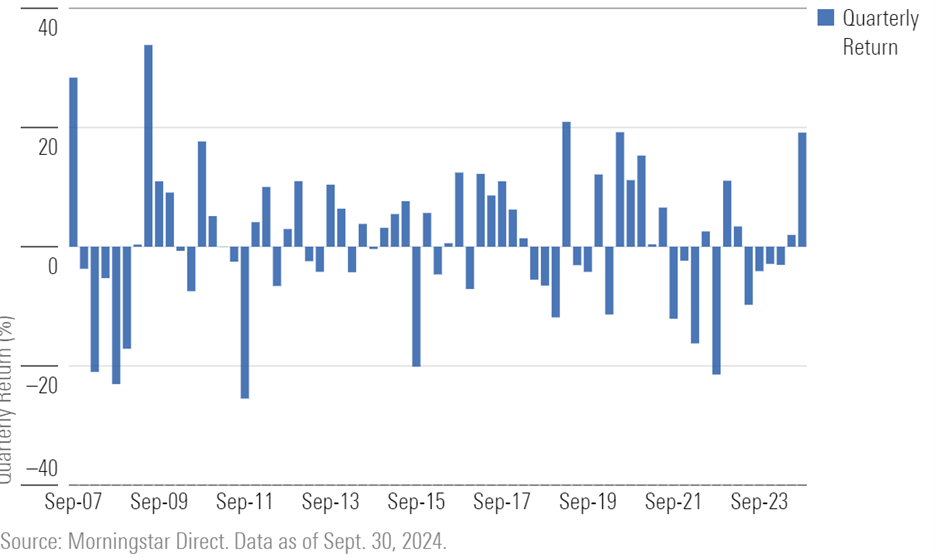

China Region Fund Category Quarterly Returns

Funds with more assets invested in China tended to fare much better than their peers. The 21% gains of Selected International SLSSX and its close sibling Davis International DILAX, which both had around 25% of assets in China in July 2024, beat 99% of their foreign large-blend category peers. JD.com JD, Alibaba BABA, and Meituan gained more than 45% and bolstered both funds’ returns.

The few funds that maintained their China weightings did well, too. Dodge and Cox Emerging Markets Stock’s DODEX 22% stake in the country as of June 2024 was just 2 percentage points lower than its helping the year prior. The fund’s 10.1% gain during 2024′s third quarter beat roughly 90% of its diversified emerging-markets category peers. China-based holdings such as Goldwind Science & Technology, China Feihe, and JD.com gained more than 60% over the quarter.

Conversely, funds that were underweight in China underperformed. The Rajiv Jain-led Goldman Sachs GQG Partners International Opportunities GSIMX gained just 0.3% in the quarter, which ranked at the bottom of the foreign large-growth category. As of March 2024, the fund had no exposure to China and held semiconductor companies Lam Research LRCX and Nvidia NVDA, which fell 23% and 2%, respectively. Federated Hermes International Leaders FGFAX and AMG Yacktman Global YFSIX also had no exposure to China and ranked in the bottom decile in the foreign large blend and global large-stock value Morningstar Category, respectively.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-27-2024/t_c482f9886c534a7a8c406623fe438463_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RSZNI74R6FG7FDSWBUF6EWKDE4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)